check

advertisement

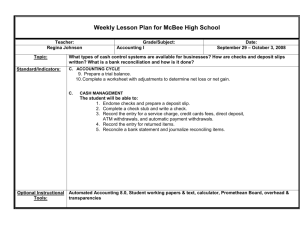

lesson six banking services presentation slides beware the high cost of financial services pawn shops charge very high ___________ for loans based on the value of tangible assets (such as jewelry or other valuable items). rent-to-own programs offer an opportunity to obtain home entertainment systems or appliances for a small ____________ ___. However, the amount paid for the item usually far _________ the cost if the item were bought on credit. check-cashing outlets charge high _____(sometimes 2 or 3 percent) just to have a paycheck or government check cashed. check-deferral services allow consumers to get a cash ____________on their next paycheck. However, these short-term loans are very _____________. A $200, two-week advance may cost over $30 (with annual costs exceeding $900). teens – lesson 6 - slide 6-A compare checking accounts location branch offices; hours of ____________; availability of ______ fees monthly fees; per __________fees; printing of checks; balance _________ fees; ____fees other charges ____________charge; __________________fees; certified check fees interest rate earned; minimum ______________to earn interest; fee charged for falling ________necessary balance restrictions _________balance; deposit insurance; holding period for deposited checks special features direct ____________; automatic _____________; overdraft ___________; online banking; discounts or free checking for ____________, _____________, or __________________of certain companies teens – lesson 6 - slide 6-B opening a checking account teens – lesson 6 - slide 6-C making a deposit 1. Write the ____of the deposit in this field. 2. If you are depositing currency (_________), write the total amount here. 3. If you are depositing ______, write the total amount here. 4. If you are depositing a check, write the bank transit number here, which is the top portion of the two-part number printed in the upper corner of the check. 5. Write the ____________ of the check here. 6. If you are depositing more checks than can be listed on the front, continue to list them on the ____, and write the ______ amount of the checks on back here. 7. Write the total amount you are _________ here. 8. If you are making a deposit inside a bank with a teller and you want to receive ____ back from your deposit, write the amount you want in this field. 9. Write the total amount (less cash back) of your _____________ in this field. teens – lesson 6 - slide 6-D Make the Following Deposits 1. September 15, 2010 - $45.00 cash, .87 coins, check – 203.56, check 19.87. Less cash received of $200.00. What is your total deposit? 2. September 22, 2010 - $20.00 cash, Check – 34.55, Check – 57.98. Less Cash received $55.00. What is your total deposit? 3. September 23, 2010 - $32.00 cash, 1.65 coins, Check – 36.89, Check – 285.99, Check – 14.87, Check – 48.99, Check – 183.99. What is your total deposit? Deposit Slip 45 00 87 203.56 Sept 15 19.87 269.30 200.00 69.30 Back side of deposit slip Who can endorse a check? The only person who can endorse a check is the one whose name has been written on the _____ of the check. Or the users of the account. A check made to McDonalds can be endorsed only by the people listed on Endorsing the _________ at the bank. a check Blank/open endorsement Anyone can _____ check. Once it’s signed anyone can ____ the check. Restrictive endorsement ____secure than blank endorsement. If it says For Deposit only, it cannot be turned in for ____. Special endorsement Transfer check to _______ party teens – lesson 6 - slide 6-E Practice endorsing checks 1. Endorse a check that was made out to you. You just got the check from your mom and you’re at the bank ready to cash it. Endorse it with a blank endorsement. 2. Endorse a check that was made out to you. You got the check from Farmer Bob for rock picking on May 28. You cannot go to the bank, but your friend will bring it in for you. You want the money deposited into your checking account. Endorse the check with a restrictive endorsement. 3. Endorse a check that was made out to you. You got the check from Sally Smith for baby sitting on September 17. You owe money to your mom, so you want to give the money to her. Endorse the check with a special endorsement of pay to the order of: your mom’s name and sign below that. Endorse a Check writing a check 1. Date Enter the _____ on which you are writing the check. 2. Payee Enter the _____of the person or the ________you are going to give the check to. 3. Amount of check in numerals Enter the _________of the check, in __________. Don’t leave any space between the pre-printed dollar symbol ($) and the numbers indicating the amount of the check; there should be no room for someone to add in extra _____________. 4. Amount of check in words Enter the amount of the check in ______. Start writing at the far ____ side of the line. Follow the dollar amount by the word “and,” then write the amount of _____over the number 100. Draw a _____ from the end of the 100 to the end of the line. teens – lesson 6 - slide 6-Fa writing a check (continued) 5. Name Your ____________ information is printed here. Never list your _______ _____________number on your printed check. 6. Signature Sign your check _______ the way you signed your name on the signature card you filled out when you ________ your account. 