Cash Repatriations – US Tax Considerations

advertisement

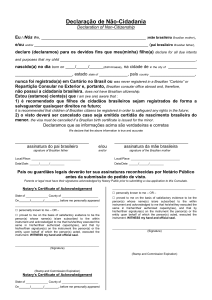

Managing the Crisis: Brazilian and US Cross-Border Tax Considerations March 25, 2009 Julio A. de Castro Dewey & LeBoeuf LLP Luiz Felipe Ferraz Demarest & Almeida Advogados Lavinia Junqueira Unibanco 1 Topics to be Covered Overview of cross-border tax issues faced by Brazilian and US companies as a result of the financial crisis Tax challenges and opportunities Recognition and acceleration of losses Acquisitions of loss companies Debt workouts, acquisition by funds of distressed debt Cash repatriations to provide liquidity in home jurisdictions Transfer pricing issues Brazil-US tax treaty Q&As 2 Certain Types of Losses From Economic Downturn Actual disposition of stock or debt at a loss Market example Sales of mortgage-backed securities (MBS) or loans at steep discounts Write-downs and write-offs of stock and debt assets Market example Banks’ write-downs of MBS Trading (“hedging”) losses Market example Foreign exchange derivative losses 3 Reactions by Tax Authorities to Crisis Brazil Deferral of payment deadline for certain federal taxes New installment tax payment program for delinquent companies IPI tax exemption/reduction in acquisition of new vehicles Creation of intermediary income tax rates for individuals (7.5% and 22.5%) Six-month suspension of requirement to present good standing certificates (CND/FGTS) in loans granted by public banks Postponement to Dec 2010 of the application of PIS/COFINS cumulative system for the real estate sector Suspension of IPI, PIS/COFINS levy in the acquisition or importation of goods for manufacturing of goods that will be exported Creation of subvention (interest rate equalization and compliance bonus on interest) in financing transactions IOF tax reduction in transactions with individuals and nonresident investors IRPJ/CSLL offsetting restrictions 4 Reactions by Tax Authorities to Crisis United States: Fairly active response Rev. Proc. 2008-51 (AHYDO relief) Notice 2008-78 (capital contribution to loss corporation) Notice 2008-83 (built-in losses of acquired banks) Rev. Proc. 2008-63 (securities borrower default) Notice 2008-91 (certain short-term cash repatriations from CFCs) 2009 Stimulus Bill Election to defer cancellation of debt income (CODI) Suspension of applicable high-yield debt (AHYDO) rules Extension of carryback period for small businesses 5 Claim and Acceleration of Offshore Tax Losses Scenario 1: Losses from Sale of Loss Subsidiary Shares 1A 1B USCo ≥80% $ < tax basis Shares Brazilian Co Assets Brazilian Co $ < tax basis Shares Buyer Buyer ≥80% USCo Assets 6 Claim and Acceleration of Offshore Tax Losses Scenario 1: Losses from Sale of Loss Subsidiary Shares US Tax Treatment of Scenario 1A: Capital loss allowable in the US cannot offset ordinary income of the corporation Loss generally from US sources for foreign tax credit purposes What if Brazilian Co had elected disregarded entity or partnership status? Brazilian Tax Treatment of Scenario 1B: Loss in the sale of a foreign subsidiary is not tax deductible. The alternative is to concentrate outbound investments in one sole foreign holding company and have the holding dispose of assets and investments 7 Claim and Acceleration of Offshore Tax Losses Scenario 2: Losses on Sale of Loss Subsidiary Assets 2A 2B USCo Brazilian Co ≥80% ≥80% $ < tax basis Brazilian Co Buyer Assets Assets $ < tax basis USCo Buyer Assets Assets 8 Claim and Acceleration of Offshore Tax Losses Scenario 2: Losses from Sale of Loss Subsidiary Assets US Tax Treatment of Scenario 2A: Loss derived by Brazilian Co not allowed as a deduction in the United States If sale at gain, in some circumstances gain could be taxable currently in the US under subpart F/CFC regime (e.g., shares of subsidiaries). Disconnect between treatment of gain and loss Loss would decrease earnings and profits of Brazilian Co, potentially decreasing future US tax on profits of foreign subsidiary under the subpart F/CFC regime Alternative planning: electing to treat Brazilian Co as disregarded immediately prior to sale of assets. In that case, loss from sale of asset could be claimed in the US Hurdles: inbound liquidation basis adjustment rules and “dual consolidated regime” 9 Claim and Acceleration of Offshore Tax Losses Scenario 2: Losses from Sale of Loss Subsidiary Assets Brazilian Tax Treatment of Scenario 2B: Loss derived by US Co not allowed as a deduction in the United States If US company has an accounting loss in the current year, this loss may be carried forward to offset future accounting income of US company If sale at a gain, profit would be taxable currently in Brazil under the Brazilian CFC rules 10 Claim and Acceleration of Offshore Tax Losses Scenario 3: Impairment (Financial Accounting) Losses 3A 3B USCo Brazilian Co ≥80% Brazilian Co Assets Financial Accounting Mark-down, Brazilian Co not insolvent