FINANCIAL AND MANAGERIAL ACCOUNTING

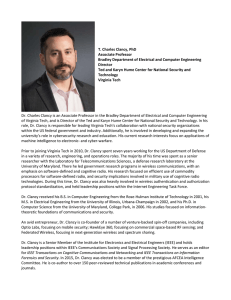

advertisement

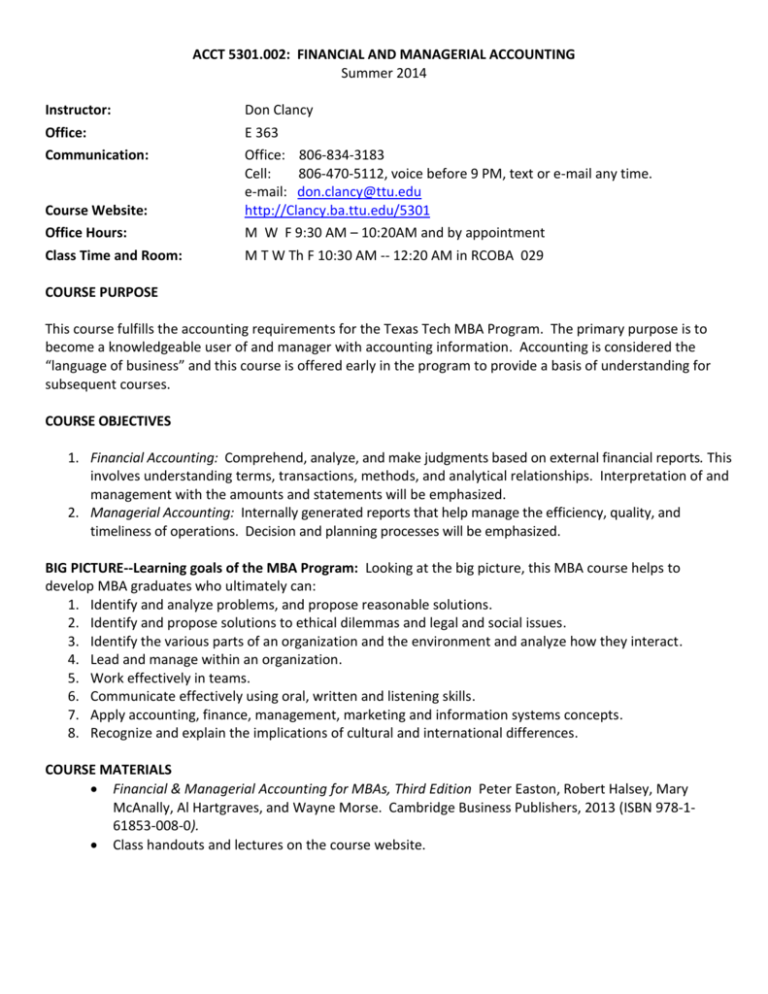

ACCT 5301.002: FINANCIAL AND MANAGERIAL ACCOUNTING Summer 2014 Instructor: Don Clancy Office: Communication: Course Website: E 363 Office: 806-834-3183 Cell: 806-470-5112, voice before 9 PM, text or e-mail any time. e-mail: don.clancy@ttu.edu http://Clancy.ba.ttu.edu/5301 Office Hours: Class Time and Room: M W F 9:30 AM – 10:20AM and by appointment M T W Th F 10:30 AM -- 12:20 AM in RCOBA 029 COURSE PURPOSE This course fulfills the accounting requirements for the Texas Tech MBA Program. The primary purpose is to become a knowledgeable user of and manager with accounting information. Accounting is considered the “language of business” and this course is offered early in the program to provide a basis of understanding for subsequent courses. COURSE OBJECTIVES 1. Financial Accounting: Comprehend, analyze, and make judgments based on external financial reports. This involves understanding terms, transactions, methods, and analytical relationships. Interpretation of and management with the amounts and statements will be emphasized. 2. Managerial Accounting: Internally generated reports that help manage the efficiency, quality, and timeliness of operations. Decision and planning processes will be emphasized. BIG PICTURE--Learning goals of the MBA Program: Looking at the big picture, this MBA course helps to develop MBA graduates who ultimately can: 1. Identify and analyze problems, and propose reasonable solutions. 2. Identify and propose solutions to ethical dilemmas and legal and social issues. 3. Identify the various parts of an organization and the environment and analyze how they interact. 4. Lead and manage within an organization. 5. Work effectively in teams. 6. Communicate effectively using oral, written and listening skills. 7. Apply accounting, finance, management, marketing and information systems concepts. 8. Recognize and explain the implications of cultural and international differences. COURSE MATERIALS Financial & Managerial Accounting for MBAs, Third Edition Peter Easton, Robert Halsey, Mary McAnally, Al Hartgraves, and Wayne Morse. Cambridge Business Publishers, 2013 (ISBN 978-161853-008-0). Class handouts and lectures on the course website. ASSESSMENT The accomplishment of learning goals will be assessed through examinations, class discussion, and case analyses. Attendance will be taken. UNIVERSITY POLICIES Integrity. Academic dishonesty will not be tolerated. All students are required to adhere to the Texas Tech University Policy on Academic Honesty. Civility in the Classroom. “Students are expected to assist in maintaining a classroom environment which is conducive to learning. In order to assure that all students have an opportunity to gain from time spent in class, unless otherwise approved by the instructor, students are prohibited from using cellular phones or beepers, eating or drinking in class, making offensive remarks, reading newspapers, sleeping or engaging in any other form of distraction. Inappropriate behavior in the classroom shall result in, minimally, a request to leave class.” ADA Requirements. Classroom accommodations will be made for students with disabilities, if requested. Religious Holidays. A student who intends to observe a religious holy day should make that intention known to the instructor prior to an absence. A student who is absent from classes for the observance of a religious holy day shall be allowed to take an examination or complete an assignment scheduled for that day within a reasonable time after the absence. ACCT 5301—002 FINANCIAL AND MANAGERIAL ACCOUNTING Course Outline Summer 2014 Date 6/3/2014 6/4/2014 6/5/2014 6/6-9/2014 6/10/2014 Text Reading Overview and Introduction 1: Financial Accounting for MBAs 2: Introducing Financial Statements 3: Accounting Adjustments and Financial Reports 4: Analyzing Financial Reports 5: Operating Income 6/11-12/2014 6: Operating Assets 6/13/2014 6/16/2014 6/17/2014 6/18/2014 6/19/2014 Exam #1 7: Investments 8: Non-Owner Financing 9: Owner Financing 14: Costs, Activities, Estimation 6/20/2014 15: Cost Volume Profit and Planning 6/23/2014 6/24/2014 6/25/2014 6/26/2014 6/27/2014 16: Relevant Costs and Benefits Exam #2 17: Product Costing: Job Order (only) 18: Activity Costing, Customer Profitability 20: Pricing 21: Operational Budgeting and Profit Planning 6/30/2014 23: Segment Reporting, Balanced Scorecard 7/1/2014 Transfer Pricing 7/3/2014 Thursday, 8:00 AM-10:30 AM, Exam #3 Exer./Prob. 1-28,32 2-23,27,31,33 3-15,19,27,40 4-23,27,32, 33, 35, 42 5-11,20,24,26 6-22,23,27,28, 34,35,37,40 7-26,27,29,33 8-24, 26,27,30 9-24,34,47,36,42 14-14,18, 21 15-18,19, 21, 24, 29,30,35,36 16-20, 23, 29 17-21,22, 26 18-10,14,18 20-21,23,27 21-20,21,25,29 23-20,30,33 23-22,23,24,36