Lucky Charms Media Plan

advertisement

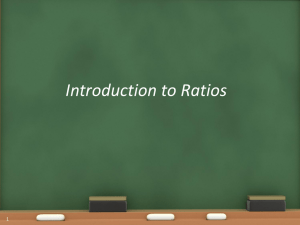

ADV 3351 Lucky Charms Media Plan Mochelle Johnson Lauren Rachel Dr. Olan Farnall Spring 2013 Table of Contents Executive Summary ...................................................................................................................................... 2 Situational Analysis ...................................................................................................................................... 3 History ....................................................................................................................................................... 3 Product ...................................................................................................................................................... 4 Advertising ................................................................................................................................................ 5 Consumer .................................................................................................................................................. 6 Competition .............................................................................................................................................. 7 Industry ..................................................................................................................................................... 8 Strengths and Weaknesses ....................................................................................................................... 9 Marketing and Communication Objective ................................................................................................ 10 Media Objective ......................................................................................................................................... 11 Strategies .................................................................................................................................................... 12 Tactics ......................................................................................................................................................... 13 Creative Media Opportunities ................................................................................................................... 14 Budget Summary ........................................................................................................................................ 15 Appendix..................................................................................................................................................... 16 1 Executive Summary Lucky Charms breakfast cereal was created in 1964 by John Holahan. Currently, Lucky Charms is produced by General Mills food company. The cereal has two main components: toasted oats and multicolored marshmallows. Lucky Charms is made with whole grain and fortified with 12 vitamins and minerals. The cereal is low in saturated fat and has no cholestoral. The brand’s mascot is a leprechaun who goes by the name of Lucky. Lucky’s slogan is, “They’re magically delicious!” Lucky Charms currently targets their marketing and advertising efforts towards children. This media plan will provide strong objectives and strategies that will contribute to higher sales revenue, new consumers and the continued loyalty of current consumers during fiscal 2014. Lucky Charms will shift their target audience from children to adults who recognize the brand from their childhood. The percentage of Lucky Charms consumers who are adults has recently risen to 45%, reported Greg Pearson, the brand’s marketing manager. Lucky Charms is now the seventhlargest cold cereal brand in the US with sales up 5.64% to $252.6 million in the 52 weeks, outpacing category-wide growth of 0.83%. General Mills Inc. was the leading breakfast cereal company in 2012, commanding a 29% value share. Being underneath the umbrella of one of the top manufacturers has been a great advantage of the Lucky Charms brand. The target market will be adults ages 18-49, who have an annual income of $60,000 or more with at least one child living in the household. The brand’s budget for fiscal 2014 is $14 