Financial Accounting Mark-down ≥80% USCo Assets 11 Claim and Acceleration of Offshore Tax Losses Scenario 3: Impairment Losses US Tax Treatment of Scenario 3A: No loss allowed for US tax purposes Planning technique: accelerate tax loss for impaired stock through a so-called Granite Trust structure, under which Brazilian Co is disaffiliated from US group and liquidated into US Co and a related foreign affiliate Brazilian Tax Treatment of Scenario 3B: Impairment loss not deductible in Brazil Planning technique: interposing a foreign holding company so that the markdown becomes an accounting loss of the foreign holding company, thereby offsetting other accounting income of such company in the computation of worldwide income taxable basis 12 Claim and Acceleration of Offshore Tax Losses Scenario 4: Trading Losses 4A 4B USCo Brazilian Co Position (e.g., BRL) with significant loss Financial Markets Position (e.g., USD) with significant loss Financial Markets 13 Claim and Acceleration of Offshore Tax Losses Scenario 4: Trading Losses US Tax Treatment of Scenario 4A: Loss can be generally claimed upon termination of the position or earlier if mark-to-market regime applies Subject to certain rules dealing with “straddles” (where there is another inverse position outstanding) Consider reportable transaction rules Mark-to-market complicated by valuation issues in the current market Character of non-mark-to-market loss generally capital 14 Claim and Acceleration of Offshore Tax Losses Scenario 4: Trading Losses Brazilian Tax Treatment of Scenario 4B: Losses incurred directly by Brazilian companies in financial investments overseas are generally not tax deductible unless: in the case of a hedging derivative entered in a foreign futures exchange market the loss is incurred in a variable income transaction (shares, gold, futures, forward, options, swap) and is offset with a variable income gain obtained in the same country/market and within the same year Planning Technique: invest in foreign markets through a foreign subsidiary or a Brazilian proprietary investment fund that invests in offshore funds (among other investments in Brazil) 15 Claim and Acceleration of Offshore Tax Losses Scenario 5: Worthless Investments 5A 5B USCo Brazilian Co ≥80% ≥80% Brazilian Co Worthless Security/Stock USCo Worthless Security/Stock Worthless Stock Brazilian S Worthless Security/Stock 16 Worthless Securities – Brazilian Tax Considerations Brazilian Tax Treatment of Scenario 5B Accounting losses may be offset with income of the US company, in the case of investments made by this company Generally, losses in investments held directly by the Brazilian company are not tax deductible 17 Worthless Securities – US Tax Considerations Section 165(g)(3) permits ordinary loss for stock of active affiliates Affiliates need to be in an operating business per legislative history Subsidiary is “affiliated” with the taxpayer if three tests are satisfied: Ownership test: direct ownership of at least 80% of the total voting power and value of the subsidiary Gross receipts test: more than 90% of the aggregate gross receipts of the subsidiary for all years must be from sources other than passive (royalties, rents, dividends, interest, etc.) Taxpayer must be a domestic corporation Anti-abuse Rule: stock of the subsidiary cannot be acquired “solely” for purpose of obtaining loss Source: loss is sourced for foreign tax credit purposes based on the residence of the parent entity. So loss is generally US source Parent allowed worthless security deduction when election made to change the tax classification of subsidiary from corporation to disregarded entity and fair market value of the subsidiary’s assets does not exceed liabilities Problem with gross receipt test for tiered structures. Worthless holding subsidiaries may not qualify 18 Claim and Acceleration of Offshore Tax Losses Incurred by US and Brazilian Companies – Scenarios Scenario 6: Investments in Brazil by US Disregarded entities Cayman Fund Delaware LLC Portfolio Security/Stock Brazilian Co 19 New Brazilian Tax Haven Rules – US a Tax Haven? “Privileged tax regime” is a tax system that: Does not tax income or taxes income at rates lower than 20% Does not tax income earned abroad or taxes such income at rates lower than 20% Grants tax benefits to nonresident parties: With no requirement of substantial economic activity in the tested jurisdiction Bound to the non-performance of substantial economic activity therein Does not allow access to information re: corporate interest, ownership of goods or rights, or to the economic transactions performed New rule specifically applies for transfer pricing purposes. Presumption that payor and payee are commonly controlled. Remittances other than for importation, exportation or payment of interest should not be included Risk that US LLCs could be treated as formed in privileged tax regime because (unless elected otherwise), they