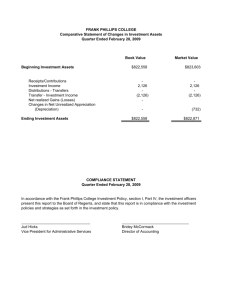

Notes to accounts - year ended 31 December 2004

advertisement