RECTIFICATION PRESENTATION

advertisement

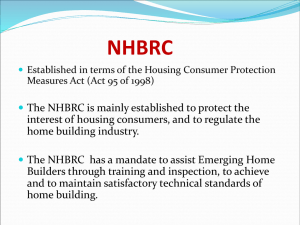

Strategic Corporate Plan 2011/12 Mr. Sipho Mashinini CEO - NHBRC Siphom@nhbrc.org.za 16 March 2011 Botshabelo Housing Accord The Land mark Botshabelo Housing Accord stated that: Government strives for the establishment of viable, socially and economically integrated communities which are situated in areas allowing convenient access to economic opportunities, health, educational and social amenities and within which South Africa’s people will have access on a progressive basis to: (a) A permanent residential structure with secure tenure, ensuring privacy and providing adequate protection against the elements. (b) The Strategy set out definite actions: • Stabilizing housing environment • Establishing a subsidy scheme to provide housing opportunities for millions • Providing housing support to communities Strategic Objectives 1. To grow, protect and sustain the NHBRC warranty fund • • • • Review and revise NHBRC pricing model Reduce operational costs Market and brand NHBRC Introduce new products in the market 2. To provide innovative quality homes that will satisfy and protect the consumer • • • Improve operations quality service levels Expand housing consumer education initiatives Rectification programme • Research new and value add NHBRC products and services Develop NHBRC standards and brands Legislative review Establishment of Investigation and Enforcement Unit. 3. Strengthen NHBRC operating processes, systems and procedures 4. Create a learning environment and build capacities to products and services • • • • • Improve and strengthen NHBRC human resource skills base Review and develop Human Capital Strategy National Rectification Project • Pre-2002 non-enrolment of homes in accordance with the Act. • PHP projects and homes were not enrolled. • Rural housing not enrolled. • “RDP houses” were not build in accordance to SABS building standards and technical requirements stipulated by the NHBRC. • No homes were inspected. • NDHS statistics data indicates that 3,047,600 houses were built between 1994 and 2010, (2,807,595+ 240,000). • Total units enrolled by NHBRC from 2002 to 2010 is 409,100. • Number of units at high risk is 2,638,500. Impact on houses • Desktop study shows that 40% of houses under risk will have workmanship related problems at a cost of R12 000 per house. • Estimated cost of rectifying minor defects will be 1,055,400 X 12 000 = R 12,7 billion. • Approximately 20% of houses at risk will have major structural defects which is 609 520 units. • To demolish and rebuild the units at current subsidy quantum of R 87 000 will be R 46 billion. • Total estimated remedial costs is therefore R 58.7 billion. Enrolment Fee • All houses rectified and meeting NHBRC requirements will be enrolled and provided with 5 year major structural warranty. • All future defects occurring within the warranty period will be covered by the NHBRC. • Enrolment fee will be calculated as for the other subsidy projects as 1.75% of the subsidy quantum, which is currently R87k. • It is expected that 60% of the houses will be rectified. • The total amount of units to be rectified is 1,583,100. • The total estimated enrolment fee is 1.75% X R 87000 X 1,583,100 = R 2.4 billion. Professional Fees • The professional fees for the services will be R1,500 per house per unit. • Total estimated professional fees is as follows: (0.6 X 2,638,500) X R1,500 = R 2.4 billion (0.4 X2.638,500) XR850 = R 0.9 billion Total estimated Professional Fees = R 3.3 billion Summary of Costs will be: Estimated remedial costs = R 58.7 billion Estimated Enrolment Fees = R 2.4 billion Estimated Professional Fees = R 3.3 billion Total Estimated Costs = R 64.4 billion Value for Money for Department • Assurance that each and every home is of quality standards that meets the National Building Regulations. • Very limited come-backs related to workmanship and structural integrity. • All houses assessed and rectified NHBRC technical requirements and qualify for a 5 year structural warranty cover provided by NHBRC. • During rectification process, contractors and sub-contractors will be trained by NHBRC. • NHBRC will develop a central registry of all houses that have been assessed and rectified. Capacity of NHBRC • NHBRC has adopted a Customer Centric Strategy. • Technical staff have been placed in all the NHBRC provincial offices which include geotechnical, structural engineers, quantity surveyors and project managers. • The provincial offices will be supported by a team of experts from Central Office. • We are short