Finance Seminar Autumn 2015 - Northamptonshire County Council

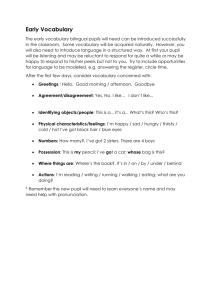

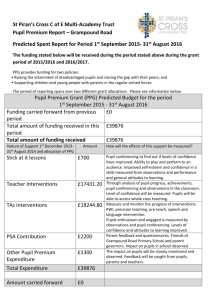

advertisement

By the public sector, for the public sector Finance Seminar Autumn 2015 Presented by Cathryn Walker By the public sector, for the public sector Agenda • FIRST SESSION Schools Finance Team 2016-17 Budget Consultations 2016-17 Budget Pupil Premium EYSFF 2016-17 High Needs Funding 2016-17 Schools Forum • SECOND SESSION School Balances 2014-15 Universal Infant FSM (UIFSM) CFR Budget Monitoring 2016-17 LGSS SLAs Audit - SFVS Audit – Personnel & Payroll Electronic Reporting including Journals and Virements Housekeeping Other By the public sector, for the public sector LGSS Schools Finance Staffing SSTM Cathryn Walker SAA Charlotte Dennison SATs Charlotte Allford Julia Miller Tier Abbass (Long Term sickness) Vacancy By the public sector, for the public sector Primary & Secondary Funding for 2016-17 • The funding formula consultation took place in September 2015 . • 77 attended the 15th September briefing sessions. • 187 responses were received by the 1st October deadline. • The proposals were revised in response to the consultation feedback and these were discussed at the 13th October Forum meeting. By the public sector, for the public sector Primary & Secondary Funding for 2016-17 • The proposals created considerable debate and challenge regarding the recommendation to reduce the Secondary deprivation funding. • Forum voted by a small majority, with abstentions, to approve the proposals including moving the savings from reducing Secondary deprivation funding into the Primary AWPU. By the public sector, for the public sector Primary & Secondary Funding for 2016-17 • Alex Hopkins has delegated power for The County Council final decision on the schools funding formula. • Alex decided at this stage, given the pressures that exist, NOT to reduce Secondary funding. • The following however should apply - By the public sector, for the public sector 1. The existing formula funding factors will be continued in 2016-17. 2. The existing primary deprivation funding of £30.6m will be capped in 2016-17 by reducing the FSMever6 rate. 3. The existing secondary deprivation funding of £27.7m will also be capped in 2016-17 by reducing the FSMever6 rate. By the public sector, for the public sector 4. Move towards a primary to secondary funding ratio of 1:1.30 (currently 1:1.34 in Northants and a national and statistical neighbours average of 1:1.28.). 5. Additional DSG schools block funding or ‘headroom’ from the DSG settlement will be applied towards this where possible. By the public sector, for the public sector 2015-16 factors – no changes proposed in 2016-17 Description Used in 2015-16 Basic per pupil entitlement (AWPU) Yes (mandatory) Deprivation (based on ever 6 FSM numbers) Yes (mandatory) Private Finance Initiative Yes Split site Yes Rates Yes Lump sum Yes By the public sector, for the public sector Q4: Split Site and Pupil Growth Question 4 - split site funding This had a varied response with schools not receiving this funding currently feeling no increase was necessary or questioning the amounts paid to some schools. The feedback shows that further work is required on this area. This will take place with an aim that specific proposals are brought to either the December or January Forum meetings. Questions 5 and 6 (Pupil growth fund) Proposals were supported Agreed to increase the staffing elements of the Pupil growth rates by 5% – at a cost of £75k to be funded from the 2016-17 schools block DSG settlement. By the public sector, for the public sector Q3: £1m Increased AP Cost Q3 – funding the increased cost of £1million in AP. The briefings and feedback identified concerns with this proposal from the majority of schools. This proposal had the largest number of comments/feedback including proposals on how practicable improvements could be made in supporting schools with challenging pupils in the future. The feedback has been shared with service colleagues so that the feedback can be utilised in order to support improvements in this area in the future. By the public sector, for the public sector Q3: £1m Increased AP Cost Q3 – funding the increased cost of £1million in AP. Discussions and responses also identified a need for schools to have better information on the cost implications and VFM of the current arrangements. It was agreed by Forum that the additional £1 million cost of AP in 2016-17 is funded from previous years DSG carry forwards to allow both further work to be undertaken on this proposal including making schools better informed e.g. the funding of CE AP places (@ £10k) includes dual registered pupil places meaning an overall cost of approx £20k p.a. per Secondary pupil. By the public sector, for the public sector Increasing numbers of Permanent Exclusions Proposals for utilising DSG carryforwards of £1.7 million in relation to addressing the number of permanent exclusions in the county were agreed by Schools Forum in July. It was also agreed following requests for this information that data about fixed term and permanent exclusions would be collated and circulated for use as a baseline. Permanent and fixed term exclusions figures from 2014 –15 were sent out to all schools on Friday 16th October. Data about fixed term and permanent exclusions in the current academic year will now be presented to Schools Forum at each meeting from 1st December 2015 identifying schools and growth across the year. This information will also be available for all schools. By the public sector, for the public sector School Budgets 2016-17 •Indicative budgets will be issued November 15 (based on Oct 14 numbers for the majority of schools). •February 2016 final individual school formula budget information will be placed onto the website updated with October 15 numbers. By the public sector, for the public sector Indicative School Budgets 2016-17 The following indicative elements will either be added to the website in March 2016 or confirmed/allocated during 2016-17: - High Needs Place funding – Special Schools & Units / Resourced Provisions a. Mainstream 6th form allocations - from the EFA b. Devolved Formula Capital (DFC) c. Allocations from the High Needs Panel d. Early Years Single Funding Formula (EYSFF) – 3 and 4, and 2 year olds formulae e. Pupil Premium – Main FSM Based on January 16 census f. High needs top ups g. High needs element 3 top ups for pupils in SEN units or resourced provision h. Special school high needs allocations i. UIFSM j. Pupil Growth funding By the public sector, for the public sector School Budget 2016-17 Overview • The DfE arrangements on 2016-17 schools funding were announced in July 2015. • What we know from Government announcements is that: 1. DSG funding is ‘protected’ i.e. flat cash funding per school pupil; and 2. Additional funding will be passported to reflect increases in pupil numbers between October 2014 and October 2015. • NCC have joined the f40 group of the lowest funded authorities. This lobby group is meeting with the Government and pushing for Education funding changes to be made. Schools have been sent information on this. By the public sector, for the public sector School Cost pressures Overview • Although in comparison to LAs, schools funding is deemed to be ‘protected’, schools are expected/required to make efficiency savings in a period when they are expected by stakeholders to deliver more. • Schools are experiencing unfunded cost pressures including: 1. Increased Employer contributions to the Teachers pension scheme from April 15 +2.4% (to 16.5%). 2. Teachers and Local Government pay awards. 3. General inflation/price increases. 4. Employers National Insurance increase of up to 3.7% (to 13.8%) from April 2016. By the public sector, for the public sector School Pressures Overview • As agreed with Forum schools will receive additional one-off funding over 3 years starting in 2014-15. This means that in 2017-18 schools will experience the joint impact of the oneoff funding ceasing and the impact of cost pressures. • The Institute of Fiscal Studies* recently stated that over a 5 year period, unless any funding changes were made, schools were likely to experience real terms cuts in spending per pupil of between 9% and 12%. • Respectively we need to plan for this and ensure sometimes difficult decisions are not delayed unnecessarily. (Note - * - Source - presentation at Fair Funding Conference Bristol – June 2015) By the public sector, for the public sector Schools Budgets 2016-17 • Minimum Funding Guarantee of minus 1.5% on Schools Block funding. Note – one off funding is outside the MFG/Cap. • Cap level to be finalised in January 2016 • Basis for funding: – October 2015 Pupil Census for per pupil allocations – January 2016 Pupil Census for Pupil Premium grant By the public sector, for the public sector Additional One Off Allocation The one off impact on the funding formula for 2016-17 only is as follows. Primary Secondary £3.4m £2.0m £13,400 £50,000 Addition to the lump sum value per school (£15k 15-16) Addition to the lump sum value per school (maximum) as 15-16 No allocation through the AWPU No allocation through the AWPU (£23 in 15-16) (£30 in15-16) By the public sector, for the public sector Changes to Unit Rates 2015/16 base value (£) 2015/16 One off increase Total 2015/16 2016/17 One off increase (£) (£) (£) Primary AWPU 2,661 23 2,684 0 Sec KS3 AWPU 3,849 30 3,879 0 Sec KS4 AWPU 4,348 30 4,378 0 Primary lump sum 125,000 15,000 140,000 13,400 Secondary lump sum 125,000 50,000 175,000 50,000 By the public sector, for the public sector De-Delegation of Services • De-delegation applies only to maintained schools. • Where services are able to be de-delegated: o The budget is delegated to all schools and academies; o Services for de-delegation have to be approved by Schools Forum (by maintained school representatives only and separately by phase); and o If approved the funding will be de-delegated (removed) from maintained school budgets by phase before the final budgets are set. By the public sector, for the public sector De-delegation 2015-16 & 2016-17 In 2015-16 two areas for Primary de-delegation were approved by Schools Forum and applied as set out below. 