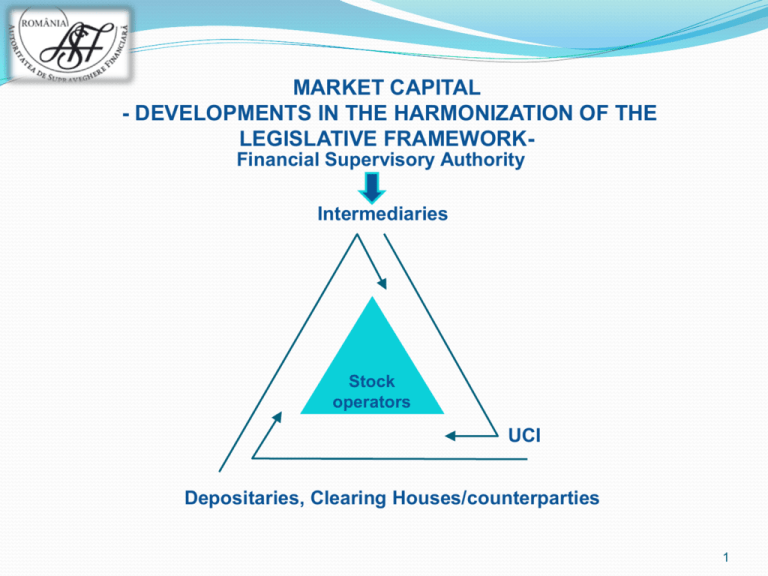

developments in the harmonization of the legislative framework

advertisement

MARKET CAPITAL - DEVELOPMENTS IN THE HARMONIZATION OF THE LEGISLATIVE FRAMEWORKFinancial Supervisory Authority Intermediaries Stock operators UCI Depositaries, Clearing Houses/counterparties 1 New legislative aspects in the capital market field 1 3 5 Rasdaq Market: Law No. 151/2014 and Regulation No. 17/2014 2 GEO No. 90/2014 4 Draft law on alternative investment fund managers Law No. 10/2015 approving GEO No. 32/2012 and supplementing certain legislative acts Central depositories: Regulation (EU) No 909/2014 2 Prima pagină RASDAQ Market: Law No. 151/2014 and Regulation No. 17/2014 Novelties I. Law No. 151/2014 • Imposing the obligation on the companies whose shares are traded on RASDAQ Market or on the unquoted shares market to call and hold the GMS within 120 days after the entry into force of the law to decide on the trading on a regulated market or within an alternative trading system • Granting the shareholders of the companies on RASDAQ market the right to withdraw from the company subject to express conditions provided by law • FSA’s obligation to issue regulations for the application of the legal provisions II. FSA Regulation No. 17/2014 brings clarification on the: • Identification date of the shareholders having the right to withdraw from the company • Term within which the companies must pay the counter value of the shares held by the shareholders having exercised the withdrawal right • Date/term when the shares traded on RASDAQ market/unquoted shares market shall be withdrawn from trading and deregistered from FSA’s records • Documents based on which FSA’s decision on the admission to trading on a regulated market/alternative trading system shall be issued 3 Prima pagină RASDAQ Market: Law No. 151/2014 and Regulation No. 17/2014 Further steps ✓ The General Meetings of Shareholders shall be held based on Law No. 151/2014 and FSA Regulation No. 17/2004 ✓ The companies from RASDAQ/unquoted shall be admitted to trading on the regulated market within the alternative trading system ✓ RASDAQ market shall no longer function after the expiry of the 12 months provided by Law No. 151/2014 4 Prima pagină “Eight Barriers” Project – changes to the Capital Market Law by GEO No. 90/2014 Novelties •Modifications to reduce the period of time necessary for admission to trading; •Improvement of certain provisions on public sale offering by aligning the provisions to the Prospectus Directive, removal of the requirements of a public offering notice and clarification of the advertising notices regime •Clarification of the powers of attorney regime by introducing the possibility for the representation of shareholders in the general meeting of shareholders also through general power of attorney, where the power of attorney is granted by the shareholder, as client, to an intermediary or a lawyer and provided that such shareholder is not in any of the specific situations provided in the draft law •Simplification of the procedures concerning the submission of documents for the participation of shareholders in general meetings •Modification and simplification of the procedure for voting by correspondence; •Reducing the payment term of dividends •Payment of dividends granted by issuers through the Central Depositary and participants in the clearing- settlement and register system •Introduction of the obligation to submit copies of the shareholders’ identity documents to the central depositary •Relaxation of the requirements on quorum and adoption of decisions in the case of extraordinary general meetings of shareholders deciding on the suspension of the preference right in the case of increasing the share capital by contribution in cash or in kind contribution 5 Prima pagină Other changes to the Capital Market Law by GEO No. 90/2014 Novelties • Increase to 20% the holding limit at market operators; • Align the conditions on quorum and voting majority within the general meetings of shareholders of market operators to the provisions of Company Law No. 31/1990; • Align the provisions on capital requirements at investment firms (SSIFs) to the provisions of Directive 2013/36/EU of the European Parliament and of the Council on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms, without imposing capital requirements other than those that are currently in place. Further steps ✓ ✓ ✓ The secondary legislation shall be amended to adapt it to the modifications brought to the primary legislation The market operators’ and central depositaries’ codes shall