are not subject to tax on a stand-alone basis In principle, not applicable to investments in financial markets 20 Acquisition of Companies with Net Operating or Built-in Losses Brazilian Rules: Income tax code allows the use of NOLs by companies after the corporate interest is changed Exception: cumulative change of corporate interest and corporate purpose, case in which NOLs should be written off Mergers: merged companies must write off NOLs 21 Acquisition of Companies with Net Operating or Builtin Losses – US Rules Section 382 limits use of net operating losses (NOLs), built-in losses and built-in deductions following an “ownership change” Ownership change: more than 50% increase in shareholder ownership of loss corporation during three-year “testing” period If loss corporation has net unrealized built-in loss that exceeds a threshold amount, built-in losses and built-in deductions generally will be subject to limitation NOLs, built-in losses and built-in deductions may offset taxable income in amount equal to the fair market value of the loss corporation’s stock multiplied by the long-term tax-exempt interest rate What is fair market value these days? 22 Acquisition Losses/“Net Unrealized Built-in Losses” – US Rules Notice 2008-83: any deduction allowed after an ownership change (as defined in Section 382(g)) to a bank with respect to losses on loans or bad debts shall not be treated as built-in loss or deduction attributable to periods before the change date Stimulus Bill repealed Notice 2008-83 prospectively for any ownership change occurring after January 16, 2009 Notice 2008-83 still applicable with respect to ownership change after January 16, 2009, if change is pursuant to written binding contract or publicly disclosed agreement entered into on or before such date 23 Acquisition Losses/“Net Unrealized Built-in Losses” US Rules Notice 2009-14: acquisitions pursuant to various programs established under the Emergency Economic Stabilization Act of 2008 Instruments denominated debt will be treated as debt and preferred stock will not be taken into account in determining if an ownership change has occurred. Generally determination of debt vs. equity based on specific facts Warrants bought by Treasury will be treated as options (and not stock). Not deemed exercised 24 Acquisition Losses/Capital Contributions to an Old Loss Corporation Section 382(l)(1): For purposes of determining value of stock of loss corporation for purposes of computing limitations, capital contributions are part of a plan a principal purpose of which is to avoid or increase any limitation not taken into account Any capital contribution made during the two-year period ending on the change date shall, except as provided in regulations, be treated as part of a tax avoidance plan No regulations dealing with these matters have been issued to date 25 Acquisition Losses/Capital Contributions to an Old Loss Corporation Notice 2008-78 (September 26, 2008): regulations under Section 382(l)(1) will be issued as described in the notice. The notice also provides that, pending the issuance of further guidance, taxpayers may rely on the rules set forth in the notice. Notice 2008-78 sets forth the following: capital contributions not presumed to be part of tax avoidance plan solely as a result of having been made during the two-year period ending on the change date capital contributions received by an old loss corporation shall be taken into account (and will not reduce the value of the old loss corporation) unless the contribution is part of a tax avoidance plan whether a capital contribution is part of a tax avoidance plan is determined based on facts and circumstances, unless (i) the contribution is described in one of the four safe harbors or (ii) Section 382(l)(1) does not apply to the contribution pursuant to Treas. Reg. § 1.382-9(k) 26 Debt Workouts/CODI Renegotiations of debt instruments Stock-for-debt exchange Property-for-debt exchange Debt-for-debt exchange Repurchases by issuers or affiliated companies at discount Consequences to issuers and holders 27 Debt Workouts – Brazilian Tax Considerations Consequences to the issuer: If the issuer pays or purchases its own debt at a discount, the discount becomes a taxable gain (income tax and social contribution) Alternatives: To postpone taxation: punctuality discount (uncertain ex nunc condition clause); negotiation of a present value discount without formally reducing the amount of nominal accrued interest and principal Shareholder purchases and capitalizes debt In case of securities or debt that may have a secondary market either now or in the future, use of a financial structure facility to intermediate purchase and holding of the security 28 Debt Workouts – Brazilian Tax Considerations Consequences to Holder: loss on sale of securities or renegotiation of debt at a discount is deductible if: loss is incurred in Brazil and debt was originally