listing specialist contractors to do the work on behalf of the NHBRC. • There will be no rectification of the completed rectified homes. Pilot Projects in KZN • Initial focus of the rectification project is in KZN ; • Preliminary results is based on assessment made recently in KZN; • Number of units to be assessed is 160,000 (preliminary); • Number of Units assessed more than 27,000; • About 80% of the units are to be demolished. It is more expensive to rectify a 16m2 to 30m2 house! Pilot Project in EC • A total of 178 848 (preliminary) units are subjected to Forensic Investigation by NHBRC in Eastern Cape Province. • NHBRC pilot investigated a total of 36,000 units. • Study indicates that 63% of units require to be rebuilt at R 87 000 quantum,(112 674 X R87 000 = R 9,802,658,880). • 37% of units can be rectified at average cost of R 30,000 (66,173 X R30,000 = R 1,985,190,000). • A total of R 11,787,848,880 (preliminary figure). Jobs Created • 100 Jobs have been created for assessment through the rectification programme. • Most of the jobs are for Technical Consultants. • More than 1000 jobs will be created during Construction of the rectification programme. • The jobs will be for both skilled and unskilled labourers. • NHBRC has created 77 jobs of Technical Scarce skills. Surface bed with no foundation Blocks laid with mud Cracks above windows with no lintels Roof anchorage done by home owners NHBRC Contribution to homes constructed - Pre 2010 • All sub-standard houses will be demolished and re-built; • NHBRC will enrol these houses; • The NHBRC has referred the Engineers to Engineering Council of South Africa for possible disciplinary action; • NHBRC Council is taking disciplinary action against builders , and • The rectification phase will be project managed by the NHBRC. • Final budget and Rectification programme 2 B finalised in Consultation with NDHS pending availability of financial resources. NHBRC Value Proposition – Post 2010 • • • • All houses will be inspected by NHBRC . All houses enrolled with NHBRC will enjoy the following benefits: – 3 Months Workmanship Cover – 1 Year Roof Leak Cover – 5 Year Major Structural Warranty Cover Future remedial costs, if any, will be covered by NHBRC warranty. NHBRC will continue to provide more training to emerging home builders. The quality of construction is not yet at the desirable level. • NHBRC will be more involved in housing consumer education, focusing on:- implications of alterations & additions. - importance of proper maintenance of houses. - benefits of the warranty scheme. • NHBRC will pay more attention to infrastructural services during project construction. NHBRC Post 2010 (Cont…) • • • NHBRC will conduct “at risk” inspections of late enrolled houses. NHBRC will continue to crosssubsidise the subsidy sector enrolment fees in order to contribute to the sustainability of human settlements and assist in service delivery. NHBRC will implement a new enrolment process, whereby the project enrolment and home enrolment phases are collapsed into a single phase (reduction in turnaround times). • • • • • NHBRC will assist the province in geotechnical investigations. NHBRC will enroll all houses including rural houses and PHP. NHBRC has established a Forensic Investigation Business Unit. Focus will be on prosecuting all defaulting Home Builders not complying with the provisions of the Act. Enforcement of the NHBRC code of ethics. NHBRC Post 2010 – The Future! Improving quality of living A home that is suitable to the needs of the majority of the people of RSA. • Contribute to reduction of housing backlog through the promotion of innovative and/or alternative building methods. NHBRC Post 2010 Training of Youth ,Men& Women GP FS WC KZN EC MP NC LP NW TOTAL Training of Youth 360 104 176 240 144 104 64 104 104 1400 Training of Women 268 80 132 180 108 76 48 80 78 1050 Training of Men 272 76 132 180 108 80 48 76 78 1050 TOTAL 900 260 440 600 360 260 160 260 260 3500 INSPECTIONS In terms of the Housing Consumers Protection Measures Act, 1998 (Act No. 95 of 1998), section 5(4)(b), the Council shall: “enrol and inspect the categories of homes that may be prescribed by the Minister” Inspection Critical Success Factors • Inspection of all homes which are enrolled. • education and training of home builders. • acceptable level of technical competency of all home builders. • reduction in claims against the warranty fund (risk management). • maintaining a high profile of NHBRC visibility. • provision of statistical data to guide pro-active decisions on risk aspects. • provision of industry feedback, and • reduction in the cost of inspection through an optimised inspection process. NHBRC Inspection Model Post 2010 Utilisation of a hybrid model (Outsourcing and in-sourcing for smaller Provinces) Hybrid model resulted in reduction in inspection fee from R 2,500 to R 1700 per home. Implementation of an on-site inspection monitoring system through use of PDA’s (Personal Digital Assistant). NHBRC Post 2010 Inspection Model BUDGET 2011/12 NUMBER OF INSPECTIONS 193 516 TOTAL COST R48 967 463 FORECAST 2010/11 AVERAGE NUMBER OF INSPECTION per HOUSE NUMBER OF INSPECTIONS 6 73 355 TOTAL COST R50,154,416 Inspection Cost per Unit Subsidy • VFP’s Average Enrolment fee Non-Subsidy 649 7 964 (552) (1 476) 97 6 488 (145) (77) (48) 6 411 Cross-subsidy Quality Assessors (488) (1 545) Contribution to Fixed Costs Cross-subsidy to fixed costs (536) (503) 4 877 (1 593) (1 039) 1 707 Outsourced Inspectorate Contribution Direct Fixed Expenditure Contribution before Cross-subsidy Net Surplus Deficit VFP’s Development contribution to subsidy sector • VFP’s Inspection costs Fixed costs Total Cross-subsidy Per-Unit R’ Million 488 51.0 503 VFP’s 991 104.2 155.2 Major Fixed Cots Cross-subsidy: Staff Costs Infrastructure costs Administration costs 51.2 21.8 31.2 Total Fixed Costs 104.2 Revenue Assumptions Non-Subsidy Subsidy Registration Fees R 750 (Inc) per builder Annual Fee R 600 (Inc) per builder Manuals R 100 (Inc) per set ENROLMENT FEE STRUCTURE Subsidy Enrolments Subsidy Quantum 1% Project enrolment 0,75% Home enrolment fee Fee Scale A R 86 553 Selling Price (R) 0 to 500 000. Applicable Enrolment fee (R) 1.3% B 500 001 to 1,0 million A + 1.0% of difference C 1,0 million to 2,0 million B + 0.75% of difference D 2,0 million to 5,0 million C + 0.5% of difference E 5,0 million + Maximum of R 34,000 Valuable Final Products Trend and Value VFP’s • VFP’s Registration Units 2010/11 FORECAST 3 000 2011/12 BUDGET COMMENTARY 3 337 Developments in GP, MP and LP Registration Rand R 3.9m R 4.1m Renewals Units 10 500 12 000 Gauteng and KZN’s activities Renewals Rand R 5.5m Enrolment Units Enrolments Rand 30 000 VFP’s R 6.3m NW increase developments in Mafikeng, Hartebeest and Rustenburg. KZN increase developments in Newcastle, Umhlatuzi and 33 170 Ballito area. R 232m R 264m 1 850 1 659 Late Enrolments Rand R 1.2m R 1.0m Average Enrolment Fee R 7.745 R 7.964 Late Enrolments Valuable Final Products Trend and Value VFP’s 2010/11 FORECAST Subsidy Projects Units 2011/12 BUDGET 14 410 105 050 R 9m R 91m Subsidy Enrolment Units 80 090 105 050 Subsidy Enrolment Rand R 38m R 68m Subsidy Projects Rand VFP’s Expenditure Trend 250 200 R' Million 150 100 50 0 -50 Budget 2014/15 Budget 2013/14 Budget 2012/13 Budget 2011/12 Forecast 2010/11 Operations Admin Payroll Council 151 141 132 123 76 25 14 24 24 19 8 8 7 7 3 Employment Cost Sem Var Fixed 215 195 178 167 151 84 77 63 69 51 58 54 50 58 66 Surplus /Deficit Before Interest -8 4 7 3 1 Statement of Financial Performance by Segment for 2011-2015 Description Revenue Operation Expenditure Fixed Expenditure Non Subsidy Subsidy Total Budget 2012-13 2013-14 2014-15 166 510 208 283 847 531 450 357 739 461 276 454 493 565 805 532 898 299 64 771 500 58 188 517 122 960 017 131 567 218 140 776 923 150 631 308 8 412 070 212 124 074 220 536 144 209 476 947 226 568 260 253 612 003 104 162 413 112 795 280 121 998 294 136 560 310 Cross Subsidy 104 162 413 Total Expenditure 177 345 983 270 312 591 447 658 573 453 839 445 489 343 477 540 803 621 (10 835 775) 13 534 940 2 699 165 7 437 009 4 222 328 (7 905 323) - 255 683 307 255 683 307 273 581 138 292 731 818 313 223 045 (10 835 775) 269 218 247 258 382 472 281 018 147 296 954 146 305 317 723 Surplus / (Deficit) before interest Net Interest Surplus/ (Deficit) Statement of Financial Position 2011-2015 BUDGET 2011/12 2012-13 2013-14 2014-15 ASSETS: Non-current assets Current assets TOTAL ASSETS: 3 367 624 734 3 617 523 169 3 883 143 623 4 177 212 868 70 621 050 78 883 511 107 305 357 113 896 074 3 438 245 784 3 696 406 680 3 990 448 979 4 291 108 943 2 529 900 288 2 795 918 435 3 092 872 581 3 398 190 303 85 352 248 77 494 996 74 583 151 69 925 392 822 993 247 822 993 247 822 993 247 822 993 247 3 438 245 784 3 696 406 679 3 990 448 979 4 291 108 943 EQUITY AND LIABILITIES: Reserves Current liabilities Technical liabilities TOTAL LIABILITIES: Warranty Fund Analysis- 2012 R’ M Allocation of Investments: Warranty Fund Reserves VFP’s Working Capital Reserves 1 240 740 Investment Reserve 1 323 TOTAL: 3 303 NHBRC will continue to assist all spheres of Government in the delivery of sustainable human settlements. Thank You.