in this course. - the College of Business!

advertisement

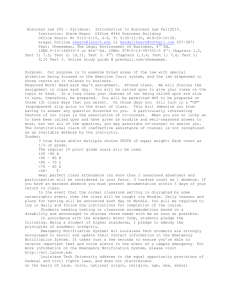

SYLLABUS FOR ACCOUNTING 307: INDIVIDUAL INCOME TAX Tuesday and Thursday 2:00-3:50 College of Business Building 111 Winter Quarter 2014-2015 Professor: William Brian Dowis Office Location: College of Business 305 Address: School of Accountancy College of Administration & Building Louisiana Tech University Ruston, LA 71272 E-mail Address: wbdowis@latech.edu Office Hours: Tuesday – 9:00-10:00 a.m., 1:00-2:00 p.m, 4:00-5:00 p.m. Wednesday – 9:00-11:00 a.m., 1:00-3:00 p.m. Thursday – 9:00-10:00 a.m., 1:00-2:00 p.m., 4:00-5:00 p.m. Required Textbook: CCH Federal Taxation-Comprehensive topics 2015 edition COURSE PREQ: Accounting 201 and all students majoring in accounting must earn at least a “C” in this course. COURSE OBECTIVES: This course is designed to foster the accounting major’s introduction to the federal tax law. It will primarily cover topics applicable to the taxation of individuals. This course will not make you a tax expert; however, these basic concepts will provide a foundation for further study or tax practice. Finally, as a side benefit of the course, the material covered will help you prepare for some of the tax questions found on the CPA examination. COURSE PROCEDURE: The attached tentative course schedule shows the material to be covered in each class meeting. You will be expected to prepare for class by reading the textbook as indicated and working the problems before coming to class. Classes will be a combination of lectures and problem solving sessions. Student participation will be emphasized. TAX RETURN PREPARATION: Students will be required to complete several tax return projects. Information on these projects will be announced during the quarter. TAX RESEARCH: You will be required to perform tax research utilizing RIA, CCH, and Lexis Online Systems and the internet. Problems will be assigned and projects will require detailed tax analysis. EXAMS: Exams can consist of problems, true-false questions, essay questions, and multiple choice questions. COURSE GRADING: Grades ACCT 307 are computed on the following basis: Three tests including the final exam 84 points Class participation (5 pts), Research Project (5 pts), and Tax Return (6 pts) 16 points TOTAL 100 points Grades are assigned according to the following ranges: A is 90-100 points B is 80-89 points C is 70-79 points D is 60-69 points F is below 60 points POLICY ON MISSING EXAMS: A score of zero will be assigned to anyone absent from a scheduled exam unless prior approval has been granted by the instructor. In those rare instances where prior approval is granted, a makeup exam will be required and scheduled at the Professor’s discretion. Assignments will be made by the Professor for each class meeting. In addition, reading lists will be handed out periodically for required topics. See tentative Schedule of Assignments for the primary class agenda. Also, the honor code of the University will be strictly adhered to in this course. CAMPUS EMERGENCY: All Louisiana Tech University students are strongly encouraged to enroll and update their contact information in the Emergency Notification System (ENS) to ensure you are able to receive important text and voice alerts in the event of a campus emergency (http://www.latech.edu/administration/ens.shtml). In case of a campus emergency, you must login to http://www.latech.edu within 24 hours of the emergency for campus updates. In case of a campus closure, you must sign on to Moodle within 36 hours to contact the instructor regarding course materials and assignments. It is anticipated that in this situation, an additional research paper or an expanded paper assignment will be used to take the place of missed faculty presentations, depending on the number of presentations missed. WRITTEN COMMUNICATIONS: At least 10% of your grade will be determined from written communication. This may be in the form of essay questions on exams, research projects, and/or homework assignments. SPECIAL ACCOMMODATIONS: Qualified students needing testing or classroom accommodations based on a disability are encouraged to make their requests to me at the beginning of the quarter either during office hours or by appointment. Note: Prior to receiving disability accommodations, verification of eligibility from the Testing and Disability Services Office is needed. Disability information is confidential. Information for Testing and Disability Services may be obtained in Wyly Tower 318 or www.latech.edu/ods. STATEMENT OF ETHICS AND SCHOLASTIC DISHONESTY: The accounting profession has a longestablished reputation for its high level of ethical conduct. This reputation reaches into the academic arena where the profession’s future leaders are being prepared. Academic dishonesty will not be tolerated in accounting courses. Academic dishonesty includes, but is not limited to copying, sharing or obtaining information from any unauthorized source during examinations or quizzes. It also includes copying from or unauthorized sharing of homework assignments, attempting to take credit for the intellectual creation of another person, or falsifying information. Any student involved in academic dishonesty will be penalized in accordance with published University rules. ACADEMIC HONOR CODE (http://www.latech.edu/documents/honor-code.pdf). An appropriate syllabus statement is “In accordance with the Academic Honor Code, students pledge the following: Being a student of higher standards, I pledge to embody the principles of academic integrity.” MOODLE: The syllabus and other class information will be available on Moodle CHANGES TO SYLLABUS: The instructor reserves the right to make changes as necessary to this syllabus. If changes are necessitated during the term of the course, the instructor will immediately notify you of such changes. Attendance is required at all class meeting dates. Only medical or extraordinary circumstances will be accepted in lieu of a zero for the missed class meeting. The class attendance policy as stated in the 2010-2011 Louisiana Tech University Bulletin will be followed. Computerized tax research will be incorporated into the course. In this endeavor, each student will be required to complete several research projects using RIA Online System, CCH Network Research Site, and Lexis Research Site. CELL PHONES: Please turn your cell phone off or put in a silent mode during class. Cell phones may not be used as a calculator for quizzes or exams. ALL PHONES MUST REMAIN IN YOUR BOOK BAG, POCKET OR PURSE AT ALL TIMES. On test days, everything except pencils, calculators and the test must be placed in front of the room on the day of the test, e.g., book bags, phones, hats, etc. TENTATIVE SCHEDULE DATE 12/4, 12/9, & 12/11 TOPICS Introduction to Tax Research 12/16, 12/18 1/6 1/8, 1/13, & 1/15 1/20, 1/22, & 1/27 1/29 & 2/3 2/5 2/10 & 2/12 2/19 2/24 2/26 3/3 Individual Taxation Test 1 Gross Income Gross Income Exclusions Deductions Test 2 Business Deductions Itemized Deductions Tax Credits, Prepayments, & Alt. Min. Tax Property Transactions Test 3 & Research Projects/Tax Returns ASSIGNMENT Chapters 1 & 2 Problems To Be Assignment Chapter 3 & Problems Chapter 4 & Problems Chapter 5 & Problems Chapter 6 & Problems Chapter 7 & Problems Chapter 8 & Problems Chapter 9 & Problems Chapter 10 & Problems