issued and acquired in Brazil (losses in outbound investments are generally not tax deductible) loss is classified as an ordinary and operational expense, necessary in holder’s due course of business. In general: if the debt is sold/renegotiated at its fair or market value, to prevent further losses of the holder; if the debt/security is linked to the holders operational activity; if the transaction is a true sale Tax authorities regularly assess these types of losses. Alternatives that allow to postpone issuers gain and holders loss may reduce holders exposure If renegotiation triggers indeed a current accounting/tax loss, it is advisable to homologate the renegotiation agreement in the due course of a judicial execution procedure or judicial debt restructuring arrangement (for Law 9,430-96 purposes) 29 Debt Workouts – Brazilian Tax Considerations General rule for the deduction of losses in defaulted credits (rather than losses in renegotiation or sale of credits), according to Law 9,430/96 For secured credits of any amount: after two years of default, as long as judicial action has been initiated and maintained for the recovery of the loan and arrest of the guarantees For unsecured credits: Deduction as expenses is allowed for credits: [a] after six months of default, for credit amount up to R$ 5,000; [b] after one year of default, for credit amounts higher than R$ 5,000 lower than R$ 30,000, provided there is evidence of collection procedures; and [c] after two years of default, amounts higher than R$ 30,000, as long as judicial collection or execution procedures have been initiated Alternative: Securitization or sale of credits (private sale, SPE, FIDC). Renegotiations may also fall aside of this rule (assessment risk) 30 Debt Workouts/CODI – US Tax Considerations Deemed debt-for-debt exchanges Reg. 1001-3: Significant modifications include: Change in yield (greater than 5% or 25 basis points) Change in timing or amount of payment (material deferral of payment, subject to safe harbor) Change in obligor or collateral (subject to certain exceptions for reorganizations) Change from non-recourse to recourse (and vice versa) 31 Debt Workouts/CODI – US Tax Considerations Issuer recognizes CODI upon repurchase of a debt instrument for an amount less than its adjusted issue price Exception for taxpayers that have filed for bankruptcy or are insolvent These taxpayers are required to reduce certain tax attributes, including NOLs, by the amount of the CODI (or a portion thereof, as applicable, in the case of insolvency) If debtor issues a debt instrument in satisfaction of indebtedness, the debtor is treated as having satisfied the indebtedness with an amount of money equal to the issue price of the debt instrument Potential for unanticipated cancellation of debt income Debt vs. Equity concerns 32 Debt Workouts/CODI – US Tax Considerations OID: difference between issue price of a debt instrument and its stated redemption price at maturity Issue price is important to determine the amount of OID, CODI (if an outstanding debt is satisfied with a new debt), and gain or loss if property is exchanged for a debt instrument In the case of public offering, issue price generally is the initial offering price to the public In the case of a private placement for cash, the issue price is the price paid by the first buyer In the case of a debt instrument issued for property and which is either traded on an established securities market, or issued for property traded on an established securities market, the issue price is the fair market value of the property 33 Debt Workouts/CODI – US Tax Considerations Excess of the issue price and unpaid stated interest of the debt instrument over its purchase price generally treated as CODI for the issuer but also creates OID, deductible over the remaining term of the instrument (timing mismatch) Interest deduction can be deferred until paid or even permanently disallowed in part if debt instrument is an AHYDO, i.e., provides for: a maturity date in excess of five years, a yield to maturity equal to or in excess of the sum of the AFR + 5%, and “significant OID” 34 US Tax Considerations – Relief in US Stimulus Bill CODI resulting from certain debt repurchase after December 31, 2008, and before January 1, 2011, can be deferred. CODI can be included rateably over the following five taxable years: For debt-for-debt exchanges (or deemed exchanges), any OID deduction with respect to the newly issued debt instrument not in excess of the deferred CODI also deferred If new debt instrument is issued and proceeds used by the issuer to repurchase pre-existing debt instrument, new debt instrument treated as issued in satisfaction of the repurchased debt instrument OID deductions deferred under same rules General exception for insolvent or bankrupt debtors does not apply if taxpayer elects to defer tax due on CODI AHYDO rules are suspended for debt instrument