in R$ millions - BM&FBOVESPA

advertisement

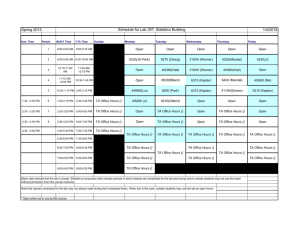

4Q15 Earnings Presentation February 19, 2016 X 1 Public Public Forward Looking Statements This presentation may contain certain statements that express the management’s expectations, beliefs and assumptions about future events or results. Such statements are not historical fact, being based on currently available competitive, financial and economic data, and on current projections about the industries BM&FBOVESPA works in. The verbs “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “plan,” “predict,” “project,” “target” and other similar verbs are intended to identify these forward-looking statements, which involve risks and uncertainties that could cause actual results to differ materially from those projected in this presentation and do not guarantee any future BM&FBOVESPA performance. The factors that might affect performance include, but are not limited to: (i) market acceptance of BM&FBOVESPA services; (ii) volatility related to (a) the Brazilian economy and securities markets and (b) the highly-competitive industries BM&FBOVESPA operates in; (iii) changes in (a) domestic and foreign legislation and taxation and (b) government policies related to the financial and securities markets; (iv) increasing competition from new entrants to the Brazilian markets; (v) ability to keep up with rapid changes in technological environment, including the implementation of enhanced functionality demanded by BM&FBOVESPA customers; (vi) ability to maintain an ongoing process for introducing competitive new products and services, while maintaining the competitiveness of existing ones; (vii) ability to attract new customers in domestic and foreign jurisdictions; (viii) ability to expand the offer of BM&FBOVESPA products in foreign jurisdictions. All forward-looking statements in this presentation are based on information and data available as of the date they were made, and BM&FBOVESPA undertakes no obligation to update them in light of new information or future development. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities where such offer or sale would be unlawful prior to registration or qualification under the securities law. No offering shall be made except by means of a prospectus meeting the requirements of the Brazilian Securities Commission CVM Instruction 400 of 2003, as amended. 2 4Q15 and 2015 Highlights Solid operating performance; bottom line impacted by non-recurring and mainly non-cash items Financial highlights 4Q15 (vs. 4Q14) Financial highlights 2015 (vs. 2014) Non-recurring items in the 4Q15 and 2015 Total revenues: R$603.3 MM, +1.8% Total revenues: R$2,458.8 MM, +9.5% BM&F seg.: R$258.8 MM, +18.9% BM&F seg.: R$1,074.5 MM, +24.0% Non-recurring impacts related to CME Group Bovespa seg.: R$222.8 MM, -18.2% Bovespa seg.: R$903.0 MM, -7.6% Sale of 20% stake Other business lines (not tied to volumes): R$121.7 MM, +18.3% Other business lines (not tied to volumes): R$481.3 MM, +19.6% - Total proceeds: R$1,201.3 MM Adj. expenses¹: R$170.4 MM, -2.6% Adj. expenses: R$614.3 MM, +3.7% Oper. income: R$329.8 MM, +16.5% Oper. income: R$1,366.0 MM, +11.4% Adj. net income²: R$534.1 MM, +43.1% (Adj. EPS of R$0.30) Adj. net income: R$1,819.2 MM, +23.0% (Adj. EPS of R$1.02) Interest on Capital (IoC): R$0.25 per share paid in Dec´15 Total payout: R$1,242.6 MM /R$0.70 per share (73.3% payout ratio, ex CME and impairment impacts) - Pre-tax result: R$724.0 MM - After-tax result: R$474.2 MM (tax off-set against IoC) Discontinuity of the equity method (non-cash) - Pre-tax result: R$1,734.9 MM - After-tax result: R$1,130.4 MM Impairment of the book value of Bovespa Holding (non-cash) - Pre-tax