Budgeting

advertisement

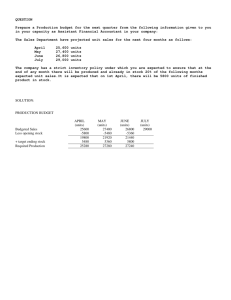

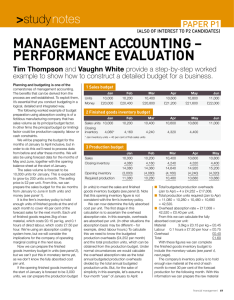

EMBA Presentation October 20, 2013 BUDGETING Overview Budgets Within the Architecture of the Organization Types of Budgets Budget Preparation Theories Example of Preparing Sales, Production and Raw Materials Budget Example of Cash Flow Forecast Budgeting and Organizational Architecture Assigns Decision Rights – Gives manager the right to spend or use organizational resources Measures Performance – Actual results to forecast Rewards Performance – Basis to incentive compensation and recognition for accomplishing goals Types of Budgets Strategic Plan Long Term Budget Operating Budget Theory of Budget Preparation Participation Bottom-up, Top-down has been found to be a very successful approach In a survey of 219 publicly traded firms, 79% indicated lower-level managers were significantly involved in the budget process 75% stated budgeting was a managerial, not accounting, function Budget Preparation Theories Budget Ratcheting Uses past historical data for next year's budget Usually raises targets from prior year May cause for lower output this year to avoid higher targets next year Line Item Budgets Reduce agency problems May restrict good management actions Steps In Preparing the Operating Budget Develop Sales Forecasts Convert Sales Forecast to Production Budget Prepare Raw Material Budget in Units Prepare Raw Material Budget in Dollars Prepare Selling, General and Administrative Budgets Prepare Income Statement Convert to Cash Forecast Prepare Pro-forma Balance Sheets The First Step to Proper Planning of Production PREPARATION OF THE SALES BUDGET Getting to the Sales Numbers Input from field sales personnel Get the numbers right!!!! Using the budget as a sales management tool Example of Salesperson’s Input Customer Projected Sales Probability Adjusted Sales A $1,000,000 .50 $500,000 B $250,000 1.00 $250,000 C $500,000 .75 $375,000 $1,000,000 .80 $800,000 Misc. Sales Projections for Production Budget January February March April May 5,000 Units 6,000 Units 8,000 Units 7,000 Units 6,000 Units Production Assumptions Require 30% of next month’s sales on hand at beginning of month Project to have 1,000 units on hand at beginning of January Calculation of Production Required Production Budget Jan - Apr 2013 Jan Feb Projected Sales in Units 5,000 6,000 8,000 7,000 Projected Ending Inventory 1,800 6,800 2,400 8,400 2,100 10,100 1,800 8,800 (1,000) (1,800) (2,400) (2,100) 5,800 6,600 7,700 6,700 Less Beginning Inventory Required Production Mar Apr May 6,000 Additional Assumptions 10% of next month’s raw materials must be on hand at beginning of month Project 5,000 units on hand at begining Production process uses 5 units of raw product for each unit of finished product Raw product costs $10.00 per unit Direct labor cost is $15.00/hour and it takes one hour to make each finished product Overhead is applied at $4.00 per DLH Calculation of Raw Materials Budget Raw Materials Budget Jan - Apr 2013 Jan Required Production Feb Mar Apr 5,800 6,600 7,700 6,700 29,000 33,000 38,500 33,500 3,300 3,850 3,350 32,300 36,850 41,850 Less Beginning Inventory (5,000) (3,300) (3,850) Required Purchases 27,300 33,550 38,000 Raw Materials Projected Ending Inventory Purchases in Dollars $ 273,000 $ 335,500 $ 380,000 Cost of Goods Manufactured Schedule Cost of Goods Manufactured Schedule Jan - Mar Jan Units Produced 5,800 Feb 6,600 Mar 7,700 Cost of Units Produced: Raw Material (5800 x 5 x $10) $ 290,000 $ 330,000 $ 385,000 Direct Labor (5800 x 1 x $15.00) 87,000 99,000 115,500 Overhead (5800 x1 x $4.00) 23,200 26,400 30,800 Total Cost $ 400,200 $ 455,400 $ 531,300 Per Unit Cost $ 69.00 $ 69.00 $ 69.00 PREPARING THE CASH FORECAST Must Be Done Prior to Preparation of Pro-forma Balance Sheets Harry's Habadashery Projected Income Statements Three Months Ending August 31, 2013 Jun Jul Aug Sales Cash Sales On Account Sales Total Sales Expenses: Cost of Goods Sold Salaries/Wages Rent Utilities Total Expenses Net Income (Loss) $ 5,000 $ 10,000 $ 12,000 100,000 125,000 130,000 105,000 135,000 142,000 66,000 30,000 10,000 2,000 81,000 35,000 10,000 2,500 85,200 42,000 10,000 2,200 108,000 128,500 139,400 $ (3,000) $ 6,500 $ 2,600 Assumptions for Cash Flow Calculation Company purchased $72,600 of inventory in May, $89,100 in June, and $93,720 in June Cash balance was $10,000 on June 1 Salaries are paid on 7th and 22nd of each month Salaries for May totaled $30,000 Additional Assumptions Rent is paid on first day of the month Utilities are paid on the 10th day of month following; May utilities totaled $3,000 All inventory is paid on the 10th day following month of purchase Company has line of credit at Old Boise National Bank in amount of $100,000 Company always wants $10,000 in cash balance at end of each month Cash Inflow Assumptions April sales on account were $80,000 May sales on account were $90,000 Accounts Receivable are collected as follows: 10% in month of sale 75% in first month following 10% in second month following Cash Flow Forecast Jun - Aug 2013 Jun Cash Inflows: Cash Sales Sales on Account $ Totals 5,000 85,500 Jul $ 10,000 96,500 Aug $ 12,000 116,750 90,500 106,500 128,750 10,000 3,000 30,000 72,600 10,000 2,000 32,500 89,100 10,000 2,500 38,500 93,720 115,600 133,600 144,750 Cash Over (Short) Add Beginning Balance (25,100) 10,000 (27,100) 10,900 (16,000) 10,800 Borrowings (15,100) 26,000 (16,200) 27,000 (5,200) 16,000 Cash Outflows: Rent Utilities Salaries and wages Inventory Totals Ending Balance $ 10,900 $ 10,800 $ 10,800 Logical Flow of Master Budget Procurement Budget Production Budget Sales Budget Ending Inventory Budget Direct Materials Budget Direct Labor Budget Cost of Goods Manufactured Budget SG&A Budget Budgeted Income Statement Factory Overhead Budget Capital Investment Budget Budgeted Cash Flows Master Budget Budgeted Balance Sheet Copyright by Frank Ilett, 2012