electronic_payment. - Budi Hermana

advertisement

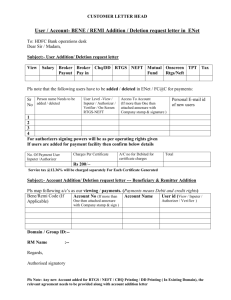

Electronic Fund Transfer Systems Electronic Clearing RTGS International Fund Transfer Intro.to FISCAM Electronic Fund Transfer System Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-1 Electronic Fund Transfer Systems Electronic Clearing RTGS International Fund Transfer Intro.to FISCAM Sistem Kliring Elektronik Pak U mempunyai tabungan di Bank X CEK Bank A CEK Bank A Penyerahan warkat kliring (Session I) 2 BI BANK X Penerimaan/Penolakan Warkat (Session II) CEK Bank A 1 Barang CEK Bank A Penerimaan Warkat (Pertemuan I/pagi) BANK A Pak E mempunyai giro di Bank A Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-2 Electronic Fund Transfer Systems Electronic Clearing RTGS International Fund Transfer Intro.to FISCAM Sistem Kliring Elektronik Warkat Kliring • • • • • • Cek Bilyet Giro Wesel Bank Untuk Transfer Surat Bukti Penerimaan Transfer Nota Debet Nota Kredit Sistem Kliring • • • • Manual Semi Otomasi Otomasi Elektronik Penyelesaian Akhir (Settlement) Pemindahbukuan rekening giro masing-masing Bank di BANK Indonesia Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-3 Electronic Fund Transfer Systems Electronic Clearing RTGS International Fund Transfer Intro.to FISCAM Sistem Kliring Elektronik MAKER (DRAWER) DATE PAYEE The paper cheque is just a carrier of information. AMOUNT CURRENCY DRAWEE BANK DRAWEE BANK NUMBER CHEQUE NUMBER AUTHORIZED SIGNATURE OF MAKER’S AGENT DRAWER ACCOUNT NUMBER Electronic transmission is better. We dematerialize the cheque (remove the paper). 06130018184310143700000000010000USD065200356425020010130 DRAWEE BANK NUMBER DRAWER ACCOUNT NUMBER CHEQUE NUMBER AMOUNT CURRENCY PAYEE BANK NUMBER PAYEE ACCOUNT NUMBER DATE Only the information is sent to the clearing house Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-4 Electronic Fund Transfer Systems Electronic Clearing RTGS Sistem Kliring Elektronik International Fund Transfer Intro.to FISCAM Diagram Sistem Kliring Elektronik Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-5 Electronic Fund Transfer Systems Electronic Clearing RTGS Sistem Kliring Elektronik International Fund Transfer Intro.to FISCAM Mekanisme 1. Pemisahan warkat per jenis transaksi (debet atau kredit), stempel kliring, dan pencantuman MICR 2. Bank pengirim merekam data ke sistem dengan menggunakan reader encoder atau data entry 3. Mengelompokkan warkat dalam batch 4. Mengirimkan batch DKE secara elektronik melalui jaringan komunikasi data ke penyelenggara, Fisik warkat dikirim juga untuk dipilah berdasarkan bank tertuju dengan menggunakan mesin baca berteknologi image 5. Peserta dapat melihat status DKE (sukses atau gagal) 6. SPKE memproses DKE setelah waktu transmit DKE berakhir 7. SPKE mem-broadcast informasi hasil kliring sehingga peserta bisa melihat secara on line posisinya Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-6 Electronic Fund Transfer Systems Electronic Clearing RTGS International Fund Transfer Sistem Kliring Elektronik 1. BUYER SENDS AN ORDER TO BUYER’S BANK TO CREDIT $X TO SELLER’S ACCOUNT IN SELLER’S BANK ACH Credit Transaction BUYER BUYER’S BANK Intro.to FISCAM SELLER 2. BUYER’S BANK SENDS TRANSACTION TO AUTOMATED CLEARINGHOUSE 6. SELLER’S BANK CREDITS SELLER’S ACCOUNT WITH $X SELLER’S BANK 4. BUYER’S BANK PAYS $Y TO SETTLEMENT BANK SETTLEMENT BANK 5. SETTLEMENT BANK PAYS $YTO SELLER’S BANK CLEARINGHOUSE 3. CLEARINGHOUSE DETERMINES THAT BUYER’S BANK OWES SELLER’S BANK $Y (ALL TRANSACTIONS ARE NETTED) Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-7 Electronic Fund Transfer Systems Electronic Clearing RTGS Sistem Kliring Elektronik 1. BUYER AUTHORIZES SELLER TO DRAW $X FROM BUYER’S ACCOUNT IN BUYER’S BANK BUYER International Fund Transfer Intro.to FISCAM ACH Debit Transaction 2. SELLER ASKS HIS BANK TO SEND TRANSACTION TO AUTOMATED SELLER CLEARINGHOUSE 7. SELLER’S BANK CREDITS SELLER’S ACCOUNT WITH $X 8. BUYER’S BANK ADVISES BUYER OF PAYMENT BUYER’S BANK 5. BUYER’S BANK PAYS $X TO SETTLEMENT BANK SETTLEMENT BANK 6. SETTLEMENT BANK PAYS $X TO SELLER’S BANK SELLER’S BANK 3. SELLER’S BANK SENDS TRANSACTION TO AUTOMATED CLEARINGHOUSE CLEARINGHOUSE 4. CLEARINGHOUSE DETERMINES THAT BUYER’S BANK OWES SELLER’S BANK $X (ALL TRANSACTIONS ARE NETTED) Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-8 Electronic Fund Transfer Systems Electronic Clearing RTGS Real Time Gross Settlement International Fund Transfer Intro.to FISCAM Tujuan 1. Memberikan