callequity.net Broker Loan Instructions

advertisement

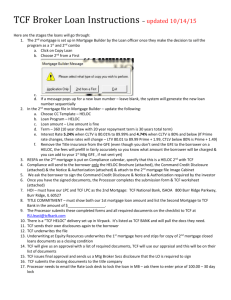

Broker Loan Instructions – updated 11/25/13 We are currently only set up as a broker with USB. Investor is in Mortgage Builder as USB BROKER. This are set up so that we know the loan was brokered. I have reports we fill out annually that say when a loan is broker vs. correspondent. These loans get underwritten and funded by USB. Very little is done in the Newark office but I know these loans may pop up on reports from time to time so I want you all to be aware. Loan officer needs to: 1. Get a copy of the GFE from US Bank to ensure we complete it to match theirs 2. Email that GFE to Compliance to complete the GFE correctly here 3. Choose loan program that includes the words “BROKER-USB” If one is missing, ask Kelly Welch to add it. 4. Put the “Send RESPA – Broker loan” on Compliance list 5. Lock the interest rate with USB directly and email that to Compliance to enter into MB 6. Submit the loan to US Bank yourself and work through the conditions you need to with the borrower. 7. If any changes in terms occur, ask Compliance to send out a Change of Circumstance and revised GFE to the borrower 8. 24 hours prior to closing – ask Megan to send out the Ohio Payment Letter (this will not show up on Megan’s reports so make sure you tell her to send it!) 9. Enter the closing date in MB on the Loan Status Screen 10. Ask the title company for a copy of the HUD1, NOTE and TIL at the closing and attach to MB (labeled BROKER) 11. Get the check from the title company once the loan disburses and forward to Cindi 12. Make sure the final GFE in file matches the HUD1 settlement statement Processor handles the following at the Loan officer’s direction: 1. Order Appraisal through US Bank’s Portal (Jenni Brown has experience here) 2. Order Title work 3. Obtain HOI dec page – 1 year HOI required in full paid at closing if client is not escrowing 4. Obtains payoffs on a refinance 5. Obtain subordinations on a refinance 6. Order VOE’s 7. Remind the LO to send the OPL 24 hours prior to closing Compliance: Make sure you have a copy of the US Bank GFE to match up our information to. Typically the GFE looks like this: Print the GFE and ensure it matches the GFE from US Bank before you send it to the borrower. Rate lock Desk: Completes the following in MB - on the rate lock confirmation screen: 1. Lock date 2. Term of lock 3. Lock expiration 4. Retail price and investor price – make all 100 (the fee will come through from the GFE to the total commissions on the loan) 5. Investor name 6. Investor loan number 7. Confirm Closer completes the closing package sent date on the Loan status screen when they see the doc order in their queue. Cindi completes the final steps: 1. Cindi needs to attach the check to the Image Cabinet in MB and add the amount of the broker portion of the origination fee to the Post Closing – Draft/Wire – Add Screen. Line 803 from HUD1. 2. Make sure GFE fees appear exactly the same as the HUD1 and change. 3. Complete the following on the Loan Status Screen: 1. Date shipped - can put whatever date in here. This needs complete so the loan does not appear on a closing department report for loans not shipped. 2. Post Closer – using the drop down choose BRO for Broker loan 3. Shipper Name - BRO 4. Cindi completes Closing Package received date as the same date as date shipped above (so loan does not appear in Motivity closing dashboard) 5. Cindi to complete the following in the Investor Reconciliation Screen: 1. Investor Fund date 2. Payment Status – all payments rec’d 6. Cindi to go to Post Closing – Final Docs – Final Document Tracking a. Enter both the Mortgage and Title Policy dates for rec’d and shipped b. Put a note in saying that we did not receive just entered dates to remove from reports 7. Give funding to Kelly to review The file needs to be shipped to the Newark office for filing TCF Broker instructions: Here are the stages the loans will go through: 1. The 2nd mortgage is set up in Mortgage Builder by the Loan officer once they make the decision to sell the program as a 1st and 2nd combo a. Click on Copy Loan b. Choose 2nd from a First 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. c. d. If a message pops up for a new loan number – leave blank, the system will generate the new loan number sequentially In the 2nd mortgage file in Mortgage Builder – update the following: a. Choose CC Template – HELOC b. Loan Program – HELOC c. Loan amount – Line amount is fine d. Term – 360 (10 year draw with 20 year repayment term is 30 years total term) e. Interest Rate 5.24% when CLTV is 80.01% to 89.99% and 4.74% when CLTV is 80% and below (If Prime rate changes, these rates will change – LTV 80.01 to 89.99 Prime + 1.99, CTLV below 80% is Prime + 1.49) f. Remove the Title insurance from the GFE (even though you don’t send the GFE to the borrower on a HELOC, the fees will prefill in fairly accurately so you know what amount the borrower will be charged & you can add to your 1st Mtg GFE , if not sent yet) RESPA on the 2nd mortgage is put on Compliance calendar, specify that this is a HELOC 2nd with TCF Compliance will send to the borrower only the HELOC Brochure (attached), the Command Credit Disclosure (attached) & the Notice & Authorization (attached) & attach to the 2nd mortgage file Image Cabinet We ask the borrower to sign the Command Credit Disclosure & Notice & Authorization required by the investor Once you have the signed documents, the Processor completes the submission form & TCF worksheet (attached) The Processor submits these completed forms and all required documents on the checklist to TCF at RLUeast@tcfbank.com TCF sends their own disclosures again to the borrower TCF underwrites the file Underwriting at Equity Resources underwrites the 1st mortgage here and stips for copy of 2nd mortgage closed loans documents as a closing condition TCF will give us an approval with a list of required documents, TCF will use our appraisal and this will be on their list of documents TCF issues final approval and sends us a Mtg Broker Svcs disclosure that the LO is required to sign TCF submits the closing documents to the title company Our title company closes our 1st mortgage and this 2nd mortgage. No fees to Equity Resources appear on the HUD1 for the 2nd mortgage HELOC We required a copy of the 2nd mortgage closed loans documents and we will request these from the Title company when we send 1st mortgage docs TCF sends us a check 45 to 60 days after closing a min $250 to $750 depending on max line amount. This does not appear on the HUD1 settlement statement. We pay LO Comp of $250 per 2nd mortgage closed – a new agreement needs signed by the LO prior to their first HELOC piggyback loan Rate lock desk and Cindi items listed above still need done