Slide 1 - Hyderabad Branch of SIRC of ICAI

advertisement

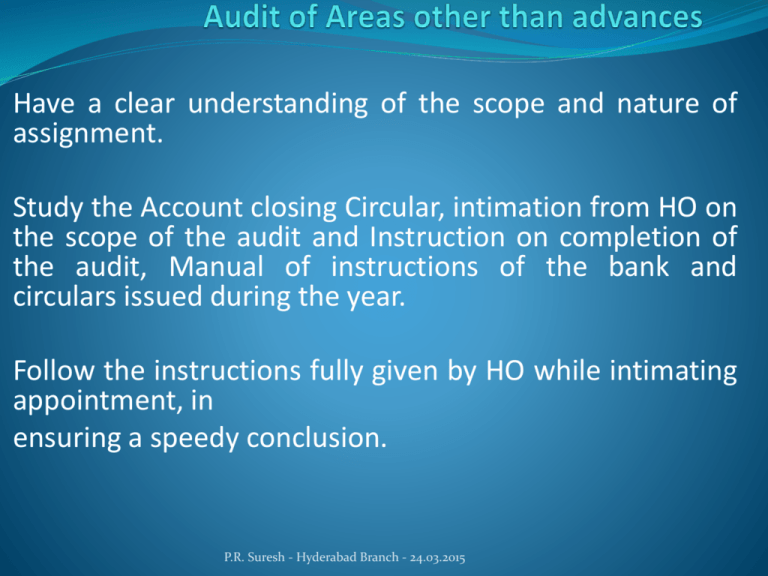

Have a clear understanding of the scope and nature of assignment. Study the Account closing Circular, intimation from HO on the scope of the audit and Instruction on completion of the audit, Manual of instructions of the bank and circulars issued during the year. Follow the instructions fully given by HO while intimating appointment, in ensuring a speedy conclusion. P.R. Suresh - Hyderabad Branch - 24.03.2015 Obtain a copy of the published accounts of the bank and go through the accounting policies and other disclosed policies. Ensure that these accounting policies are implemented by the branch. Wherever these are not followed, the same should be qualified in the branch auditor's report. Refer to the same in LFAR where questions are asked on the adoption of accounting policies. It is better to complete all the work at the branch, and hand over all the statements & reports to the branch manager and obtain acknowledgement for files. There will be pressure to do a quick, haphazard job. Resist such pressures and do a efficient and speedy branch audit. P.R. Suresh - Hyderabad Branch - 24.03.2015 Income Recognition Recovery Policy Four way Classification Financial Statements Agricultural advances System based NPA determination P.R. Suresh - Hyderabad Branch - 24.03.2015 Physical verifications : Cash Verification, unused valuable stationery, jewel held as security for jewel loans, loan against deposits Major customers with working capital limit unit visit Cash in ATM Jewel loans Loan against deposits P.R. Suresh - Hyderabad Branch - 24.03.2015 Premises – Rental increase / pending approval – Contingent liability – accrued liability Bank Guarantees Invoked / Letter of credit devolved closer to balance sheet date – reporting of contingent / clear liability P.R. Suresh - Hyderabad Branch - 24.03.2015 Others : Bank Reconciliation Statement – old items pending adjustment Fixed Assets – FA register Physical verification Date of Asset put to use Assets pending capitalization Damaged / Discarded Assets / clear liability P.R. Suresh - Hyderabad Branch - 24.03.2015 Details of Expired BG / LC’s Sundry Deposits items Test Check of Interest on Deposits Test Check Interest on Advances Year end provisions – rent, telephone, security, electricity, communication expenses, leave travel etc., Income on Commission etc for more than the year under audit. P.R. Suresh - Hyderabad Branch - 24.03.2015 Legal Expenses Interest on Overdue deposits TDS on Provision of Interest on Overdue Deposits Comparitive Analysis of Current year P & L and B/s With Previous year P.R. Suresh - Hyderabad Branch - 24.03.2015 Long Form Audit Report – Issues for consideration and requirements Credit Appraisal Sanctioning / Disbursement Documentation Review / Monitoring / supervision Annexure to LFAR for advances above 2 Crores – Auditors duty P.R. Suresh - Hyderabad Branch - 24.03.2015 Tax Audit : - TDS on provision for interest 40 (a)(i)(a) & under TDS Depreciation w.r.t. Depreciation Accounting Clause 34a of tax audit report – mapping and reporting TDS refunds and Form15G & 15 H P.R. Suresh - Hyderabad Branch - 24.03.2015 ALM 12 Odd Dates Capital Adequacy Ratio Ghosh Committee Report / Jhilani Committee Report P.R. Suresh - Hyderabad Branch - 24.03.2015 PMRY Certificate DICGC Certificate Confirmation that MOC’s of earlier year passed P.R. Suresh - Hyderabad Branch - 24.03.2015 RBI Circulars 1. 2. 3. 4. 5. 6. Prudential norms on Income Recognition, Asset Classification and Provisioning pertaining to Advances Loans and Advances – Statutory and Other restrictions Interest Rate on Advances Banks Finance to NBFC Disclosure in Financial Statements – Notes to Accounts Prudential Norms on Capital Adequacy – Basel I P.R. Suresh - Hyderabad Branch - 24.03.2015 .7 Housing Finance 8. Guidelines for Relief Measures By Banks in areas affected by natural calamities 9. Frauds – Classification and Reporting 10. KYC Norms / Anti Money Laundering AML standards / Combating of Financing of Terrorism (CFT)/ obligation of banks under PMLA, 2002 11. Lending to Priority Sector 12. Lending to Micro, Small & Medium Enterprises 13. Wilful Defaulters 14. Priority Sector Lending – Targets 15. Basel III Capital Regulations P.R. Suresh - Hyderabad Branch - 24.03.2015 Service Tax rate credits / filing of ST-3. / reverse charge mechanism Special Mention accounts / Weak Standard Assets / Potential NPA Advances list – control return Assigned Limits – Agricultural branches – accounting treatment – role of auditors. Fraud by or against the bank P.R. Suresh - Hyderabad Branch - 24.03.2015 Credit card dues – debit balances in savings bank accounts. Provision for Restructured Assets Certificate of Lending to Sensitive Sector Interest Sub vention – Agricultural advances Interest Sub vention – Technology Upgradation Fund Scheme Interest sub vention – Housing Loans below Rs.10 Lakhs BS-8 Provision for sacrifice P.R. Suresh - Hyderabad Branch - 24.03.2015 Anti Money Laundering & Suspicious transaction reporting Customer id – splitting – duplication P.R. Suresh - Hyderabad Branch - 24.03.2015 Pre audit communication with branch Audit Program Management Representation Letter Documentation in audit Discuss Issues with branch management Peer Review Requirements P.R. Suresh - Hyderabad Branch - 24.03.2015 Thanks to each one of you for the special opportunity to interact and learn from this experience Members of the Hyderabad branch have always been sharp, erudite and quite a fun to address and become knowledgeable Special thanks to the Chairman Raghunandan for inviting me I can be contacted at suresh@chandranandraman.com or 9845058988 P.R. Suresh - Hyderabad Branch - 24.03.2015 I can be contacted at suresh@chandranandraman.com or 9845058988 THANK YOU ONCE AGAIN P.R. Suresh - Hyderabad Branch - 24.03.2015