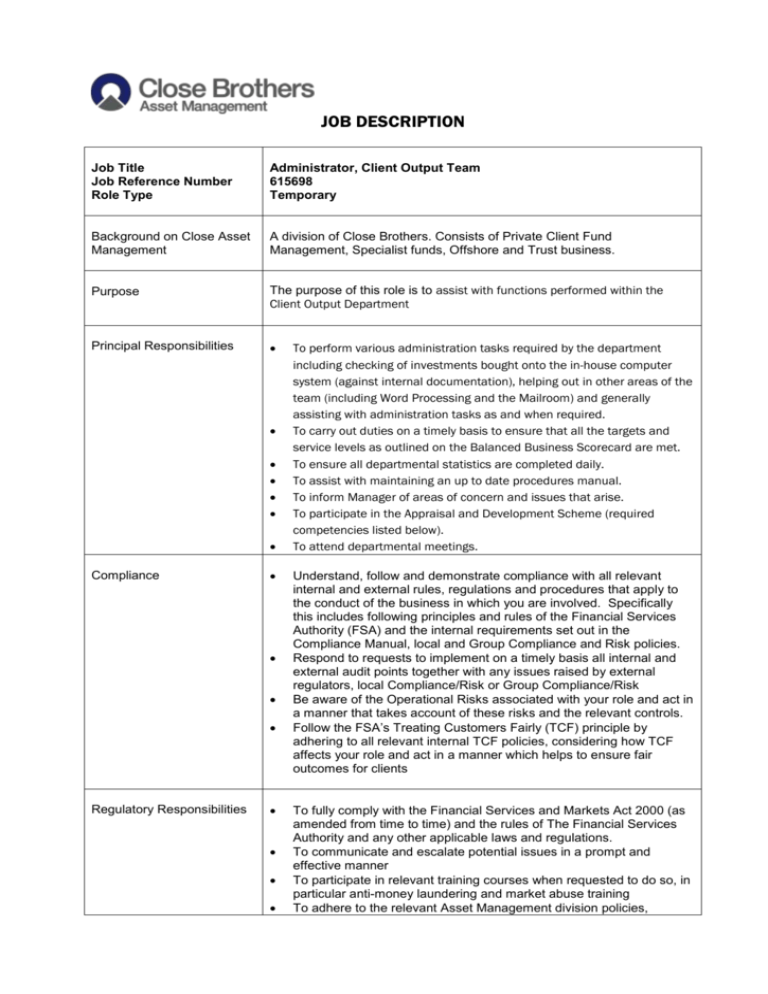

JOB DESCRIPTION Job Title Job Reference Number Role Type

advertisement

JOB DESCRIPTION Job Title Job Reference Number Role Type Administrator, Client Output Team 615698 Temporary Background on Close Asset Management A division of Close Brothers. Consists of Private Client Fund Management, Specialist funds, Offshore and Trust business. Purpose The purpose of this role is to assist with functions performed within the Client Output Department Principal Responsibilities Compliance Regulatory Responsibilities To perform various administration tasks required by the department including checking of investments bought onto the in-house computer system (against internal documentation), helping out in other areas of the team (including Word Processing and the Mailroom) and generally assisting with administration tasks as and when required. To carry out duties on a timely basis to ensure that all the targets and service levels as outlined on the Balanced Business Scorecard are met. To ensure all departmental statistics are completed daily. To assist with maintaining an up to date procedures manual. To inform Manager of areas of concern and issues that arise. To participate in the Appraisal and Development Scheme (required competencies listed below). To attend departmental meetings. Understand, follow and demonstrate compliance with all relevant internal and external rules, regulations and procedures that apply to the conduct of the business in which you are involved. Specifically this includes following principles and rules of the Financial Services Authority (FSA) and the internal requirements set out in the Compliance Manual, local and Group Compliance and Risk policies. Respond to requests to implement on a timely basis all internal and external audit points together with any issues raised by external regulators, local Compliance/Risk or Group Compliance/Risk Be aware of the Operational Risks associated with your role and act in a manner that takes account of these risks and the relevant controls. Follow the FSA’s Treating Customers Fairly (TCF) principle by adhering to all relevant internal TCF policies, considering how TCF affects your role and act in a manner which helps to ensure fair outcomes for clients To fully comply with the Financial Services and Markets Act 2000 (as amended from time to time) and the rules of The Financial Services Authority and any other applicable laws and regulations. To communicate and escalate potential issues in a prompt and effective manner To participate in relevant training courses when requested to do so, in particular anti-money laundering and market abuse training To adhere to the relevant Asset Management division policies, Extra Notes including those on conflicts of interest, gifts and entertainment at all times To follow the Group and local rules on personal account dealing as set out in the Group Personal Dealing Rules and supplemented by specific additional local requirements set out in the relevant Compliance Manual To fully comply with the relevant Anti-Money Laundering regulations, specifically relating to the verification of clients and report promptly any knowledge or suspicion of money laundering activities to the relevant MLRO To fully comply with the FSA’s statement of Principle and Code of Practice for Approved Persons, as set out in the FSA’s rules To fully comply with the FSA’s statement of Principle and Code of Practice for Approved Persons, as set out in the FSA’s rules and to undertake and record sufficient appropriate CPD to evidence that you have adequately maintained your competence This job description is a guide and current duties of the job can be varied from time to time The job holder may be expected to carry out other duties as may be requested of him/her that are deemed to be within their capabilities We are an equal opportunity employer and we are opposed to discrimination on any grounds. Please contact us if you are visiting our offices and require any form of personal assistance or physical adaptations to be provided for your appointment. A member of staff will be happy to help.