What-the-examiners-said-2011

advertisement

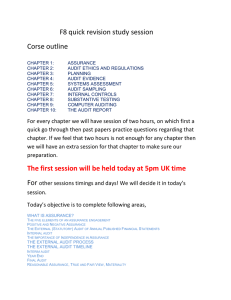

What the ACCA Examiners said Sarah Colley, FCCA sarahcolley@bpp.com Contents • Comments for each paper from examiner • Includes key changes from June 2011 exams • Common themes F5 Performance Management - comments • Basics done well including variances and budgets • Struggled with linear programming, planning and operational variances, pricing strategies and classic performance management questions • Must be able to discuss subjects, not just perform routine calculations F5 Performance Management – What’s new • Backflush accounting is deleted • Included - Specialist cost and management accounting techniques - Decision making - Standard costing and variance analysis F7 Financial Reporting comments • Basic areas done well on Qu 1- 3 • Weak when non standard requirement such as cashflow extracts, complications in group accounting questions. • Must relate ratio comments to scenario • Qu 4 and 5 poor, failure to refer to accounting standards and demonstrate understanding • Handwriting getting worse F7 Financial Reporting – What’s new • Syllabus largely same but some more rules based requirements • Will continue to test several standards within question 4 & 5 • To ensure understanding rather than mechanics will test in a non standard way F8 Audit and assurance comments • Most students are completing all 5 questions but many leave question 1 until last • Other strong areas, ethics, report to management, going concern indicators • Weaknesses include assurance, audit risk, substantive procedures vs test of controls, audit reports, definitions • Layout poor and question requirement not answered • F3 knowledge F8 Audit and Assurance what’s new • Nothing major, and no future changes planned either to syllabus or exam style F9 Financial Management - comments • Frequently examined areas including NPV, IRR, WACC, cost of debt, working capital management consistently done well • Questions on long term finance and impact of financing on financial position never answered well • To improve study whole syllabus including theory and link this to techniques, try and reflect on what a financial manager would do F9 Financial Management – what’s new • Addition of Islamic Finance but only at knowledge level • Structure of exam to stay same • Level of questions remain same P1 Governance, Risk and Ethics comments • Areas done well include core corporate governance themes, knowledge marks, time management and organised answers • Weak areas where tasks are 2 parts, answering questions with verbs such as evaluate, construct and assess, ethical reasoning task and professional marks in Qu 1 • Must not question spot • Must read and study the case and each question before starting the answer P1 Governance, Risk and Ethics – what’s new • New name • New content on risk: - dynamic nature of risk assessment - management responses to changing risk assessment - risk appetite - ALARP - objective and subjective risk perception - related and correlated risk P2 Corporate Reporting comments • Basic knowledge of IFRS, the written parts of topical issues, cashflows and new goodwill calculation • The question is often not answered at all or all parts or scenario not used. Layout is weak and application of knowledge is lacking • To improve need to apply knowledge, understand the principles, write better essays, do more revision and manage stress P2 Corporate Reporting what’s new • IFRS 9 • IASB work programme • IFRS for SMEs • Reorganisations • More group accounting in future • Format still same, Qu 2 major theme, Qu 3 specialised industry, Qu 4 current development with application in part b P3 Business Analysis - comments • Strong areas, strategic position, choice and implementation, IT and financial analysis • Poor areas, business process change, project management, people and exam technique • Practise doing questions in full to time, answer requirement, use quantitative data provided, rational model and the interconnections P3 Business Analysis – what’s new • Lots!! • Evaluation of business forecasting models • Establish pricing strategies including financial and non financial factors • Project management restructured • Performance and reward management and quality removed • Pilot paper available on ACCA website P7 Advanced Audit and Assurance - comments • Good performance on requirements featuring risk assessment, discussion of ethical and quality control matters, audit procedures and factual knowledge • Poor answers included bullet points and waffle, with a failure to demonstrate higher level skills • Need to learn clarified ISA and improve application skills P7 Advanced Audit and Assurance – what’s new • No change on focus • Some requirements may be embedded in scenario • Few requirements will be based solely on factual knowledge • More practical requirements Common themes • Time management • Lack of reading around • Dealing with questions in a non standard format • Need to practise full questions to time • Not answering question requirement • Examining whole syllabus • Exam based on real life situations Questions