million. Lucky Charms will utilize a continuous advertising plan that will start in January of fiscal 2014. In order to accomplish the outlined media objectives, Lucky Charms will utilize a mix media strategy. Television, radio and magazine advertisements will be used as the traditional media in 2014. Lucky Charms will reach their goal by obtaining a reach/frequency level of 64.5/2.5 (GRPs 163). Lucky Charms will buy media for both national and spot markets. The brand will position spot advertisments in the top 20 markets according to the Media Flight Program. Lucky Charms will use creative media opportunites, such as social media sites and tablet/phone applications to further brand awareness and recognition while interacting with consumers. Lucky Charms will continue to grow in fiscal 2014 because of its established brand image, high brand loyalty, expanding target market and the ability to meet consumer demands. 2 Situation Analysis History of Lucky Charms Lucky Charms cereal first appeared in stores in 1964 after John Holahan thought of the idea when he decided to mix General Mills’ principal prodcut, Cheerios, with bits of Brach's circus peanuts. General Mills’ advertising company and Company decided to market the cereal around the idea of charm bracelets. Lucky Charms was the first cereal to include marshmallows. The first boxes of Lucky Charms cereal contained marshmallows in the shapes of pink hearts, yellow moons, orange stars and green clovers. Lucky Charms features a leprechaun mascot, Lucky, who is animated in commercials. The marshmallows are meant to represent Lucky's magical charms, each having their own special meaning or “powers.” Originally, the oat cereal was not sugar coated but after initial sales failed meeting goals, the oats became sugar coated and Lucky Charms’ success grew. The recipe for Lucky Charms cereal remained unchanged until 2005 with the introduction of a new flavor: Chocolate Lucky Charms. Soon after Lucky Charms was launched, the General Mills marketing department found that sales did much better if the composition of the marshmallow pieces (marbits) changed occasionally. Throughout the years, over 40 different limited editions were created to meet consumer demands. Some editions included: Winter Lucky Charms, Olympic-themed Lucky Charms, and Lucky Charms featuring marshmallow landmarks from around the world. Research proved more brightly colored charms resulted in better sales against dull or pastel colors. General Mills currently conducts regular concept ideation studies for Lucky Charms to understand and meet consumer demands. 3 Older marshmallows were phased out periodically to make room for the new. The size and brightness of the marshmallows also changed in 2004. In 2013, six new rainbow swirl moons were introduced to the marshmallow clan. From the original four marshmallows, the permanent roster as of 2013 includes eight marshmallows. Lucky Charms were sold in the United Kingdom during the mid-1990s. Today, Lucky Charms is not banned in Britain but General Mills made a business decision to stop selling the cereal directly to Britain for uncertain reasons. Theories suggest some elements of Lucky Charms’ brand, included the mascot and the green clover marshmallow offended people in Britian but General Mills decided that the Leprechaun mascot was too important to lose. Product Lucky Charms is a brand of cereal produced by the General Mills food company of Golden Valley, Minnesota. Lucky Charms is made with whole grain, fortified with 12 vitamins and minerals and a good source of calcium. ‘Magically delicious’, the cereal consists of two components: toasted oat-based pieces and multi-colored marshmallow bits in various shapes and colors. Lucky Charms and all other General Mills Big G cereals contain more whole grain than any other single ingredient. 