Evem More About Bargains . . .

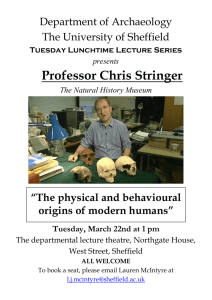

advertisement

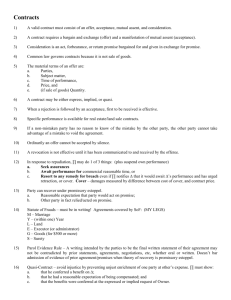

Even More About Bargains . .. Contracts – 1.24.2011 Prof. Merges Bargain vs. Performance • The bargain or exchange –May be “promise for promise”, or –Promise for an action, i.e., performance Promise for promise • X promises to work for Y for one year • Y promises to pay X monthly Promise for performance • X says, “if you carry this package to the UPS office I will give you $10.00 • The promisor bargains for an action, seeks an action to “close the bargain” or exchange • Unilateral K Performance • Often separate in time from the promise • Bilateral K: The return promise may be for a performance far in the future • In a bilateral K, a return promise binds the parties. When is performance required? • X promises to work for Y for a year, conditioned on Y’s payment to X at the end of each month • Y misses two months’ payments • X is not required to work the next month Rights and duties • Under the K, X has the right to receive payment for his work • And Y has a duty to pay • After Y’s non-payment, X’s duty is suspended, perhaps at an end Wesley Newcomb Hohfeld. Fundamental Legal Conceptions, As Applied in Judicial Reasoning and Other Legal Essays . Yale University Press, New Haven, 1923. Strong v. Sheffield Strong v. Sheffield • Procedural History Strong v. Sheffield • Procedural History • Trial court: judgment for P; General term reversed Strong v. Sheffield • Promissory Note? • General Term? Strong v. Sheffield • Promissory Note? • General Term? – Maker or endorser – Payee Facts • P, Benjamin Strong, sold a business to Rard Sheffield, his niece’s husband • “Later,” Rard’s debt was embodied in a promissory note, or a “demand note” • This converted the contractual debt from Rard to B. Strong into a negotiable instrument -- due on demand to the note’s holder Charles Andrews 1827-1918 What is “the general rule” Andrews recites at p. 69? What is “the general rule” Andrews recites at p. 69? “. . . The general rule that a promise, not supported by consideration, is nudum pactum . . . “ What exception does he mention? What exception does he mention? • “The contract between the maker or endorser of a promissory note forms no exception” to this general rule Why is there a “no inquiry into consideration” rule for promissory notes? Negotiable Instruments – Quick Summary • Before the UCC, “negotiable instrument” was generally viewed as synonymous with negotiable paper or bills and notes. • “Simple forms of contract long recognized in the world's commerce and governed by the law merchant." 1 Joseph F. Randolph, A Treatise on the Law of Commercial Paper § 1, at 1 (2d ed. 1899). "Defined most broadly, commercial paper refers to any writing embodying rights that are customarily conveyed by transferring the writing. . . .” Richard E. Speidel, Negotiable Instruments and Check Collection in a Nutshell 1 (4th ed. 1993). Consideration and commercial paper • “The law governing commercial paper precludes an inquiry into the consideration as against bona fide holders for value before maturity . . . .” Why? “A large subset of commercial paper consists of such writings that are negotiable, which means that the law enables a transferee to acquire the embodied rights free of claims and defenses against the transferor." Richard E. Speidel, Negotiable Instruments and Check Collection in a Nutshell 1 (4th ed. 1993). commercial paper. 1. An instrument, other than cash, for the payment of money. • Commercial paper -- typically existing in the form of a draft (such as a check) or a note (such as a certificate of deposit) -- is governed by Article 3 of the UCC. Credit and economic activity, growth • Negotiability allows merchants to get their cash faster, buy new inventory faster, sell more goods – all of which increases the velocity of economic activity Why not relevant here? • “Has no application where the suit is between the original parties to the agreement” • No bona fide purchaser (BFP) issue • Policies favoring negotiability, flow of credit, are not implicated here What was “the original deal”? What was “the original deal”? Mr. Sheffield Promise to repay $$ Mr. Strong What was “the second deal”? Mr. Sheffield Promise to repay Business Endorsed: Mrs. Strong Mr. Strong Promissory Note Mrs. Sheffield Promissory Note Mr. Strong Promissory Note Mrs. Sheffield Mr. Strong ???? What is the consideration issue? What is the consideration issue? • What did Mr. Strong promise Mr. and/or Mrs. Sheffield? What did Mr. Strong say? “[I]f you will give me a note, with your wife’s endorsement I will not pay that note away; I will not put it in any bank for collection, but will hold it until