FIN560: Derivatives and Assets Pricing

advertisement

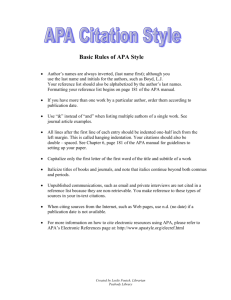

FIN560: Derivatives and Assets Pricing Credit Hours: 3 Contact Hours: This is a 3-credit course, offered in accelerated format. This means that 16 weeks of material is covered in 8 weeks. The exact number of hours per week that you can expect to spend on each course will vary based upon the weekly coursework, as well as your study style and preferences. You should plan to spend 10-25 hours per week in each course reading material, interacting on the discussion boards, writing papers, completing projects, and doing research. Faculty Information Name: Phone: CSU-GC Email: Virtual Office Hours: Course Description and Outcomes This course provides a broad introduction to the derivatives markets including forwards, futures, swaps, and options. Derivative securities play an integral part in managing risk for multinational corporations, portfolio managers, and institutional investors, as well as provide opportunities for speculators around the world. The main goal of the course is to leave the student with an understanding of various derivatives strategies and implications for portfolio management. Course Learning Outcomes: 1. Identify the different types of financial markets as well as basic theories of derivatives and risk management. 2. Analyze, compare, and contrast derivative forwards, futures, swaps, and options agreements. 3. Describe financial risk management strategies to support corporate and investment planning processes as well as critical business plan objectives. 4. Analyze and evaluate asset pricing models for options. 5. Design financial engineering and security solutions for corporate and financial wealth creation. Participation & Attendance Prompt and consistent attendance in your online courses is essential for your success at CSU-Global Campus. Failure to verify your attendance within the first 7 days of this course may result in your withdrawal. If for some reason you would like to drop a course, please contact your advisor. Online classes have deadlines, assignments, and participation requirements just like on-campus classes. Budget your time carefully and keep an open line of communication with your instructor. If you are having technical problems, problems with your assignments, or other problems that are impeding your progress, let your instructor know as soon as possible. Course Materials Required: McDonald, R. L. (2013). Derivatives markets (3rd ed.). Upper Saddle River, NJ: Pearson. ISBN13: 9780321543080. Recommended: Durbin, M. (2010). All about derivatives (2nd ed.). New York, NY: McGraw Hill. ISBN13: 9780071743518 (This book is strongly recommended as a supplement to the main textbook to enhance students’ understanding of derivatives.) Course Schedule Due Dates The Academic Week at CSU-Global begins on Monday and ends the following Sunday. Discussion Boards: The original post must be completed by Thursday at 12 midnight MT and Peer Responses posted by Sunday 12 midnight MT. Late posts may not be awarded points. Mastery Exercises: Students may access and retake mastery exercises through the last day of class until they achieve the scores they desire. Critical Thinking Activities: Assignments are due Sunday at 12 midnight MT. Week # Readings Required: Chapters 1 & 4 in Derivatives Markets Required: Chapters 2 & 3 in Derivatives Markets 1 2 Assignments Discussion (25 points) Critical Thinking (70 points) Discussion (25 points) Critical Thinking (70 points) Required: Chapters 5, 6, & 7 in Derivatives Markets Required: Chapters 8 & 9 in Derivatives Markets Required: Chapters 15 & 16 in Derivatives Markets Required: Chapters 10 & 12 in Derivatives Markets Required: Chapters 18, 19, & 20 in Derivatives Markets Required: Chapters 21 & 22 in Derivatives Markets 3 4 5 6 7 8 Discussion (25 points) Critical Thinking (60 points) Discussion (25 points) Critical Thinking (60 points) Discussion (25 points) Critical Thinking (70 points) Discussion (25 points) Critical Thinking (60 points) Discussion (25 points) Critical Thinking (60 points) Discussion (25 points) Portfolio (350 points) Assignment Details This course includes the following assignments/projects: Module 1 CRITICAL THINKING: Risk Management Strategies (70 points) Respond to the following questions: ABC Corp. mines copper, with fixed costs of $0.60/lb and variable cost of $0.30/lb. The 1-year forward price of copper is $1.10/lb. The 1-year effective annual interest rate is 6.2%. One-year option prices for copper are shown in the table below. Strike 