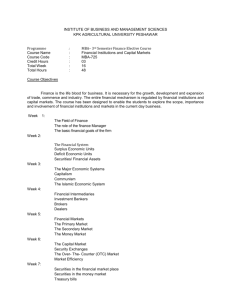

Securities and Investments

advertisement

Securities and Investments Gateway to Business Fall 2007 Topics • Securities • Common Stock, Bonds, Mutual Funds • Securities Markets • Primary, Secondary • Investment Banking • Mutual Funds • Risk and Return What is a Security? • An instrument for personal protection • Legal claim on corporate assets and profits Corporate Securities • Issued (sold) by corporations to investors • Represent legal claims against the corporation’s assets and profits • Most common examples: • Common Stocks • Bonds Corporate Securities Assets Corporate Assets are financed by Debt and Equity Corporate Bonds Debt (Borrowed Money) Common Stock Equity (Owners’ Money) Common Stocks and Corp Bonds • Corporate Bonds are Debt Securities • money borrowed by the corporation • money invested by lenders to the corporation • provide fixed income to bondholders • Common Stocks are Equity Securities • money invested by owners of the corporation • provide variable (residual) income to stockholders Common Stocks and Corp Bonds • Corporations pay Interest to Bondholders • Failure to pay interest results in default • Corporations pay Dividends to Stockholders • Firms have no obligation to pay dividends • When would they pay dividends? • When wouldn’t they pay dividends? How do Corps Issue (Sell) Stock? • Initial Public Offering (IPO) • Initial sale of a corporation’s stock to the “public” • Known as “Going Public” • Google IPO August 19, 2004 • Issued 22.5 million shares of stock at $85 per share • GOOG raised $1.9 Billion from Equity Investors in the Primary Market. GOOG Stock Price in the Secondary Market Price-Earnings (P/E) Ratio • P/E ratio is Stock Price divided by EPS • It is what investors are willing to pay for $1 of current Earnings • i.e., it is the Market Value of $1 of current earnings • How does Google’s stock price and P/E ratio compare to a more mature company like Proctor and Gamble? Google valuation data Proctor and Gamble valuation data Wal-Mart or Dicks Sporting Goods? Wal-Mart (WMT) vs. Dick’s (DKS) November 9, 2007 Stock Price Shares Out (million) Market Cap ($billion) WMT DKS $42.90 $27.50 4,068 110 174.5 3.1 Sales ($billion) Assets ($billion) Net Income ($million) EPS P/E Ratio 348.6 151.2 11,280 $2.99 14.5x 3.1 1.5 112 $1.28 22x WMT or DKS? Growth Jan-07 Jan-06 Jan-05 Jan-04 Revenue 10.5 9.6 11.3 4.9 Net income 0.5 9.4 13.4 12.6 EPS 1.1 11.2 16.4 14.4 Avg 9.1% 9.0% 10.8% Growth Feb-07 Jan-06 Jan-05 Jan-04 Revenue 18.6 24.4 43.4 15.6 Net income 54.3 5.9 30.5 38.0 EPS 50.4 3.8 23.8 12.2 Avg 25.5% 32.2% 22.6% Wal-Mart & Dick’s Since January, 2003 A recent check-in on Dick’s vs. Wal-Mart October 2008 – October 2010 Wal-Mart & Dick’s Each had their growth phase Mutual Fund • An investment company (corporation) that invests in common stocks and bonds issued by other corporations • Allows diversification for individual investors • Professional investment management • A mutual fund can make money from its securities in two ways: a security can pay dividends or interest to the fund, or a security can rise in value. A fund can also lose money and drop in value. Risk and Return Return Small company Common Stocks Large company Common Stocks Corporate Bonds Long-term US Treasury securities Short-term US Treasury securities Risk Terms • Market capitalization (market cap) • Price-earnings ratio • Common stock—ownership, residual income, dividends • Corporate bond--debt security, fixed income, interest • Investment bank • IPO, going public • Primary and secondary markets • Mutual Fund Web References • • • • • • Wall Street Journal (www.wsj.com) New York Stock Exchange (www.nyse.com) NASDAQ Market (www.nasdaq.com) Investment Company Institute (www.ici.org) The Motley Fool (www.fool.com) Investor Words (www.investorwords.com)