4 Advertising In October 2012, Lucky Charms cereal moved advertising from appealing to just children, towards one that is appealing with adults as well. After the national campaign, the brand posted its best fiscal volume ever. Lucky Charms attributes this success to their change in marketing target. Consumers are able to reminisce with a jingle that hadn't been used in more than a decade: "hearts, stars and clovers" - Lucky's Litany. The jingle contributed to a rise in sales. The new campaign is part of the 49-year-oldcereal brand's new strategy of targeting adults who grew up with Lucky the Leprechaun. A commercial called "Transportasty" shows a woman rediscovering Lucky Charms at her workplace. She is then transported to Lucky's magical forest, where Lucky says, "You're always after me Lucky Charms." She responds to his famous line by saying, "I forgot how good these taste." The commercial recieved positive feedback. A Facebook page was also created to have consumers discuss and reminisce on the changes of Lucky Charms over the years. However, the company is not moving away from kids. A commercial of kids sneaking into Lucky's magical vault of charms was also created. 5 Consumer For four decades, Lucky Charms cereal has been the kids’ brand with adult appeal. The percentage of Lucky Charms consumers who are adults has risen to 45%, said Greg Pearson, Lucky Charms marketing manager at General Mills. There is an emotional connection between adults and Lucky Charms that has been tapped in recent nostalgic TV commercials. The average number of time breakfast is eaten on a weekly basis increases with the number of children in a household. Consumers are appealed by ready-to-eat cereals that pack in vitamins, minerals and key essential nutrients. Cereal eaters consume less fat, less cholesterol and more fiber than noncereal eaters. Consumers appreciate the convience and affordability of cereals like Lucky Charms. Lucky Charms has evolved the quality and appearance of their cereal to meet with consumers’ demands. “We know that people of any age love Lucky Charms – whether they're 12 or 42.” –Greg Pearson VALS- Achievers and Believers Choose familiar products and established brands Interested in time-saving devices/products Commitment to family and career Value consensus, predictability and stability Active in the consumer marketplace Follow established routines Generally loyal customers 6 Competition General Mills Inc. was the leading breakfast cereal company in 2012, commanding a 29% value share. General Mills was followed closely by Kellogg Co, which accounted for 26% of sales. General Mills Cheerios First introduced in 1941 as Cheerioats, name was changed in 1945 Cheerios soon became the number one cold cereal for General Mills in 1951 13 different flavors Health claims promote the cereal helps reduce cholesterol Cheerios have a 10.2% share of the cold breakfast cereal market, according to MRI data. General Mills Honey Nut Cheerios Variation of Cheerios Slightly sweeter than the original Cheerios, with added honey and almond flavors Mascot has been Buzz since introduction Positions soluble fiber and low saturated fat as health appeals Takes the top slot at grocery stores, according to SymphonyIRI, with sales up 2% in the last year to $339 million General Mills Cinnamon Toast Crunch First produced in 1984 by General Mills Small rectangles of wheat and rice, covered in cinnamon and sugar Currently advertising to adults as the cereal they grew up with. Advertised as, “The taste you can see!” in past promotions Cinnamon Toast Crunch, posted gains 7.5%, respectively, during a recent 52week period, according to IRI/Symphony data. Kellogg’s Frosted Flakes Consists of sugar-coated corn flakes The brand has used Tony the Tiger as the mascot since introduction Kellogg’s fiscal 2011 sales totaled more than $13 billion Currently targeting dads and kids in advertisements 7 Industry The ready-to-eat cereal category generates $10 billion in retail sales in the U.S. 9.6 lbs of cereal are consumed per person in the United States annually according to the General Mills 2012 Annual Report General Mills, consisting of 8 brands, spent $142 million in advertising in 2011 Kellogg, consiting of 5 brands spent $108 million in advertising in 2011 Store brands, such as Malt-O-Meal, rely more on competitive pricing Not only are there many brands in the industry, but the rate at which new ones are introduced is high and increasing over time U.S. consumers love their cereal. Some 97 percent of households with children use cereal, according to Experian Simmons NCS research, and it's the top breakfast option for 84 percent of consumers. While the market