Diversifying Alliances

advertisement

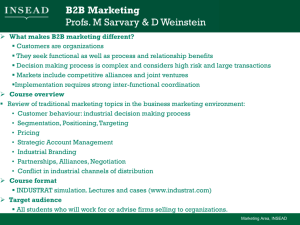

Chapter 9 Cooperative Strategy Who can we trust? 1 Cooperative Strategy Cooperative strategy is a strategy in which firms – work together – to achieve a shared objective Cooperating with other firms is a strategy that – creates value for a customer – exceeds the cost of constructing customer value in other ways – establishes a favorable position relative to competition 2 Strategic Alliance A strategic alliance is a cooperative strategy in which – firms combine some of their resources and capabilities – to create a competitive advantage A strategic alliance involves – exchange and sharing of resources and capabilities – co-development or distribution of goods or services 3 Strategic Alliance Firm A Resources Capabilities Core Competencies Firm B Resources Capabilities Core Competencies Combined Resources Capabilities Core Competencies Mutual interests in designing, manufacturing, or distributing goods or services 4 Types of Cooperative Strategies Joint venture: two or more firms create an independent company by combining parts of their assets Equity strategic alliance: partners who own different percentages of equity in a new venture Nonequity strategic alliances: contractual agreements given to a company to supply, produce, or distribute a firm’s goods or services without equity sharing 5 Joint Venture Firm A Firm B Resources Capabilities Core Competencies Resources Capabilities Core Competencies Combined Resources Capabilities Core Competencies Firm C 6 Business-Level Cooperative Strategies: Complementary Strategic Alliances Complementary Alliances • complementary strategic alliances are designed to take advantage of market opportunities by combining partner firms’ assets in complementary ways to create new value – these include distribution, supplier or outsourcing alliances where firms rely on upstream or downstream partners to build competitive advantage 7 Business-Level Cooperative Strategies: Competition Response Alliances Complementary Alliances Competition Response Alliances • competition response strategic alliances occur when firms join forces to respond to a strategic action of another competitor • because they can be difficult to reverse and expensive to operate, competition response strategic alliances are primarily formed to respond to strategic rather than tactical actions 8 Business-Level Cooperative Strategies: Uncertainty Reducing Alliances Complementary Alliances Competition Response Alliances Uncertainty Reducing Alliances • uncertainty reducing strategic alliances are used to hedge against risk and uncertainty • these alliances are most noticed in fast-cycle markets • alliance may be formed to reduce the uncertainty associated with developing new product or technology standards 9 Business-Level Cooperative Strategies: Competition Reducing Alliances Complementary Alliances Competition Response Alliances Uncertainty Reducing Alliances Competition Reducing Alliances • competition reducing strategic alliances may be created to avoid destructive or excessive competition • explicit collusion exists when firms directly negotiate production output and pricing agreements in order to reduce competition (illegal) • tacit collusion exists when several firms in an industry indirectly coordinate their production and pricing decisions by observing each other’s competitive actions and 10 responses Business-Level Cooperative Strategies: Competition Reducing Alliances Complementary Alliances Competition Response Alliances Uncertainty Reducing Alliances Competition Reducing Alliances • mutual forbearance is a form of tacit collusion in which firms avoid competitive attacks against those rivals they meet in multiple markets • competition reducing strategic alliances may require governments to find ways to permit collaboration among rivals without violating antitrust laws 11 Corporate-Level Cooperative Strategies Corporate-level cooperative strategies are designed to facilitate product and/or market diversification - diversifying strategic alliance - synergistic strategic alliance - franchising Diversifying alliances and synergistic alliances allow firms - to grow and diversify their operations - through a means other than a merger or acquisition 12 Corporate-Level Cooperative Strategies: Diversifying Alliances Diversifying Alliances • diversifying strategic alliance allows a firm to expand into new product or market areas without completing a merger or an acquisition • provides some of the potential synergistic benefits of a merger or acquisition, but with less risk and greater levels of flexibility • permits a “test” of whether a future merger between the partners would benefit both 13 parties Corporate-Level Cooperative Strategies: Synergistic Alliances Diversifying Alliances Synergistic Alliances • synergistic strategic alliances create joint economies of scope between two or more firms • create synergy across multiple functions or multiple businesses between partner firms 14 Corporate-Level Cooperative Strategies: Franchising Diversifying Alliances Synergistic Alliances Franchising • franchising spreads risks and uses resources, capabilities, and competencies without merging or acquiring another company • contractual relationship concerning the franchise that is developed between two parties, the franchisee and the franchisor • an alternative to pursuing growth through mergers and acquisitions 15 International Cooperative Strategies Cross-border strategic alliance – an international cooperative strategy in which firms with headquarters in different nations combine some of their resources and capabilities to create a competitive advantage – a firm may form cross-border strategic alliances to leverage core competencies that are the foundation of its domestic success to expand into international markets 16 International Cooperative Strategies Allows risk sharing by reducing financial investment Host partner knows local market and customs International alliances can be difficult to manage due to differences in management styles, cultures or regulatory constraints Must gauge partner’s strategic intent so they do not gain access to important technology and become a competitor 17 Competitive Risks with Cooperative Strategies • Partner may act opportunistically • Misrepresentation of competencies brought to the partnership • Partner fails to make committed resources and capabilities available to its partners • Firm may make investments that are specific to the alliance while its partner does not 18