ACFIN_Program_Presentation_2010

advertisement

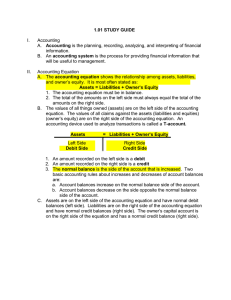

Accounting/Finance Ms. Egyirba Walker-Arthur Accounting/Finance Program Manager ewarthur@seo-usa.org Purpose of the Accounting Department at an Investment Bank • Enhance the company's competitive leadership position and strategic flexibility and to ensure the accuracy of critical financial information • Responsibilities Include: – Market and credit risk management – Treasury – Financial & regulatory reporting and controls – Corporate and strategic planning – Internal audit – Tax policy – Regulatory supervision on a global basis 1 What’s the difference? Public vs. Private Accounting Private or corporate accountants perform the same types of tasks of public accountants, yet these tasks are specific to the companies for which they work. PUBLIC ACCOUNTING (BIG FOUR) • Public accountants work for a particular accounting firm and serve various clients in ranging fields • Involved in the collecting and external reporting of financial information PRIVATE ACCOUNTING (SEO) • Private accountants work as internal accountants for one company • Involved in the internal use of financial information to and help managers within the company make more effective business decisions 2 Why work in Accounting at an Investment Bank? • Learn the business of running an Investment Bank – Opportunity to gain a broad and deep knowledge of various areas of a bank (Rotational Programs) – Private accountants get to know a business more intimately than their colleagues in public accounting who are only able to obtain a high-level view – Help execute strategic goals, drive disciplined growth, and enhance operational efficiencies • More Doors Opened – Working in private accounting opens up career paths outside of the specific disciplines of audit and tax which are the main staples of public accounting 3 Why work in Accounting at an Investment Bank? • Less Stressful Environment than Public Accounting – Private accountants work with the same group of colleagues and tend to have a more relaxed lifestyle. Public accounts deal with a wide variety of people and demands, thus their work is inevitably more stressful. • Work/Life Balance – Other than the account-closing month, private accountants have more or less a 9-5 job • Exposure to Senior Management – Have the opportunity to work with industry leaders on developing cutting-edge products, processes, policies and infrastructures. 4 Accounting Departments at Investment Banks • Business Unit Finance Opportunity to merge other business interests with accounting by working with Business Units like Human Resources, Marketing, etc. • Controllers Great department if SEC and other regulatory reporting interests you – you will be on the frontline of interaction with investors. • Corporate Tax If you like having input into creative tax strategies and reporting, tax may be the best fit for you. 5 Accounting Departments at Investment Banks • Corporate Treasury Be involved in the cash transaction and the actual movement of money to and from the firm • Internal Audit A chance to travel and interact with business unit management all over the firm • Risk Monitoring A role that is constantly redefined with the proliferation of new credit and equity products in the market every day 6 Typical Intern Tasks • • • • • • SEO Accounting/Finance interns have worked on: Calculating daily or weekly P&L for specific products or trading desks Preparing budgets and forecasts for business units Analyzing trends in expenses and revenues Reconciling accounts Preparing and posting journal entries to the general ledger Preparing ad hoc reports and financial statements 7 Internship Requirements & Partner Firms • Minimum cumulative G.P.A of 3.0 • Minimum of three accounting courses with a grade of B or better in each by the time the summer begins • Broad knowledge of the finance industry • Excellent quantitative and analytical skills • Open to junior finance/accounting majors ONLY. Seniors who will have one semester to complete at the time of the internship may be considered. 8