pelayanan sistem transfer dana antar peserta, antar nasabah peserta dan pihak lainnya secara cepat, aman, dan efisien 2. Memberikan kepastian pembayaran 3. Memperlancar aliran pembayaran (payment flows) 4. Mengurangi resiko settlement baik bagi peserta maupun nasabah peserta (systemic risk) 5. Meningkatkan efektifitas pengelolaan dana (management fund) bagi peserta melalui sentralisasi rekening giro 6. Memberikan informasi yang mendukung kebijakan moneter dan early warning system bagi pengawasan bank 7. Meningkatkan efisiensi pasar uang Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-9 Electronic Fund Transfer Systems Electronic Clearing RTGS International Fund Transfer Net VS Gross Real Time Gross Settlement NET SETTLEMENT Internet Bank Gross Payment Before Netting Sender Bank Intro.to FISCAM Receiving Bank A B C Ammount of Liability D A - 90 40 80 210 B 70 - 0 0 70 C 0 50 - 20 70 D 10 30 60 - 100 Total Claim 80 170 100 100 450 Net Claims (+) or Liabilities (-) of Each Bank Bank A B C D Net Total -130 100 30 0 0 Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-10 Electronic Fund Transfer Systems Electronic Clearing RTGS International Fund Transfer Intro.to FISCAM Net VS Gross Real Time Gross Settlement GROSS SETTLEMENT (40) BANK A (80) (90) (70) BANK B BANK C (50) (60) (10) (30) (20) BANK D Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-11 Electronic Fund Transfer Systems Electronic Clearing RTGS Real Time Gross Settlement International Fund Transfer Intro.to FISCAM Karakteristik 1. 2. 3. 4. 5. 6. 7. 8. 9. V Shaped Structure Transfer mechanism Window Time No Money No Game Capping Queue Management and Gridlock Resolution Intraday Liquidity Facility Bye-Laws Information Technology Security and Disaster Recovery Plan 10.Future Plan Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-12 Electronic Fund Transfer Systems Electronic Clearing RTGS International Fund Transfer Real Time Gross Settlement Intro.to FISCAM V Shaped Structure Sender Bank Receiving Bank 3. Full Payment Message 1. Full Payment Message 2. Settlement RCC BI-RTGS Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-13 Electronic Fund Transfer Systems Electronic Clearing RTGS Real Time Gross Settlement 1. 2. 3. International Fund Transfer Intro.to FISCAM Transfer Mechanism Sender Bank enters credit transfer input into RTGS Terminal which will be further transmitted to RCC at Bank Indonesia RCC will process the credit transfer with the following mechanism: • To verify whether the checking account balance of the sender bank is higher or equal to the nominal ammount of credit transfer • When the sender bank’s checking account is adequate, a posting in the sender bank and receiving bank checking accounts will be executed simultaneously • When the sender bank checking account is not adequate, the credit transfer will be placed in queue within the RTGS machine Settled credit transfer information will be transmitted automatically to RCC to RTGS terminal to receiving bank Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-14 Electronic Fund Transfer Systems Electronic Clearing RTGS International Fund Transfer Intro.to FISCAM Real Time Gross Settlement Window Time 06.30 a.m. to 5.00 pm Prolong time for certain cases No Money No Game Only credit other participant account Not Allowed to Debit other participant account Capping • • To minimize vairous payment system risk In the beginning, Rp 1 Billiun Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-15 Electronic Fund Transfer Systems Electronic Clearing RTGS Real Time Gross Settlement 1. International Fund Transfer Intro.to FISCAM Queue Management and Gridlock Resolution The queue in BI-RTGS system based on priority level and first in first out (FIFO) 2. 3. 4. The queue modul in BI-RTGS system shall be completed with bypass FIFO facility which automatically operates when the queue reaches a certain ammount, for the purpose of reducing the number of queues The priority level in queue module in BI-RTGS system is as follows: • First priority Coverage of clearing result • Second priority Bank transaction with BI/the government • Third priority Credit transfer originating from BI-RTGS participant banks When BI-RTGS detects gridlock, gridlock resolution facility will be operated automatically as well as manually based on the criteria of balance adequacy or using First Available First Out (FAFO) method Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-16 Electronic Fund Transfer Systems Electronic Clearing RTGS Real Time Gross Settlement 1. 