Walgreens Strategy – Current Direction - The Co

advertisement

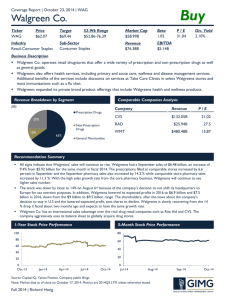

Strategy Assessment and Recommendations Michael Aplington Melissa Connolly Shelly Hennig Michael Holpe Michelle Shah Dilip Trivedy 11/29/2012 MGMT 590 Strategic Management Fall 2012 University of Illinois at Chicago Contents Introduction ..................................................................................................................................... 1 Retail Drugstore Industry................................................................................................................ 1 Prescription Drugs..................................................................................................................................... 2 Walgreen’s Resource Analysis ....................................................................................................... 2 Physical Assets .......................................................................................................................................... 2 Financial Resources ................................................................................................................................... 3 Walgreens Strategy – Current Direction ......................................................................................... 4 Leveraging the Medical Staff .................................................................................................................... 4 Expanding Take Care Clinics ...................................................................................................................... 5 Advancements in Information Technology ............................................................................................... 5 Walgreens Strategy – Moving Forward .......................................................................................... 6 Affordable Care Act (ACA)......................................................................................................................... 6 Partnerships with Affordable Care Organizations: ................................................................................... 7 In-Patient Transitions and Outpatient Pharmacies................................................................................... 9 Well Transitions ...................................................................................................................................... 10 Outpatient Pharmacies ........................................................................................................................... 11 Pharmacy Benefit Manager Business: .................................................................................................... 11 Strategic Uncertainties and Risks ................................................................................................. 13 Politics and the Changes in Healthcare Law ........................................................................................... 15 Increased Provision of Clinical Services .................................................................................................. 17 Financial Uncertainties............................................................................................................................ 18 Competition ............................................................................................................................................ 19 Other General Uncertainties ................................................................................................................... 20 Conclusion .................................................................................................................................... 21 Works Cited .................................................................................................................................. 22 Page |1 Introduction Walgreens is the largest retail drugstore chain operating 8210 locations that include drugstores, worksite health and wellness centers, infusion and respiratory services facilities, specialty pharmacies and mail service facilities. (Walgreens, 2011) Walgreens offers its products and services through drugstores, as well as through mail, by telephone, and via the Internet. Retail Drugstore Industry The retail drugstore industry is highly competitive. Competitors in this industry include retail drugstore chains, independently owned drugstores, supermarkets, mass merchandisers, discount stores, dollar stores and mail order pharmacies. The largest retail drugstores in the US are CVS Caremark Corporation, Walgreen Company and Rite Aid Corporation. Together they account for 43.5% of the pharmacy market. All three generate revenue by three product classes: prescription drugs, non-prescription drugs and general merchandise. Prescription drug sales account for roughly two-thirds of all revenue for each of the three largest retail drugstores. 