Document

advertisement

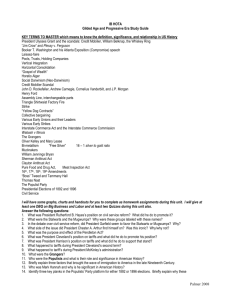

Comprehensive Volume, 18th Edition Chapter 7: The Legal Environment of International Trade Principles of International Law Parties may choose the parameters of their agreement. Which country’s laws will govern the transaction? Where and how will disputes be resolved? What currency or monetary system will be used for the transaction? Chapter 7 A large number of international trade organizations exist to help facilitate multinational transactions in goods, services and investments. Major Treaties Chapter 7 The General Agreement on Tariffs and Trade (GATT), subscribed to by the United States and most of the industrialized countries of the world, is based on the principle of trade without discrimination. The United Nations Convention on Contracts for the International Sale of Goods (CISG) provides uniform rules for international sales contracts between parties in contracting nations. Goals of International Trade Organizations and Treaties Chapter 7 General Agreement on Tariffs and Trade (GATT) promote world trade United Nations Convention on Contracts for the International Sale of Goods (CISG) establish uniform rules for international sales contracts United Nations Conference on Trade and Development (UNCTAD) redistribute income internationally through trade European Economic Community (EEC) remove trade barriers and unify economic policies Goals of International Trade Organizations and Treaties Chapter 7 United States - Canada Free Trade Agreement (FTA) increase trade between these countries North American Free Trade Agreement (NAFTA) eliminate tariffs between Mexico, Canada, and U.S. International Monetary Fund (IMF) facilitate expansion and balanced growth of international trade Organization of Petroleum Exporting Countries (OPEC) control oil production and exploration Forms of Business Structure for International Trade Direct sales from business to international customer – no “middleman.” Export Sales Domestic business works with foreign business to sell or produce product. Agency Foreign Distributorship Licensing and Franchising Domestic business sets up a business in a foreign country & maintains control. Chapter 7 Wholly Owned Subsidiary Joint Venture Antitrust Considerations In choosing the form for doing business abroad, U.S. firms must be careful not to violate the antitrust laws of host countries. Anticompetitive foreign transactions may have an adverse impact on competition in U.S. domestic markets. Chapter 7 Doing Business Internationally Export Sale Direct sale; payment by letter of credit U.S. firm not present in foreign country Export subject to tariff, but U.S. firm not subject to taxation by importing country Agency Foreign agent--representative Commonly subjects U.S. firm to local tax Foreign Distributorship Chapter 7 Distributor takes title, risks U.S. firm avoids managing foreign operation Doing Business Internationally Licensing Transfer of technology rights for royalties Includes Franchising – which also grants the right to use of trademarks and copyrights under controlled conditions Wholly Owned Subsidiary Domestic company establishes company in foreign country; Maintains control Joint Venture Chapter 7 Arrangement between a U.S. manufacturer and a foreign entity; governed by contract between them. Regulation in International Trade Export Regulations Licensing • Applies to materials and products which may be controlled for security reasons, limited by sanctions, or in short supply. • Some businesses use licensed foreign freight forwarders who are experts in all aspects of exporting goods. • Criminal sanctions apply if false information regarding the intended use of the material is given in the licensing application. Intellectual Property Issues Chapter 7 Counterfeit Goods – various treaties and laws protect against the importation of goods which violate U.S. copyright or trademark laws. Gray Market Goods – a foreign business that owns the right to use a trademark only outside of the United States is not allowed to import those goods to the U.S. Regulation in International Trade Antitrust United States courts assume jurisdiction in antitrust cases if there is a direct effect on U.S. commerce. They apply a “jurisdictional rule of reason,” weighing the interests of the United States against the interests of the foreign country involved in making a decision on whether to hear an antitrust case. Defenses against U.S. antitrust laws applied outside the U.S. include: • Act of State Doctrine (obligation to respect the judgment of another country for actions taken within its own territory) • Sovereign Compliance Doctrine (when a defendant’s actions were compelled by the foreign government) • Sovereign Immunity Doctrine (protects a sovereign government from being sued in most cases) Securities Chapter 7 United States courts have jurisdiction in international securities fraud cases if there is a loss to Americans living in the United States. In some cases, U.S. courts have jurisdiction if a loss is to Americans living abroad. Regulation in International Trade Barriers to trade Tarriffs – monetary tax or duty applied to imported goods; raises price of imports. Non-tarriff barriers – non-monetary restrictions such as quantity limits, quality standards, inspection requirements and production requirements. Export controls – policies to deny certain countries the rights to buy materials of military importance or to refuse to sell any goods to certain countries as a means of punishment for that country’s activities or human rights policies. Antidumping Laws – Dumping (selling at less than fair market value) of foreign goods is illegal in the United States. Other considerations for multinational companies Expropriation – the taking over of a U.S. owned business in a foreign country by that foreign government is a risk that business owners often face. Treaties and the foreign government’s desire to maintain friendly trade relations help mitigate this risk. Some Chapter businesses purchase insurance against this risk. 7 Foreign Corrupt Practices Act – bribing of foreign officials is illegal for U.S. firms doing business abroad – even if bribing is an accepted practice in that country.