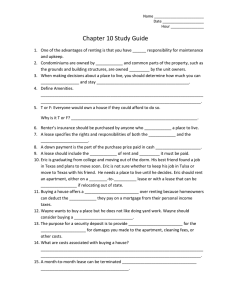

Renting Versus Buying Standard 10 Assessment Multiple Choice

advertisement

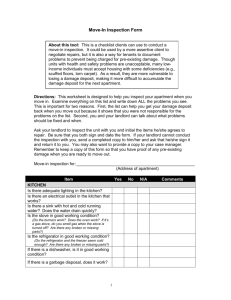

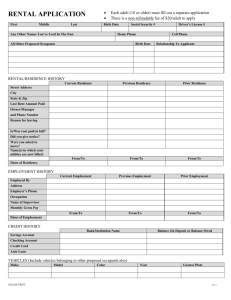

Renting Versus Buying Standard 10 Assessment Multiple Choice: Circle the letter of the choice that BEST completes each statement. 1. One of the advantages of renting is that you b. can remodel or make decorative changes as wanted. c. have less responsibility for maintenance and upkeep. 2. Condominiums are c. built like apartments, but have fewer units and fewer people living in the complex. d. owned by individuals and common parts of the property, such as the grounds and building structure, are owned jointly by the unit owners. 3. When making decisions about a place to live, you should a. determine what you want and figure out a way to pay for it. b. determine how much you can spend and stay within your budget. 4. Amenities refer to b. extra features that cost more than most people can afford. c. additional features such as swimming pools, exercise rooms, etc. 5. “Everyone would own a house if they could afford to do so.” This statement is a. false because not everyone wants to own a house. b. true because owning a home is the American dream. c. true because living in a house has more advantages than living in an apartment. . 6. Renter’s insurance a. is available only to people who rent a house. b. is available only to people who rent an apartment. c. should be purchased by anyone who rents a place to live. 7. A lease specifies _______________________________ when renting a place to live. b. only the rights and responsibilities of the tenant c. only the rights and responsibilities of the landlord d. the rights and responsibilities of the tenant and landlord 8. A down payment is the a. part of the purchase price paid in cash up front. b. amount that a person must pay when renting an apartment. 9. Which of the following should be included in a lease before you sign? a. The amount of the rent and how it must be paid. b. If you have roommate, only one person’s name and signature. c. The hours that the office is open and how to contact the manager. 10. Janalee is graduating from college and moving out of the dorm. Her best friend found a job in Dallas and plans to move soon. Janalee is not sure whether to keep her job in Tulsa or move to Dallas with her friend. She needs a place to live until she decides. What do you recommend? Janalee should a. buy a house because she can sell it when she leaves and make some money on it. b. sign a one year lease on an apartment because it will give her time to decide what she wants to do. c. rent an apartment, either on a month-to-month lease or with a lease that she can cancel if relocating out of state. 11. Buying a house offers a tax advantage over renting because homeowners a. can deduct the interest they pay on a mortgage from their personal income taxes. b. can deduct their mortgage payment from their personal income taxes. 12. Wayne wants to buy a place but he does not like doing yard work. Wayne should a. consider buying a condominium. b. buy a house and pay someone else to mow the yard. c. rent a house and ask the owner to mow the yard for him. d. find a nice apartment because he would have no yard work. 13. The purpose for a security deposit is to b. pay for all maintenance while you live in the apartment. c. allow the owner/landlord draw interest on your money while you live in the apartment. d. provide some protection for the landlord for damage you made to the apartment, cleaning fees, or other costs. 14. Which of these costs are associated with buying a house? b. Down payments, points, and homeowner association fees c. Lease payments, security deposits, and loan application fees 15. A month-to-month lease can be terminated a. only by the landlord. b. only by the tenant. c. only by the landlord or the tenant. 16. Most landlords will ask you to inspect your apartment when you move in, and they give you a form to sign. What should you do? a. Just sign the form and return it to landlord; it is just a formality and has little meaning. d. Complete the form you were given, making a note of any needed repairs, sign the form, make a copy for yourself, and return it to the landlord. 17. Which of the following statements is TRUE? a. Renting an apartment is a greater financial commitment than owning a house. b. Owning a house is a greater financial commitment than renting an apartment. c. There is little financial difference between owning a house and renting an apartment. 18. Which of the following is a DISADVANTAGE to renting a place to live? Finding a(n) b. complex near the bus stop. d. apartment that will accept pets. 19. Juan and Rebecca want to buy a house, but they have no idea what price range they can afford. What do you recommend to them? c. Get pre-approved for a mortgage before looking for a place to buy. 20. If you want to buy a house, MOST experts would recommend that finance it with a(n) b. fixed rate mortgage. c. variable rate mortgage. 21. When negotiating an offer on a house, your top priority is making an offer that a. protects the real estate agent. b. you know the seller will accept without further negotiations. c. includes the contingencies and details you want considered. 22. The deposit you pay when making an offer to show you are serious about buying the house is called a. frank money. c. security deposit. d. earnest money. 23. If you had to give someone advice on buying a house, what you recommend? a. Buy a house you can afford. d. When the bank pre-approves you for a mortgage amount, spend all of it on a house. 24. “Buying a house is the most expensive purchase most people make.” Is this statement true or false? a. The statement is TRUE because buying a house is a major expenditure for most individuals and families. b. The statement is TRUE because most people spend at least 50 percent of their income on housing. 25. In addition to making a mortgage payment each month, homeowners are responsible to pay for all of the following EXCEPT a. utilities. b c. maintenance. d. security deposit. 26. When buying a house, the buyer is required to pay closing costs which includes b. title insurance, attorney fees, survey costs, points, and inspection fees. c. maintenance fees. d. property taxes. 27. If the down payment on your house is less than 20% of the house price, you may be required to pay ________________ each month with your mortgage payment. a. personal property insurance b. private property insurance c. private mortgage insurance 28. To reduce your monthly house payment, you can a. make a larger down payment. b. make a smaller down payment. c. increase your interest rates. 29. Suppose your gross monthly income is $3,000. Using the Housing Expense Ratio, your maximum housing expense should be a. $1,080. b. $840. c. $500. 30. When renting a place to live, utilities are b. always paid the tenant. c. paid either by the tenant or landlord. .