2011 Retails Stores Clinics Net Income Sales Revenue Revenue by product class Prescription Drug Non-Prescription Drug General Merchandise Walgreens 7,761 355 $2.71B $72.2B CVS 7,300 549 $3,56 $107.1B Rite Aid 4,665 14 ($55.5)M $25.21M 65% 10% 25% 68% 11% 21% 68% 9% 23% Retail Drugstore Major Competitors Page |2 Prescription Drugs In 2011, the US retail pharmacy business generated $273.4 billion in revenue. The pharmacy business is divided into two segments based on dispensing method. The first segment, traditional brick and mortar retail pharmacies, relies on customers who go to a physical location to purchase their prescriptions and consists of CVS, Walgreen Company, Wal-Mart Stores, Inc. and Rite Aid Corporation. The second segment, mail order Pharmacy Benefit Managers (PBM), relies on customers who receive their prescriptions through the mail and consists of CVS Caremark Corporation and Express Scripts Holding Co. Company CVS Caremark Corporation Walgreen Company Express Scripts Holding Co. Wal-Mart Stores, Inc. Rite Aid Corporation 2011 Prescription Revenue (in billions) $56.6 $45.1 $39.7 $17.4 $17.1 Market Share 20.7% 16.5% 14.6% 6.4% 6.3% Pharmacy Market Share – Top Five Companies (Adam J. Fein, 2012) Walgreen’s Resource Analysis Walgreens is market leader with a multitude of resources including strong physical and financial assets. The combination of these many resources lends to consistently strong performance and overwhelming success. Physical Assets With over 8,000 locations, the sheer number of stores is one of Walgreens’ strongest assets. The location of the drugstores adds to the strength of this resource. Walgreens strategically places their stores at locations convenient to their customers like a busy intersection. Location Type Drugstores Worksite Health and Wellness Centers 2011 7,761 355 2010 7,562 367 2009 6,997 377 Page |3 Infusion and Respiratory Services Facilities Specialty Pharmacies Mail Service Facility 83 9 2 101 14 2 105 15 2 Total 8,210 8,046 7,496 Number of Locations Walgreens’s Take Care clinics are conveniently located at drugstores, hospitals, medical centers and employer worksites. Walgreens has locations in every region of the US. Their nationwide presence builds brand recognition throughout the country and helps cement brand loyalty among customers. Financial Resources Walgreens’ strong financial position is a significant resource. With 37th consecutive years of record sales, they have the financial strength and flexibility to pursue the current strategy and modify the direction of the company when needed. Walgreens also has the available capital to add and/ or update their locations to keep up with consumer demands. Furthermore, their strong balance sheet allows them to recruit and maintain superior talent to run their organization. 2011 was a strong financial year for Walgreens. Disciplined focus on the core business strategy resulted in new records sales of $72.2 billion in fiscal 2011 with a gross profit of $20.5 billion and earnings per diluted share of $2.94. Prescription sales increased 6.3% in 2011. Page |4 Walgreens Strategy – Current Direction Walgreens broad strategy is to advance the role community pharmacies play in the healthcare of Americans. By expanding the scope of their “convenience-based healthcare services”, Walgreens is attempting to transform their role from a traditional retail “drugstore” into a one-stop shop for “health and daily living”. In enacting this change, Walgreens hopes to leave their direct competition (i.e. CVS and Rite-Aid) behind to compete with one another in the old drugstore format. Walgreens has named the theme of this revolution, the Walgreens “Well Experience”. To achieve this transformation, Walgreens has adopted three key strategic objectives: 1) Extend deeper into “healthcare provider” space by leveraging the capabilities of medical staff 2) Increase the footprint and impact of Take Care Clinics across the US 3) Upgrade information technology to improve the customer experience and build loyalty Leveraging the Medical Staff Walgreens first introduced the “Well Experience” theme in 2011 and rolled out a new store format. The new design moves the pharmacy, which was traditionally located in the back of the store, to front and center of the store and gives it a more “open” feel. The goal is to enhance patient-pharmacist interaction and encourage face-to-face conversation by moving these professionals out from behind the counter. Walgreens plans to invest in credentialing pharmacist in disease management, provide training in patient consultation and require that their pharmacists are certified immunizers. Creating the “Well Experience” also expands store inventory to include fresh, healthy foods. By creating the “Well Experience”, Walgreens hopes to grow its retail Page |5 pharmacy business, improve health, prevent hospitalizations and save money for patients, employers, insurers and the health care system as a whole. Expanding Take Care Clinics The second