impact: R$1,662.7 MM - After-tax impact: R$1,097.4 MM Share buyback: R$286.8 MM 1 Adjusted to (i) depreciation and amortization; (ii) stock grant plan costs – principal and payroll taxes – and stock option plan; (iii) tax on dividends from CME Group; and (iv) transfer of fines and provisions. ² Adjusted to (i) deferred taxes related to the goodwill; (ii) stock grant plan costs – principal and payroll taxes – net of tax deductibility, and stock option plan; (iii) investment in CME Group under the equity method of accounting, net of taxes related to dividends; (iv) taxes paid overseas to be compensated; (v) tax credits from IoC; (vi) non-recurring impact from the partial divestment in CME Group; (vii) nonrecurring impact from the discontinuity of the equity method of accounting; and (viii) extraordinary impact of the impairment of goodwill, net of taxes 3 Strategic Developments – 2015 Main Landmarks Delivering on the strategic plan Building a world-class IT and operations infrastructure Developing products and markets Clearing BM&FBOVESPA Greater liquidity for listed products Equities phase: Conclusion of IT development in Oct’15 Market makers: 20 new programs in 2015 (active programs total 35) Test and certification phases with market participants throughout 2016 Sec. lending: efforts to attract more lenders (local pension funds and foreign investors) Market Development PUMA Trading System Inflation futures: 4 contracts re-launched in Jun’15 Resilience: availability of 99.995% BDRs2: 19 new companies in 2015, totaling 85 Performance: 2015¹ average number of messages per day grew 345.1% compared to 2010 Tesouro Direto: improvements on the platform iBalcão Accomplishments in 2015: Conclusion of the OTC derivatives migration to the new platform (NDFs, Swaps, Flex Options) Launching of new products and functionalities in the fixed income registration platform ¹ Updated until Dec´15. 2 Non-sponsored Brazilian Depository Receipts Enhancements to pricing and incentives 1Q15: DMA; securities lending; issuers; and options on equity-based indices futures 2Q15: mini contracts; Int. Rate in BRL contracts fee rebalancing; and depositary 3Q15: market data; and OTC derivatives Corporate Governance for State-owned Companies Investment in Bolsa de Comercio de Santiago 4 4Q15 Revenue Breakdown¹ Business model resilience and revenues growth Top line growth driven by revenues from financial and commodities derivatives and increased non-volume related revenues (in R$ millions) USD-linked revenues represented 28% of the total Total Revenues R$603.3 MM 1 The revenue breakdown considers the revenue lines “others” of the Bovespa segment and “foreign exchange” and “securities” of the BM&F segment, as reported in the financial statements note 20, within the other revenues not tied to volumes. ² Trade and post-trade. 5 Derivatives Market¹ FX depreciation pushed revenues up despite drop in ADV of contracts REVENUE (in R$ millions) ADV (in millions of contracts) Contracts priced in USD² represented ~57% of derivatives revenues in 4Q15 (~28% of derivatives ADV) 301 213 246 253 21 21 19 109 86 24 253 31 153 129 96 4Q14 1Q15 Interest rates in BRL 131 102 143 124 80 2Q15 3Q15 Contracts priced in USD² 4Q15 Others Contracts 4Q14 4Q15 YoY Interest rates in BRL 1.22 1.04 -15.3% FX rates Interest rates in USD Commodities 0.50 0.26 0.01 0.41 0.29 0.01 -18.1% 11.4% -51.2% Mini contracts Stock indices OTC 0.42 0.14 0.01 0.60 0.11 0.01 43.5% -23.2% -47.9% TOTAL 2.56 2.45 -4.3% RATE PER CONTRACT (RPC) RPC: R$1.753 per contract, +27.3% y-o-y, mainly reflecting the depreciation of BRL versus USD 2015 Revenue (in R$ millions) R$1,053.5, +23.9% ADV (in millions of contracts) 2,860.0, +10.7% RPC (in