Financial Management – SPS 827

advertisement

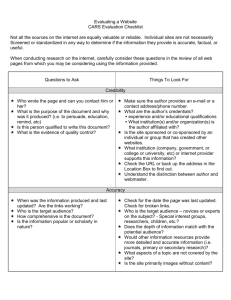

Financial Management 827 – Introduction 2014 Andrew Graham Queens University School of Policy Studies www.andrewbgraham.ca Andrew.Graham@queensu.ca 2 Structure of Today’s Class Course Outline • The Goods Financial Management • The Context and the Public Sector What is Financial Management • The What Andrew.Graham@queensu.ca 3 You had a choice. This course or… Feared by more people than even before. Andrew.Graham@queensu.ca Round the room What are you looking for in this course? 4 5 What are the financial challenges facing the public sector managers today?? Mastering Finance in Government Andrew.Graham@queensu.ca 6 The Public Sector Financial Landscape • • • • • • • A Mix of Criteria Difficulty of Relating Costs and Benefits Apples and Oranges Performance Measurement is Elusive Constraints on Goals and Objectives Service Orientation of Many Public Sector Organizations Generally Lower Rates of Compensation Andrew.Graham@queensu.ca 7 The Public Sector Financial Landscape • Varying Forms of Governance • Short-term orientation - one election to the next Political • • • • • • • Realities and Necessities Need for Visibility – show me the ribbon to cut Multiple external pressures In Your Fish Bowl accountability Bureaucratic rules and regulations Managerial Constraints Management cultures Legislative restrictions Legislative restrictions Today’s Operating Environment Cuts Delivery mechanisms changing Expectations Continuous improvement Modernization New accounting practice Information analytics Reallocation Oversight Andrew.Graham@queensu.ca THE COURSE 9 Andrew.Graham@queensu.ca 10 Objectives of the Course – ‘As Advertised’ • Focus on tools in managing public finances in order to carry out good public policy • Understanding how financial considerations fit into good policy formulation, choice of policy instruments and implementation • Public sector financial management as a policy issue itself: • accountability, • due diligence, • relationship to taxation and debt We are going to be hands on. Andrew.Graham@queensu.ca 11 Objectives of the Course – ‘As Advertised’ • The basic elements of financial management – aware not expert • Hands-on management of financial responsibilities of any public manager • Public managers can no longer ignore core financial skills or leave them to others – vastly increased cost sensitivities, more and more emphasis on bang for buck, accountability, growth in contracting means have to understand costs There are some basic business skills that are increasingly expected of public managers. Financial literacy – more to come, Andrew.Graham@queensu.ca 12 Objectives of the Course – ‘As Advertised’ • To help you • Understand where financial management is an integral part in delivering public goods • be an effective user of financial information, • take an informed approach to your role as a financial manager and • carry out your responsibilities as a public sector financial manager Andrew.Graham@queensu.ca 13 What the course is not about • The politics of budgetary processes • Public finance – taxation policy, economic policy • Getting you certified as a CGA – we are doing a fly past not an accreditation process • Seeing if you can do detailed calculations or math • Balancing your own personal budget, or lack thereof. Andrew.Graham@queensu.ca Structure of the Course Public Sector Financial Management Concepts of Accounting and Financial Statements Budgeting: Forms and Process Reallocation and Cut-backs Managerial Control and Controllership Expenditure and Cash Management Reporting and Accountability 14 Andrew.Graham@queensu.ca 15 Structure of the Course Format • ‘Open’ Lectures – designed to invite participation and debate • PowerPoints as text • Small group work and discussions • Table drops – mini-cases and exercises • Take-homes assignments • Cash Management Exercise – the big assignment Andrew.Graham@queensu.ca 16 Evaluation/Tests/Exams • “Test as you go” approach: mixture of questions, many from the text • No ‘final exam’ – final assignment will be exercise driven • Take homes are due on time and failure to turn them in will affect the mark • Participation is rated on involvement in the various small group exercises, table drops and general engagement Andrew.Graham@queensu.ca 17 Evaluation/Tests/Exams • Take Home Tests (2 in all) • Cash Management Exercise • Participation 40% 50% 10% Andrew.Graham@queensu.ca Web-Based Course Material • Note: use Moodle • Lectures will be posted in advance on Moodle and on my website • Tests and related readings will be posted • I will communicate through e-mail. • This is the text and I will add one chapter on Moodle. 