1 School Improvement – SIG £10 per pupil 2 Trade Union Officials £2.10 per pupil These were also approved by Schools Forum on the 13th October 2015 for 2016-17. This will be reflected in the indicative school budgets published in November 2015. By the public sector, for the public sector Additional One Off Allocation – Nursery and Special schools • Special and Nursery schools also to receive relevant share of final one-off allocation (£60k in total) in 2016-17 • Nursery schools – £2,100 to be included in 201617 EYSFF lump sum • Special schools - £3,300 payment to be made in October 2016 transfers By the public sector, for the public sector Additional One Off Allocation • Importantly this additional delegation is outside of the MFG / Cap meaning schools and Northamptonshire academies will get the full benefit of this additional one off funding. • 2016-17 is the third and FINAL year of the agreed 3 year release of reserves. Therefore, schools should note 2016-17 will be the final year when one-off funding will be released on a similar scale and should plan their budget accordingly. • PLEASE MAKE ALL PEERS/COLLEAGUES AWARE OF THIS FINAL DISTRIBUTION. At every opportunity we are emphasising that 2016-17 is the last year of the one-off funding distribution and that schools need to plan ahead, please help us pass on the information. By the public sector, for the public sector Pupil Premium • Pupil Premium values are still to be announced for 2016-17 Pupil Premium Category Primary Secondary Looked After Children (Pupil Premium Plus) Service Child 2015/16 £ 2016/17 £ Change £ 1,320 ? ? 935 ? ? 1,900 ? ? 300 ? ? By the public sector, for the public sector Pupil premium • Schools will receive £1,320? per primary pupil who is currently eligible for free school meals (FSM) or has been eligible for FSM in the past 6 years (FSM ‘Ever 6’) and £935 for secondary FSM ‘Ever 6’ pupils. Note this will be based on the January 2016 school census return. • An estimated amount (2015-16 allocation adjusted for any change in the pupil premium rate per eligible pupil) will be shown in schools 2016-17 indicative budgets. • If schools are aware of changes in eligible numbers and therefore likely pupil premium funding they should reflect this in their 2016-17 budget submission. By the public sector, for the public sector Pupil premium – Falling numbers? • A number of Infant and primary schools have seen the impact of falling registration of new UIFSM from reception onwards • This impacts on schools allocation of pupil premium funding. • Schools need to be pro-active in ensuring parents do register for FSM and are taking up a FSM for the January census. • Some schools are more successful than others at this so schools are advised to liaise with other schools in their cluster to see what approaches have been taken and to decide what approaches would work best with their school’s parents and pupils. By the public sector, for the public sector Pupil premium (cont) • Rate of £1,900? for looked-after children (LAC). The eligibility criteria includes those pupils who have been in care for one day or more. • The LAC funding is allocated to schools through the budget top ups on a termly basis via the Virtual Schools team. The allocation to a school is dependent on the school having an agreed PEP for the LAC child they are supporting. • Schools will also receive £1,900 for eligible pupils who have been registered on the January school census as having been adopted from care or leaving care under a special guardianship or residence order. • Note - The above is NOT reflected in schools indicative budget information. By the public sector, for the public sector Primary PE and Sports Grant The EFA have published funding allocations for the PE and sport premium which primary schools will receive in the academic year 2015 to 2016. Local authorities are required to pass the PE and Sports Grant funding onto participating maintained schools within one month of receipt. They have revised the grant conditions this year. The most significant changes include: ways in which the premium should not be spent website reporting requirements By the public sector, for the public sector Primary PE and Sports Grant The premium must be spent by schools on making additional and sustainable improvements to the provision of PE and sport for the benefit of all pupils to encourage the development of healthy, active lifestyles. The Secretary of State does not consider the following expenditure