Ensuring Accuracy in your filed Quarterly Report

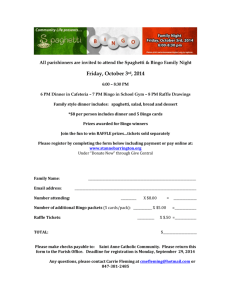

advertisement

Ensuring Accuracy in your filed Quarterly Report WHO should review this training? • Whomever completes and files your quarterly report • The Bingo Chairperson, officer or director that reviews and approves bingo paperwork • Whomever has to answer the phone call or the letter from the Charitable Bingo Operations Division informing you of a possible filing error • All of the above A new automated computer program reviews all quarterly reports…. • Helps detect, identify and flag likely errors early on • Tracks data information from one quarter to the next • Allows Bingo Division to quickly contact organization • Uniform approach and standards • Generates a letter to licensee outlining “irregularities” found. November 19, 2010 John D. Taxpayer LICENSED BINGO ORGANIZATION INC 804 W Pilgrim Ave La Porte, TX 76644-9834 Re: Taxpayer Number: 15432345670 Dear Mr. Taxpayer: Our office is in receipt of your Texas Bingo Quarterly Report for the Third Quarter of 2010. After reviewing the information reported, please be advised that the following irregularities were found: •The previous quarter's bingo funds balance reported on line 33 does not match the bingo funds balance reported on line 42 of the previous quarters report. Please note that any changes to line 42 will affect ALL subsequent reports filed with the Commission. If your organization has filed subsequent reports, these must also be amended. Please contact our office for a copy of these reports, if needed. Enclosed is a copy of the report you filed with our office. Please make the necessary corrections to the left of the line item, if applicable, and write "Amended" at the top of the report. A copy of the amended report should be maintained for your records. If an error in reporting was not made by your organization, please contact our office to resolve the issue. Please submit corrected Texas Bingo Quarterly Report or contact our office by December 3, 2010. Reports should be mailed to the Texas Lottery Commission, Charitable Bingo Operations Division, P.O. Box 16630, Austin, Texas 78761-6630 or faxed to (512) 344-5316. Should you have any questions, please do not hesitate to contact the Accounting Services Section at 1-800-246-4677. Thank you for your attention to this matter. Sincerely, Accounting Services Section Charitable Bingo Operations Division Texas Lottery Commission Sample EXCEPTION LETTER QR Common Mistakes: Conductors & Units • Number of occasions reported on QR exceed number of licensed occasions for the quarter. Make sure all occasions are reported because showing the wrong number of occasions could make it look like your organization gave away more then $2500 per occasion in regular prizes. • Current QR Line 28 Prize Fees –Paid must equal Previous QR Line 6a Total Prize Fees, Penalty and Interest Due. NOTE: If you pay the prize fee in the same quarter that the prize fee is due then Line 28 Prize Fees –Paid will be 0. • Current QR Line 33 Previous quarter bingo funds balance must match exactly with Line 42 Previous quarterly report bingo funds at end of quarter – bank balance. •Transfer of funds reported on line 31…..make sure the Commission was notified of the fund transfer as required by Section 2001.451(c)(2). •Current QR Line 35 Bingo Funds at end of quarter-Per Bank Balance must match exactly with Line 42 Bingo Funds at end of quarter-Per Bank Balance Continued on next slide…… QR Common Mistakes: Conductors & Units • Electronic bingo sales reported or zero on Line 4, make sure you also report Electronic Cost of Goods Purchased (Line 16) as applicable. • Pull-tab bingo event sales reported or zero on Line 6, make sure you also report Event Cost of Goods Purchased (Line 17) as applicable. •Pull-tab bingo-Instant sales reported or zero on Line 7, make sure you also report Instant Cost of Goods Purchased (Line 17) as applicable. • Current QR Line 33 Previous quarter bingo funds balance must equal Past QR Line 42 Bingo Funds at end of quarter-Per Bank Balances •Regular Bingo Prizes awarded for the quarter exceed $2,500 per occasion. Remember, if you are reporting information that you know that most likely you will receive an exception letter, enclose a note with your quarterly report explaining the item and special circumstances. REMINDER ! All reporting is done on a CASH BASIS------you report the income or expense when it is actually earned or paid! QR Common Mistakes: Conductors & Units QR Common Mistakes: UNITS • Schedule B (Charitable Distributions-Accounting Units) not submitted with Quarterly Report as required by Rule • Total Number of Occasions listed on Schedule B does not match line 1 of Unit QR •Total Charitable Distribution Amounts Disbursed to Unit Members (Schedule B) does not match Line 30 of filed Quarterly report. •Transfer of Funds amount (Schedule B)-received or reimbursed does not match Line 31 of the filed Quarterly Report. • Unit Member Contributions (Schedule B)- received or reimbursed do not match QR Line 32 Unit member contributions (bingo funds)-received or reimbursed. • Schedule B lists unit member not found in Bingo Division’s licensing records. Make sure the Commission was properly and timely notified as required by Rule 402.205(p). •Unit member “Contributions” to Unit must be within 60 days of unit member joining unit; otherwise, show as Transfer of Funds” (Per 402.203(i)(1) QR Common Mistakes: LESSORS • Rent collected exceed an average of $600 per occasion. • Lessor QR (Line 6) Property taxes, utility expenses and insurance premiums Collected from organizations does not match amount reported by organizations or unit (line 14). If you ever have a question about filling out your quarterly report and just want to make sure you are reporting your information correctly, do not hesitate to contact the Charitable Bingo Operations Division at 1-800-246-4677 (listen for Charitable Bingo) or by e-mail: bingo.services@lottery.state.tx.us. We are here to assist you.