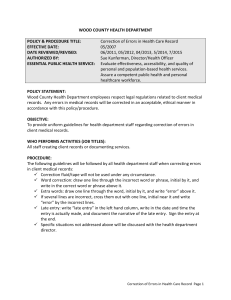

errors-vital

advertisement

Week 10 CORRECTION OF ERRORS AND SUSPENSE ACCOUNT Learning Objectives Errors not affecting trial balance agreement After you have studied this chapter, you should be able to: • correct all errors which do not affect trial balance totals being equal • distinguish between the different kinds of errors that may arise Suspense accounts and errors After you have studied this chapter, you should be able to: • explain why a suspense account may be used • create a suspense account in order to balance the trial balance • correct errors using a suspense account • recalculate profits after errors have been corrected • explain why using a suspense account is generally inappropriate Recap: Analyzing and Recording Process Analyze each transaction and event form source documents Record relevant transactions and events in a journal Post journal information to ledger accounts Prepare and analyze the trial balance DISCOVER ERROR!!! Errors Most errors are found after preparing the trial balance. Errors cannot be crossed out or erased. If there are errors, the trial balance will not agree. But there are some errors which will not affect the agreement of the trial balance totals. Steps in Analyzing and Correcting Errors 1st Step 1. Determine the correct journal entry and the appropriate debits and credits. 2nd Step 2. Analyze the original errors journal entry and determine all the debits and credits that were recorded. 3rd Step 3. Preparing the correcting entries. Errors Revealed by Trial Balance 1. 2. 3. 4. Errors in calculation – Miscalculation of the trial balance totals or the net account balances. Errors of omission of one entry – Omission of either the debit or credit entry of a transaction. Posting to the wrong side of an account. Errors in amount – debit entry of a transaction differs in amount with the credit entry. Note: Suspense account is opened to take care of errors which have caused an imbalance in the Trial Balance. Errors NOT Revealed by Trial Balance 1. Errors of omission – A transaction is completely omitted from the books. 2. Errors of commission – An entry posted at the correct amount but to the wrong person’s account. 3. Errors of principle – An entry is made in the wrong class of account. 4. Complete reversal of entries – An account that should be debited is credited and vice versa. 5. Compensating errors – where errors cancel each other out. 6. Errors of original entry – The original figure incorrectly entered although the correct double-entry principle has been observed. CORRECTION OF ERRORS - Errors of Omission When a transaction has been completely omitted from the books, it can be corrected by simply making a double-entry to record the transaction. EXAMPLE A cash payment of RM 1,600 for rent has been omitted from the books. 1st Step 2nd Step Correction: Correct entry: Error: Dr Dr Cash Cash Dr Dr 3rd Step Rent Account Account Rent RM 1,600 RM1,600 Cash Account Account Cash Rent Rent Rent Cr Cr Cr Cr RM 1,600 RM1,600 CORRECTION OF ERRORS - Errors of Omission The journal entry is as follows: General Journal Particulars 1st Step Actual: Rent Dr (RM) 1,600 Cash 2nd Step Error: Rent 3rd Step 1,600 0 Cash Correction: Rent Cash Being correction of error – payment for rent omitted from books Cr (RM) 0 1,600 1,600 CORRECTION OF ERRORS - Errors of Commission An entry has been posted to the wrong account of the same category. EXAMPLE A sale of RM150 to Folin Brothers has been posted to Lin Associates. 1st Step 2nd Step 3rd Step Correction: Dr Correct Error: entry: Debtor- Folin Brother DebtorDr Debtor-Folin Dr Debtor- LinBrother Associates Lin Associates RM RM 150 Sales 150 Sales RM 150 Cr Cr Cr X Dr Dr Dr DebtorLin Associates Sales Sales Cr Cr Cr DebtorDebtorDebtor Folin BrotherRM RM Folin 150RM - LinBrother Associates 150150 √ CORRECTION OF ERRORS - Errors of Commission The journal entry is as follows: General Journal Particulars 1st Step Actual: Folin Brother Dr (RM) 150 Sales 2nd Step Errors: Lin Associates Sales Correction: Folin Brother 3rd Step Lin Associates Being correction of error – Lin Associates wrongly debited Cr (RM) 150 150 X 150 √ 150 150 CORRECTION OF ERRORS - Errors of Principle An entry is posted to an account of a different category e.g. an expense is recorded as an asset. EXAMPLE Repairs to vehicles amounting to RM 1,000 has been posted to Vehicles Account. 