issued between September 1, 2008, and December 31, 2009, in exchange (or deemed exchange) for a pre-existing obligation which is not itself an AHYDO However, suspension does not apply to certain contingent debt obligations and to any obligation issued to a related person 35 US Tax Considerations – Administrative Relief Rev. Proc. 2008-51: IRS will not treat the following debt instruments as AHYDOs: Debt instrument issued for money pursuant to financing commitment if it would not be an AHYDO if issue price were net cash proceeds actually received by issuer Debt instrument exchanged/indirectly exchanged for debt instrument issued pursuant to a financing commitment if: debt instrument issued within 15 months of issuance of old debt instrument, debt instrument would not be an AHYDO if issue price were net cash proceeds actually received by issuer, If debt instrument issued on or after August 8, 2008: – maturity date not more than one year later than the maturity date of the old maturity date – stated redemption price not greater than the stated redemption price of the old instrument 36 Case Study 1 Issuer defaults on a $1 billion note and wants to cure the default Lenders agree to waive the relevant covenant subject to an increase in interest rate Note is worth $700 million Issuer treated as satisfying the old note with a new note with an issue price of $700 million Debtor realizes $300 million of CODI Lenders realize $300 million of loss New note has $300 million of OID and could be an AHYDO 37 Foreign Funds Investing in Distressed Debt ManCo • ManCo investment advisor for Hedge Fund only • ManCo can bind HF • ManCo operates exclusively in either US or BR • ManCo receives investment advisory fees • Hedge Fund (through ManCo) either: (i) originates loans in the US/BR; (ii) buys US/BR debt in secondary market; (iii) buys US/BR loans in anticipation of renegotiating them, or (iv) Forecloses on underlying collateral (e.g., real estate). Investors Hedge Fund Tax Haven Jurisdiction Distressed Loans US Delaware LLC Distressed Loans BR 38 Foreign Funds Investing in Distressed Debt – Brazilian Tax Considerations If an investment fund acquires distressed debt of a Brazilian company, the following issues should be addressed: Fair sale/purchase value (evaluation of credit portfolio x fund MTM) True sale verification Due diligence of credit portfolio: credit exists and is definable Succession of credit rights: silent or formal assignment? Replacement of creditor in judicial suits (x moral or financial hazard demands linked to collection procedures)? For purchaser: holding structure for the portfolio x WHT levy (FIDC is advisable) For seller: sale will trigger a net operating loss carryforward? (should be avoided) 39 Foreign Funds Investing in Distressed Debt – US Tax Considerations Non-resident individual or corporation engaged in business in the US is taxable on income effectively connected with that trade or business Foreign person considered engaged in a US business if it: Makes personal, mortgage or other loans to the public Buys, sells for the public notes, drafts, checks etc. Loan origination: how many does it take to create trade or business? Secondary purchases: level of involvement in connection with original loan? Renegotiations? 40 Foreign Funds Investing in Distressed Debt – US Tax Considerations IRS Office of Chief Counsel studying issues surrounding foreign funds investing in US distressed debt If fund buying distressed debt engages in purchase of debt with a view towards restructuring the issuer and selling quickly, it will likely be viewed as engaging in a trade or business in the United States Consequence: net basis taxation in the US If hedge fund makes passive investments, buying distressed debt and helping manage the company with a view toward making a capital gain on the sale of stock, it may not be viewed as engaging in a trade or business in the United States No net basis taxation 41 Cash Repatriations – Sample Scenario Parent company needs liquidity Income of Brazilian Co not subpart F USCo IOF tax (0.38% flat + up to 1.5% for the first year) ≥80% Loan Foreign Co Assets Alternative: investment in offshore financial markets and extension of loan within financial markets. Interest is tax deductible (34%) and taxable at source (15% WHT). Brazilian Co ≥80% Loan USCo Assets 42 Cash Repatriations – Brazilian Tax Considerations No capital gain tax up to capital amount invested in foreign currency Accumulated losses Tax incentive reserves Dividends: exempt of withholding tax Payment of Interest on Equity: 15% of income withholding income tax. Deductible up to 50% of the profit reserves or 50% of the year profit (the highest) Interest: subject to 15% withholding tax (or 25% if to a low tax jurisdiction) Thin capitalization rules Transfer pricing limitation 43 Services/Royalties – Brazilian Tax Considerations Payment of: Services (import): High taxation - 