GICWED

Gulf Investment Corporation Weekly Economic Digest

Volume 2, Issue 96, 01 November 2012

Inside this Issue:

The Bottom Line: Clearing House Systems

Do the Chinese People Dislike the Yuan?

In Focus

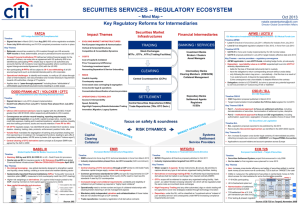

The Bottom Line: Clearing House Systems

This issue of the digest briefly highlights salient aspects of clearing,

payment, and settlement systems in the USA, GCC, Europe, Japan,

and China. The Clearing House in the US is considered the oldest

organization in the field as it was established in 1853. Its main

activities include payments, clearing, and settlement services to

banks and financial institutions, occupying 50% of US deposits and

fund transfers, check-image payments, and automated clearing

houses. An important note on the clearing of derivatives is that as

part of the Reform plan in 2009, the Option Clearing Corporation was

launched in March 2010 to back equity derivatives.

InBahrain,

the CBB operates and manages the national payment and

In Focus

settlement systems. The CBB operates a Real Time Gross Settlement

(RTGS) System where all inter-bank payments are processed and

settled in real time on-line mode. The RTGS system is multi-currency

capable and based on Straight Through Processing (STP) and at the

end of each business day, the system will transfer any remaining

balances from banks’ RTGS accounts to the banks clearing accounts.

The CBB offers an Automated Cheque Clearing System (ACS), which

1

was implemented in 1993 .

In Kuwait, the Kuwait Clearing Company (KCC) was established in

1982 after the collapse of the unofficial stock market, also known as

Souk Al-Manakh crisis. An Amiri decree in 1983 was issued in order to

establish the Kuwait Stock Exchange that later on in 1986 appointed

KCC to act on its behalf as a clearing, settlement and depository agent

for all security and derivatives transactions at the KSE. KCC was a

pioneer in introducing derivates to the region. Most recently, KCC

upgraded its systems TCS BaNCS to the new version, eliminating

legacy systems like the Registrar Services System, and hence

minimizing operational risks. This system now allows KCC 220,000

2

customers to have real time information and reporting .

In Oman, in September 2006, a joint effort between HP Middle East

and the Central Bank of Oman was released to the public, announcing

the completion of the Automated Clearing House solution (ACH),

complementing the Real Time Gross Settlement System (RTGS). The

ACH, the RTGS, and the Check Imaging System are the building blocks

3

that will aid in achieving real time settlement of payments . Also,

such systems pertain credit and counterparty risk reduction, allow

more transparent insight to determinants of economic activity, and

4

finally impose a high systemic value .

The Qatar Payment System (QPS) is designed on the concept of Real

Time Gross Settlement (RTGS) and Electronic Straight Through

Processing (e_STP). QPS is based on a swift network that consists of

inter-bank payments and settlements. RTG permits all banks

operating in Qatar to make immediate inter-bank money transfers

through their accounts with QCB. QCB’s clearing system is the set-off

by using electronic records and scanned images of cheques. e_STP is a

system designed to monitor intra-day transactions. The system

monitors a movement of a trade from entry to final processing and

5

reconciliation .

1

The Central Bank of Bahrain.

Source:www.tcs.com, Press Releases July 30 2012.

www.ameinfo.com, October 2006.

4

Central Bank of Oman.

5

Source: Qatar Central Bank.

In Saudi Arabia, the Capital Market Law provides for the

establishment of the Securities Depository Center solely entrusted to

execute the transactions of deposit, transfer, settlement, clearing and

registering ownership of securities traded on the exchange. The

functions of the Securities Depository Center are currently operated

by the Saudi stock exchange (Tadawul). Executed securities must be

cleared and settled according to a list of provisions and procedures.

Finally, the UAE central bank developed a mechanism, called UAEFTS,

for fund transfers where transfers of money take place from one bank

to another through the UAE’s central bank system. While the

mechanism is the country’s Real Time Gross Settlement System

(RTGS), the number of transfers undertaken daily reaches 8,000,

totaling AED 10 bn with no limit on the amount of funds that could be

th

transferred. Effective from April 14 2012, all banks in the UAE are

required to accept and process AED payment instructions through

UAEFTS and to switch from SWIFT financial messages to a file based

settlement system.

