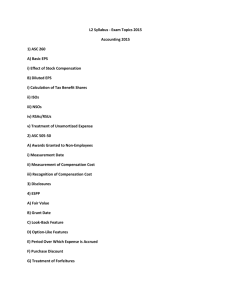

L3 Syllabus - Exam Topics 2015 Accounting 2015 1) ASC 260 A

advertisement

L3 Syllabus - Exam Topics 2015 Accounting 2015 1) ASC 260 A) Basic EPS i) Effect of Stock Compensation B) Diluted EPS i) Awards Outstanding for Part of a Period Only ii) Calculation of Tax Benefit Shares iii) ISOs iv) NSOs v) RSAs/RSUs vi) SARs vii) Treatment of Unamortized Expense C) EPS i) Two-class Method Required for Dividends Paid on Unvested Awards 2) ASC 505-50 A) Awards Granted to Non-Employees i) Measurement Date ii) Measurement of Compensation Cost iii) Recognition of Compensation Cost 3) Disclosures 4) ESPP A) Automatic Rollover Provisions B) Fair Value C) Grant Date D) Increases in Contribution Rates E) Look-Back Feature F) Non-Qualified Plans G) Option-Like Features H) Period Over Which Expense is Accrued I) Purchase Discount J) Share Shortfall K) Treatment of Forfeitures L) Treatment of Withdrawals 5) Forfeiture Rate A) Adjusting to Actual Outcome B) Changes in Estimates i) Dynamic Method ii) Static Method C) Initial Estimate D) Static vs. Dynamic Methods 6) Grants to Employees A) Definition of Employee B) Measurement Date i) Communication of Grants ii) Definition of Performance Conditions iii) General Understanding iv) Grants Contingent on Shareholder Approval 7) International A) IFRS 2 i) Black-Scholes vs. Binomial ii) Country-Specific Valuation Inputs and Forfeiture Assumptions iii) Liability Treatment for Share Withholding iv) Non-compensatory Plans v) Required Attribution Method for Awards with Graded Vesting vi) Tax Accounting vii) Treatment of Grants to Non-employees B) Role of the IASB 8) Liability Treatment A) Adjustments to Fair Value B) Cash Settlement Triggered by Event Outside Company Control C) Options Exercisable after Termination D) Repurchase Obligations E) Required Cash Settlements F) Tandem Awards 9) Market Condition Awards A) Expense Recognition for Changes in Quantity B) Expense Recognition for Changes in Service Period 10) Measurement of Compensation Costs A) Cash-settled RSUs; Phantom Stock B) Cash-Settled SARs C) Cheap Stock Issues D) Dividends on RSAs/RSUs F) Net, Pyramid, and Swap Exercises G) Non-forfeiture of Dividend Payments H) Non-payment of Dividends on RSUs I) RSAs/RSUs J) Shares Tendered to Cover Tax Withholding K) Stock Options L) Stock-Settled SARs M) Vesting Contingent Upon Market Conditions N) Vesting Contingent Upon Service/Performance Conditions 11) Modifications A) Additional Compensation Cost B) Award Classification Changes C) Awards Cancelled for No Consideration D) Cash Settlement of Awards E) Change in Employment Status (with Modification of Award) F) Definition of Modification G) Incremental Cost Compared to Proxy Disclosure H) Measurement Date I) Non-Price Related Changes J) Repricing K) Restructuring/Purchase Business Combination L) Treatment of Cancelled Option M) Type I - Probable to Probable N) Type III - Improbable to Probable 12) Performance Condition Awards A) Discretion for Payouts B) Expense Recognition for Changes in Fair Value C) Expense Recognition for Changes in Quantity D) Performance Metrics Outside Control of Company (CIC, IPO, Regulatory Approval) E) Retirement Eligible Employees 13) Recognition of Compensation Cost A) Arrangements Granted to Employees B) Cancellation/Expiration i) Vested Options C) Change in Employment Status (No Modification of Awards) D) Derived Service Period E) Explicit Service Period F) Implicit Service Period G) Liability Awards H) Non-Substantive Service Conditions I) Service Inception Date J) Straight-line and Accelerated Accrual 14) Role of FASB 15) Staff Accounting Bulletin No. 107 A) Valuation