File - Accounting 1120

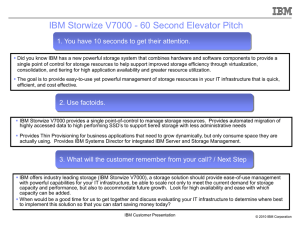

advertisement

Adam Kingston 4/25/14 Accounting 1120 Financial Statement Analysis Introduction: In a final step to conclude my Financial Statement Analysis for IBM’s 2014 consolidated financial statements; I will go through each ratio that I have calculated and figured for the years 2013 and 2014, and write in words a summary of what I know to be true as far as correctness of my calculations, Profitability, Risk, efficiency and stockholder/ investor relations. I will also compare some of each category (listed in the previous sentence) to the current industry averages. After completion of this analysis paper, we will see how well and efficient IBM has performed with in the analyzed years. Profitability: Gross Profit %: The Gross profit percentage is a ratio calculated by dividing Gross profit by net sales. This ratio is sometimes called the Gross Margin Ratio. For the year 2014 we calculated that IBM’s Gross Profit percentage was 73%, and for the year 2013 it was 72%. According to the industry averages IBM is down by approximately 7%. This shows that IBM has increased its profitability from the years 2013 and 2014. Rate of return on total assets: To calculate rate of return on total assets, you take net income and add it to interest expense and divide that number by average total assets. This Ratio shows the company’s ability and success in generating cash from average total assets. In the year 2014 IBM had a rate of return on assets of 10.6%. They had an approximately 3% decrease from the previous year. 2013 was at a 13.4% return on assets. Adam Kingston 4/25/14 Accounting 1120 Financial Statement Analysis In the year 2014 IBM became less profitable in using their assets. According to industry averages which sits at 1.6%, they are still relatively high in their ability to generate profit from assets. Profit Margin Ratio: When calculating the profit margin ratio, you take net income divided by net sales. This ratio shows how much net income per dollar of net sales is earned in a business. For the year 2014 IBM had a profit margin of 26 %. In the year 2013 they were at a 34 % profit margin. This indicates that their profit margin has fallen by approximately 8 %, which also indicates that they have become less profitable in the past year. According to industry averages they are much more profitable than most companies in their industry. Rate of return on common stockholders’ Equity: This is ratio is calculated by taking net income and subtracting it by preferred dividends, and then taking that total and dividing it by the average common stockholder’s equity. By calculating this ratio it will give you “the relationship between net income available to common stockholders and their average common equity invested in the company.” (Pg. 1037. Horngern’s Accounting book). By calculating IBM’s rate of return on common stockholder’s equity for the years 2014 and 2013, we come up with 22 % and 32 % percent respectively. From the years 2013 and 2014 IBM’s ability to generate profit from their equity has decreased by approximately 10 %. Earnings per Share: To calculate earnings per share you minus net income from preferred dividends and divide the total by weighted average number of common shares outstanding. This ratio calculates a company’s net Adam Kingston 4/25/14 Accounting 1120 Financial Statement Analysis income per share of outstanding stock. For 2014 IBM’s earnings per share was at nine dollars and ninety eight cents. For the year 2013 the company’s earnings per share was at thirteen dollars and eighty six cents. This indicates that they have become less profitable throughout the past year. Industry averages show that IBM has a higher earnings per share than the average company in its industry. This means that they are still more profitable than the average company but they are become less profitable. Risk: Current Ratio: To calculate the current ratio we take total current assets and divide them by total current liabilities. This calculates the businesses ability to pay current liabilities with their current assets. In 2014 IBM had a current ratio which states that for every one dollar of current liabilities they had one dollar and twenty five cents of current assets. In 2013 IBM’s current ratio stated that for every one dollar of current liabilities they had one dollar and twenty eight cents of current assets. According to industry averages which states that for every one dollar of current liabilities there is one dollar and eighty six cents of current assets, IBM is more risky than the average company in its industry, and has also become more risky than itself throughout the past year. Acid- Test Ratio: To calculate the acid test ratio, we use cash plus short term investments plus current receivables; divide the total by total current liabilities. This is the company’s ability to pay all current liabilities if they were to come due immediately. For the year 2014 IBM’s acid test ratio was twenty one cents of quick assets for every dollar of current liabilities. For the year 2013 there were twenty seven Adam Kingston 4/25/14 Accounting 1120 Financial Statement Analysis cents of quick assets for every dollar of current liabilities. Compared to Industry averages this is extremely low, which makes the business more risky. The business has also become more risky throughout the two years provided. Free cash flow: IBM had a free cash flow of nine billion six hundred and two million dollars