15% of withholding income tax, 9.25% of PIS/COFINS social contributions, 5% of ISS (tax on services); 10% of CIDE Royalties: 15% of withholding income tax, 10% of CIDE in certain cases. Deduction of the expenses. Conditions: certificate approval from the Central Bank of Brazil and the National Institute of Industrial Property 44 Cash Repatriations – US Tax Considerations Undistributed income and losses of Brazilian Co not included in USCo’s taxable income subject to (i) entity classification considerations, and (ii) US antideferral regimes generally applicable to “passive” income under subpart F Operation of Subpart F Subpart F rules require “US Shareholders” of a controlled foreign corporation (or CFC) to include their pro rata share of the CFC’s Subpart F income in their own taxable income, whether or not the CFC has made actual distributions Controlled Foreign Corporation A CFC is a foreign corporation that is more than 50 percent (measured by vote or value) owned by US Shareholders Foreign Co is a CFC US Shareholder A US Shareholder is a US person who owns 10 percent or more of the total combined voting power of all classes of stock of the CFC. Ownership may be direct or indirect, or by attribution from certain related parties USCo is a US Shareholder 45 Cash Repatriations – US Tax Considerations If a CFC invests its earnings and profits in certain “US property,” the US Shareholders of the CFC may be taxable on the amount of such investment Earnings and profits of a CFC that have been previously taxed as Subpart F income that are invested in US property are generally not subject to this tax A loan made by a CFC to a US Shareholder or certain related parties is generally treated as an investment in US property 46 Cash Repatriations – US Tax Considerations Notice 2008-91: parent companies of CFCs can receive certain 60-day term loans without these loans being treated as “obligations” of US persons Previously, Notice 88-108 permitted 30-day term loans The purpose of the Notice, the IRS stated, was “[t]o facilitate liquidity in the near term” Notice 2008-91 only covers loans made during the 2008 and 2009 tax years Limit on the aggregate time a corporation can have an outstanding loan: 180 days/year Therefore, USCo can take as many 60-day loans from Foreign Co over nearly half a year No restrictions on how the loans may be used 47 Cash Repatriations – US Tax Considerations On May 27, 2008, Treasury and IRS published Rev. Proc. 200826: IRS won't question whether security is “readily marketable security” which is one exception to definition of “US property”, as long as security is of type that was readily marketable at any time within 3 years before 5/12/2008 Safe harbor was considered necessary due to “current market conditions and liquidity constraints” which have created uncertainty as to marketability of previously marketable securities Notice 2009-10 extends the application of Rev. Proc. 2008-26 to any day during calendar year 2009, for which it is relevant whether securities are readily marketable for purposes of section 956(c)(2)(J) 48 Cash Repatriations – Brazilian Tax Considerations Brazilian CFC regime – controlled and associated companies Supreme Court yet to decide on associated companies Taxation of profits on availability (accrual) Compensation of losses in the same country Foreign tax credit is allowable 49 Brazilian Securitization Vehicles Brazilian company holds credit portfolio directly: - Non deductibility of credit provisions. Postponement of credit loss deductibility (6 months to 2 years). Possible to empower control of deductibility (rather than in the case of sale and renegotiations) - Losses and recoveries accounted for in different tax periods may not be off settable (taxation of recoveries at a gain x freezing of losses, etc.) - Financial revenues not taxable by PIS/COFINS (nonfinancial companies, non-cumulative PIS/COFINS tax regime) 50 Brazilian Securitization Vehicles Brazilian company holds credit portfolio through FIDC: - Credit provisions comprised within MTM of fund´s portfolio. Net MTM income/loss on fund is taxable/tax deductible on a current basis (matching of accounting and tax losses, not possible to empower control of deductibility, but gains and losses are computed on a net current basis) Income on investment in fund is not taxable by PIS/COFINS, but is subject to WHT of 22.5% to 15%, creditable against corporate income tax payable Other Brazilian securitization vehicles only recommended for mortgage/real state credits (possible future issuance of exempt securities for private banking financing portfolios) Rather than that, the only benefits used to be CPMF and PIS/COFINS, which do no longer prevail 51 Transfer Pricing Issues Overview of Brazilian and US transfer pricing rules Challenges in matching US and Brazilian transfer pricing goals Do tax treaties give transfer pricing protection/shelter? 