be amended The market operators’ instruments of incorporation shall be amended 6 GEO No. 32/2012 – Overview Essential aspects regulated in 2012 • Issued for the application of Directive (EU) No 65/2009; • Introduction of SAI passport within the EU, i.e. SAI in a EU member state (home member state) may manage a UCITS in another EU member state (host member state); • Simplification of the cross-border marketing procedure of a UCITS; • Creation of the legal framework for cross-border mergers of UCITS; • Introduction of a new type of UCITS, the master-feeder type, to facilitate the consolidation of UCITS units; • Replacement of the simplified prospectus with the key information document intended for investors (Key Information Document - KID), to provide synthetic information for investors in UCITS; • Improvement of the cooperation mechanisms among national supervisory authorities. 7 Prima pagină Law No. 10/2015 approving GEO No. 32/2012 and supplementing certain legislative acts Novelties • Introduction of a provision imposing that the evaluation of the creditworthiness of UCITS units must not be exclusively/automatically based on credit ratings issued by rating agencies • Consolidation of FSA’s supervisory prerogatives related to the operations on the capital market in line with the European Union’s legislation • Appointment of FSA as competent authority responsible for the fulfillment of the tasks resulting from Regulation (EU) No. 648/2012 (on OTC derivatives, central counterparties and trade repositories) • Possibility granted to market operators to choose between the monistic and dualistic administration systems •Irrevocability of transfer orders placed in the clearing-settlement system 8 Prima pagină Law No. 10/2015 approving GEO No. 32/2012 and amending certain legislative acts Novelties • Introduction of explicit provisions on the criminalisation of the deeds of theft of financial instruments of clients and/or money funds related thereof as felony, given their social danger • Modifications brought to create the legal prerequisites to amend the instruments of incorporation of investment companies (SIFs), in accordance with the provisions of Law No. 31/1990 on the conditions on quorum and voting majority required for the investment companies’ general meetings of shareholders •Modifications of the penalizing regime •Further steps ✓ ✓ FSA shall modify the secondary legislation to adapt it to the modifications brought to the primary legislation by Law No. 10/2015. The investment companies’ instruments of incorporation shall be amended 9 Prima pagină Draft law on alternative investment fund managers Novelties • The main purpose of this draft legislative act is to transpose Directive No. 61/2011 (AIFMD) into the legislation of Romania • AIFMD aims to provide at the level of the European Union a harmonized regulatory and supervisory framework for alternative investment fund managers (AIFMs), and to regulate the activity of all alternative investment fund managers (AIF), other than undertakings for collective investment in transferable securities (UCITS), marketing units in particular to professional investors, establishing authorisation requirements, capital requirements, risk and liquidity management operational requirements, organisational requirements inclusively on the evaluation of the assets of AIF portfolio, depositary requirements, requirements on the possibility of delegation of AIFM functions, transparency requirements, cross-border marketing requirements • The definition of AIFM and AIF, indicating that AIF are both the NON-UCI regulated by the capital market legislation, and those which do not currently fall within the scope thereof 10 Prima pagină Draft law on alternative investment fund managers Novelties • Imposing certain transparency and reporting obligations on NON-UCI administrators currently falling, or not, within the scope of the capital market legislation, which, given the value of the managed portfolios, do not require authorisation in accordance with AIFMD, in line with the provisions of Art. 22-24 of AIFMD and Art. 103 - 110 of Commission Delegated Regulation (EU) No 231/2013 of 19 December 2012 supplementing Directive 2011/61/EU of the European Parliament and of the Council with regard to exemptions, general operating conditions, depositaries, leverage, transparency and supervision • Imposing the possibility that the function of depository of AIF assets of Romania be held also by an investment firm (SSIF) authorised by FSA or the branch of an investment firm authorised in another member state, whose object of activity