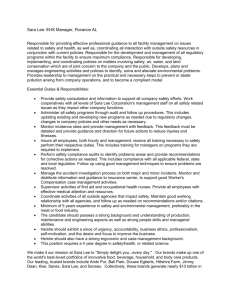

strategic management 2

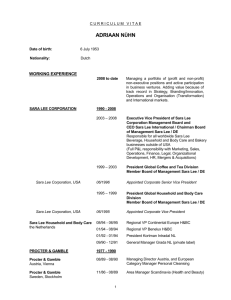

advertisement

Eric Tinoco Sara Lee Case Questions Assignment Questions 1. What is Sara Lee’s corporate strategy? How has its retrenchment strategy changed the nature of its business lineup? Sara Lee’s ongoing and current corporate strategy began in March 2008 and is known as ‘Project Accelerate’. It included additional business process outsourcing, operating segment restructuring, new supply chain efficiencies, reductions in corporate overhead, and reductions in employee benefit costs. By the end of fiscal 2010 Project Accelerate had produced total cumulative benefits of $180 million. Management projected that cumulative benefits for Project Accelerate to reach $350-$400 million by thye end of fiscal 2012. With respect to its retrenchment strategy, in 2010 the division had a number of market-leading brands such as Ball Park franks, Jimmy Dean sausage, Hillshire Farm smoked sausage, State Fair corn dogs, Sara Lee frozen deserts, and Senseo single-serving coffeemakers and coffee pods. In 2010, its North American Fresh Bakery unit was the best-selling brand of packaged bread sold in the U.S., with an 8.3% market share. Its North America Foodservice unit held a 65% market share in liquid coffee and tea sold to food service customers, a 52% market share in pies, a 19% market share in cakes, and a 20% share of refrigerated dough sold to food service customers. Its International Beverage, International Bakery, and International Household & Body Care units all had leading product brands in various markets throughout the world. 2. What is your assessment of the long-term attractiveness of the industries represented in Sara Lee Corp.’s business portfolio? Based on performance figures as of the end of fiscal 2010, the long-term attractiveness of Sara Lee appears high. Its Project Accelerate has resulted in a re-focusing of its core products while divesting away of non-core businesses has allowed it to repurchase stock thereby increasing EPS and making the brand more attractive to prospective investors. 3. What is your assessment of the competitive strength of Sara Lee Corp.’s different business units? My assessment of the competitive strength of Sara Lee’s different business units is high. The company’s new business line-up will allow it to lower operating expenses through its continued emphasis on efficiency, its focus on its most promising markets, and by reducing inventories. 4. What does a 9-cell industry attractiveness/business strength matrix displaying Sara Lee’s business units look like? Some of the business units will be in the upper left hand corner of the 9-cell industry attractivenesscompetitive strength matrix. And this will allow them to have units with high significance needs. 5. Does Sara Lee’s portfolio exhibit good strategic opportunities for skills transfer, cost sharing, or brand sharing do you see? Yes, I believe Sara Lee’s portfolio exhibits good strategic fit. As mentioned in answer 3, the company narrowing into food retail industry has increased the chance for value-chain matchups. The narrowing has also opened up opportunities for skills transfer, cost sharing, and brand sharing as segments use mostly the same products and product line. 6. What is your assessment of Sara Lee’s period following the divestitures that were the core of Sara Lee’s retrenchment strategy? Out of all the Sara Lee’s Units, the International bakery is the weakest after the retrenchment. Most of the strongest and successful ones are International Beverage and North America retail. The performance during the fiscal year 2008 – to 2010 was sufficient enough just the way they projected it to be. The company still has good foresight because they have plans and strategies to rise and make more profit. 7. What is your overall evaluation of Sara Lee’s retrenchment plan? What evidence and/or reasons support a conclusion that Sara Lee’s shareholders have or have not benefitted from the strategy? I believe that Sara Lee’s retrenchment was a good idea because they improved their weak points and they eliminated those non-core business units in order to focus more on the stronger units that could yield profit to the company. Project Accelerate looks to be on target in achieving expected benefits of $350 million to $400 million by 2012, which would lead to improvements in earnings per share of $0.15 to $0.20. 8. What actions do you recommend that Sara Lee management take to improve the company’s performance and boost shareholder value? Your recommended actions must be supported with convincing, analysis-based arguments. I believe if Sara Lee sticks to the retrenchment plan, there would be an increase in their profits. They company should always monitor new entries into the market in order to identify the potential threats and deal with them pro-active to the extent possible. Also, as they generate more free-cash flow as revenues increase while costs decrease, I would recommend that they continue their sharerepurchase program. It rewards investors and signals to the market that the company’s management strongly believes in their future prospects.