chapter ten

Legal Forces

McGraw-Hill/Irwin

International Business, 11/e

Copyright © 2008 The McGraw-Hill Companies, Inc. All rights reserved.

Learning Objectives

Discuss the complexity of the legal forces that

confront international business

Recognize the importance of foreign law

Explain contract devices and institutions that

assist in interpreting international contracts

Recognize the need and methods to protect your

intellectual properties

10-3

Learning Objectives

Discuss enforcement of antitrust laws

Explain the risk of product liability legal actions,

which can result in imprisonment for employees or

fines for them and the company

Discuss U.S. laws that affect international

business operations

10-4

International Legal Forces

• Rule of law allows foreign

businesses to know interests will

be protected

• Public International Law

– Legal relations between governments

• Private International Law

– Laws governing transactions of

individuals and companies that cross

international borders

10-5

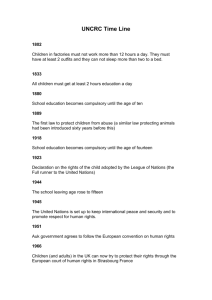

Sources of International Law

• The most important source is found in

bilateral and multilateral treaties between

nations

– Treaties are agreements between countries,

which may be bilateral (between two countries)

or multilateral (involving more than two

countries); also called conventions, covenants,

compacts, or protocols

– United Nation’s International Court of Justice

creates law when it decides disputes

10-6

Extraterritoriality

• A country’s attempt to apply its laws

to foreigners or nonresidents and to

acts and activities that take place

outside its borders

– Not done through force, but by

traditional legal means

10-7

International Dispute Settlement

Litigation in the United States

well-developed court systems that facilitate

litigation

One reason many people outside the

U.S. dislike litigation in the U.S. is the

process of discovery

Unlike most other countries, the U.S.

has two major court systems

The federal court system and the

state court systems

10-8

Performance of Contracts

• United Nations Solution

– Many countries, including the U.S., have

ratified the UN Convention on Contracts

for International Sales of Goods (CISG)

– CISG established uniform legal rules to

govern international sales contracts and

the rights and obligations of the buyer and

seller

– CISG is automatically applied to all

contracts

10-9

Performance of Contracts

• Private Solution: Arbitration

– Instead of going to court in any country,

companies may opt for arbitration

• A process, agreed to by parties to a dispute

in lieu of going to court, by which a neutral

person or body makes a binding decision

• Generally faster

• More informal

• Confidential

• Less expensive

10-10

Enforcement of Foreign Arbitration Awards

• The UN Convention on the Recognition and

Enforcement of Foreign Arbitral Awards

– The U.S. and most UN member-countries of

have ratified this convention

– Binds ratifying countries to compel arbitration

when the parties have so agreed in their

contract and to enforce the resulting awards

10-11

Intellectual Property: Patents, Trademarks,

Trade Names, Copyrights, and Trade Secrets

Intellectual property includes

Patents

Trademarks

Trade names

Copyrights

Trade secrets

All result from the exercise of

someone’s intellect

10-12

Intellectual Property

Patents (Protection)

International Convention for the

Protection of Industrial Property

European Patent Organization (EPO)

The World Intellectual Property

Organization (WIPO)

10-13

Intellectual Property

Trademarks

Protection varies by country, 10 to 20

years

Madrid Agreement of 1891

General American Convention for

Trademark and Commercial Protection

Bilateral basis in friendship,

commerce, and navigation treaties

10-14

Intellectual Property

Trade Names

Protected in countries that adhere to the

Convention for the Protection of Industrial

Property

Copyrights

– Protection provided under the Berne

Convention of 1886 adhered to by 77 countries

– Universal Copyright Convention of 1954

adopted by 92 countries

10-15

Common Law or Civil Law?

Common Law

Jurisdiction has

more power to

expand rules to fit

particular cases

Civil Law

Jurisdiction is

bound by the

words in the

code

Much more

predictable

10-16

Legal System Differences between

Europe and United States

Europe

Legislation is rarely amended and

regulations are rarely revised

Courts are not as often asked to give their

interpretations

If they are, the decisions are rarely

appealed

United States

Laws and regulations are constantly being

amended or revised by legislatures and the

agencies

10-17

Legal System Differences between England

and the U.S.