0.9500 0.9750 1.0000 1.0250 1.0340 1.0500 Call $0.0649 0.0500 0.0376 0.0274 0.0243 0.0194 Put $0.0178 0.0265 0.0376 0.0509 0.0563 0.0665 In your answers, consider copper prices in 1 year of $0.70, $0.80, $0.90, $1.00, $1.10, and $1.20. a. b. c. d. If ABC Corp. does nothing to manage copper price risk, what is its profit one year from now, per pound of copper? If on the other hand ABC Corp. sells forward its expected copper production, what is its estimated profit one year from now? Construct a table for the two scenarios. Assume the 1-year copper forward price were $0.90 instead of $1.10. If ABC Corp. were to sell forward its expected copper production, what is its estimated profit one year from now? What if the forward copper price is $0.60? Should ABC Corp. produce copper? Construct tables for the scenarios. Using table, compute estimated profit in 1 year if ABC Corp. buys a put option with a strike of $1.00. Using table, compute estimated profit in 1 year if ABC Corp. sells a call option with a strike of $1.00. e. Using table, compute estimated profit in 1 year if Corp. buys collars with the following strikes: i. $0.95 for the put and $1.00 for the call ii. $0.975 for the put and $1.025 for the call iii. $1.05 for the put and $1.05 for the call Complete your responses in 2-4 pages using Microsoft Word or Excel. For calculations, you must show work to receive credit. Your well-written response should be formatted according to CSU-Global APA guidelines, with any sources properly cited. Upload your completed work to the Week 1 Assignments page. Module 2 CRITICAL THINKING: Forwards and Options (70 points) Respond to each of the following questions (notice that there are main questions and sub-questions below some of the main questions – don’t miss any!) 1. 2. 3. 4. 5. 6. 7. Suppose you enter into a long 6-month forward position at a forward price of $60. What is the payoff in 6 months for prices of $50, $55, $60, $65, and $70? Suppose that instead you buy a 6-month call option with a strike price of $60. What is the payoff in 6 months at the same prices for the underlying asset? Comparing the payoffs of parts (a) and (b), which contract should be more expensive (i.e., the long call or long forward)? Why is this so? Suppose you enter into a short 6-month forward position at a forward price of $60. What is the payoff in 6 months for prices of $50, $55, $60, $65, and $70? Suppose you buy a 6-month put option with a strike price of $60. What is the payoff in 6 months at the same prices for the underlying asset? Comparing the payoffs of parts (a) and (b), which contract should be more expensive (i.e., the long put or short forward)? Why is this so? Use the following premiums for S&P options with 6 months to expiration: Strike Call Put $950 $120.405 $51.777 1000 93.809 74.201 1020 84.470 84.470 1050 71.802 101.214 1107 51.873 137.167 Assume you buy a 1,000-strike S&P call, sell a 1050-strike S&P call, sell a 1,000-strike S&P put, and buy a 1050strike S&P put. a. Using a table, verify that there is no S&P price risk in this transaction. b. What is the initial cost of the position? c. What is the value of the position after 6 months? d. What is the implicit interest rate in these cash flows over 6 months? 8. Here is a quote from an investment website about an investment strategy using options: One strategy investors are applying to the XYZ options is using “synthetic stock.” A synthetic stock is created when an investor simultaneously purchases a call option and sells a put option on the same stock. The end result is that the synthetic stock has the same value, in terms of capital gain potential, as the underlying stock itself. Provided the premiums on the options are the same, they cancel each other out so the transaction fees are a wash. (as cited in McDonald, 2013, question 3.19) Suppose, to be concrete that the premium on the call you buy is the same as the premium on the put you sell, and both have the same strikes and times to expiration. a. b. c. d. e. What can you say about the strike price? What term best describes the position you have created? What is the shape of the profit diagram? Suppose the options have a bid-ask spread. If you are creating a synthetic purchased stock and the net premium is zero inclusive of the bid-ask spread, where will the strike price be relative to the forward price? If you create a synthetic short stock with zero premium inclusive of the bid-ask spread, where will the strike price be relative to the forward price? Do you consider the “transaction fees” to really be “a wash”? Why or