R$) R$1.516, +12.3% ¹ Revenue does not consider the revenue lines “foreign exchange” and “securities” of the BM&F segment, as reported in the financial statements note 20, which totaled R$5.7 million in the 4Q15 and R$21.0 million in 2015. ² Most of the fees charged on FX, Interest rates in USD and Commodities contracts are referred in USD. 6 Equities Market¹ Revenues impacted by lower market capitalization of listed companies and turnover REVENUE² (in R$ millions) ADTV (in R$ millions) Markets 4Q14 Cash Equities Equities Derivatives TOTAL² 4Q15 YoY 8,299.5 6,631.3 -20.1% 354.4 231.1 -34.8% 8,654.7 6,865.0 -20.7% Average market capitalization fell 12.4% Turnover velocity of 79.1% in 4Q15 vs. 87.5% in 4Q14 4Q14 volume and turnover had been fueled by preelection volatility (ADTV in Oct´14 wasR$10.9 billion) TRADING AND POST-TRADING MARGINS (in bps) Reached 5.254 bps in 4Q15, +4.8% y-o-y (+0.24bps) 2015 Revenue (in R$ millions) R$881.5, -7.8% ADTV (in R$ millions) R$6,792.8, -6.9% Margins (in bps) 5.275, flat ¹ Revenue does not considers the revenue line “others” of the Bovespa segment, as reported in the financial statements note 20, which totaled R$6.4 million in the 4Q15 and R$21.5 million in 2015. ²Includes fixed income line. 7 Business Lines not Related to Volumes Solid growth in revenues not tied to volumes 4Q15 REVENUE BREAKDOWN¹ (in R$ millions) Solid growth mainly impacted by new commercial policies and depreciation of BRL versus USD Equities Market (BOVESPA Seg.) 222.8 Derivatives Market (BM&F Seg.) 258.8 ¹ Revenue as reported in the financial statements note 20. Other lines of business in R$ millions Market Data (Vendors) 30.2 Depository 27.7 Securities lending 25.5 Listing 12.2 Bank - financial intermediation and bank fees 10.0 Trading participant access 9.8 Other 6.2 Total 121.7 +18.3% Y-o-Y 8 4Q15 Adjusted Expenses¹ Continued focus through diligent expense management 4Q15 adjusted expenses decreased 2.6% y-o-y (in R$ millions) Adjusted personnel2 (+7.4%): grew below annual wage adjustment of ~9% Data processing (-21.9%): nonrecurring payment in 4Q14 of R$9.5 MM for upgrade rights of PUMA Platform Third party services (-16.2%): lower expenses with consulting and legal advisory services Commun. (-58.4%): reduction of mailing expenses of custody statements Others3 (+5.6%) (in R$ millions and % of total adjusted expenses) 4Q15 92.5 (54%) 32.0 (19%) 11.4 (7%) 1.3 (1%) 33.2 (19%) 4Q14 86.1 (49%) 40.9 (23%) 13.6 (8%) 3.2 (2%) 31.0 (18%) ¹ Expenses adjusted to Company’s (i) depreciation and amortization; (ii) costs from stock grant plan – principal and payroll taxes – and stock option plan; (iii) tax on dividends from the CME Group in 4Q14; and (iv) transfer of fines and provisions. 2 Excluding the impact of stock grant/option expenses. 3 Include expenses with maintenance, board and committee members compensation, marketing and others. 9 Expenses Discipline Delivering efficiency through diligent expense management -11.2% Third party services 3.2% -6.7% Marketing 5.7% -4.5% -57.0% -61.1% 1 Total Personnel 2 Data processing -1.8% Real Change3 18.5% -11.5% Data processing -3.8% Nominal Change 16.9% -11.5% 1,8% Third party services Total Personnel 2 3.9% (in R$ millions) -20.8% -40.0% Marketing Real Change3 2015 vs. 2014 -69.1% -76.6% Communicat. Nominal Change Communicat. Adjusted expenses grew 3.7%, significantly below average inflation of 10.7%1, reflecting prioritization of activities, review of contracts and enhancement of processes -75.0% -81.0% 2015 vs. 2011 (in R$ millions) IPCA last 12 months until Dec´15 (Source IBGE) 2 Includes personnel expenses and capitalization and excludes costs from stock grant plan – principal and payroll taxes – stock option and 10 bonus expenses. 