key strategic initiative of Walgreens is growing the footprint of their Take Care Clinic chain. The goal of the Take Care Clinic is to provide “personalized, quality healthcare, made-easy”. The clinics are designed to prevent patients from making expensive emergency room visits when their traditional physician’s office is closed or when they don’t have one. By increasing the number of Take Care Clinics in its 7,900 US drugstores would play to one of Walgreens greatest strengths as nearly two-thirds of the population of the USA lives within three miles of a Walgreens store. Advancements in Information Technology The third key strategy of Walgreens is the advancement of their information technology. The company’s most recent series of upgrades have really defined their aggressiveness in this category. In strengthening their multi-channel strategy through investments in e-commerce and mobile technology, Walgreens will continue to build the customer experience and customer loyalty. As part of upgrading stores and creating the “Well Experience”, Walgreens is rolling out a new point-of-sale system across the chain that will help to improve the speed of service and reduce costs. The new system allows for the implementation of the new Balance Rewards program aimed at building customer loyalty and is capable of reading two-dimensional barcodes on mobile phones for coupon and special redemption, a feature very few retailers are currently offering. Page |6 Walgreens has also made major improvements to the company’s presence on the web. Walgreens.com visitors can now chat with a pharmacists online, manage and refill prescriptions, and have them delivered to their front door, free of charge. Through their acquisition of Drugstore.com, Walgreens has added an e-commerce user base of three million customers and website that offers 75,000 household, health, beauty, vision and skin care products. Walgreens is making major steps toward online/offline integration with the company’s Web Pickup pilot program. The Web Pickup service allows customers to go online, see a store’s inventory in real time, order what they need and pick-up in person in less than an hour, usually without even leaving their car. Walgreens recently released an award-winning mobile app. Customers can order prescriptions or regular good via their smartphone and have them delivered to their home, sometimes free of charge. Nearly half of all prescription refills done online are coming through the mobile channel. The company has also invested in a separate app to assist with in-store navigation and creating a shopping checklist. Walgreens Strategy – Moving Forward The US Healthcare Industry is changing. Walgreens has a unique and timely opportunity to become a key player in the new regulations and processes that are soon to change the industry. Our strategic suggestions focus on Affordable Care Organizations, in-hospital consulting and PBM partnership or aquisition. Affordable Care Act (ACA) Health care costs in the United States are quickly becoming unsustainable, having doubled in the last decade. In fact, total spending approached $2.6 trillion in 2010 alone, accounting for 17.9% Page |7 of the nation’s Gross Domestic Product (Nussbaum). The lack of coordination of care for patients with multiple chronic conditions often results in incomplete care, duplicate care, and an increased risk of suffering medical errors. In March of 2010, President Obama signed the Affordable Care Act (ACA). The ACA includes a number of policies to help physicians, hospitals, pharmacists, and other caregivers improve the safety and quality of patient care and make health care more affordable. By focusing on the needs of patients and linking payments to outcomes, these delivery system reforms will help improve the health of individuals and communities and slow cost growth. (CMS.gov. (2012) With the introduction of the Affordable Care Act, there is a huge opportunity for Walgreens to become the market leader, and in more ways than one. In addition to the growing population and the aging Baby-Boomers, the Affordable Care Act is expected to create tens of millions of new patients needing health care across the country. This will create a greater need for the services of Walgreens pharmacists, nurse practitioners, and physician’s assistants. By focusing on forging strategic partnerships with two specific types of organizations - Affordable Care Organizations (ACOs) and Pharmacy Benefit Managers (PBMs) – and by further engraining themselves in the in-patient consultation process, Walgreens can continue to grow and ensure success over the long-term. Partnerships with Affordable Care Organizations: Healthcare is in a state of rapid and complete transformation. With implementation of the Affordable Care Act (ACA), there are several distinct opportunities for healthcare providers and healthcare companies to make strategic changes that will likely yield significant financial returns. One significant change