as falling within the scope of additional or sustainable improvement: •employing coaches or specialist teachers to cover planning preparation and assessment (PPA) arrangements - these should come out of schools’ core staffing budgets •teaching the minimum requirements of the national curriculum PE programmes of study - including those specified for swimming. By the public sector, for the public sector Primary PE and Sports Grant Schools must use the funding to make additional and sustainable improvements to the quality of PE and sport they offer. This means that you should use the premium to: develop or add to the PE and sport activities that your school already offers make improvements now that will benefit pupils joining the school in future years For example, you can use your funding to: •hire qualified sports coaches to work with teachers •provide existing staff with training or resources to help them teach PE and sport more effectively •introduce new sports or activities and encourage more pupils to take up sport •support and involve the least active children by running or extending school sports clubs, holiday clubs and Change4Life clubs •run sport competitions •increase pupils’ participation in the School Games •run sports activities with other schools By the public sector, for the public sector Primary PE and Sports Grant Maintained schools, including those that convert to academies, must publish information about their use of the premium on their website by 4 April 2016. Schools should publish the amount of premium received; a full breakdown of how it has been spent (or will be spent); what impact the school has seen on pupils’ PE and sport participation and attainment and how the improvements will be sustainable in the future Schools will receive the funding across 2 financial years •7/12 of the funding allocation in November 2015 •5/12 of the funding allocation in May 2016 By the public sector, for the public sector EYSFF 2016/17 • 3-4 year olds EYSFF includes EY pupil premium (53p per hour per eligible child = £300 p.a) • Main EYSFF being reviewed for 2016-17. Consultation started in October 2015 • Discussed at Forum Oct and Dec 15, Jan and March 2016. • http://www.northamptonshire.gov.uk/en/council services/educationandlearning/services/schlfin/p ages/schoolsforum.aspx By the public sector, for the public sector EYSFF 2016/17 • EYSFF rates and elements decided and published, including indicative budgets (excl 2 year olds) , March 2016. • The initial data from the Autumn 2015 headcount indicates current take up at around 1,940 2 year olds • The Northants rate paid to providers is £4.85 per hour. • This means there is £0.05 or 1% of the £4.90 DSG funding contribution to central costs By the public sector, for the public sector Early Years future funding – DfE announcements • The early years block per pupil unit of funding in 2016 to 2017 will be confirmed after the spending review and will continue to be based on participation. • The Government are committed to making schools and early education funding fairer and will put forward proposals in due course. • The Government recognise the links between funding for early education, schools and pupils with high cost Special Educational Needs. These are complex issues to consider, and they will consult extensively with the sector and the public on them. By the public sector, for the public sector Calls for Evidence – Cost of Providing Childcare • The Government has committed to give working parents, of three and four-year-olds, 30 hours of free childcare a week. • The government is carrying out a review of the cost of providing childcare. It has committed to increasing the average childcare funding rates paid to providers. • The announced increase in entitlement from September 2017 has major implications and the call for evidence, looking at the costs of provision, is just one element of this. By the public sector, for the public sector High Needs Funding 2016/17 • High Needs EFA DSG 2016-17 funding announcement in December • Schools Forum January and March 2016 discussion on high needs pressures, funding and high needs funding rates • Working with FACE to create a new RAS (Resource Allocation System) to use across all of high needs including Education, Health and Care (EHC) plans and reviewing existing statements. An update report will be taken to the 1st December Schools Forum meeting. By the public sector, for the public sector High Needs Funding 2016-17 • Arrangements for High Needs funding were announced on the 24th September 2015 (follow the link below): arrangements for high needs funding in 2016 to 2017 • Headlines are as follows: • Anticipate no additional high needs DSG funding for 201617 (unlike previous years when additional funding was provided). • High needs place change request form to be submitted by 16th November 2015. By the public sector, for the public sector Schools Forum Below is