is large in size, the biggest concern for marketers is that it has been in decline since 2009. This is due in part to the fact that with a household penetration rate in excess of 90%, it is hard to attract new consumers. This makes it more important for manufacturers and retailers to retain their core cereal consumer base, of which households with children are a key component. Mintel Report forecasts that the total cold cereal market will grow to $9.8 billion in 2016 for a projected 9 percent cumulative increase between 2011 and 2016. Recent trends in cold cereals focus on a Better-for-You nutritional profile by reducing amounts of sugar and increasing whole grains. In October 2012, Lucky Charms posted its best fiscal volume ever after targeting adults with TV commercials and an interactive mobile game called “Chase for the Charms.” According to the General Mills 2012 Annual Report for fiscal 2012, General Mills’ global net sales totaled $16.7 billion. Big G cereals, including Lucky Charms, earned $2.4 billion for fiscal 2012. According to SymphonyIRI, Lucky Charms is now the seventh-largest cold cereal brand, with sales up 5.64% to $252.6 million in the 52 weeks ending Oct. 7, outpacing category-wide growth of 0.83%. 8 Strengths Lucky Charms is the kid’s brand with adult appeal. Most would agree, Lucky Charms reigns number one in the hearts of American children and recently adults, who have rediscovered their favorite childhood cereal. Of all the cold breakfast cereals in the market, Lucky Charms offers something that no one can resist: marshmallows. Lucky Charms cereal is low in saturated fat and has no cholesterol. Lucky Charms is very high in iron, riboflavin, thiamin, zinc, niacin, vitamin B6 and B12. General Mills’ environmental policies, practices and performance place it among the best 50% of companies rated by GoodGuide, a business that provides authoritative information about the performance of products and companies. A recent report in a consumer magazine ranked kid cereals by nutritional content, and all nine General Mills ‘Big G’ kid cereals in the report were ranked in the top half. All Big G kid cereals have atleast eight grams of whole grain per serving and have 12 grams or less of sugar per serving. Weaknesses Many argue that Lucky Charms cereal is not nutritous and has a high sugar content. While most children’s cereals do have large amounts of sugar, one serving of General Mills’ cereal has .2g of sugar less than Kellogg and .7g less than Post. Another problem for Lucky Charms is the large amount of competition in the cold breakfast cereal market. From 2008 to 2011, cold cereal companies, including General Mills, increased advertising to children for many of their least nutritious products. Lucky Charms appeared Lucky Charms currently uses child-targeted marketing on TV, Advergame websites and third-party youth websites. Lucky Charms appeared on 10 ten lists for ‘Cereals most frequently advertised to children’ and ‘Advertised cereals with the poorest nutrition ratings,’ on cerealfacts.org. Our goal for this campaign is to move the target audience away from children and towards adults. Adults will recognize Lucky Charms from their childhood and be pursuaded by the nutrional value found in our cereal. 9 Marketing & Communication Objectives Marketing Objective For the fiscal 2014 campaign, Lucky Charms will aim to increase sales revenue by 5%. Our objective is to engage our target market through the use of traditional and non-traditional types of media including television, radio, magazines and internet. We want to gain new consumers while maintaining the loyalty of old consumers. We want to preserve our status as one of the largest cold cereal brands in the United States by continuing to improve product awareness. Rationale: According to Symphony IRI, Lucky Charms’ sales grew 5.64%, to $252.6 million, from fiscal year 2011 to 2012. We want to mirror that growth in fiscal 2014 by encouraging new and old customers to pick Lucky Charms over other cold cereals, hot cereals and other breakfast foods. If Lucky Charms’ sales revenue is increased by 5%, their market share will allow increase. Communication Objective Lucky Charms will communicate to their target market that they are not only ‘magically delicious’ but also a nutritious breakfast cereal. They will be known as a cereal brand that is preferred and liked by both adults and children across the U.S. The mascot, Lucky, will help to animate and communicate the brand’s message. Lucky Charms will continue to deliver an affordable, convienent and nutritous breakfast cereal to consumers. Lucky Charms strives to maintain their success by listening customers in order to meet consumer demands, as they have done for four decades. Rationale: Lucky Charms must differentiate themselves from their competition. Lucky Charms offers 12 vitamins and minerals, are a great source of calcium and taste delicious. Lucky Charms needs to stand out in the cold breakfast cereal market. All branding opportunities and advertising messages will promote this message and communicate Lucky Charms’ fun brand image. 10 Media Objectives Target Audience Media buys for fiscal 2014 should be targeted towards adults between the ages of 18 and 49, who have an income of $60,000+ with atleast one child living in the household. Rationale: MRI data shows that 83.8% of people who bought Lucky Charms within the last six months are adults ages 18-49. According to MRI data, 94.7% of consumers who bought Lucky Charms within that timeframe have a child or children between the ages of 2 and 17 in their household. MRI data also shows that about 51.4% of people who have consumed Lucky Charms within the last 6 months have a household income of $60,000 or greater. Geographic For fiscal 2014, Lucky Charms will purchase media for both national and spot markets. Spot market will consist of the top 20 cities. Rationale: Lucky Charms is a national brand and has the highest share of the cold breakfast cereal market currently. Advertisements are effective everywhere in the United States and geographic emphasis does not heavily determine the brand’s spot markets. Lucky Charms will place ads in the top 20 markets given from the Media Flight Plan program. A list of the markets is attached to this media plan. Scheduling/Timing Advertising is to be selected for all twelve months of fiscal 2014 and will use a continuous advertising plan, which will start in January. Rationale: Purchasing media for all 12 months of the campaign will increase both, Lucky Charms’ reach and frequency levels. The 2012 General Mills’ Annual Report and Lowe’s Corner Store support a continuous plan for Lucky Charms as well, as there is little seasonal influence in the brand’s sales trends. Budget The overall budget for fiscal 2014 is $14,000,000. Media will be selected based on an efficiency model. Rationale: Lucky Charms’ budget for fiscal 2014 was indicated in the parameters of the assignment. Reach/Frequency For all months of the fiscal 2014 campaign, Lucky Charms will select media that obtain a reach level of 64.5 and an average frequency of 2.5. Rationale: The campaign’s frequency level of 2.5 was determind using the Ostrow model. Since Lucky Charms is a well known brand and has a large market share currently, average reach and frequency levels will be used to maintain the brand’s reputation and place in the market. 11 Media Strategies In order to accomplish the outlined media objectives, Lucky Charms will utilize a mix media strategy. This strategy extends reach and flattens distribution of frequency. Advertising messages will be delivered through TV, radio and newspapers. Television National advertisements will be played on network cable during the daytime, prime and late fringe segments. Spot ads will be played on prime TV. Spot ads will be played during the prime segment in select markets. 30 second commercials will be used in the campaign. Rationale: Lucky Charms should utilize TV advertisements because the ads can include sight, sound and motion for dynamic selling. TV ads build reach and can target both selective and mass markets. MRI data shows that 81.3% of consumers who used Lucky Charms in the last six months had any cable viewing last week. MRI also shows that 47.8% of these consumers fall in the fourth and fifth TV-total quintile. Radio Spot ads will be played on radio stations during the evening drive and nighttime segments. 