With the implementation of UAEFTS, usage of SWIFT messages will be

discontinued for all AED payments between banks, whereas SWIFT

messages will continue for other currency payments. Other forms of

payments include cheque clearings, which started in July 2008, with

the number of cheques cleared daily amounting to 97,000, totaling

AED 3.8 bn. ATMs is another payment method that started in 1996,

where 3,200 ATMs that belong to 45 banks are connected to GCCNET

6

with monthly withdrawal transactions reaching four million .

Europe, has a number of clearing houses, including the European

Multilateral Clearing Facility (EMCF) which serves as Europe’s largest

cash equities clearing company, and focuses on providing reliable

services against transparent and predictable pricing and using robust

7

risk management systems . The EMCF delivers services to 20

European markets through 10 multilateral trading facilities (MTF) and

exchanges. Another leading clearing house is London’s Clear net

Group that serves major international exchanges and platforms, as

well as a range of OTC markets. It clears a broad range of asset classes

including: securities, exchange traded derivatives, energy, freight,

interbank interest rate swap and euro and sterling denominated

bonds and repos.

The Bank of Japan provides two types of safe and convenient

settlement assets. One is banknotes, which are used by many

individuals and the other is deposits in BOJ accounts, which are used

by financial institutions. The bank also provides a system to settle

financial transactions by using BOJ accounts. Funds transfers between

BOJ accounts are used to settle interbank money market transactions,

the cash legs of Japanese government bonds (JGBs) and other

securities transactions, and net positions arising from private-sector

clearing systems. The bank has introduced real-time gross settlement

(RTGS) as the sole settlement mode for BOJ-NET FTS.

At the same time, given that settlement under RTGS requires a larger

amount of liquidity during the day, the bank has established an

intraday overdraft facility to support financial institutions' funding.

Following the conversion to RTGS, the bank has been working on the

next-generation RTGS (RTGS-XG) project of the BOJ-NET FTS, which

will enable large-value payments previously handled by the two

private-sector deferred net settlement (DNS) systems -- the Zengin

Data Telecommunication System (Zengin System) and the Foreign

Exchange Yen Clearing System (FXYCS) -- to be brought within the

2

3

Website: www.gic.com.kw

Telephone No: +965 2222-5000

6

7

The Central Bank of UAE.

http://www.euromcf.nl/

Volume 2 Issue 96

Page | 2

BOJ-NET FTS. As part of the project, the bank introduced liquidity8

saving features into the BOJ-NET FTS .

Finally, in recent years, China’s payment system has developed

rapidly as it becomes more market oriented and specialized. China’s

payment systems include the High Value Payment System (HVPS), the

Bulk Electronic Payment System (BEPS), interbank fund transfer

system, interbank bankcard payment system, cross-bank clearing

system for online payments, intra-city bill clearing system and foreign

currency payment system. In 2011, this payment system processed

15.5 bn transactions amounting to 1992 trillion Yuan of which 372

million transactions were processed by the PBC’s HVPS with a total

value of 1335 trillion Yuan, about 29 times of GDP for 2011.

Non-cash payment transactions increased by 22% y-o-y in 2011 with a

value of 1104trillion Yuan were processed. The commercial paper and

bank card transactions reached a trading volume of 301 and 324

trillion Yuan respectively with a 38.6% penetration rate of bank cards

while 325 institutions gained access to the Electronic Commercial

Draft System (ECDS). At the year-end, 120 institutions were accessed

to the interbank on line payment system, which was extended to the

whole country in the beginning of the year, with a daily average of

212 thousand transactions processed or an increase of 400% y-o-y.

The PBC also promoted the establishment of the China Association of

Payment and Settlement (CAPS) as an exploration in promoting the

industry’s self regulation to complement government supervision and

9

regulation .

In Focus

The UAE prime minister, Sheikh Mohammed bin Rashid AlMaktoum, has announced approval of a 2013 federal budget

that implements a heavy emphasis on social spending but

without the deficits of the last two years. The budget, a part

of the three-year government financial plan with total

spending of AED 133 billion, envisions a total spending of AED

44.6 billion ($12.1 billion) and no deficits. The UAE federal

budget accounts for only around 11% of overall fiscal

spending in the UAE, with Abu Dhabi composing the major

chunk, and six other individual emirates making up the rest.