includes the non-core service of safekeeping and administration of financial instruments for the account of clients, including custodianship and related services, such as cash/collateral management, referred to in Art. 5 Para (1)1 Letter a) of Law No. 297/2004 and forming the object of the capital adequacy requirements, including of the capital requirements for operational risks, and which holds, in all cases, own funds at least equal to the value of the initial capital in line with the provisions of Directive 2013/36/EU and Regulation (EU) No 575/2013 11 Draft law on alternative investment fund managers Novelties • Imposing the authorisation obligation by FSA within 12 months after the entry into force of the law of: 1. the NON-UCI administrators authorised/licensed by FSA until the entry into force of such law and fulfilling the criteria provided by AIFMD (the value of total assets of managed AIF exceeds EUR 500 mil. or EUR 100 mil. by leverage) to be included in the category of the administrators which must unconditionally comply with AIFM 2. administrators of investment funds falling within the scope of AIFMD and which have not been authorised/licensed by FSA until the date of the entry into force of such law • Imposing the registration obligation with FSA within 12 months after the entry into force of the law on all alternative investment fund managers which currently do not fall within the scope of the capital market legislation which, given the value of the managed portfolios, do not require authorisation in accordance with AIFMD. This category also covers the venture capital fund managers, and the social entrepreneurship fund managers, intending to market the units on the territory of the states of the European Economic Area as EuVECA or EuSEF, whose activity is regulated as of 22.07.2013 by the provisions of Regulations (EU) No. 345/2013 on European venture capital funds and No. 346/2013 on European social entrepreneurship funds 12 Prima pagină Draft law on alternative investment fund managers Further steps ✓ A draft legislation regarding alternative investment funds shall be prepared and the provisions of Law No. 297/2004 applicable to NONUCI (including SIF) shall be repealed accordingly. ✓ FSA shall amend the secondary legislation to adapt it to the modifications brought to the primary legislation by the Law on alternative investment fund managers, to implement the provisions of ESMA guidelines issued for the application of AIFMD. 13 Prima pagină Regulation (EU) No. 909/2014 Novelties • Uniform obligations for settlement of financial instruments at the EU level • Obligation that the financial instruments of the issuers in EU be represented by account registration • Settlement cycle of maximum 2 working days (T+2) – as of 1 January 2015 • Measures to prevent and address settlement fails – detailed through technical standards • Obligation of authorisation and supervision of central depositories in line with EU uniform rules • Organisational requirements/rules of conduct/mandatory prudential requirements for CSD of the EU • Introduction of the European passport for authorised CSDs • Requirements applicable to connections among CSDs 14 Prima pagină Regulation (EU) No. 909/2014 Further steps • Issuance by the European Commission of technical standards (TS) for applying Regulation No 909/2014 (first draft envisaged for 18 June 2015) on: detailing the CSDs authorisation procedure detailing the organisational/operational requirements applicable to CSDs detailing the measures for preventing settlement fails • Within 6 months after the entry into force of TS, all CSDs of the EU shall: request reauthorisation based on Regulation (EU) No 909/2014 notify the relevant connections with other central depositories • Obligation of the two central depositories of Romania to reauthorize as central depositories in line with Regulation (EU) No 909/2014; • Review of the primary and secondary legislation to align to the new European provisions; • Until the authorisation of the depositories in accordance with Regulation (EU) No. 909/2014, the national rules on the authorisation and acknowledgment of central depositories shall continue to apply. 15 Prima pagină FSA Priorities for the capital market STEAM Project – emerging market Launch communication, financial education and professional training programmes Strengthen the protection function of investors and modernise petitions’ processing process FSA STRATEGY 2015 Review and relaunch corporate and municipal bond market Align market infrastructure to European standards Settle RASDAQ market issue 16 & Thank you!