2. 3. 4. 5. 6. 7. International Fund Transfer Intro.to FISCAM Intraday Liquidity Facility BI-RTGS participant banks shall file application to obtain FLI with BI Banks shall pledge SBI and or government bonds as collateral so that FLI facility is fully secured BI will determine the maximum FLI that could be withdrawn in a certain period within 1 day. The FLI used by BI-RTGS participant banks as required by the bank’s real need in an intraday (provided when needed) When a bank receives incoming transfer, the incoming transfer will automatically be used to reduce FLI balance used On certain limitation, FLI facility shall be returned to BI at the end of a day. If the bank could not return it on time, the FLI facility will be transfermed into FPJP overnight On T+1, BI will claim all the bank liabilities by using “super priority” transaction which will be settled before other transactions At certain time in the morning, if the bank has not settled the payables, the bank will be suspended from BI-RTGS Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-17 Electronic Fund Transfer Systems Electronic Clearing RTGS International Fund Transfer Intro.to FISCAM Fedwire (US RTGS) • Real-time gross settlement system of the Federal Reserve • Used by any institution that has an account at the Federal Reserve • Used mainly for large transfers (average: $3.5M) • On-line connection (7800 institutions, 99% of transfers) – Direct connection – Computer dialup • Off-line connection (1700 institutions, 1% of transfers) – Telephone instructions with codeword • FedLine access from PCs • Some services over the Web (not funds transfer yet) Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-18 Electronic Fund Transfer Systems Electronic Clearing RTGS Fedwire (US RTGS) International Fund Transfer Intro.to FISCAM Participants • • • • • Depository institutions Agencies and branches of foreign banks Member banks of the Federal Reserve System U.S. Treasury and authorized agencies Foreign central banks, foreign monetary authorities, foreign governments, and certain international organizations; and • Any other entities authorized by a Reserve Bank Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-19 Electronic Fund Transfer Systems Electronic Clearing RTGS International Fund Transfer Intro.to FISCAM How Fedwire Works Fedwire (US RTGS) PNC WANTS TO TRANSFER $1M TO EVERGREEN BANK EVERGEEN BANK (SEATTLE) 9. SEATTLE BRANCH NOTIFIES EVERGREEN. PAYMENT IS NOW IRREVOCABLE. PNC BANK (PITTSBURGH) 1. PNC SENDS TRANSFER ORDER TO PITTSBURGH BRANCH OF CLEVELAND FED SAN FRANCISCO FED (SEATTLE BRANCH) CLEVELAND FED (PITTSBURGH BRANCH) 8. SF FED NOTIFIES SEATTLE BRANCH 2. PITTSBURGH BRANCH SENDS ORDER TO CLEVELAND FED INTERDISTRICT SETTLEMENT FUND SAN FRANCISCO FED 6. ISF NOTIFIES SF FED EVERGREEN BANK ... WELLS FARGO WESTERN BANK 7. SF FED ADDS $1M TO EVERGEEN ACCOUNT ATLANTA FED BOSTON FED CLEVELAND FED ... 4. CLEVELAND SENDS ORDER TO ISF CLEVELAND FED SAN FRANCISCO FED DOLLAR BANK MELLON BANK ... PNC BANK 5. ISF SUBTRACTS $1M FROM CLEVELAND, ADDS $1M TO SF 3. CLEVELAND FED SUBTRACTS $1M FROM PNC ACCOUNT Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-20 Electronic Fund Transfer Systems Electronic Clearing RTGS International Fund Transfer Intro.to FISCAM Fedwire (US RTGS) • In 2000, – 108 million Fedwire transfers – Value $380T (11 times the World Economic Product) – New York Fed: 40 million transfers, $209T • “Instantaneous” (within minutes) irrevocable settlement • Payment guaranteed by Fed • Operates 18 hours/day on business days • No minimum dollar amount • Daylight overdrafts permitted (intraday peak: $70B) – Fee charged if not collateralized ($6.94 per million) Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-21 Electronic Fund Transfer Systems Electronic Clearing RTGS International Fund Transfer Intro.to FISCAM CHIPS • (Clearing House Interbank Payments System) – Private, owned by NY Clearing House Association – U.S. dollar leg of foreign exchange (90% share) – 128 banks, 29 countries – Continuous multilateral netting • Each bank’s position v. every other bank constantly recalculated – Irrevocable transactions, end-of-day settlement – $1.44T per day, average transaction $6.6M – Cost per transaction: $0.13 - $0.40 Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-22 Electronic Fund Transfer Systems Electronic Clearing CHIPS RTGS International Fund Transfer Intro.to FISCAM CHIPS Operation • London Bank L has an account in a NY Bank A • Wants to transfer $1M to the account of Bank J in NY Bank B (A and B are on CHIPS) • Bank L sends Bank A a SWIFT message • Bank A verifies the message, enters it into CHIPS (Bank A has the $1M; doesn’t rely on L’s credit) • CHIPS verifies that the transaction is within A’s debit limit and the B-A bilateral limit; otherwise rejects • CHIPS notifies Bank B that $1M is being deposited from Bank L through Bank A for Bank J • Bank B notifies Bank J that $1M has been added to its account Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-23 Electronic Fund Transfer Systems Electronic Clearing CHIPS RTGS International Fund Transfer Intro.to FISCAM CHIPS Operation • CHIPS closes at 4:30 p.m. NY time • Each settling bank gets a settlement report showing net amount owed or owing • Settling banks have until 5:30 to challenge the total or must pay into the CHIPS account at the NY Federal Reserve by Fedwire (US RTGS) • Banks with net credit positions are paid by 5:45 • All payment orders are final and irrevocable • Fedwire is a payment system • CHIPS is a clearing system • SWIFT is a messaging system Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-24 Electronic Fund Transfer Systems Electronic Clearing RTGS International Fund Transfer CHIPS Operation CHIPS LONDON BANK L 1. BANK L TELLS BANK A TO PAY $1M TO J’s ACCOUNT IN BANK B S W I F T JACKSONVILLE BANK J 2. BANK A VERIFIES FUNDS, ENTERS CHIPS TRANSACTION NEW YORK BANK A (L’S CORRESPONDENT) F E D W I R E Intro.to FISCAM CHIPS CHIPS CHIPS CHIPS 4. AT 4:30, CHIPS TELLS BANK A HOW MUCH TO PAY VIA FEDWIRE 9. CHIPS ADVISES B OF CREDIT AMT A’S ACCOUNT B’S ACCOUNT S W I F T 10. B CREDITS J WITH $1M NEW YORK BANK B (J’S CORRESPONDENT) 3. CHIPS VERIFIES CREDIT LIMITS, ADJUSTS ACCTS INTERNALLY 7. BY 5:45, CHIPS MAKES PAYMENT TO B 5. BANK A MUST PAY BY 5:30 FEDERAL RESERVE A’s ACCOUNT B’s ACCOUNT 6. FED MOVES $$ INTO CHIPS ACCT 8. FED DEBITS CHIPS ACCOUNT; CREDITS B’S ACCOUNT CHIPS SETTLEMENT ACCOUNT Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-25 Electronic Fund Transfer Systems Electronic Clearing RTGS International Fund Transfer Intro.to FISCAM SWIFT A major international interbank network, transmitting instructions and other information, NOT a fund transfer network. Settlements are conducted through Fedwire, CHIPS, etc. Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-26 Electronic Fund Transfer Systems Electronic Clearing RTGS International Fund Transfer Intro.to FISCAM SWIFT • Society for Worldwide Interbank Financial Telecommunication (non-profit, Brussels) • Financial messaging system, not a payment system – Settlement must occur separately • • • • • • • 7125 institutions, 193 countries 1.27 billion messages per year: $5 trillion per day Cost ~ $0.20 per message X.25 packet protocol CCITT X.400 store-and-forward standard Moving to full IP network in 2002 swiftML – interoperable with ebXML Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-27 Electronic Fund Transfer Systems Electronic Clearing SWIFT RTGS International Fund Transfer Intro.to FISCAM Security Control There are five central requirements of network security: (1) Confidentiality: Data should not be disclosed to unauthorized persons; (2) Access control: Operation of the system is under some control mechanism to prevent illegal access of data; (3) Integrity: Message information should remain original to carry designated transaction details. (4) Data origin authentication: Some way is used to prove the source of data; (5) Nonrepudiation: System should provide some features to ensure that nobody can deny involvement in an electronic transaction so that the legal effect of an EDI transaction can be relied on. Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-28 Electronic Fund Transfer Systems Electronic Clearing RTGS SWIFT International Fund Transfer Intro.to FISCAM Security Control End-to-end authentication SWIFT provides secret-key and end-to-end authentication; i.e. authentication between two banks detecting any bogus payment message. Sequence number control Authentication control does not prevent a message from being replicated, deleted, or stored and retransmitted at a later date. The sequence numbering of messages handles these requirements. A payment message is transmitted with an input sequence number, output sequence number, and transaction reference number. They must be in order separately. The format and the input sequence number are checked by the SWIFT operating center and those messages with format errors or wrong sequence numbers are rejected by operating centers. Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-29 Electronic Fund Transfer Systems Electronic Clearing RTGS International Fund Transfer Intro.to FISCAM SWIFT User access control Terminals logging into the system must verify their identity using a password issued by SWIFT. The password is sent in two parts in the form of a table. Encryption between operating centers To preserve the privacy of the banks' messages, the international lines that connect operating centers and join them to regional processors are protected by encryption. SIPN level core security solutions • • • • IP Packet filtering IP Encryption Authentication and Integrity Router Authorization Firewalls Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-30 Electronic Fund Transfer Systems Electronic Clearing RTGS Others Fund Transfer System International Fund Transfer Intro.to FISCAM CHAPS CHAPS (Clearing House Automated Payment System) is an electronic transfer system for sending same-day value payments from bank to bank. It operates in partnership with the Bank of England in providing the payment and settlement service. CHAPS was developed in 1984, and is one of the largest real-time gross settlement systems in the world, second only to Fedwire in the US. CHAPS offers its Members and their participants an efficient, risk-free, reliable sameday payment mechanism. Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-31 Electronic Fund Transfer Systems Electronic Clearing • RTGS International Fund Transfer Intro.to FISCAM Others Fund Transfer System CHAPS Sterling Volumes and Values 1990,1997,1999 & 2000 Q1 1990 Q1 1997 Q1 1999 Q1 2000 Average daily 31,000 62,000 72,000 81,738 volume Average daily £78 £139 £169 £189 value billion billion billion billion Average £2.5 £2.2 £2.3 £2.31 transaction value million million million million Minimum £5,000 0 0 0 transaction value Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-32 Electronic Fund Transfer Systems Electronic Clearing RTGS Others Fund Transfer System International Fund Transfer Intro.to FISCAM TARGET TARGET, which stands for the Trans-European Automated Real-time Gross settlement Express Transfer system, is the real-time gross settlement system for the euro. TARGET consists of fifteen national real-time gross settlement (RTGS) systems and the ECB payment mechanism (EPM), which are interlinked so as to provide a uniform platform for the processing of cross-border payments. TARGET is more than simply a payment infrastructure; it will offer a premium payment service which will overcome national borders between payment systems in the EU. TARGET is a real-time system: under normal circumstances payments will reach their destination within a couple of minutes, if not only a few seconds, of being debited from the sending participant's account; all payments will receive the same treatment, regardless of their value. Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-33 Electronic Fund Transfer Systems Electronic Clearing RTGS Others Fund Transfer System International Fund Transfer Intro.to FISCAM TARGET TARGET is a gross settlement system in which each payment will be handled individually. Acknowledgement of the successful execution of each individual payment order will be sent to the sending national central bank in real time. TARGET provides intraday finality: settlement will be final once the funds have been credited. The money received will be central bank money. It will be possible to re-use these funds several times a day. Liquidity will be tied up only for the length of time necessary for real-time settlement to take place. TARGET is accessible to a large number of participants. Hence, most credit institutions will be able to use TARGET to make payments on their own behalf, independently of other participants. TARGET is very easy to use. To initiate a cross-border payment via TARGET, participants will simply send their payment orders to the euro RTGS system in which they participate using the domestic message format with which they are familiar. TARGET will take care of the rest. Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-34 Electronic Fund Transfer Systems Electronic Clearing RTGS International Fund Transfer Intro.to FISCAM Others Fund Transfer System Diskusi Program Pascasarjana, Universitas Gunadarma, Magister Management , Budi Hermana-35