52 Overview of US Transfer Pricing Rules Section 482 allows IRS to make adjustments or reallocations when necessary to prevent evasion of taxes or clearly reflect income in transactions between related parties The true taxable income of a controlled taxpayer is determined using an arm’s-length standard, which is satisfied if “the results of the controlled transaction are consistent with the results that would have been realized if uncontrolled taxpayers had engaged in the same transaction under the same circumstances” The Regulations identify several pricing methods for determining whether the arm’s-length standard is satisfied and, if not, the arm's-length result 53 Challenges in Matching US and Brazilian Transfer Pricing Goals Brazilian rules – adaptation of OECD standards to Brazilian peculiarities Use of traditional methods (imports and exports) Use of fixed gross margins No APAs Allowance of hidden comparables Related parties – corporate or business relationship, tax haven jurisdictions and transactions under “privileged tax regime” Difficulties in the Brazilian scenario Qualification of professionals Reliable and detailed database Brazilian transfer pricing reform pending of approval since 2001 54 Do Tax Treaties Give Transfer Pricing Protection/Shelter? OECD provides avoidance of double taxation in Article IX of Convenion Model Article IX of Brazil treaties only consider first paragraph of Convention Model Paragraph 1 – if related parties exist and transact in conditions that may not be considered arm’s length, then any profits that would, but for those conditions, have accrued to one of the enterprises may be included in the profits of that enterprise and taxed accordingly Paragraph 2 – if avoidance of double taxation 55 US Brazil Tax Treaty Will It Happen? Friction Points March 2007: US and Brazil signed a Tax Information Exchange Agreement (TIEA) Purpose: facilitating administration of both countries’ tax systems Both governments have expressed hope that signing of the TIEA would be first step to deeper bilateral tax relationship However, declaration states that two countries still “diverge” on several important areas Both countries previously attempted to reach an agreement on tax treaty US Treasury Department and Brazilian Receita Federal initiated informal discussions in 2006 to exchange views on several tax policy issues, including: transfer pricing; permanent establishment; taxation of income from services; mutual agreement procedures; Most favored nation clauses in other treaties On March 11, 2009 US Sen. Dick Lugar introduced a United States Senate Resolution calling for the strengthening of US-Brazil economic relations through a double tax treaty 56 Will It Happen? Friction Points Major Political Obstacles: Will Brazilian companies benefit as much as US companies? Loss of tax revenues in Brazil Tax sparing No uniform pressure from Brazilian companies and their representatives Major Legal Obstacles in Brazil Need for Constitutional Amendment Competent Authority: Tax dispute settlement Need for change in ordinary law Reduction in interest, dividend and royalty rates Transfer pricing adjustments 57 What Is It Expected To Say? July 2008: National Foreign Trade Council (NFTC) comments to Treasury in support of tax treaty between the United States and Brazil Tax provisions in tax treaties recently ratified by Brazil not helpful to US companies Following the US treaty precedents would enhance free flow of capital between countries The NFTC recommended the following provisions: Reduction of parent-subsidiary dividend withholding rate to zero Reduction of interest withholding rate from 15% to zero, including for loans by banks, financial institutions and non-bank finance companies Reduction of royalty and services withholding rate from 25% to 0% Arms-length standard for transfer pricing and APA programs Mutual agreement/competent authority provision Permanent establishment and business profits provisions reflecting US and OECD models Treasury agreed and stated that it remained committed to negotiating a tax treaty that satisfies goal of eliminating tax-related barriers to trade and investment between US and Brazil 58 Exchange of Tax Information Between US and Brazilian Tax Authorities TIEA Status: pending ratification by Brazilian Congress. Unlikely to happen Questions arose regarding constitutionality of the agreement and the impact on Brazilian companies Fear that the IRS may use (or abuse) Brazilian tax information as a basis to audit Brazilian businesses and transactions in the United States with adverse consequences Brazilian industry believes that Receita not interested in treaty – only wanted TIEA to increase reach of its audits List of covered taxes is longer in Brazil On July 8, 2008, lawmaker Regis de Oliveira delivered an opinion to the House Commission (CCJ) to reject the agreement based on its unconstitutionality, illegality, and poor wording 59 Questions? 60 Thank you! 61