7. Memo Use this space to ______ why you wrote the check. If you are paying a bill, this is a good place to put information requested by the company. 8. Identification numbers These numbers are used to identify the _____, your account ________, and the check ________. They are printed in a special magnetic ink that machines can read. teens – lesson 6 - slide 6-Fb Practice Writing a Check • On September 10, you write a check #106 to your mom for $46.94. • On September 17, you write a check #107 to Burger King for $8.67. • On September 19, you write a check #108 to Mr. Luke for $12.00 for a WMS T-shirt. You wrote the check out to the wrong person, so you need to void it. • On September 19, you write a check #109 to WMS for $12.00 for a WMS T-shirt. Write Your Checks Here ___ ___ ___ ___ keeping a running balance (a) Keeping a Running Balance: Check Transaction One line entry 161 6/4 Sound Out – new tape deck 216 30 150 67 (b) Keeping a Running Balance: ATM Cards teens – lesson 6 - slide 6-Ga keeping a running balance (continued) (c) Keeping a Running Balance: Check Cards teens – lesson 6 - slide 6-Gb Practice Recording these Transactions • On September 10, you write a check #106 to your mom for $46.94. • On September 17, you write a check #107 to Burger King for $8.67. • On September 19, you write a check #108 to Mr. Luke for $12.00 for a WMS T-shirt. You wrote the check out to the wrong person, so you need to void it. • On September 19, you write a check #109 to WMS for $12.00 for a WMS T-shirt. • On September 20, you use your check card at Fareway to buy groceries for $79.66. • On September 20, your paycheck for $490 is automatically deposited. • On September 21, you use your ATM card to withdraw $40.00. • On September 22, you use your check card at Scheels to buy a $22.00 birthday present for your dad. Record the Transactions Here reading a bank statement 1 Match this up with your check register. Look for any checks that are in your register, but are not on the bank statement. Look for any deposits that are on your register, but not on the statement. Notice check 185 isn’t listed on the statement. teens – lesson 6 - slide 6-H ATM 5/12 Deposit 521.78 DirD 184 185 181 ATM Trans 5/17 5/17 5/19 5/24 5/24 5/27 Direct Deposit-paycheck 258.90 183 186 187 182 ATM ATM 5/26 5/30 6/03 6/4 6/15 5/30 State Farm – Car Insurance John Smith Perkins Transfer of money from savings Scheels Wal-MArt Fareway Center Sports 1232.27 30.00 15.00 40.00 1200.00 217.54 54.47 53.97 17.00 20.00 20.00 771.08 1292.86 1551.76 319.49 289.49 274.49 234.49 1434.49 1216.95 999.41 944.94 890.97 873.97 853.97 reconciling a checking account step 1: Obtain the current _____________from your bank _______________. step 2: Add any deposits that you have recorded in your check register but that are _____ on this statement. step 3: Subtract any outstanding checks (checks you have written but that have ____yet ________the banking system). step 4: Compare the result with the current __________in your check _________. Note: The balance in your check register should be adjusted to include: (a) deductions for service fees or other charges; (b) additions for direct deposits and interest earned. teens – lesson 6 - slide 6-I Banking Vocabulary ATM -- ______________ ___________ ______________. automatic payments… utility companies, loan payments, and other businesses use an automatic payment system with bills paid through ______ _________from a bank account. bounced check-- A check that a bank has __________to cash or pay because you have ___ money to cover it in your account. check-- A written ___________ instructing a bank to pay money from the writer's ______. checking account -- An account for which the holder can write _______. currency -- Money -- In practice, currency means ______, particularly paper money. Bankers often use the phrase "coin and currency" to refer to _______ and ___________. teens – lesson 6 - slide 6-J Banking Vocabulary • debit card -- A banking card enhanced with _____ (automated teller machine) and _____ (point-of-sale) features that can be used to purchase goods and services ______________. The card may require the user to sign his or her ________or enter a ____(personal identification number) into special equipment. • direct deposit… earnings ______________ deposited into bank accounts, saving time, effort, and money. • deposit slip -- An itemized slip showing the exact amount of paper money, coin, and checks being ____________ to a particular ___________. • endorse -- To sign, as the payee, the ______ of a check before cashing, depositing, or giving it to someone else. • overdraft -- A check written for ______ money than is currently in the _______. If the bank refuses to cash the check, it is said to have "bounced." Banking Vocabulary • • • personal identification number (PIN) -- A _____ that provides _________ for consumers at an ATM. point of sale (POS) -- The store or other location where a transaction takes __________. withdrawal -- An amount of money taken ______ of an account. Smart Cards smart cards, sometimes called “electronic wallets,” look like ATM cards; however, they also include a ______________. • This minicomputer stores ____________ amounts for buying goods and services. • A smart card can also store data about a person’s account ___________, transaction records, insurance information, and medical history. • Uses for smart cards may expand in the ___________. teens – lesson 6 - slide 6-K