30 second commercials will be used. Rationale: Radio commercials are an effective choice for the campaign because they are inexpensive and build a high frequency. MRI data shows that 46.4% of people who purchased Lucky Charms within the last six months fall in the first and third radio quintiles. Ads will be played heavily in order to gain more awareness and promote the brand. . Radio is ubiquitous, reaching consumers on-air, online, on-site and on-demand -- whether they are at home, at work or in their car. Magazine Magazine advertisements will run in ‘Women’s’, ‘Men’s’ and ‘General Interest’ magazines. Full-page, four-color and full-page B&W ads will be used in the campaign. Rationale: Magazines will help build reach throughout the country. Lucky Charms’ magazine ads should include color to stand out and to clearly convey the fun, memorable brand image. MRI data shows 41.7% of people who used Lucky Charms within the last 6 months read General Editorial magazines. MRI data also shows that 55.6% of these consumers read Women magazines. 12 Tactical Recommendations Television Lucky Charms will advertise on television networks with index scores of 130 and higher that have audiences between 18 to 49 years old. These stations include: Food Network, E! (Entertainment Television), History Channel, MTV, and TLC. These programs are effective because they will reach both males and females. By using daytime, prime time and late fringe segments, Lucky Charms will reach 44.8% of their target audience according to MRI data. MRI data shows 30.5% of consumers who purchased Lucky Charms within the last six months watch History Channel. MRI also shows 28.1% of these consumers watch Food Network. Radio According to the Radio Advertising Bureau, radio reaches 70.4% of persons age 18 to 49 per day on average. Lucky Charms will market their product on local radio stations that cater to an 18+ audience. During the weekday, 53.2% of homemakers who listened to the radio between 6 a.m. and 10 a.m. purchased Lucky Charms within the last six months, according to MRI data. Radio -- with lower costs and many stations -- can focus on narrow segments that are designed to target a specific audience. It is a passive medium allowing consumers to multi-task and listen while they work or play -- essential in today's world. Magazines Lucky Charms will advertise in magazine types including: ‘Men’s’, ‘Women’s’ and ‘General Interest.’ Advertisements will be printed in magazines such as Ok!, Lucky, Men’s Journal, Parenthood, Game Informer, Parent, Star and Cosmopolitan. Magazines are read not only in print but also on tablets, which will expand our reach and interaction with customers. MRI data shows 55.6% of consumers who purchased Lucky Charms within the last six months read ‘Women’ magazines. MRI also shows 40.3% of these consumers read ‘News and Entertainment Weeklies’ magazines. 13 Creative Media Opportunities Promotional Support In order to work in the parameters of the budget, Lucky Charms must use social media resources in order to promote its brand message and image. Social media resources such as Instagram, Facebook, and Twitter provide Lucky Charms with ways to promote their brand for little to no cost. With Instagram and Twitter, people can earn prizes by using the hashtag “#magicallydelicious” or “#luckycharms”. Facebook also provides Lucky Charms with many cheap opportunities to gain consumers. Through Facebook, Lucky Charms can provide money as incentive for consumers to "share" the Lucky Charms Facebook page. This media mix provides Lucky Charms with a chance to gain awareness and promote the brand while staying under budget. Lucky Charms will also continue to expand their new mobile app for adults. In the game, called ‘Chase for the Charms,’ players are on the quest for Lucky’s magical marshmallow pieces. The more you collect: the more prizes you get. The app is available on smartphones and tablets. 