a link to the link to the website to see the latest information. • Schools Forum - Northamptonshire County Council Schools are recommended to read Forum Matters when published to keep up to date with latest developments. By the public sector, for the public sector School Balances 2014-15 • Information on maintained schools balances presented and discussed with schools forum. • Summarised information on maintained school balances by sector included in Schools Outturn report to Cabinet in June. By the public sector, for the public sector DSG 2014-15 School balances • CAPITAL BALANCES School sector Nursery Primary Secondary Special Total 2013-14 (£m) 0.15 2.12 0.65 0.42 3.34 2014-15 (£m) 0.20 2.98 0.06 0.52 3.75 Movement (£m) 0.05 0.86 -0.59 0.10 0.41 By the public sector, for the public sector DSG 2014-15 School balances • COMMUNITY FOCUSSED RESERVES 2013-14 School Children’s Sector Centres (£m) Nursery Primary Secondary Special Total 0.48 0.31 0 0 0.79 2013-14 Other (£m) 0.46 0.17 0 0 0.63 2014-15 Children’s Centres (£m) 0.00 0.00 0.00 0.00 0.00 2014-15 (£m) Total Movement (£m) 0.81 0.08 0.00 0.00 0.89 -0.13 -0.40 0.00 0.00 -0.53 Other By the public sector, for the public sector DSG 2014-15 School balances • COMMITTED REVENUE BALANCES School sector Nursery Primary Secondary Special Total 2013-14 (£m) 2014-15 (£m) 0.98 4.59 1.02 1.08 7.67 0.34 6.51 0.55 0.98 8.38 Movement (£m) -0.64 1.92 -0.47 -0.10 0.71 By the public sector, for the public sector DSG 2014-15 School balances • UNCOMMITTED REVENUE BALANCES School sector Nursery Primary Secondary Special Total 2013-14 (£m) 0.18 7.53 0.26 0.58 8.55 2014-15 (£m) 0.18 9.32 -0.09 0.47 9.88 Movement (£m) 0.00 1.79 -0.35 -0.11 1.33 By the public sector, for the public sector Balances • Schools need to be thinking about year end carryforwards and Committed / Uncommitted revenue balances. • To calculate the 8% or 5% Uncommitted balance permitted take the current Oracle Report (total Revised Budget column) minus previous years carryforward (column 1 “Balances”) then multiply by the relevant percentage. By the public sector, for the public sector By the public sector, for the public sector School Balances 2015-16 • A number of changes to the balances scheme were made for 2014-15. • Currently no major changes are planned for 2015-16. • All UIFSM schools will be able to identify if they owe or are owed UIFSM grant funding for the period September 2015 to March 2016 which can then be reflected on the SB1 form. • Where possible the maximum figure allowed will be shown on each relevant row on the SB1 form. Schools must take account of this information. By the public sector, for the public sector School Balances 2015-16 By the public sector, for the public sector School Balances 2015-16 By the public sector, for the public sector School Balances 2015-16 By the public sector, for the public sector Universal FSM for Infants •Funding information and guidance on NCC website •http://www.northamptonshire.gov.uk/en/councilservices/educationandlearn ing/services/schlfin/pages/budget_funding.aspx In the 2015 to 2016 academic year schools will be paid funding at a flat rate of £2.30 for each meal taken by newly eligible pupils. Schools will be expected to fund existing free school meals under the existing criteria that they do currently. For the academic year 2015 to 2016, a provisional allocation of UIFSM grant to schools will be based on the final allocation for academic year 2014 to 2015. A final allocation for academic year 2015 to 2016 will be calculated in June 2016, based on take-up recorded in the October 2015 and January 2016 school censuses. By the public sector, for the public sector Universal FSM for Infants • From September 2015 all schools including those whose meals are provided by Nourish are being charged for FSM, UIFSM and other meals based on actual volumes. •This means that schools will need to monitor this area carefully as there will be differences between budget and actual costs •FSM – if spending more than budget this is a pressure that needs to be covered from elsewhere in the school budget. •UIFSM – actual volumes will differ to the indicative funding/numbers allocated by the EFA. This ‘difference’ needs to be identified and recorded by the school as it should be picked up when the EFA update the allocation for the 2015-16 academic year (in June 2016) to reflect actual UIFSM numbers in each school. (see SB1 slides) By the public sector, for the public sector CFR Reporting 2014-15 • Errors on submission – Schools still not entering an e-mail address. – Opening Balances differed from previous years closing balances. – Notes not entered against Yellow warning triangles. – Positive amounts on income codes and negatives on expenditure By the public sector, for the public sector CFR Reporting 2015-16 • Schools should be checking the current report is correct when compared to Oracle and the Cumulative Expense Analysis