2nd Step Correction: Correct entry: Error: Dr Dr Repair expense Repair expense Dr Vehicle Account Cash/ Vehicle RM 1,000 Cash/ Acct. payable RM 1,000 acct payable RM 1,000 3rd Step Dr Dr Dr 1st Step Cr CrCr X Vehicle Cr Cash / Account payable Cr Cash/ account payable Cr Repair RM 1,000 Repair 1,000 Vehicle RMRM 1,000 √ CORRECTION OF ERRORS - Errors of Principle The journal entry is as follows: General Journal Particulars 1st Step Actual: Repair Dr (RM) 1,000 Cash/Accounts payable 2nd Step Errors: Vehicle Cash/Accounts payable Correction: Repair 3rd Step Vehicle Being correction of error – repairs to vehicles posted to Vehicles Account Cr (RM) 1,000 1,000 √ X 1,000 1,000 1,000 CORRECTION OF ERRORS - Errors of Original Entry A wrong amount is recorded in a book of original entry or a document such as an invoice and subsequently posted to the ledger accounts EXAMPLE A purchase of RM665 from Paper Manufacturers Ltd has been entered in the Purchases Journal and posted to the ledger as RM656. 1st Step Correct entry: Correction: Error: Purchases Dr Purchases Dr Dr Purchases Paper Paper MfgMfg LtdLtd RMRM 656 Paper Mfg Ltd 9 665 2nd Step 3rd Step Dr Dr Dr Paper Manufacturers Ltd Paper Manufacturers Ltd Purchases Paper Manufacturers Ltd Repair Purchases Cr Cr Cr Cr Cr RM Cr 665 RM 9 RM 656 CORRECTION OF ERRORS - Errors of Original Entry The journal entry is as follows: General Journal Particulars 1st Step Actual: Purchases Dr (RM) 665 Paper Manufacturers Ltd 2nd Step Errors: Purchases 3rd Step 665 656 Paper Manufacturers Ltd Correction: Purchases Paper Manufacturers Ltd Being correction of error – purchases understated by RM 9 Cr (RM) 656 9 9 CORRECTION OF ERRORS - Compensating Errors An error on the debit side is compensated by an error of equal amount on the credit side. EXAMPLE Rent revenue account is overcast by RM10, so as the Wages Account.. 1st Step 2nd Step Correction Dr Wages Dr 3rd Step Cash Rent Revenue Account RM10 Cash Wages Account RM 600 Rent revenue Cr RM350 Cr RM10 CORRECTION OF ERRORS - Errors of Principle The journal entry is as follows: General Journal Particulars 1st Step 2nd Step Cr (RM) Actual: Errors: Correction: Rent revenue 3rd Step Dr (RM) Wages Being correction of error – rent received and wages paid overstated by $10 each 10 10 CORRECTION OF ERRORS - Complete Reversal of Entries When recording a transaction, the debit entry and the credit entry are reversed. EXAMPLE A payment of RM 700 to a creditor, Martin, was debited to the Cash account and credited to Martin’s Account. 1st Step Correction: Correct entry: Error: Dr Dr Dr Cash Cash Martin 2nd Step 3rd Step Dr Dr Dr Martin Martin Cash RM700 700 RM1,400 RM X Cash Cash Martin Martin Martin Cash Cr Cr Cr Cr Cr RMCr 700 RM RM 1,400 700 √ CORRECTION OF ERRORS - Errors of Principle The journal entry is as follows: General Journal Particulars 1st Step Actual: Martin Dr (RM) 700 Cash 2nd Step Errors: Cash 3rd Step 700 700 X Martin Correction: Martin Cash Being correction of error – payment to Martin debited to Cash Account and credited to Martin’s account Cr (RM) 700 X 1400 1400 Lecture Exercise 1 Record the entries needed in the journal to correct the following errors. Narratives are not required: (a) Motor expenses of RM56 entered incorrectly in the Motor Vehicles account. (b) Insurance RM98 paid by cash should have been entered as RM89. (c) Sale of goods for RM375 to S Lin entered into the account of S Lim. (d) Private withdrawal of RM150 cash had been debited to Sundry expenses account (e) Returns outwards of RM75 had been credited to Returns inwards by mistake. (f) Purchase of stock on credit from D Wing for RM115 had been completely omitted. BREAK CORRECTION OF ERRORS - Suspense Account • A Suspense Account is opened to take care of errors which have caused an imbalance in the Trial Balance. • When they are discovered, they have to be corrected by a double-entry, one in the Suspense Account and the other in the account concerned. CORRECTION OF ERRORS - Suspense