why not? Complete your response in 2-4 pages using Microsoft Word or Excel. For calculations, you must show work to receive credit. Your well-written response should be formatted according to CSU-Global APA guidelines, with any sources properly cited. Upload your completed work to the Week 2 Assignments page. Module 3 CRITICAL THINKING: Forwards and Futures (60 Points) Respond to the following questions: 1. Suppose a company’s $50 stock pays an 8% continuous dividend and the continuously compounded risk-free rate is 6%. Calculate the following: a. the price of a prepaid forward contract that expires 1 year from now b. the price of a forward contract that expires 1 year from now (Hint: You will need a scientific calculator.) 2. Suppose the gold spot price is $1700/oz, the 1-year forward price is 1760.54, and the continuously compounded risk-free rate is 4%. Calculate the following: a. the lease rate b. the return on a cash-and-carry if gold cannot be loaned c. the return on a cash-and-carry if gold is loaned and it earns the lease rate (Hint: You will need a scientific calculator.) 3. Compute Macaulay and modified durations for the following bonds: a. a 5-year bond paying annual coupons of 3.322% and selling at par b. an 8-year bond paying semiannual coupons with a coupon rate of 9% and a yield of 8% c. a 10-year bond paying annual coupons of 5% with a price of $96 and a maturity value of $100 Hint: You can use the Excel functions Mduration and Duration to calculate the required durations. For c, you will need to use the Excel function to calculate yield before you can calculate Mduration and Duration). 4. A 5-year bond with a 4.45% coupon sells for $107.48. A 7-year bond with a 5.75% coupon sells for 116.564. The conversion factor for the 5-year bond is 0.933891 while the 7-year bond is 0.98588. Assume that the yields for both bonds are 6% and that coupon payments are semiannual. Which of the two bonds is cheaper to deliver given a T-note futures price of 117.92? Complete your response in 2-4 pages using Microsoft Word or Excel. For calculations, you must show work to receive credit. Your well-written response should be formatted according to CSU-Global APA guidelines, with any sources properly cited. Upload your completed work to the Week 3 Assignments page. Module 4 CRITICAL THINKING: Swaps and Options Pricing (60 points) Respond to the following questions. 1. Assume that oil forward prices for 1 year, 2 years, and 3 years are $18, $19, and $20. The 1-year effective annual interest rate is 6.5%, the 2-year interest rate is 7.0%, and the 3-year interest rate is 7.5%. a. What is the 3-year swap price? b. What is the price of a 2-year swap beginning in one year? (That is, the first swap settlement will be in 2 years and the second in 3 years.) 2. You are the financial manager of a company and you are presented with this scenario: The exchange rate is 0.95 $/€, the euro-denominated continuously compounded interest rate is 4%, the dollar-denominated continuously compounded interest rate is 6%, and the price of a 1-year 0.93-strike European call on the euro is $0.0571. Calculate the price of a 0.93-strike European put. 3. Given the call and put prices below Strike 55 60 65 Call premium 20 16 11.50 Put premium 9 12.75 16.45 a. b. c. What are convexity violations for the call and put premiums? What spread you would you use to effect arbitrage? Demonstrate that the spread position is an arbitrage. Complete your 2-4 page response using Microsoft Word or Excel. For calculations, you must show work to receive credit. Your well-written response should be formatted according to CSU-Global APA guidelines, with any sources properly cited. Upload your completed work to the Week 4 Assignments page. Module 5 CRITICAL THINKING: Structured Notes and Corporate Applications (70 points) Respond to the following questions. 1. Assume you work for an oil company that deals with oil contracts and you are responsible for constructing those oil contracts. Assume you have an oil contract that has the following characteristics: Zero initial cost and the buyer pays S – F each quarter with a cap of $21.90 − F and a floor of $19.90 − F. If oil volatility is 15%, calculate F. 2. Assume this scenario: A single 5-year zero-coupon debt issue with a maturity value of $120 and the expected return on assets of 12%. Calculate the following: a. the expected return on equity b. the volatility of equity 3. Assume this scenario: A single 5-year zero-coupon debt issue with a maturity value of $120 and the expected return on assets of 12%. Calculate the following: a. the expected return on debt b. the volatility of debt 4. Assume your firm has 20 shares of equity, a 10-year zero-coupon debt with a maturity value of $200 and warrants for 8 shares with a strike price of $25. Calculate the value of the debt, the share price, and the price of the warrant. 