resulting from the ACA is the change in payment structure from Page |8 fee-for-service to outcomes-based reimbursement (HealthCare.gov, 2012). This means that healthcare providers will no longer be reimbursed on the imaging, labs, testing, and consultations they provide; rather, they will be reimbursed on the actual outcome of the patient. This is a change that will demand collaboration among healthcare providers and patient follow-up that until now has not been a focus. As a result of the change in reimbursement structure healthcare providers have started forming Accountable Care Organizations (ACO’s). ACO’s typically consist of a group of hospital-affiliated practitioners across specialty areas. These groups take responsibility for patient outcomes and as a result must collaborate in order to assure positive outcomes for their patients. Providers within an ACO must have channels for effective communication in order for providers to communicate the current plan of care for the patient and establish follow-up measures (HealthCare.gov, 2012). The pioneers in ACO formation have not found an efficient way to manage patient’s medication therapy. Management of medication includes reconciliation of inpatient and outpatient medications as patients are discharged from the hospital as well as following-up with patients to assure that prescriptions have been filled and are being taken as directed (Diagle, 2012). Walgreens is in a position to address medication therapy management of patients in an ACO environment. The company could position itself as the provider responsible for reconciliation, dispensing, education, and follow-up in terms of medication management for these patients. This initiative would require the company to hire additional staff and likely utilize current staff members in different ways; however the benefit would be substantial. Page |9 Patients receiving medication reconciliation, education and follow-up from a Walgreens pharmacist will likely have better outcomes compared to patients who do not have the services available to them (Diagle, 2012). These services will be desired by ACO’s as they are reimbursed based on outcomes. Walgreens will pitch these benefits to currently functioning ACO’s as well as ACO’s currently in formation. The company will require participating ACO’s to e-prescribe all patient prescriptions to Walgreens, where the patient will then pick-up the medications and receive consultation. The patient’s Walgreens pharmacist will be responsible for following-up with patients within one week to inquire about proper adherence to medication regimen as well as document any reported side effects, adverse effects, or allergies. The Walgreens pharmacist will document this interaction in the patient’s chart, which is visible by all other practitioners participating in the ACO. The Walgreen’s pharmacist will also be responsible for following-up with patients if refills are not picked-up, this follow-up will also be documented in the patient’s chart. Walgreens would recognize an increase in prescription volume as well as increased revenue from medication therapy management services, as they are able to bill insurance companies for this service. This initiative would also allow for an ACO to function as a complete collaboration among healthcare providers, which is an overarching goal of ACO formation. Overall, this initiative would be advantageous for ACO’s and Walgreens. In-Patient Transitions and Outpatient Pharmacies Preventable hospital readmissions cost the healthcare system and estimated $25 billion annually (O’Reilly, 2011). As part of the Affordable Care Act, Medicare penalties will be enforced against hospitals that discharge patients and then readmit them within 30 days at too frequent of a rate. These hospitals are already looking at up to $280 million in penalties as a result (Harry, P a g e | 10 2012). Walgreens has the opportunity to position themselves as an in-hospital partner to ensure discharge transitions are effective. In doing so, they establish themselves as the patient’s trusted partner for post-hospital care as well as a valuable financial partner for the hospital system. This can be accomplished with two strategic initiatives: WellTransitions and outpatient pharmacies. Well Transitions In October, Walgreen’s announced the WellTransitions program, an initiative designed to reduce readmissions by using pharmacists to coordinate patient care during admission and discharge. Walgreen’s associates will be on hand at hospitals to provide up to date patient to hospital staff when a patient is admitted. When the patient is discharged, the pharmacist is there during the consultation to ensure that the transition is smooth and to answer patient questions. This takes the burden of medicine reconciliation off of the patient and the medical staff. They also provide bedside medication distribution and direct follow up with the patients 9 days and 25 days after discharge. Medication refill data and