Account EXAMPLE • The credit side of a Trial Balance is short of RM100. • A Suspense Account is temporarily opened. • The difference between the two sides in the Trial Balance is entered in this account. Trial Balance as at 31 December 2002 Totals Suspense Account Dr (RM) Cr (RM) 95,600 95,500 100 95,600 95,600 CORRECTION OF ERRORS - Suspense Account • The Suspense Account will have a credit balance when the credit total in the Trial Balance is short and a debit balance when the debit total is short. Dr Suspense Account Cr Dec 31 Difference in books RM100 Errors Affecting TB Agreement and their Correction • Errors which cause an imbalance in the Trial Balance affect only one side of an account. • This class of errors requires only one entry, either on the DR or CR side, to correct them. • The other entry has to be made in the Suspense Account, thus adhering to the double-entry principle. Errors Affecting TB Agreement and their Correction EXAMPLE • A sale of RM80 to Linda has been credited to Sales Account but omitted from Linda’s account. • The debit side of the Trial Balance was later found to have a deficiency of RM80. Dr Sales Account Linda Dr Suspense Account Difference in books RM80 Cr RM80 Cr Errors Affecting TB Agreement and their Correction To correct the error... Dr Cr Linda Suspense Account Dr Cr Difference in books RM80 RM80 Suspense Account Linda RM80 Errors Affecting TB Agreement and their Correction The journal entry is as follows: General Journal Date Particulars Linda Suspense Account Being correction of error – amount not posted to Linda’s account Dr ($) Cr ($) 80 80 Correction of an Error Requiring More Than Two Entries . EXAMPLE • Returns outwards RM100 to Samy has been correctly entered in Samy’s account but wrongly debited to Purchases Account. Dr Samy Dr Dr Purchases Return outwards Purchases Account RM100 Suspense Account Returns Outwards Account Suspense Account Suspense Account RM100 Difference in books RM100 RM200 Cr RM100 Cr RM100 Cr Correction of an Error Requiring More Than Two Entries The journal entry is as follows: General Journal Date Particulars Suspense Account Dr ($) Cr ($) 200 Purchases 100 Returns Outwards 100 Being correction of error – returns outwards wrongly posted to Purchases Account Lecture Exercise 2 The following errors were made: i. $78 cash paid for stationery was entered in the Stationery Account and the Cash Account as $87. ii. $400 paid for repairs for machinery was debited to Machinery Account. iii. Sales Account and Purchases Account were overcast by $300 each. iv. Commission received $1,500 was wrongly debited to the Commission Revenue Account and credited to the Cash Account. What entries should be made to correct these errors? Lecture Exercise 3 The debit total in the Trial Balance exceeded the credit total by RM32. On checking the books, the following errors were found: i. Rent received, RM400 had been recorded on the payment side of the Cash Book and debited to the Rent Expenses Account. ii. Goods amounting to RM70, returned to Alex, had been treated as sales. The amount was debited to the account of a debtor, B. Fowler and credited to the Sales Account. iii.A cheque of RM51 received from K. Jack had been debited in error to R. Jackson’s account. The entry in the Bank Account was correct. iv. A purchase of equipment, paid by a cheque of RM1,100, was entered as RM1,000 in the books. v. The remainder of the difference in the books was due to an error in over casting the Sales Journal. Show how these errors could be corrected. Lecture Exercise 4 You have extracted a trial balance on 31 December 2006 which failed to agree by RM350, a shortage on the debit side of the trial balance. A suspense account was opened for the difference. The following errors were later found: – The purchases daybook had been undercast by RM200. – The insurance account had been undercast by RM50. – Sale of equipment of RM400 had been credited in error to the Sales account. – Sales account had been overcast by RM175 – Discounts received had been undercast by RM75 You are required to: (a) Show the journal entries necessary to correct the errors. (b) Draw up the suspense account after the errors have been corrected