5. Patriot Corp. compensates executives with 10-year European call options which is granted at the money. If there is a significant drop in the share price, the company’s board will reset the strike price of the options to equal the new share price. Then, the maturity of the repriced option will equal the remaining maturity of the original option. Suppose σ = 30%, r = 6%, δ = 0, and the original share price is $100. Calculate the following: a. the value at grant of an option that will not be repriced b. the value at grant of an option that is repriced when the share price reaches $60. c. the repricing trigger that maximizes the initial value of the option. Complete your 2-4 page response using Microsoft Word or Excel. For calculations, you must show work to receive credit. Your well-written response should be formatted according to CSU-Global APA guidelines, with any sources properly cited. Upload your completed work to the Week 5 Assignments page. Module 6 CRITICAL THINKING: Option Pricing (60 points) Respond to the following questions. 1. Given the following, answer the questions that follow. S= $100, K = $95, r = 8% (and continuously compounded), σ = 30%, δ= 0, T = 1 year, and n= 3. a. b. c. Confirm that the binomial option price for an American call option is $18.283. (Hint: There is no early exercise. Therefore, a European call would have the same price.) Demonstrate that the binomial option price for a European put option is $5.979. Verify that put-call parity is satisfied. Confirm that the price of an American put is $6.678. 2. If S= $120, K = $100, σ = 30%, r = 0, and δ= 0.08, compute the following: a. The Black-Scholes call price for 1 year, 2 years, 5 years, 10 years, 50 years, 100 years, and 500 years to maturity. Explain your answer as time to expiration, T, approaches infinity. b. Change r from 0 to 0.001. Then repeat a. What happens as time to expiration, T, approaches infinity? Explain your answer and include what, if any, accounts for the change. 3. Consider this scenario: A bull spread where you buy a 40-strike call and sell a 45-strike call. In addition, σ = 0.30, r = 0.08, δ= 0, and T = 0.5. Calculate the following: a. Delta, gamma, vega, theta, and rho if S= $40. b. Delta, gamma, vega, theta, and rho if S= $45. c. Are any of your answers to (a) and (b) different? If so, state the reason. Complete your 2-4 page response using Microsoft Word or Excel. For calculations, you must show work to receive credit. Your well-written response should be formatted according to CSU-Global APA guidelines, with any sources properly cited. Upload your completed work to the Week 6 Assignments page. Module 7 CRITICAL THINKING: Lognormal Distribution and Monte Carlo Valuation (60 points) Respond to the following questions. 1. Suppose you observe the following month-end stock prices for stocks Y and Z: Day 0 1 2 3 4 Stock Y 100 105 102 97 100 Stock Z 100 105 150 97 100 Compute the following for each stock. a. The mean monthly continuously compounded return b. The annual return c. The mean monthly standard deviation d. The mean annual standard deviation 2. Use Monte Carlo to compute prices for claims that pay the following if S0= 100, r= 0.06, σS= 0.4 and δ= 0: a. S21 b. √S1 c. S1-2 3. Suppose S(0)= 100, r= 0.06, σS= 0.4 and δ= 0. Use the equation below to compute prices for claims that pay the following: 1 F0,1P S a S0a exp a 1 r a a 1 2 1 a. S2 b. √S c. S-2 Compare your answers in question 3 to the ones you obtained in question 2. Complete your 2-4 page response using Microsoft Word or Excel. For calculations, you must show work to receive credit. Your well-written response should be formatted according to CSU-Global APA guidelines, with any sources properly cited. Upload your completed work to the Week 7 Assignments page. Module 8 Portfolio Project: Derivative Instruments & Financial Engineering (350 points) Derivative instruments, that is, forwards, futures, swaps, and options, are risk management instruments. They play an integral part in managing risk for multinational corporations, portfolio managers, and institutional investors, as well as provide opportunities for speculators around the world. Select one of these instruments to research and discuss in detail. In your paper you will need to discuss types, importance, typical