of free cash flow in the year 2014. This was a big increase from the previous year which was approximately six billion dollars of free cash flow. IBM became more liquid in there free cash flow from 2013 to the year 2014. Debt to equity ratio: In the year 2014 IBM had a debt to equity ratio of approximately nine dollars to every two dollars of equity. In 2013 it was four dollars of debt to every one dollar of equity. IBM has become more risky in the year 2014. Debt Ratio: The debt ratio is calculated by taking total liabilities and dividing them by total assets. This ratio gives you the proportion of assets financed with debt in a company. In the year 2013 IBM had a debt ratio of eighty two percent, and in 2014 they moved up to ninety percent. This means that they became more debt financed. One would see this as a more risky company to invest in, and they became more risky throughout the two years. The industry average company had a debt ratio of fifty nine percent. IBM is more risky than the average industry company and is becoming more risky itself. Adam Kingston 4/25/14 Accounting 1120 Financial Statement Analysis Efficiency: Inventory turnover ratio: Inventory turnover is a ratio that measures how efficiently a company can sell the inventory they have in stock, also known as merchandise inventory. Inventory turnover is calculated by taking the cost of goods sold and dividing it by the average merchandise inventory. For the year 2014 IBM’s inventory turnover was twenty one times, and the previous year was twenty three times. This shows that IBM became less efficient in its ability to turnover and sell its inventory. For the average company in the industry, their inventory turnover is seventeen and a half times. This shows that IBM is still on average more efficient than the average company but is still has become less efficient in the last year. Days Sales in inventory: The day’s sales in inventory ratio is an efficiency ratio that calculates how many days a company’s merchandise will be in its inventory. This ratio is calculated by dividing three hundred and sixty five days by the inventory turnover ratio. The industry average is approximately twenty one days. For the year two thousand and fourteen IBM had a day’s sales in inventory of approximately seventeen days, and the previous year it was at approximately sixteen days. This shows that IBM is more efficient than the average company in the industry, but is becoming less efficient. Accounts receivable turnover ratio: This Ratio calculates the amount of times a company collects its average receivables balance throughout the year. It is calculated by taking net credit sales and dividing that by the average net accounts receivables. In the year 2014 IBM had an AR turnover ratio of approximately three times. The Adam Kingston 4/25/14 Accounting 1120 Financial Statement Analysis previous year it had a ratio of just over three times. According to industry averages which stand at approximately 6 times, IBM is less efficient than the average company in collecting its receivables. IBM has also become less efficient in collecting receivables from the past year. Day’s sales in receivables: IBM had day’s sales in receivables of one hundred and two days for the year 2014 and had ninety two days for the year 2013. The average company in the industry had an average of sixty two days. This ratio is calculated by dividing three hundred and sixty five days by the accounts receivable turnover ratio. This ratio calculates and tells how long a company’s accounts receivables go uncollected. IBM is less efficient in this ratio than the average company in its industry. IBM has also become less efficient in its collections of accounts receivables. Cash flow per share: This ratio is calculated by taking all operating cash flow from the statement of cash flows operating section and dividing it by the total number of shares outstanding. This ratio gives you an idea of how much cash you will receive per common share that is issued. In the year 2014 IBM had a cash flow per share of seven dollars and sixty on cents. In the previous year it was at seven dollars and ninety cents. This shows that IBM has become less profitable in there common stock per share earnings. This would be something that would turn investors away from a company. But the Industry average is at two dollars and sixty six cents, this is something that would ensure the best return to investors in this industry. Overall IBM has become less able to generate cash flow per share but is still higher than the industry average. Adam Kingston 4/25/14 Accounting 1120 Financial Statement Analysis Basic Earnings per share: In 2014 IBM had a basic EPS of eleven dollars and sixty cents. The previous year they had sixteen dollars and eleven cents. Throughout those two years IBM became less profitable in their Basic EPS. This would make them less desirable to invest in. But in comparison to the industry averages it is much higher. Industry average is two dollars and sixty six cents. Basic earnings per share is a ratio to indicate how profitable a company is with its common shares. Conclusion: In all calculations and speculations of IBM’s consolidated financial statements for the years 2013 and 2013, and as far as correctness of calculations it appears that IBM has become more risky, less profitable, and less efficient from the years 2013 to 2014. According to Industry averages they are still overall a better option of investment than most company’s in the industry.