18 Andrew.Graham@queensu.ca Remember, there is no stupid question. 19 20 What is Financial Literacy? • Understand the lingo: Some core terminology, much of which is addressed in the text, is essential. • Read the Reports: This is best translated as being an intelligent user of financial information, be it costing for policy design or cash forecasts for the first quarter of the fiscal year. • Understanding the Implications: Developing an analytical capacity and intuitive sense of the consequences of certain financial decisions, e.g. contracting. 21 What is Financial Literacy? • Get Clarity: This may mean asking dumb questions. It may also mean pushing the point of understanding so that everyone is actually talking about the same thing. • Marry up Numbers on a Pages with What Happens at the Mission End of the Organization: A financially literate manager can see the link – or insist that it be clearly stated – between what may be for some just a bunch of numbers and the policy and operational impact. A financially literate manager needs a financial literate organization. Andrew.Graham@queensu.ca Forecasting Controlling Financial Condition Analysis Costing 22 Identifying, Assessing and Managing Risk Core FM Skills Communicating financial and program information Andrew.Graham@queensu.ca 23 Financial Management Fits in the Cycle of Public Sector Policy and Management Andrew.Graham@queensu.ca PERPETUAL CYCLE Resources Accountability Policy Probity Implementation Events 24 Andrew.Graham@queensu.ca The Big Bad Public Sector….. 25 Andrew.Graham@queensu.ca 26 The Public Sector Challenge Complexity Transparency Limited resources Increased political context Definition difficulties Common activities across more than one government, department or project Risk complexity Andrew.Graham@queensu.ca 27 Public Sector – what is it? • Public sector larger and more complex than government in traditional sense • Course adopts an inclusive focus: • Government, all levels • Near government: agencies, crowns (to a limited extent), special entities • Greater public sector entities: health and education Andrew.Graham@queensu.ca 28 Andrew.Graham@queensu.ca 29 Government spends a lot of money – and it belongs to you Consolidated federal, provincial, territorial and local government expenditures, 2008-2009 = $594,600,000,000 Consolidated federal, provincial, territorial and local government revenue, 2008-2009 = $ 585,795,000,000 Andrew.Graham@queensu.ca 30 What this means to Canadians • Canadians enjoy an average $17,000 benefit from the public services which our taxes fund • Looking at Canadians in median income households, their benefit from public services amounts to $41,000 — equivalent to roughly 63% of their total income. • More than 2/3 of Canadians receive public services worth more than 50% of their household incomes. Andrew.Graham@queensu.ca 31 Federal Government Revenue Sources: 2012-13 Andrew.Graham@queensu.ca Federal Government Expenses 2012-2013 32 Andrew.Graham@queensu.ca 33 Capital and Infrastructure: From Roads to Rinks Andrew.Graham@queensu.ca Canada’s Deficit and Surplus 34 Andrew.Graham@queensu.ca Ontario’s Deficit 35 Andrew.Graham@queensu.ca 36 Public Finances are complex – example: transfers Andrew.Graham@queensu.ca Source: http://www.fin.gc.ca/fedprov/mtp-eng.asp 37 Andrew.Graham@queensu.ca 38 Federal Government Contracting Activity 2010 All contracts below $25K - 1,133,429 All contracts above $25K – 15,070,053 Andrew.Graham@queensu.ca 39 Total Government Purchasing • No one knows for sure • WTO estimates that it is 10-15% of GDP for developed countries • Leads us to $130-$200 billion annually • All governments and broader public service included Andrew.Graham@queensu.ca 40 Financial Management: Underlying Ideas at Play A way of describing a complex set of activities to see how they relate to each other, their dependencies and causalities and provide a full picture. Andrew.Graham@queensu.ca 41 Policy, Direction: The Public Good to be Achieved: the Policy Process Accounting, Evaluating and Reporting It’s about the money.. Delivery the Public Good: Operations, Management and Control Resourcing the Policy Objectives: the Budget Process Andrew.Graham@queensu.ca 42 What is Financial Management? Financial Management is that part of the management and policy process that focuses on financial resources, securing and using them and the information to deliver services and support managerial decision making and reporting. Andrew.Graham@queensu.ca 43 Why Financial Management? • Governments could not function without funds for policy and programs • Money is a scarce commodity and competition for it is fierce which makes its effective management critical • The search for and competition for funds will