England has a split legal profession with

barristers and solicitors

England has no jury for civil court

actions

Contingency fees less common in

England

Award of costs to the winner in civil

litigation standard in England

Pretrial discovery differs

10-18

Standardizing Laws

• Many attempts have been made to standardize

laws among various countries

• International business flows much better with a

uniform set of rules

• Attempts include

– Tax conventions and treaties

– Antitrust cooperation

– International Center for Settlement of

Investment Disputes

– UN Convention on International Sale of Goods

– International Organization for Standardization

(ISO)

– International Electrotechnical Commission (IEC)

10-19

Taxation

• Nonrevenue tax purposes

– To redistribute income, discourage

consumption of products such as tobacco

and alcohol, and encourage purchase of

domestic rather than imported products

10-20

National Tax Approach Differences

• Tax Levels

– Range from relatively high in some

Western European countries to zero in

tax havens

– Some countries have capital gains taxes,

and some do not

• Capital gain is realized when an asset

is sold for an amount greater than its

cost

10-21

National Differences of Approach

• Tax Types

– Capital gains tax

– Income tax

• Common in industrialized countries

– Value-added tax

• Tax based on the value of goods and

services

• Used in Europe

– Unitary tax

10-22

Taxation

10-23

Tax Laws and Regulations

• Complexity of national tax systems

differs

– Many consider tax laws and regulations of the

U.S. the most complex

• Compliance with tax laws and their

enforcement vary widely

– Germany and U.S. strict, Italy and Spain

relatively lax

• Other differences include

– Tax incentives, exemptions, costs,

depreciation allowances, foreign tax credits,

timing, and double corporate taxation

10-24

Taxation

Tax Treaties or Conventions

– Treaties between countries that bind the

governments to share information about

taxpayers and cooperate in tax law

enforcement, often called tax conventions

– The U.S. has tax treaties with over 50

countries

10-25

Taxation

• National Tax Jurisdiction

– A tax system for expatriate citizens of a

country whereby the country taxes them on

the basis of nationality even though they live

and work abroad

• Territorial Tax Jurisdiction

¯ Expatriates are exempt from their country’s

taxes

10-26

Antitrust Laws

• Antitrust laws

– Laws to prevent price fixing, market sharing,

and business monopolies

• Competition policy

– The European Union equivalent of antitrust laws

• The U.S. and the EU have attempted to

enforce their antitrust laws extraterritorially

• Japan’s Fair Trade Commission

– the “toothless tiger”

– Japanese companies are incorporating antitrust

thinking into strategy

10-27

Tariffs, Quotas, and Other

Trade Obstacles

Purposes of

tariffs

To raise revenue for

government

To protect domestic

producers

Quotas limit the

number or

amount of imports

For protection

Other trade

obstacles include

Health requirements

Packaging

requirements

Language

requirements

Weak patent or

trademark protection

Quarantine periods

Voluntary Restraint

Agreements

10-28

Torts

Product Liability

– Standard that holds a company and its officers and

directors liable and possibly subject to fines or

imprisonment when their product causes death,

injury, or damage

Strict Liability

– Standard that holds the designer or manufacturer

liable for damages caused by a product without the

need for a plaintiff to prove negligence in the

product’s design or manufacture

10-29

U.S. Laws That Affect U.S. Firms’

International Business

• Federal Employment Laws

– Title VII of the CRA of 1964

– ADEA and ADA

• Foreign Corrupt Practices Act (FCPA)

– U.S. law prohibits making payments to

foreign government officials for special

treatment

– Congress passed FCPA outlawing bribery,

but not “grease” payments

10-30

2002 Bribe Payers Index

10-31

Accounting Law

• Sarbanes-Oxley Act (SOX)

– Brings major changes to the regulation of

corporate governance and financial practice

• New reporting requirements

• Officer and director responsibilities

• Auditor independence

– Applies to any company, domestic or foreign,

that has securities registered or is required to

file reports under the Securities Exchange Act

of 1934

10-32