i) Changing Valuation Models ii) Determining Expected Term iii) Simplified Expected Term Formula iv) Use of Historical Volatility v) Use of Implied Volatility vi) Use of Peer Volatility 16) Tax Accounting A) Nonqualified Arrangements i) APIC ii) DTAs iii) Shortfalls B) Qualified Arrangements 17) Valuation by Privately Held Companies 18) Valuation Factors A) Equity Treatment i) Fair Value Not Adjusted for Changes in Model Inputs B) Expected Term C) Impact on Value i) Dividend Yield ii) Expected Term iii) Interest Rate iv) Volatility D) Interest Rate Selection E) Post-Vesting Termination F) Required Factors G) Suboptimal Exercise Factor H) Volatility I) Volatility for Private Companies 19) Valuation Models A) Black-Scholes B) Lattice Models C) Market Value of Options D) Monte Carlo Simulations L3 Syllabus - Exam Topics 2015 Corporate and Securities Law 2015 1) Blue Sky Laws A) General Understanding 2) Corporate Governance A) Clawbacks B) Directors and Officers i) Conflicts of Interest C) Shareholder Concerns and Considerations i) Say on Pay ii) When is Plan Approval Required? D) Stock Market Regulations i) Requirements ii) Street Name vs. Registered Shareholders (a) Broker Voting 3) Corporate Law A) Authorization to Grant Equity i) Board of Directors vs. Committee B) Board of Directors i) Independence Rules (a) Compensation Committee Qualification C) Characteristics of Corporate Entities i) Public vs. Private Corporations F) Dividends G) Stock Issuance H) Stock Splits I) Voting Rights i) RSAs vs. RSUs 4) Divorce A) Basic Technical Issues Upon Transfer i) Practical Legal Issues B) DOMA 5) Federal Reserve Act A) Fundamentals of Regulation T i) Broker-Assisted Option Exercises - Margin Rules 6) Plan Provisions A) Plan Design Considerations i) Amendments (a) Maintaining compliance, required shareholder approval ii) Basic Corporate Governance 7) Sarbanes-Oxley Act of 2002 A) General Understanding 8) Securities Act of 1933 A) Form S-8 i) Effect of Delinquent Annual or Quarterly Filings ii) Prospectus iii) Technical Requirements iv) Uses and Basic Filing Obligations (a) Coverage for Gifted/Transferred Stock (b) Information Dissemination (c) Permissible Offerees of Securities Registered (d) Registering Resales on Form S-8 v) Which Issuers May Use Form S-8 (a) Form S-8 Availability B) Regulation D C) Rule 144 i) Affiliate ii) Control Securities iii) Form 144 iv) Holding Period (a) Calculation (b) Non-Recourse Loans (c) Other Requirements v) Restricted Securities vi) Use and Limitations D) Rule 701 i) Application to Post IPO Sales ii) General Understanding iii) Resale Provisions of Affiliates iv) Resale Provisions of Non-Affiliates E) Securities Registration i) Award Types Not Requiring Registration 9) Securities Exchange Act of 1934 A) Form 8-K i) Trigger Events and Filing Deadline B) General Understanding of Insider Trading i) Trading Windows and Blackout Periods C) General Understanding of Insider Trading Under Rule 10b-5 i) Basic Rules and Issues D) Regulation 13D and 13G i) Beneficial Ownership Determination E) Regulation S-K i) Annual Compensation (a) Compensation of Directors (b) Determining NEOs ii) Grants of Plan Based Awards iii) Item 405 (a) 16(a) Late Filing Consequences iv) Option Exercises and Stock Vested v) Option Repricing Information (a) Stockholder Approval vi) Outstanding Equity Awards at Fiscal Year End vii) Plan Disclosures (a) Non-Approved Plans viii) Summary Compensation Table & CD&A (a) Emerging Growth Companies F) Rule 10b5-1 i) Trading Plans G) Section 12 i) Reporting Thresholds H) Section 16 i) Persons subject to Section 16 I) Section 16 Reporting Requirements and Matching Exemptions i) Adjustment of