Sheikh Mohammed also said that social spending will have

the largest share of 51% of the budget, while education will

account for 22% and water and electricity for 12%. The prime

minister also noted that the 2013 budget will prioritize

health, education & social benefits for citizens as well as the

improvement of government services (Zawya, October 29,

2012).

Steel producers in Saudi Arabia are set for a busy few years,

with growth in the industry driven by rising demand due to

state-backed investments and increasing activity in the

private sector. However, even with additional capacity, the

sector is working to bridge the supply gap. The Kingdom is

already the largest steel producer in the Middle East and

North Africa, and a recent estimate from industry research

firm RNCOS states that steel consumption will rise by

almost 20% per year between 2012 and 2015, with steel

rod, wire, bar and reinforcing bar all currently in high

demand. The growth projections for the coming years are

now double those RNCOS made earlier in 2012, which put

the increase in demand at around 10% per year. The

company expects steel consumption to be well over 12m

tons this year, as more projects come off the drawing board

(Oxford Business Group, 30 October 2012).

The King Abdullah City for Atomic and Renewable Energy

(KA-Care), created in 2010 to develop renewable energy

sources in Saudi Arabia, is planning a 17GW nuclear power

programmed by 2032. Although still in its infancy, sources

close to KA-Care suggest Riyadh’s nuclear plan could include

16 reactors spread around the country and costing $7

billion each, but this could change as the programe evolves

(MEED, 20 September 2012).

Do the Chinese Dislike the Yuan?

Chinese capital flight has been significant for the past years estimated

at $37 bn in H2 2011, followed by $68bn in Q2 2012 after probability

of a hard landing in China increased again. During the third quarter

2012 capital outflows are estimated at $31bn, pulled down by the

effect of QE3, and the weakening of the USD. The capital flight

pattern is discontinued by sudden inflows of hot money or

speculative money, betting on a strong Yuan and an economic

recovery for China.

Despite the government-imposed upper sealing transfer of $50,000

per year outside the country, Chinese investors are channeling their

wealth through stock markets and real estate outside the country.

However, the cost of this financial suppression is high since inflows of

foreign exchange from trade surpluses and net FDI are not showing

up in the foreign reserves accounts, through a manipulation of

10

invoices, underestimating exports, and overestimating imports .

Hence, China’s trade balance is inevitably much higher than what is

currently being reported.

China’s major trading partners are the EU, the US, Japan and the GCC.

China’s trade has risen appreciably with its partners: For example, its

trade with the GCC now accounts for nearly 10% of the total GCC

trade. But China’s trade with other countries is also increasing. For

instance, a close look at China’s ratio of imports from Australia and

Canada compared to the rest of China’s trading partners reveals a

visible trend. China’s share of imports from Australia is steadily rising

since 2003, bouncing from an annual average of 1.77% in 2003 to

4.64% in 2011.

Meanwhile, the share of imports from Canada averaged 1.24%

throughout the last 12 years. China’s share of exports with Australia

and Canada were relatively close to each other in early 2000 and up

to 2009, where the share of exports to Australia started to trend

upwards versus a downwards sloping trend to Canada.

8

9

The Central Bank of Japan.

People’s Bank of China “ 2011 Annual Report”.

The Economist, “ Capital Outflows, The flight of the renminbi” 27/10/2012.

10

Information:

GICWED is a weekly economic digest, produced by the Economics Division at

GIC. GICWED provides weekly review and analysis of unfolding global and

regional developments.

Contributors to GICWED are: Dalal Al-Jaser, Dalma Al-Essa, Emilia D’Costa,

Hiba Itani, Joby Ditto & Dr. Magdy Ali.

Contact: Dr. Sulayman Al-Qudsi, Email address: salqudsi@gic.com.kw

Phone No: 2222-5141.

Volume 2 Issue 96

General disclaimer / important information

This document is confidential and is being supplied to you solely for

your information and may not be reproduced or redistributed, in

whole or in part, directly or indirectly, to any other person.

This document does not constitute or form part of an offer to

subscribe for or purchase, or an invitation or solicitation of an offer to

subscribe for or purchase, any securities, nor shall it, or any part of it,

form the basis of, or be relied on in connection with, any contract or

commitment whatsoever. If any of the companies identified herein

should at any time commence an offer of securities, any decision to

invest in any such offer to subscribe for or acquire any such securities

must be based wholly on the information contained in a prospectus

and any supplementary prospectus issued or to be issued in

connection with any such offer and not on the contents of this

document.

