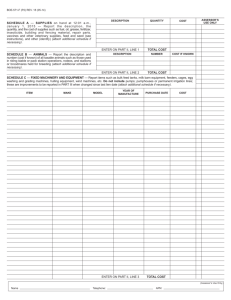

STATEMENT OF SERVICES RENDERED FOR IHF

STATEMENT OF SERVICES RENDERED FOR IHF- NURSE FOLLOW-UP

THIS AREA MUST BE COMPLETED IN FULL BY THE ASSESSOR – PLEASE PRINT CLEARLY

Assessor or Corp Name:

HST #:

Assessor Address:

CPSO #:

Name of IHF:

IHF#

IHF Address:

Assessment Date:

1.

Post Assessment Follow-up No. of hours

(Feedback meeting, review of plan of action, etc.)

@ $64.55/hour

2.

Travel time No. of hours @ $64.55/hour

Approval of preparation and travel time (Management signature required):

$

$

0.00

0.00

PLEASE NOTE THAT ALL EXPENSES LISTED BELOW MUST BE ACCOMPANIED BY AN ITEMIZED ORIGINAL RECEIPT.

3.

Transportation costs (itemize below) a) Please check: Plane Train Bus $ b) Private car:

No of km (max 5000km) c) Taxi/limo: d) Parking:

Over 5000km e) Other costs – specify:

4.

Maintenance costs Hotel

Meals

Other costs – specify:

@$0.5

ϱ /km $ 0.00

@$0.4

ϵ /km $ 0.00

$

$

$

$

$

$

5.

TOTAL CLAIM FOR SERVICES RENDERED:

Assessor Signature:

COST CENTRE: 4756 (DI) 4770 (Ambulatory)

Department Verification:

4764 (Sleep)

Date:

$ 0.00

$ 0.00

$ 0.00

4769 (Ophtho) 7776 (Reassessments)

Date:

Payment Authorization:

FOR FINANCE USE ONLY

Member #:

Claim Date:

Amount:

Checked by:

Cheque #:

Batch/Entry #:

Date:

ACCOUNTING CODES

Total to be paid $

AMOUNT

Clear Form

THE COLLEGE OF PHYSICIANS AND SURGEONS OF ONTARIO, 80 COLLEGE STREET, TORONTO, ONTARIO, M5G 2E2

INSTRUCTIONS

1.

Post-Assessment Follow-up – Claim the number of hours spent cumulatively on feedback meetings, reviewing documentation/plans of action etc., and declare the total amount of fees.

2.

Travel Time – Indicate the number of hours spent travelling to and from a feedback meeting and declare the total amount of fees.

3.

Note: The total amount claimed for Post-Assessment Follow-up (#1) and Travel Time (#2) together should not exceed six hours.

Any total that exceeds six hours will require review by the Management. Also, a written explanation will need to accompany the claim identifying the special circumstance.

Transportation Costs – Claim actual cost of transportation by economy air, train, or bus fare. Please ensure you arrange to travel by the most economical means available, this includes consideration of total travel time. Attach original receipts for all transportation costs.

4.

When claiming for the use of your personal car, indicate the number of kilometres and total the amount based on the authorized rate. Car expenses claims must not exceed the cost of the equivalent economy fare where applicable. The rate includes the cost of fuel. When renting a vehicle, you can claim for fuel, but not kilometres travelled.

Indicate costs incurred for parking, and/or taxis (costs travelling between residence and airport, train or bus station and similar charges to/from facility) and attach original receipts.

Travel by TTC does not require a receipt.

For Ontario Highway 407 toll rate reimbursements, provide a record of your charges by sending a printout of the applicable bill reflecting your expenses.

Maintenance Costs – Claim the actual cost as indicated on receipts up to the maximum allowance of $300.00 per day. Allowable expenses are accommodation and meals. Attach original itemized receipt(s) for all expenses being claimed.

5.

Other Costs – Specify other assessment related expenses (ie. postage, courier, transcription, and long distance phone charges) incurred in the course of the assessment. An original itemized receipt for the amount claimed must be attached.

The expense claim form must be signed and dated by the person submitting the claim.

Note: If you plan to include any receipts from previous assessments for which you are now seeking reimbursement, please ensure that you attach an explanation outlining the name of the physician and/or facility, and date of the assessment.

M ay 1, 2015