report. • Schools should be checking that the CFR apportionment has been actioned correctly – Warning messages when going into the report. • School should check the Validation report for codes not mapped and missing expenditure / PFI Charges / Bad Debt. • Schools should check that income codes are in credit and expenditure codes are positive. Usually due to accruals. • Schools will have a red X against Insurance due to the schools not yet being invoiced for this but will correct itself in due course if applicable. By the public sector, for the public sector Budget Monitoring • Schools should be checking the current Oracle report and comparing to the Cumulative Expense Analysis report. • There has been issues with differences between the budget top up file and where the budget was loaded onto SIMS/Oracle. So we would suggest the school completes a virement form to amend Oracle. • Don’t forget to vire Pupil Premium as per the budget proposal form if appropriate. This process will need to be repeated when the 7/12ths funding is devolved in January. By the public sector, for the public sector LGSS 16-17 The 2016/17 schools and academies brochures • We understand plan is to publish 1st week December 2015. • The brochures will be available through: o the new schools and academies enewsletter which will be emailed to all Northamptonshire schools and academies. o www.lgss.co.uk o www.northamptonshire.gov.uk - the traded services to schools page • • There will be no prices in the brochure for 2016/17 . Bespoke charges will be sent to schools/academies who purchased LGSS services in 2015/16. New customers: please contact LGSS for a bespoke charge info@lgss.co.uk • By the public sector, for the public sector Governance and Financial Management and Compliance with the Schools Financial Value Standard (SFVS) –2015/2016 Recently a thematic audit was carried out on the above areas and the main strategic recommendations relevant to governors are below. The prosecution of a school bursar in 2012 and a second one in 2014, together with a number of school related special investigations have highlighted the need to ensure that appropriate management controls are in place in schools. There needs to be sufficient evidence of these being implemented by Headteachers and appropriate checks completed by Governing Bodies. It is recommended that your finance committee reviews these recommendations against your governance procedures in financial management. Governance documents and procedures Schools should be reminded of the following: • The Governing Body should review any powers and duties it is delegating to a committee annually i.e. Terms of Reference. • Where a review has been completed by the committee the terms of reference must then be presented to the Governing Body for approval i.e. a committee cannot approve its own terms of reference. By the public sector, for the public sector Medium Term Planning Schools should be reminded of the need to make medium term development plans and for these to be approved by their Governing Body. • Schools should be reminded that the Governing Body have a statutory duty to monitor the school development plan and to do this there should be a formal agreement of the plan against which performance is to be measured. School Development Plans will evolve over time and any subsequent agreed revisions of the plan should be approved and minuted. • Schools should be reminded to prepare premises plans that can be linked to their three year financial projections. Financial Management • • • • In 20% of schools there was insufficient evidence that the Headteacher had checked that the budget and expenditure on the school’s local accounting system had been reconciled to the NCC records on Oracle The reconciliation of the budget and expenditure each month is fundamental to good budget management and monitoring. Headteachers are responsible for completing a management check to ensure that this task has been completed by the Bursar/Business Manager. In 13% of the schools they had not checked that staff travelling on school business e.g. to courses and meetings, had appropriate cover on their motor insurance policies. Schools should be reminded to ensure that these checks undertaken. In 15% of the schools that hired out their premises checks had not been completed to confirm that the hirers of the premises had third party indemnity in place to meet any claims that could arise. In some cases policies were on file but they were out of date. Schools should be reminded of the requirement to check that appropriate insurance is in place prior to allowing access to the premises. By the public sector, for the public sector Protecting the school against theft and fraud • • The Schools Financial Management Handbook states that the audited accounts of the school fund should be presented to Governors. Schools should be reminded that in addition to reporting to Governors