inevitably bring in the culture of the organization, its capacity and role of people, power and politics, writ large and small in what might initially be seem to concern itself with only figures and dollars. Andrew.Graham@queensu.ca 44 Why Financial Management? • The money is public and administered in a democracy thereby creating a broad base of ownership and interest. • Accounting for those funds is a primordial value of democratic society • Budgeting and financial management procedures are the accounting manifestation of public policy 45 RESOURCE LEVELS SET HOLDING AND BEING HELD TO ACCOUNT FOR THE RESOURCES USING THE RESOURCES Plan, budget, cost, authorize Funding Your Objectives Report, account, audit, evaluate, recost, reallocate Measuring Performance against Objectives and Retooling Control, monitor, adjust, reallocate Achieving Your Objectives Public Financial Management Objectives Cost effective service Fiscal Discipline Procedural Control Fiscal Control Efficient resource allocation Accounting Discipline Effective decision making Required Financial Management Elements • Management Decision Support • Financial evaluation • Program risk management • Capital investment analysis • Financial performance • Accounting, Budgets and Financial • Business Planning, Fiscal Planning • Risk Management, Accountability management and Budgeting • Strategic business planning • Capital planning • Integrated capital, operating and cash-flow budgeting • In-year cash management Reporting • Accounting policy application and control • Budget compliance and control • Costing • Financial reporting and Control • Program risk management and control • Asset and Liability risk management and control • Transfer Payment, Agency and Trust risk management and control Andrew.Graham@queensu.ca 49 Issues and Discussion Financial information does not tell the full story, but it does tell an important part of it Focus on information tends to reflect the accounting perspective The focus of this course is on the decision maker as well as the interaction between the two Financial management is a two way street: serving managers’ needs and serving the accounting needs of the public sector Andrew.Graham@queensu.ca 50 Issues and Discussion • Financial management practice also involves such elements as • Allocating resources, • Reallocating resources, • Monitoring financial and program performance, • Monitoring the use of funds within assigned budgets • Deciding on adjustments to spending or fees as a result of financial information and • Accounting for all the above Andrew.Graham@queensu.ca 51 Issues and Discussion • More than just receiving reports and reacting to them • Financial management is involved in sound policy making right through to accounting for past performance • Especially crucial in program delivery areas where resources are always scarce and demands high requiring the most effective means to manage resources. Andrew.Graham@queensu.ca 52 Issues and Discussion • Financial resource management and accounting are a hugely powerful metaphor for government performance • Often financial information serves as a surrogate for performance information Andrew.Graham@queensu.ca The Architecture of Financial Management 53 Some Terminology • Management Accounting: getting accounting information to managers in a form that they can use; focus here is on the internal needs of managers to know what is going on in terms of their money, instead of public reporting. • Financial Accounting: focuses on the preparation of financial statements, which must conform to external accounting standards, for the information of owners, shareholders, taxpayers, etc. Andrew.Graham@queensu.ca Financial Management Financial Accounting Financing of Programs 55 Andrew.Graham@queensu.ca 56 Financing of Programs Source of Funding: Budgeting Deployment of Resources: Control Generation of Revenue Reallocation and Reduction Andrew.Graham@queensu.ca 57 Financial Accounting Accounting for Management Managerial Accounting generates financial Information for decision making, accountability and planning Accounting for Financial Reporting Financial accounting generates retrospective information of financial position and performance. Andrew.Graham@queensu.ca 58 Accounting for Management Planning Future Cash Management and Control Present Reporting Compliance and Performance Past Andrew.Graham@queensu.ca 59 Accounting for Financial Purposes Internal Reporting External Reporting Audit Andrew.Graham@queensu.ca 60 How the Course is Structured to Address These Elements Context Risk The Basics Accounting Financial Statements Budgeting 827 Budgets Reallocation Control Cash Management Reporting Accountability Audit Andrew.Graham@queensu.ca 61