This document has been prepared by Gulf Investment Corporation to

provide background information about the relevant industry. Any

forward-looking statements, opinions and expectations contained

herein are entirely those of Gulf Investment Corporation as part of its

internal research coverage and no other person shall be liable for any

loss arising from use of this document or otherwise arising in

11

connection therewith.

This document does not purport to be a complete description of the

matters referred to in the document. The information on which this

document is based has been obtained from sources which Gulf

Investment Corporation believes to be reliable, but Gulf Investment

Corporation has not independently verified such information.

Accordingly no representation or warranty, express or implied, is

made as to the fairness, accuracy, completeness or correctness of the

information and opinions contained in this document and no reliance

should be placed on such information or opinions. The information

and views given in this document are current as at the date of this

document, and are subject to change without notice.

There can be no assurance that actual results will not differ materially

from those set out in any forward-looking statements contained in

this document or that future result or events will be consistent with

any opinions, estimates, projections or forecasts contained in this

document. The analysis contained in this document is based on

numerous assumptions. Different assumptions could result in

materially different results. Investments in emerging markets are

speculative and considerably more volatile than investments in

established markets. Some of the main risks are political risks,

economic risks, credit risks, and market risks. Opinions expressed in

this document may differ from those expressed by other divisions of

Gulf Investment Corporation as a result of using different

assumptions or criteria. Some investments may not be readily

realisable if the market in the securities is illiquid and valuing the

investment and identifying the risk to which you are exposed may be

difficult to quantify. Futures and options trading is considered risky.

Past performance of an investment is no guarantee for its future

performance. Some investments may be subject to sudden and large

falls in value and on realisation you may receive back less than you

invested or be required to pay more. Changes in foreign exchange

rates may have an adverse effect on the price, value or income of an

investment. Of necessity, this document does not take into account

your particular investment objectives, financial situation or needs. If

you need advice tailored to your specific circumstances, we

recommend that you seek separate financial and/or tax advice on the

financial, legal, regulatory, credit, tax, accounting and other

implications of investing in any securities referred to in this

document. Neither Gulf Investment Corporation nor any of its

members, directors, officers or employees nor any other person

accepts any liability whatsoever for any loss howsoever arising from

any use of this document or its contents or otherwise arising in

connection therewith. Gulf Investment Corporation may at present

11

Include language in square brackets for research publications only.

Page | 3

hold or in the future participate in an offering of securities described

in this document or provide advisory or other services to the issuer of

the relevant securities or to an entity connected with such issuer.

No action has been taken or will be taken that would permit a public

offering of any securities described herein in any jurisdiction in which

action for that purpose is required. No offers, sales, resales or

delivery of any securities described herein or distribution of any

offering material relating to any such securities may be made in or

from any jurisdiction except in circumstances which will result in

compliance with any applicable laws and regulations and which will

not impose any obligation on Gulf Investment Corporation or any of

its affiliates.

Neither this document, in whole or in part, nor any copy of it may be

taken or transmitted into the United States, Canada, Japan or

Australia or distributed, directly or indirectly, in the United States or

to any U.S. person (as defined in Regulation S under the U.S.

Securities Act of 1933, as amended) or distributed or redistributed in

Canada, Japan or Australia or to any resident thereof. Any failure to

comply with these restrictions may constitute a violation of the

securities laws of the United States, Canada, Japan or Australia.

To the extent that this document is distributed in the U.K., the U.K.

recipients acknowledge and agree that they are (i) persons who have

professional experience in matters relating to investments falling

within Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005 (the Order) or (ii) persons falling

within Article 49(2)(a) to (d) (high net worth entities) of the Order or

(iii) persons who are intermediate customers under Chapter 4 of the

Conduct of Business Rules of the U.K. Financial Services Authority (all

such persons together being referred to as relevant persons). This

document is directed only at relevant persons and other persons

should not act or rely on this document or any of its contents.

The distribution of this document in other jurisdictions may be

restricted by law, and persons into whose possession this document

comes should inform themselves about, and observe, any such

restrictions. Any failure to comply with these restrictions may

constitute a violation of the laws of such other jurisdiction.

By accepting this document you agree to be bound by the foregoing

limitations, instructions and restrictions.

Copyright © 2012 Gulf Investment Corporation. All rights reserved.