that the Private Fund accounts have been audited, evidence of this should be provided to the Governors and that the accounts should be presented for review and discussion. Business Continuity • The Governing Body should review and challenge the Business Continuity Plan and when satisfied that it is fit for purpose its approval should be minuted. Thematic Audits • Schools should be reminded of the value in completing self assessments by using the thematic audit templates which are updated as and when regulations change. • The results of the thematic audits should be reported to governors i.e. good practice identified and areas where controls need to be improved. • An action plan should be prepared to address any weaknesses and its implementation should be monitored by the Finance Committee or Governing Body By the public sector, for the public sector Personnel and Payroll Thematic Audit of Primary Schools – 2014/15 Limited assurance was given for the personnel and payroll processes carried out in the Primary Schools within the sample. Whilst being able to provide substantial assurance with regards to the governance processes and moderate assurance for some aspects of payroll, the overall system of control is weak and there is evidence of non-compliance with the controls that do exist which may result in the relevant risks not being managed. • The table below provides a breakdown on the level of assurance for the fifteen schools audited. Personnel and Payroll Level of Assurance Limited Moderate Substantial 7 5 3 By the public sector, for the public sector Employment of Relatives • Seven of the fifteen schools audited employed staff who were related. Two of these schools could not demonstrate that an appropriate segregation of duties was in place for the payment of staff who were related. • An appropriate segregation of duties is critical to effective internal control; it reduces the risk of both fraud and inappropriate activity. Recommendations In order to comply with Financial Regulations, schools should be strongly advised that: • an appropriate segregation of duties must be in place for all financial processes; and • no individual should authorise any payments relating to themselves or a relative. By the public sector, for the public sector Employees – Payroll Checking and Monitoring • In two of the fifteen schools audited, there was a lack of documentary evidence to confirm that the Bursar / School Business Manager checked the payroll reports to confirm if new starters, staff whose contracts had changed and additional hours had been paid correctly. • Ten of the fifteen schools audited had purchased LGSS Payroll Services. Appropriate checks were not evidenced on the payroll validation reports in three of the ten schools. In addition, an appropriate management check was not evidenced on the payroll validation reports in seven of the ten schools. • In seven of the fifteen schools there was no evidence that the payroll reports had been presented to the Headteacher for a management check to be completed. • There was a lack of documentary evidence that the salaries on SIMS and Oracle were reconciled each month in two of the fifteen schools. By the public sector, for the public sector Appropriate preventative and detective controls must be in place if School Management are to reduce the risk of fraud, budget overspends and reputational damage to the school. Such controls include a segregation of duties and appropriate management checks on financial reports. Recommendations In order to comply with Financial Regulations and the Schools Financial Value Standard, schools should be strongly advised to: • carry out appropriate checks on all of the payroll reports; • present the payroll reports to the Headteacher who should complete a management check and sign the reports to confirm this has been done; • ensure that a segregation of duties is in place for all financial activities; and • ensure that the salaries on SIMS and Oracle are reconciled each month. By the public sector, for the public sector Audit Points Areas of Good Practice: GOVERNANCE • The committee that dealt with personnel issues had appropriate Terms of Reference in place (93%); • The responsibility for appointing staff, creating new posts and re-grading of staff had been appropriately delegated (93%); • Headteachers reported regularly to Governors on staffing changes and issues (93%); • Governors had agreed a Pay policy for the school (100%); • Governors had adopted the NCC Whistle Blowing policy (100%); • Staff had been made aware of the Whistle Blowing policy (93%); • At least one member of the Recruitment Panel had attended Safer Recruitment training (93%); and • Personnel records were retained for the appropriate time (100%). EMPLOYEES – STAFF RECRUITMENT • Personnel files were stored in a secure area (100%); • Qualifications were checked / held on file for qualified staff (100%); • The SENCO