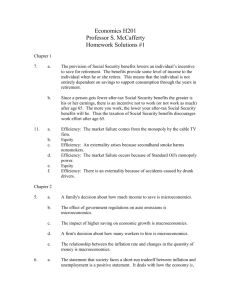

AP Macroeconomics unit 5 homework

advertisement

AP Macroeconomics Ms. Conn Name: ______________________________ Date: ___________ Period: ____________ Unit V--The monetary system Chapter 16 Homework Part 1—due in class on Tuesday, December 16 1. Read Chapter 16 (p. 323-345) and answer the following questions. a. List and describe the three functions of money. b. What are the primary responsibilities of the Federal Reserve? If the Fed wants to increase the supply of money, how does it usually do so? c. Describe how banks create money. If the Fed wanted to use all three of its policy tools to decrease the money supply, what would it do? AP Macroeconomics Ms. Conn Name: ______________________________ Date: ___________ Period: ____________ Part 2—due in class on Wednesday, December 17 1. Answer the Problems and Applications for Chapter 16 (p. 345-346) Part 3—due in class on Thursday, December 18 1. Complete Flashcards for Key Concepts for Chapter 16 (p. 345) 2. Complete True/False Questions from Self-Test study guide handout. 3. Complete Multiple-choice Questions from Self-Test study guide handout. Part 4—due in class on Friday, December 19 1. Watch any 3 Khan Academy videos: Overview of Fractional Reserve Banking, Money Supply: M0, M1, and M2, Money supply and demand impacting interest rates, Monetary and fiscal policy, Banking 4: Multiplier Effect and the money supply, Banking 8: reserve ratios, Banking 13: Open Market Operations, Banking 14: Fed funds rate 2. Study for Friday’s quiz. AP Macroeconomics Ms. Conn Name: ______________________________ Date: ___________ Period: ____________ Homework: Chapter 13 Saving, Investment, and the Financial System Part 1—due in class on Monday, January 5 Read Chapter 13. Answer the following questions completely as you read. 1. How do bonds provide profit for people who want to save money? 2. What are the three characteristics that differ between bonds? How does each characteristic affect the bond’s interest rate? 3. How does the sale of stock help both the company and the purchaser of the stock? 4. What are the two roles that banks play in the economy? 5. How do mutual funds provide advantages to investors that individual stocks do not? 6. Mathematically, why must saving equal investment? AP Macroeconomics Ms. Conn Name: ______________________________ Date: ___________ Period: ____________ 7. What is the difference between private and public saving? 8. In macroeconomics, how are saving and investment different? 9. How do saving and investment relate to the market for loanable funds? 10. Why can the interest rate be considered the price for loanable funds? 11. What is an example of a saving incentive? How would it impact the loanable funds market? AP Macroeconomics Ms. Conn Name: ______________________________ Date: ___________ Period: ____________ 12. What is an example of an investment incentive? How would it impact the loanable funds market? 13. What is a budget deficit? How does it impact the loanable funds market? Part 2—due in class on Tuesday, January 6 1. Answer the Problems and Applications for Chapter 13 (p. 278-279) Part 3—due in class on Wednesday, January 7 1. Complete Flashcards for Key Concepts for Chapter 13 (p. 277) 2. Watch any 3 Khan Academy videos: Introduction to Bonds, Relationship between bond prices and interest rates, What it means to buy a company’s stock, Bonds vs. stocks Part 4—due in class on Thursday, January 8 1. Complete True/False Questions from Self-Test study guide handout. 2. Complete Multiple-choice Questions from Self-Test study guide handout. Part 5—study for quiz in class on Friday, January 9 AP Macroeconomics Ms. Conn Name: ______________________________ Date: ___________ Period: ____________ Homework Chapter 17 Money Growth and Inflation Part 1—due in class on Monday, January 12 Read Chapter 17. Answer the following questions completely as you read. 1. Explain how an increase in the price level affects the real value of money. 2. According to the quantity theory of money, what is the effect of an increase in the quantity of money? 3. Explain the difference between nominal and real variables and give two examples of each. According to the principle of monetary neutrality, which variables are affected by changes in the quantity of money? 4. In what sense is inflation like a tax? How does thinking about inflation as a tax help explain hyperinflation? AP Macroeconomics Ms. Conn Name: ______________________________ Date: ___________ Period: ____________ 5. According to the Fisher effect, how does an increase in the inflation rate affect the real interest rate and the nominal interest rate? 6. What are the costs of inflation? Which of these costs do you think are most important for the U.S. economy? 7. If inflation is less than expected, who benefits—debtors or creditors? Explain. 8. What is the velocity of money formula? 9. What is the quantity equation? AP Macroeconomics Ms. Conn Name: ______________________________ Date: ___________ Period: ____________ Part 2—due in class on Tuesday, January 13 1. Answer the Problems and Applications for Chapter 17 (p. 370-371)) Part 3—due in class on Wednesday, January 14 1. Complete Flashcards for Key Concepts for Chapter 17 (p. 370) 2. Watch 3 Khan Academy videos: Moderate inflation in a good economy, Velocity of money rather than quantity driving prices, Relation between nominal and real returns and inflation Part 4—due in class on Thursday, January 15 1. Complete True/False Questions from Self-Test study guide handout. 2. Complete Multiple-choice Questions from Self-Test study guide handout. Part 5—study for diagnostic exam on all AP Macroeconomics tomorrow