Ownership for ESPP ii) Approval Requirements iii) Cancellation and Regrant iv) Cash Settlement of an SAR v) Delivery of Previously Owned Stock in Payment of Option Exercise Price vi) Exemptions vii) Formula / Director Plans - Amount, Price, and Timing of Formula Awards J) Section 16(a) Reporting i) Equity Award Expiration or Cancellation ii) Equity Grants iii) Exercise iv) Form 3, Form 4, Form 5 v) General Reporting Guidelines vi) Post-Termination Reporting vii) Restricted Stock (Awards & Units) — Vest/Release viii) Transfer K) Section 16(b) Short-Swing Profits i) Calculation of Six-Month Period ii) Exemptions L) Terminology i) Annual and Special Meetings of Shareholders ii) Record Date 10) Securities Law - General Understanding A) General Understanding of Multiple Classes of Stock i) Preferred, Convertible, Options on Different Classes, etc. B) International Issues C) Par Value 11)Tender Offer Regulation and Option Repricing A) Tender Offer Rules i) Option Exchange Program (a) Plan Provisions Prohibiting or Allowing (b) Stockholder Approval Requirements (c) Executive Officer Participation (d) Timing (20 day) (e) Communication Restrictions (f) Schedule TO (g) Proxy Disclosure (h) Stock Exchange Requirements (i) Institutional Shareholders 12) Transfer Agent A) Issuance Authority B) Reserves L3 Syllabus - Exam Topics 2015 Equity Plan Design, Analysis and Administration 2015 1) Characteristics of Equity Awards A) ESPP Features i) Enrollment Date ii) Enrollment Process iii) General Knowledge & Understanding iv) Offering Period v) Price Determination vi) Purchase Date vii) Purchase Period B) Grants/Awards i) Calculating Vesting ii) Definition of an Equity Grant iii) Definition of Vesting iv) Grant Term/Expiration C) Performance Awards i) Administration Processes D) Phantom Stock i) Features of Phantom Stock E) Restricted Stock Plans i) Administration Processes ii) Advantages and Disadvantages iii) Issuance of Shares - RSAs iv) Issuance of Shares - RSUs v) Methods of Tax Payment vi) Par Value Award Consideration vii) Purchase Price viii) Repurchase Upon Termination ix) Restricted Stock Awards x) Restricted Stock Units F) Stock Appreciation Rights i) Basic Characteristics - SARs ii) Basic Characteristics - Tandem SARs iii) Payout Amount - Cash iv) Payout Amount - Stock G) Stock Options i) Defintion of Exercise 2) External Considerations A) Shareholder Concerns and Considerations i) Plan Features (a) Dilution (b) Repricing (c) Value Transfer 3) Governing and Supporting Documents A) Collateral (Auxiliary) Documents i) Prospectus (a) Distribution Methods B) Grant Agreement i) Definition of a Grant Agreement ii) Required Elements iii) Vesting Provisions C) Grant Procedures i) Internal Approval & Controls D) Notice of Exercise E) Plan Provisions i) Administration of the Plan ii) Amendments iii) Change in Control Provisions iv) Death v) Disability/LOA vi) Dividends and Equivalent Rights vii) Duration of Plan viii) Early Exercise Provisions ix) Eligible Employees - ESPP x) Eligible Employees - Options xi) Evergreen xii) Fair Market Value Definition xiii) Merger and Acquisition Application xiv) Minimum Exercise Price xv) Performance Measures xvi) Repricing Programs xvii) Retirement xviii)Severance - Limitations in the Document xix) Share Reserves xx) Splits xxi) Termination xxii) Transferability (a) Divorce (b) Transferable Stock Options 4) Planning A) Acceptance Requirements B) Amount of Securities Issued C) Basic ESPP Provisions i) Dilution D) Choosing an Equity Plan E) Domestic Data Protection F) International Planning Considerations i) Data Protection ii) Employment Laws iii) Exchange Controls iv) Implementing Global Stock Plans