14 Budget Summary The following is a budget summary for Lucky Charms’ media purchasing plan for fiscal 2014. Numbers are reported in millions and rounded to nearest decimal. Majority of the media buy for Lucky Charms were in radio and television which helped build higher reach and frequency levels. Television – 6,472.9 Radio – 4,683.5 Magazines – 2,799.1 Lucky Charm's Budget 20.1% 46.4% TV Radio Magazines 33.6% 15 Monthly Budget Target Demo: All Adults ages 18-49 Natl Univ (000):131026 Spot Univ (000):60639 Medium Covg. Unit GRPs CPP CPM Total Cost Net TV-Prime NATL :15 8 18911 14.43 151288 Net Cable-Daytime NATL :30 8 4908 3.75 39264 Net Cable-Prime NATL :30 8 24811 18.94 198488 Net Cable-L Fringe NATL :30 1 9692 7.4 9692 Net Radio-Evening Drive NATL :30 50 2660 2.03 133000 Net Radio-Nightime NATL :30 50 2520 1.92 126000 Magazines-Mens NATL FPG 4 20227 15.44 80908 B&W Magazines-Womens NATL FPG 5 15980 12.2 79900 B&W Magazines-General NATL FPG 4 18112 13.82 72448 Interest 4C National Totals 138 6456 4.93 890988 Spot TV-Prime Spot Radio-Evening Drive Spot Radio-Nighttime Spot Totals SPOT SPOT SPOT :30 :60 :60 5 10 11 26 28135 10839 2082 10460 46.4 17.87 3.43 17.25 140675 108390 22902 271967 Total Plan 150.032833 7751 5.92 1162955 Note: CPM based on media that contribute both cost and GRPs; For Total Plan, Spot GRPs are weighted to %US coverage before calculations. Market List Market Name Cleveland, OH Denver, CO Detroit, MI Miami-Ft. Lauderdale, FL Minneapolis-St. Paul, MN Orlando et al, FL Phoenix, AZ Sacramento-Stockton, CA Seattle-Tacoma, WA Tampa-St Pete, FL Atlanta, GA Boston, MA Chicago, IL Dallas-Ft. Worth, TX Houston, TX Los Angeles, CA New York, NY Philadelphia, PA San Francisco et al, CA Washington, DC 20 Markets Chosen, covering 44.05% of US households. Rank %US 17 18 11 16 15 19 12 20 14 13 8 7 3 5 10 2 1 4 6 9 1.36 1.31 1.7 1.36 1.51 1.27 1.6 1.23 1.58 1.58 2.04 2.12 3.07 2.16 1.82 5 6.54 2.61 2.14 2.05 16 Medium Net TV-Prime $(000) Net Cable-Daytime $(000) Net Cable-Prime $(000) Net Cable-L Fringe $(000) Net Radio-Evening Drive $(000) Net Radio-Nightime $(000) Magazines-Mens $(000) Magazines-Womens $(000) Magazines-General Interest $(000) Spot TV-Prime $(000) Spot Radio-Evening Drive $(000) Spot Radio-Nighttime $(000) National Only Area GRPS $(000) Reach Avg. Freq. Spot Only Area GRPS $(000) Reach Avg. Freq. Spot + National GRPS $(000) Reach Avg. Freq. Lucky Charms Media Plan - Fiscal 2014 Jan 8 151.3 8 39.3 8 198.5 1 9.7 50 133.0 50 126.0 4 80.9 5 79.9 4 72.4 5 140.7 10 108.4 11 22.9 137 891 56.8 2.4 Feb 8 151.3 8 39.3 8 198.5 1 9.7 50 133.0 50 126.0 4 80.9 5 79.9 4 72.4 5 140.7 10 108.4 11 22.9 26 272 19.1 1.4 137 891 56.8 2.4 Mar 8 151.3 8 39.3 8 198.5 1 9.7 50 133.0 50 126.0 4 80.9 5 79.9 4 72.4 5 140.7 10 108.4 11 22.9 163 1163 64.5 2.5 26 272 19.1 1.4 137 891 56.8 2.4 Apr 8 151.3 8 39.3 8 198.5 1 9.7 50 133.0 50 126.0 4 80.9 5 79.9 4 72.4 5 140.7 10 108.4 11 22.9 163 1163 64.5 2.5 26 272 19.1 1.4 137 891 56.8 2.4 May 8 151.3 8 39.3 8 198.5 1 9.7 50 133.0 50 126.0 4 80.9 5 79.9 4 72.4 5 140.7 10 108.4 11 22.9 163 1163 64.5 2.5 26 272 19.1 1.4 137 891 56.8 2.4 Jun 8 151.3 8 39.3 8 198.5 1 9.7 50 133.0 50 126.0 4 80.9 5 79.9 4 72.4 5 140.7 10 108.4 11 22.9 163 1163 64.5 2.5 26 272 19.1 1.4 137 891 56.8 2.4 Jul 8 151.3 8 39.3 8 198.5 1 9.7 50 133.0 50 126.0 4 80.9 5 79.9 4 72.4 5 140.7 10 108.4 11 22.9 163 1163 64.5 2.5 26 272 19.1 1.4 137 891 56.8 2.4 Aug 8 151.3 8 39.3 8 198.5 1 9.7 50 133.0 50 126.0 4 80.9 5 79.9 4 72.4 5 140.7 10 108.4 11 22.9 163 1163 64.5 2.5 26 272 19.1 1.4 137 891 56.8 2.4 Sep 8 151.3 8 39.3 8 198.5 1 9.7 50 133.0 50 126.0 4 80.9 5 79.9 4 72.4 5 140.7 10 108.4 11 22.9 163 1163 64.5 2.5 26 272 19.1 1.4 137 891 56.8 2.4 Oct 8 151.3 8 39.3 8 198.5 1 9.7 50 133.0 50 126.0 4 80.9 5 79.9 4 72.4 5 140.7 10 108.4 11 22.9 163 1163 64.5 2.5 26 272 19.1 1.4 137 891 56.8 2.4 163 1163 64.5 2.5 26 272 19.1 1.4 137 891 56.8 2.4 GRPS: Cost: GRPS: Cost: GRPS: Cost: Mochelle Johnson and Lauren Rachel Olan Farnall Spring 2013 137 891 56.8 2.4 26 272 19.1 1.4 163 1163 64.5 2.5 Student Professor Semester 26 272 19.1 1.4 163 1163 64.5 2.5 1967 13955.5 312 3263.6 1655 10691.9 Adults ages 18-49 Total Across GRPS: 96 COST: 1815.5 GRPS: 96 COST: 471.2 GRPS: 96 COST: 2381.9 GRPS: 12 COST: 116.3 GRPS: 600 COST: 1596.0 GRPS: 600 COST: 1512.0 GRPS: 48 COST: 970.9 GRPS: 60 COST: 958.8 GRPS: 48 COST: 869.4 GRPS: 60 COST: 1688.1 GRPS: 120 COST: 1300.7 GRPS: 132 COST: 274.8 163 1163 64.5 2.5 Target Demo: All Nov Dec 8 8 151.3 151.3 8 8 39.3 39.3 8 8 198.5 198.5 1 1 9.7 9.7 50 50 133.0 133.0 50 50 126.0 126.0 4 4 80.9 80.9 5 5 79.9 79.9 4 4 72.4 72.4 5 5 140.7 140.7 10 10 108.4 108.4 11 11 22.9 22.9 17