Coordinator was a qualified Teacher who had either achieved, or was working towards achieving the SENCO qualification (where applicable – 100%); • Schools maintained a central log of pre-employment checks (100%); • The identity of new employees was checked (100%); and • DBS clearance was confirmed for agency staff (where applicable - 100%). By the public sector, for the public sector Audit Points Areas of Good Practice: EMPLOYEES – PAYROLL • Payroll records were held securely and access to the payroll provider was appropriately controlled (93%); and • Safeguarding checks were carried out for self employed individuals who provided services to the school (100%). EMPLOYEES – VARIATIONS TO CONTRACT • Additional payments such as SIP work and Honarariums were approved by the Governors (100%). EMPLOYEES – PAYROLL CHECKING AND MONITORING AND OWN PAYROLL SCHOOLS • Salary costs were checked for accuracy each month (93%); and • Adequate controls were in place in the two schools where they processed their own payroll (100%). By the public sector, for the public sector Journals & Virements Please be aware that there are new forms to complete when submitting the above. These can be found on the Schools Finance website under the forms library. These should then be returned to Finance as attachments to e-mails. By the public sector, for the public sector Journals By the public sector, for the public sector Journals By the public sector, for the public sector Virements By the public sector, for the public sector Housekeeping Salary Scales on FMS The Teacher pay scales are now available from our website. Attached to the Personnel 7 update notes and how to action this on SIMS with effect from 1st September. Teachers Pension The actual rate applicable from 1 September 2015 is 16.48% not 16.4% as already notified. This can be amended in SIMS.Net via Tools/Staff/Superannuation thereby removing the couple of pound variation in FMS. By the public sector, for the public sector Housekeeping Contd • Submittals via email attachments as 1 pdf file not individual documents. Checking that the file does contain all the required information and is readable and has not slipped when scanning – Also we will not accept FMS reports exported to Excel. Please note that with regards to the journal/virement templates these stay in the Excel format. • LB26 – schools responsibility to identify errors and correct the problem. We can advise how to correct on FMS but should not be undertaking this work on the schools behalf. By the public sector, for the public sector Top Tips • Now is the time to be checking to see if you are able to streamline the structure. You will not be able to do this if you have used the Cost Centre in this financial year. De-link the ledger code and then delete the Cost Centre. • Within FMS you have the ability to pay a supplier normally paid by BACS by cheque. This is of benefit if your “inputter” is absent and to prevent late payments charges. Example on next slide By the public sector, for the public sector By the public sector, for the public sector FMS Upgrade Ability to Hide and Unhide Cost Centre Ledger Code Combinations • • • Tools | General Ledger Setup | Tab 6: C/Centre Ledger Code Links It is now possible to hide or unhide cost centre, ledger and fund code combinations that are no longer required. Once hidden, these combinations will not be available when processing new transactions in Accounts Payable, Petty Cash or Service Term Mappings. The combinations will still appear on reports, but where there is no balance on the combination, zero balances can be hidden when running the report. This applies to EX and ES codes. Modification to Default Bank Code in Cash Book Journal and VAT Reimbursement Entry • • Focus | General Ledger | Manual Journal Processing - Cash Book Journal Entry When entering a cash book journal or VAT reimbursement, the Bank Ledger Code field now defaults to a bank account if only one bank account exists. If more than one bank account exists, the field remains blank, ensuring the wrong bank account cannot be selected accidentally. By the public sector, for the public sector FMS Upgrade Reports Produced in New Reporting Engine • • • • Reports | New Reports | General Ledger | Audit | Audit Trail Reports | New Reports | General Ledger | Audit | Journal Audit Trail Reports | New Reports | General Ledger Setup | Chart of Account Listing The Audit Trail, Journal Audit Trail and Chart of Account Listing reports have been produced in the new reporting engine and will replace the existing reports in the FMS 2016 Summer Release. Retirement of Old Format Reports • • • Focus | General Ledger | Chart of Accounts Review Focus | Personnel Links | Salary Projection The reports that can be produced from the Chart of Accounts Review and Salary Projection areas can now be produced using the new reporting engine only. By the public sector, for the public sector Questions?