G) Plan Design Considerations i) Grant Perspective H) Plan Objectives I) Policies and Procedures i) Purpose and Objectives ii) Sarbanes-Oxley J) Understanding When Plan Provisions Govern K) Vesting Requirements 5) Understanding of Transactional Functions A) Exercise Processes i) Same-Day-Sale Processes B) Exercising Methods i) Broker-Assisted Exercises (STC, SDS) ii) Cash (Also Known as Exercise and Hold) iii) Net Exercise iv) Stock Swaps (a) Procedures and Mechanics L3 Syllabus - Exam Topics 2015 Taxation 2015 1) Basics of Taxation A) Terms and Definitions i) Capital Gain/Loss ii) Estimated Tax Payments iii) Ordinary Income 2) Evergreen Provisions A) Application to ISOs and ESPPs i) Maximum Share Limits 3) International A) IRC Section 423 - ESPPs i) Plan Considerations B) Mobile Employee Tax Treatment C) Options, Restricted Stock and Units i) Plan Considerations D) Recharge Arrangements E) Tax Withholding (Non Mobile Employees) 4) IRC Section 83 A) Making 83(b) Elections i) Benefits and Risks ii) Election Procedures 5) IRC Section 162(m) - Certain Excess Employee Remuneration A) Design B) Employer Tax Treatment i) Performance Based Compensation C) Full-Value Awards D) Repricing E) Stock Options/SARs 6) IRC Section 280G – Golden Parachute Payments 7) IRC Section 409A A) Compliance / Noncompliance Consequences B) Deferral Elections i) Non-performance Awards ii) Performance Awards C) Exemptions to 409A D) General Understanding E) Short-term deferrals 8) IRC Section 422 - ISOs A) Amendments and/or Modifications i) Maintaining ISO Status (a) Changes in Employment Status (b) Plan or Grant Modifications B) Employee Tax Treatment i) Alternative Minimum Tax ii) Dispositions iii) Early Exercise iv) Holding Period (a) Disqualified Versus Qualified C) Employer Tax Treatment i) Dispositions D) Loans and Promissory Notes E) Special Circumstances i) Mergers and Consolidations ii) Repricing F) Statutory Requirements i) Eligibility ii) Grant and Plan Requirements 9) IRC Section 423 - ESPPs A) Employee Tax Treatment i) Dispositions B) Employer Tax Treatment i) Deduction and Reporting Requirements C) Statutory Requirements i) Employee Eligibility ii) Plan Requirements 10) IRC Section 6039 A) Reporting and Penalties B) Requirements and Tracking i) Application to ESPPs ii) Application to ISOs 11) Loans and Promissory Notes 12) Non IRC Section 423 - ESPPs A) Employee Tax Treatment B) Employer Tax Treatment i) General Provisions 13) NSOs A) Employee Tax Treatment i) Capital Gain/Loss Basis ii) Early Exercise iii) Recognition of Income – Amount and Timing B) Employer Tax Treatment i) Deduction and Reporting Requirements C) Special Circumstances i) Gifting and Transferability D) Withholding 14) Performance Awards A) Corporate Tax Deduction B) Global Tax Considerations C) Income and Withholding D) Pro-rata Payouts upon Retirement 15) Restricted Stock A) Dividends and Dividend Equivalents B) Employee Tax Treatment i) Income and Withholding ii) Retirement iii) Section 83(b) Election C) Employer Tax Treatment i) Corporate Tax Deductions ii) Withholding Obligations D) Restricted Stock Purchases and Direct Stock Purchases i) Non-lapse Restrictions 16) Special Circumstances A) Death i) IRC Section 422 - ISOs ii) IRC Section 423 - ESPPs iii) Nonqualified Grants B) Divorce i) IRC Section 422 - ISOs ii) IRC Section 423 - ESPPs iii) Nonqualified Grants C) LOA i) IRC Section 422 - ISOs ii) IRC Section 423 - ESPPs iii) Nonqualified Grants 17) SARs A) Employee Tax Treatment B) Employer Tax Treatment 18) Stock Swaps A) ISO B) NSO 19) Technical Issues A) Cost Basis Reporting i) Form 1099-B B) Withholding i) Non-Employees and Directors ii) Tax Deposit Timing