3 Calculated based on the annual wage increase for personnel expenditure and the accumulated IPCA for the other lines of expenses. Financial Highlights Solid and liquid financial profile CASH AND FINANCIAL INVESTMENTS (in R$ millions) 4Q15 5,201 Company’s cash and financial investments Unrestricted cash (available funds) includes R$1,201.3 million from the partial divestment in the CME Group 3Q15 8,165 2Q15 4,033 Financial result of R$ 289.8 MM, up 436.2% versus 4Q14, mainly due to: R$173.4 million in dividends received from CME Group 1Q15 4,335 higher interest rates higher average cash and financial investments balance 4Q14 3,856 Third party Total³ Restricted Available ¹ Includes earnings and rights on securities in custody. ² Includes BM&FBOVESPA Bank clients’ deposits. ³ Does not include investments in CME Group and in Bolsa de Comercio de Santiago booked as a financial investment that amounted to R$4,853.6 million in Dec’15. 11 Financial Highlights Investments and returning cash to shareholders ¹ Considers dividends, interest on capital and share buyback on the Company’s average market capitalization. 12 Adjusted Net Income Reconciliation of net income – ex-CME and impairment NET INCOME IFRS (in R$ millions) IFRS net income1 Change 4Q15/4Q14 4Q14 125.4% - - (1,130.4) - - - - - (474.2) - - 1,097.4 - - 1,097.4 - - 704.2 232.4 203.0% 1,695.0 977.1 73.5% 7.8 7.0 10.7% 45.4 28.8 57.5% (+) Deferred Liability (goodwill) 137.5 138.6 -0.8% 550.1 554.6 -0.8% (-) Equity in results of investee (173.7) (34.7) 401.3% (309.9) (162.7) 90.4% 59.1 29.8 98.2% 88.5 81.0 9.3% (200.8) 534.1 373.2 - (249.8) 1,819.2 1,478.7 - (+) Impairment IFRS net inc. ex-CME and impairment impacts (+) Stock Grant/Option (+) Recoverable taxes paid overseas (-) IOC adjustment2 Adjusted net income 232,4 14.6 Change 2015/2014 2014 977.1 (-) Gain on disposal of investment in affiliate (407.7) 2015 2,202.2 (-) Discontinuity of the equity method 1 4Q15 -275.4% 43.1% Attributed to BM&FBOVESPA´s Shareholders. 2 Tax benefits from Interest on Capital (IoC) adjusted to preserve the comparability with the previous periods. 23.0% 13 Main Impacts in the 2015 IFRS Earnings CME Group, Impairment and IoC Nonrecurring impacts related to CME Group Sale of 20% of the equity investment (1% of the CME Group total shares) Pre-tax result of R$724.0 MM; after-tax result of R$474.2 MM (tax due off-set against IoC); cash proceeds of R$1,201.3 MM Discontinuity of the equity method (non-cash) Pre-tax result of R$1,734.9 MM; after-tax result: R$1,130.4 MM Starting from Sep’15, the dividends received from CME Group are recognized as financial income Impairment1 of the book value of Bovespa Holding Impairment in the recoverable amount of intangible assets Pre-tax impact of R$1,662.7 MM; after-tax impact of R$1,097.4 MM (non-cash) Adoption of interest on capital (IoC) Tax efficiency for the Company Reflects deterioration of the macroeconomic scenario that negatively impacted expectations of future profitability of the Bovespa segment reduction in the market value of the companies listed in the Bovespa Segment worsening expectations for interest rates and country risk for the short- and long-terms reflected in higher cost of capital in the valuation In 2015 the Company opted for distributing its payout using interest on capital, which will generate tax losses that can be offset in future periods against taxable earnings This change should allow us to better achieve our objectives of returning capital to shareholders through a different combination of interest on capital, dividends and share repurchases 1 Reported in the financial statements - note 9 14 APPENDIX 15 Financial Statements Summary of balance sheet (consolidated) ASSETS LIABILITIES AND SHAREHOLDERS´EQUITY (in R$ millions) Current assets 12/31/2015 12/31/2014 (in R$ millions) Current liabilities 8,673.8 2,785.2 440.8 500.5 7,798.5 1,962.2 434.4 322.5 17,635.1 22,478.2 1,961.4 1,522.5 1,815.6 1,392.8 Others 145.8 129.8 Investments 30.6 3,761.3 453.1 421.2 15,190.0 16,773.2 Goodwill 14,401.6 16,064.3 Minority shareholdings Total Assets 26,308.9 25,263.5 Liabilities and Shareholders´ eq. Cash and cash equivalents Financial investments Others Non-current assets Long-term receivables Financial investments Property and equipment Intangible assets 12/31/2015 12/31/2014 2,096.8 1,891.8 1,338.0 1,321.9 758.8 569.9 Non-current liabilities 5,859.9 4,383.2 Foreign debt issues 2,384.1 1,619.1 3,272.3 2,584.5 203.5 179.6 18,352.2 18,988.4 2,540.2 2,540.2 14,300.3 15,220.4 1,501.6 1,218.9 10.1 8.9 26,308.9 25,263.5 Collateral for transactions Others Deferred Inc. Tax and Social Contrib. Others Shareholders´ equity Capital stock Capital reserve Others 16 Financial Statements Net income and adjusted expenses reconciliations ADJUSTED NET INCOME RECONCILIATION (in R$ millions) 4Q15 IRFS net income* Stock Grant/Option (recurring net of tax) Deferred tax liabilities Equity in income of investees (net of taxes) Recoverable taxes paid overseas IoC Adjustments Discontinuity of the equity method (net of taxes) Gain on disposal of investment in associate (net of tax) Impairment (net of tax) Adjusted net income Change 4Q15/4Q14 232.4 -275.4% 4Q14 (407.7) Change 4Q15/3Q15 2,012.5 -120.3% 3Q15 2015 Change 2015/2014 977.1 125.4% 2014 2,202.2 7.8 7.0 10.7% 12.8 -39.4% 45.4 28.8 57.5% 137.5 138.6 -0.8% 137.5 0.0% 550.1 554.6 -0.8% (173.7) (34.7) 401.3% (37.6) 361.8% (309.9) (162.7) 90.4% 59.1 29.8 98.2% - - 88.5 81.0 9.3% (200.8) 14.6 1,097.4 534.1 373.2 309.7% (249.8) -101.3% (1,130.4) (474.2) 1,097.4 1,819.2 16.9% 1,478.7 23.0% (49.0) - (1,145.0) (474.2) 43.1% 457.0 *Attributable to BM&FBOVESPA’s shareholders. ADJUSTED EXPENSES RECONCILIATION (in R$ millions) 4Q15 4Q14 Change 4Q15/4Q14 Change 4Q15/3Q15 3Q15 2015 2014 Change 2015/2014 Total Expenses 213.4 250.4 -14.8% 217.8 -2.0% 850.7 804.1 5.8% Depreciation (26.0) (32.1) -19.0% (26.1) -0.3% (110.9) (119.1) -6.9% Stock Grant/Option (14.1) (7.0) 100.9% (19.4) -27.5% (99.0) (28.8) 243.6% - (32.8) - - - - (49.4) - (2.8) (4.4) -35.2% (8.7) -67.2% (26.5) (19.5) 35.5% - 0.9 - - - - 5.2 - 170.4 174.9 -2.6% 163.6 4.2% 614.3 592.3 3.7% Tax on dividends from the CME Group Provisions BBM impact Adjusted Expenses 17 Financial Statements Summary of income statement (consolidated) SUMMARY OF INCOME STATEMENT (in R$ millions) 4Q15 4Q14 Change 4Q15/4Q14 3Q15 Change 4Q15/3Q15 2015 2014 Change 2015/2014 543.2 533.4 1.8% 598.3 -9.2% 2,216.6 2,030.4 9.2% (213.4) (250.4) -14.8% (217.8) -2.0% (850.7) (804.1) 5.8% 329.8 283.1 16.5% 380.5 -13.3% 1,366.0 1,226.4 11.4% 60.7% 53.1% 765 bps 63.6% -288 bps 61.6% 60.4% 122 bps 289.8 54.1 436.2% 86.0 236.9% 508.8 208.2 144.4% (1,043.0) 404.6 -357.8% 2,974.4 -135.1% 2,807.2 1,646.7 70.5% Net Income ex-extraordinary impacts* 704.2 232.4 203.0% 393.3 79.0% 1,695.0 977.1 73.5% Adjusted Net Income 534.1 373.2 43.1% 457.0 16.9% 1,819.2 1,478.7 23.0% Adjusted EPS (in R$) 0.300 0.204 46.8% 0.256 17.2% 1.015 0.804 26.3% Adjusted Expenses (170.4) (174.9) -2.6% (163.6) 4.2% (614.3) (592.3) 3.7% Net Revenues Expenses Operating Income Operating margin Financial Result EBT *Excludes the net gain from the partial divestment in CME Group, the net impact from the discontinuity of the equity method of accounting for the remaining investment in CME Group and impairment impacts. 18 Contact Investor Relations Department Phone: 55 11 2565-4729 / 4418 / 4207 / 4834 / 7938 ri@bmfbovespa.com.br 19