users, usage as a risk management tool, pricing, effects of regulations, as well as disclosure requirements of the instrument as required by the Securities Exchange Commission. In addition, using theories covered in the course, apply financial engineering to the selected derivative instrument and other securities. In other words, create new financial product(s) from your selected instrument and others as applicable. Your total project should be 8-10 pages long. Spend time to ensure that the formatting complies with CSU-Global APA guidelines, and thoroughly proofread and grammar-check your final product. Review the Portfolio Project grading rubric on the Course Information page for details. Ensure you have both a title and reference page which includes 6-8 resources. The CSU-Global Library is a great place to find these sources! Your references must be credible and be formatted according to CSU-Global APA guidelines. Upload your completed work to the Week 8 Assignments page. Preliminary Deliverable: You are required to submit a draft outline of your Portfolio Project to the instructor by the end of Week 4. Your outline should be a Word document in which you will list the major headings and sections of your paper. Course Policies Late Work Students are permitted a 7 day grace period during which they may submit a Critical Thinking assignment after the original due date without penalty. Papers submitted between 8 and 14 days after the original due date will be accepted with a potential 10 percent reduction in grade for late submission. Papers submitted 15 or more days beyond the original due date may not be accepted unless prior arrangements have been made with the instructor. No Portfolios will be accepted late and no assignments will be accepted after the last day of class unless a student has requested an incomplete grade in accordance with the Incomplete Policy. Course Grading 20% Discussion Participation 45% Critical Thinking Activities 35% Final Portfolio Project Grading Scale and Policies A 95.0 – 100 A- 90.0 – 94.9 B+ 86.7 – 89.9 B 83.3 – 86.6 B- 80.0 – 83.2 C+ 75.0 – 79.9 C 70.0 – 74.9 D 60.0 – 69.9 F 59.9 or below FN* Failure for Nonparticipation I** Incomplete * Students who stop attending class and fail the course for nonparticipation will be issued the “FN” grade. The FN grade may have implications for financial aid and scholarship awards. ** An “I” grade may be assigned at the Instructor’s discretion to students who are in good standing (passing) in the course. Students should have completed a majority of the coursework in order to be eligible for the “I” grade. Students should request an "I" grade from the Instructor with a written justification, which must include explanation of extenuating circumstances that prevented timely completion of the coursework. If the request is approved, the Instructor will require a written agreement consisting of a) the specific coursework to be completed, b) the plan to complete the coursework, and c) the deadline for completion. The agreement will be kept on file at CSU-Global Campus. An incomplete course must be satisfactorily completed within the time frame stipulated in the agreement, but no later than the end of the following semester from the date the “I” was given. An incomplete not removed within one year shall convert to an F and be included in the computation of the student’s grade point average. Plagiarism Plagiarism offenses are to be reported to the Office of Student Success, which will record offenses, instruct Faculty of needed interventions, and meet with students as appropriate. For more information on the penalties for plagiarism, please review the Student Handbook. APA Students are expected to follow the CSU-Global APA requirements when citing in APA (based on the APA Style Manual, 6th edition). For details on CSU-Global APA style, please review the APA resources located under the Library tab in Blackboard. Netiquette All posts and classroom communication must be conducted in a professional and respectful manner in accordance with the student code of conduct. Think before you push the Send button. Did you say just what you meant? How will the person on the other end read the words? Any derogatory or inappropriate comments regarding race, gender, age, religion, sexual orientation, are unacceptable and subject to disciplinary action. If you have concerns about something that has been said, please let your instructor know. Institutional Policies Refer to the Academic Catalog for comprehensive documentation of CSU-GC institutional policies.