such time as I want my money.” Why wasn’t this consideration? Why wasn’t this consideration? “There was nothing on the face of the note to prevent an immediate suit on it to recover the debt” – p. 70 Wife’s endorsement • Essentially a guarantee of payment • Says in effect, “I will back this debt with my assets” “Illusory Promises” – Rest. 2d § 77 A promise or apparent promise is not consideration if by its terms the promisor or purported promisor reserves a choice of alternative performances unless (a) each of the alternative performances would have been consideration if it alone had been bargained for; or (b) one of the alternative performances would have been consideration and there is or appears to the parties to be a substantial possibility that before the promisor exercises his choice events may eliminate the alternatives which would not have been consideration. Mattei v. Hopper Fee Schedule – Contra Costa County 1959 Office work or consultation:$20.00 per hour (down from $25.00 in the 1957 Schedule) Drafting Real Property Purchase Agreement:$50.00Drafting miscellaneous contract:$25.00Drafting a General Partnership Agreement:$100.00Ordinary Will:$15.00Trust Will:$50.00Trial Per Diem:$175.00Depositions in defense cases:$50.00Adoption:$150.00Default Divorce:$250.00 (Property Settlement Agreement $50.00 extra)Handling Quiet Title action:$200.00Drafting Lease:$50.00 or 5% of the first-year's rent Handling a civil or a criminal appeal,from filing through oral argument:$250.00 • Procedural history Terms of the deal Terms of the deal • Deposit on full payment amount • Closing w/in 120 days • “Subject to Coldwell Banker & Co. obtaining leases satisfactory to the [plaintiff].” Who wants to negate (renege on) the deal? Who wants to negate (renege on) the deal? • Why? • One theory: “economic holdout” or “holdup” Assembling parcels for development Separately owned parcels Economic Advantages to Being the “last holdout” • Entire value of project is “at risk” for the party assembling the parcels • Can lead to “extortionate pricing” Defendant’s 1st Argument Defendant’s 1st Argument • Deposit receipt was merely an offer • Obtaining high-quality lessees and informing defendant of that would constitute acceptance of the offer Offer-Acceptance • Without proper acceptance of a binding offer, there is no contract • Differs from consideration, in which there is at least the appearance of a completed deal – the only question is whether the completed deal is a “true bargain” What is defendant’s consideration argument? What is defendant’s consideration argument? • The clause making the lessees “satisfactory to the purchaser” gave the plaintiff an “out”; no real obligation at all – thus no consideration for buyer’s promise to convey title What is the first argument that “satisfation clauses” can be binding? What is the first argument that “satisfaction clauses” can be binding? • Satisfactory to a “reasonable person” – applies with respect to operative fitness, mechanical utility, etc. Rest. 2d sec. 228 A contracts with B to install a heating system in B's factory, for a price of $20,000 to be paid "on condition of satisfactory completion." A installs the heating system, but B states that he is not satisfied with it and refuses to pay the $20,000. B gives no reason except that he does not approve of the heating system, and according to experts in the field the system as installed is entirely satisfactory. A has a claim against B for $20,000 since it is practicable to apply an objective test to the installation of the heating system. Fancy, taste or judgment • Different standard applies – difficult to apply objective test in these areas A contracts with B to paint a portrait of B's daughter, for which B promises to pay $5,000 "if entirely satisfied." A paints the portrait, but B honestly states that he is not satisfied with it and refuses to pay the $5,000. B gives no reason except that the portrait does not please him, and according to experts in the field the portrait is an admirable work of art. A has no claim against B since it is not practicable to apply an objective test to the painting. A contracts with B to paint a portrait of B's daughter, for which B promises to pay $5,000 "if entirely satisfied." A paints the portrait, but B refuses to even look at the portrait or to pay the $5,000. What result? What result? “[T]he promisor’s determination that he is not satisified, when made in good faith, has been held to be a defense to an action . . .” -- P. 74, par. 2 Where is the ¢ ?? Where is the ¢ ?? “[T]he promisor’s duty to exercise his judgment in good faith is an adequate consideration to support the K.” The law of “satisfaction” clauses • California cases • How does this court handle them?