AAMP2 - Activating your university user account

advertisement

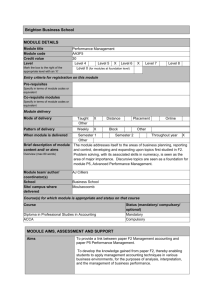

Brighton Business School MODULE DETAILS Module title Module code Credit value Level Mark the box to the right of the appropriate level with an ‘X’ Corporate Reporting AAMP2 30 Level 4 Level 5 Level 6 Level 0 (for modules at foundation level) Level 7 X Level 8 Entry criteria for registration on this module Pre-requisites ACCA Paper - Audit and Assurance (F8), Specify in terms of module codes or equivalent Co-requisite modules Specify in terms of module codes or equivalent Module delivery Mode of delivery Taught Other X Distance Placement Pattern of delivery Weekly X Block Other Online When module is delivered Semester 1 Semester 2 Throughout year X Other Brief description of module The module examines professional competences within the corporate reporting environment including specific professional knowledge about content and/ or aims preparation and presentation of consolidated and other financial Overview (max 80 words) statements; concepts, theories, and principles, and students’ ability to question and comment on proposed accounting treatments. Students should be capable of relating professional issues to relevant concepts and practical situations.The evaluation of alternative accounting practices and the identification and prioritisation of issues will be a key element of the paper. Module team/ author/ Nigel Padbury/Patricia Coffey coordinator(s) School Business School Site/ campus where Moulsecoomb delivered Course(s) for which module is appropriate and status on that course Course MSc Accounting Post graduate Diploma in Accounting Status (mandatory/ compulsory/ optional) Mandatory Mandatory MODULE AIMS, ASSESSMENT AND SUPPORT Aims To apply knowledge, skills and exercise professional judgement in the application and evaluation of financial reporting principles and practices in a range of business contexts and situations. Learning outcomes On successful completion of this module students should be able to: Subject specific A Discuss the professional and ethical duties of the accountant B Evaluate the financial reporting framework C Advise on and report the financial performance of entities D Prepare the financial statements of groups of entities in accordance with relevant accounting standards E Explain reporting issues relating to specialised entities F Discuss the implications of changes in accounting regulation on financial reporting G Appraise the financial performance and position of entities H Evaluate current developments Cognitive A Demonstrate personal skills such as problem solving, assimilating information and decision making B Demonstrate the ability to integrate technical knowledge and exercise professional and ethical judgements in evaluating corporate reporting issues in a business context. Content DETAILED SYLLABUS A The professional and ethical duty of the accountant 1. Professional behaviour and compliance with accounting standards 2. Ethical requirements of corporate reporting and the consequences of unethical behaviour 3. Social responsibility B The financial reporting framework 1. The applications, strengths and weaknesses of an accounting framework 2. Critical evaluation of principles and practices C Reporting the financial performance of entities 1. Performance reporting 2. Non current assets 3. Financial instruments 4. Leases 5. Segment reporting 6. Employee benefits 7. Taxation 8. Provisions, contingencies and events after the balance sheet date 9. Related parties 10. Share-based payment D Financial statements of groups of entities 1. Group accounting including statements of cash flows 2. Continuing and discontinued interests 3. Changes in group structures 4. Foreign transactions and entities E Specialised entities and specialised transactions 1. Financial reporting in specialised, not-for-profit and public sector entities 2. Entity reconstructions F Implications of changes in accounting regulation on financial reporting 1. The effect of changes in accounting standards on accounting systems 2. Proposed changes to accounting standards G The appraisal of financial performance and position of entities 1. The creation of suitable accounting policies 2. Analysis and interpretation of financial information and measurement of performance H Current developments 1. Environmental and social reporting 2. Convergence between national and international reporting standards 3. Current reporting issues Learning support Latest Editions of: ACCA Manual – Kaplan Publishers P2 Corporate Reporting ACCA Manual – BPP P2 Corporate Reporting International Accounting Standards (IASs), International Financial Reporting Standards (IFRSs) and Exposure Drafts (EDs) as per examinable documents. Accountants Guide, CAET (or other ASB reference text) Elliot B. & Elliot J.Financial Accounting & Reporting Prentice Hall Pierce A. & Brennan A. Principles & practice of Group Accounts. Thompson The ACCA Student Accountant Professional journals The Financial Times The Economist Websites www.accountingweb.co.uk www.accountancyage.com www.economist.com www.ft.com www.hmrc.gov.uk www.coi.gov.uk www.tax.org.uk www.asb.org.uk www.iod.co.uk www.frc.org.uk www.frrp.org.uk www.ifa.org.uk www.iasb.org.uk www.audit-commision.gov.uk www.open.gov.uk/nao/home/htm www.fasb.org www.ifac.org www.cbi.org.uk www.fsb.org.uk www.carol.co.uk www.pqaccountant.com www.iasplus.com www.corporatereporting.com All students benefit from: Studentcentral Online Library Resources (e-journals and e-books) Library facilities Teaching and learning activities Details of teaching and learning activities The module will use a mix of teaching and learning processes. Each session will be of 2 hours duration. The basis of the presentation of new material will be by the use of lectures supported by course notes and practical examples. This is typically intended to take up one hour. The remaining hour will be more workshop-based. Students will be presented with questions to work through and thee will be both discursive and calculation-based. The aim of the workshop is to ensure understanding of the subject and to encourage critical and analytical thinking. Students are expected to plan their own study time. Assessment hours are indicative of the time to be allocated to revision and formal assessment Allocation of study hours (indicative) Study hours Where 10 credits = 100 learning hours SCHEDULED This is an indication of the number of hours students can expect to spend in scheduled teaching activities including lectures, seminars, tutorials, project supervision, demonstrations, practical classes and workshops, supervised time in workshops/ studios, fieldwork, and external visits. 44 GUIDED INDEPENDENT STUDY All students are expected to undertake guided independent study which includes wider reading/ practice, follow-up work, the completion of assessment tasks, and revisions. 256 PLACEMENT The placement is a specific type of learning away from the University. It includes work-based learning and study that occurs overseas. N/A TOTAL STUDY HOURS 300 Assessment tasks Details of assessment on this module The module will be assessed by a three-hour paper based. The structure below is indicative. Examination worth 100%. There will be 15 minutes reading time available prior to the commencement of the examination. The examination paper will comprise two sections. Section A will consist of one scenario-based question worth 50 marks. It will deal with the preparation of complex consolidated financial statements including group cash flow statements and with issues in financial reporting. Students will be required to answer two out of three questions in Section B, which will normally comprise two questions which will be scenario or case-study based and one question which will be an essay. Section B could deal with any aspects of the syllabus. Types of assessment task1 % weighting (or indicate if component is pass/fail) WRITTEN Written exam 100% COURSEWORK Written assignment/ essay, report, dissertation, portfolio, project output, set exercise N/A PRACTICAL Oral assessment and presentation, practical skills assessment, set exercise N/A EXAMINATION INFORMATION Area examination board MSc/Postgraduate Diploma in Accounting External examiners Name Position and institution Date appointed Date tenure ends Yes No Refer to Studentcentral QUALITY ASSURANCE Date of first approval Only complete where this is not the first version Date of last revision Only complete where this is not the first version Date of approval for this version July 2014 Version number 1 Modules replaced AAP02 Specify codes of modules for which this is a replacement Available as free-standing module? X