patient updates can be shared with primary care physicians seamlessly (Fellow, 2012) There are currently 12 hospitals participating in the program and all are reporting significant reductions to their readmission rates. The cost for the program and resources are covered by the reduction of fees and penalties through healthcare reform. Patients are also satisfied with the program and they are more likely to participate because they recognize the brand as one they trust. Expansion of this program will be beneficial to the future of Walgreens. It engrains them in the healthcare process and expands their role as a trusted advisor. CVS Caremark is partnering with a third party, DoveTail Health, to provide similar transition service. As with everything between the competitors, if Walgreens doesn’t jump on this, CVS will. P a g e | 11 Outpatient Pharmacies Another initiative that warrants expansion is in-hospital pharmacy facilities. Currently Walgreens operates 100-plus hospital pharmacy locations across the country. Patients can have their prescriptions filled on-site before they are discharged. The prescription is them connected to one of the 8,000-plus community pharmacies, enabling continuity in prescription management from in-patient to out-patient treatment. The in-hospital location also allows the pharmacist to work directly with medical staff to carry out custom prescriptions or complex treatment plans. The pharmacists can work hand in hand with the hospital to reduce costs, reconcile and align medications, ensure accurate first-fills and improve medication possession ratios – all of which help reduce readmissions and potential financial penalties. A stronger connection between inpatient and outpatient settings improves outcomes and reduces costs (Walgreens, 2011). Pharmacy Benefit Manager Business: Pharmacy Benefit Managers (PBMs) are middlemen between its customers – managed care organization, insurers, government agencies, corporations, unions - and drug companies. PBMs offer a number of services such as design and administration of the drug benefit coverage plan, negotiate drug pricing and other terms with participating drug stores, buy drugs directly from the drug manufacturers and distribute them by mail order, and prescription management. Stand-alone retail drug stores and PBMs are being forced to fundamentally change their business models due to a reduction in the number of blockbuster drugs, shorter product lifecycles and design cycles, low barriers to entry and reproduction of efficient distribution systems by the competitors. Many of these companies are losing their strategic competitive advantage and are seeking the next big thing to rejuvenate their sales. P a g e | 12 PBM business provides synergies to the retail drug store business. Customers can obtain their medications from either a retail pharmacy or a mail-order pharmacy. This model provides customers a choice for pharmacy channel – retail or mail. CVS Caremark has achieved a greater share of prescription revenues through integrated offerings of PBM business and retail pharmacy. For qualifying participants, “Maintenance Choice” program provides the option of filling their 90-day maintenance prescriptions by mail or at one of the retail locations at the same co-pay and pricing as mail order, which is very difficult for a standalone PBM or retail pharmacy to offer. More than 10 million members have adopted Maintenance Choice program as of January 2012. (CVS Annual Report) Year Retail Pharmacy net sales (in billions) 2011 $59.6 2010 $57.3 2009 $55.3 Net Retail Sales through PBM (in billions) $11.3 $8.7 $7.7 % Retail Pharmacy sales due to PBM % Increase in retail sales due to PBM 19% 15% 14% 4% 1% CVS Caremark Retail Pharmacy Sales As per CVS Caremark’s 2011 financial statement, PBM business has contributed 14%, 15% and 19% towards retail sales in for the years 2009, 2010 and 2011 respectively. Moreover, there is steady year over year increase in the share of retail pharmacy sales due to PBM. Walgreens sold its pharmacy benefit management business, Walgreens Health Initiatives, Inc., to Catalyst Health Solutions, Inc. in 2011 and negotiated partnership with standalone PBMs such as Medco and Express Scripts. Failure to renew contract with Express Scripts-Medco had resulted in big loss of revenue for Walgreens. Prescription sales fell 9.9% in the quarter ended May 31 2012, compared to a year earlier, and they slipped 3.9% year-over-year in the prior P a g e | 13 quarter. Its earnings fell about $113 million over the course of those two quarters due to the Express Scripts contract termination (CNN Money). In spite of Walgreens reaching a deal with Express Scripts early in Q3 2012, CVS expects to retain at least 50% of the customers it gained as a result of poaching customer through an aggressive discounts program (Seeking Alpha). Express Scripts Holding (post Medco merger) and CVS Caremark controlled about 32% and 17% of the prescription-drug market share respectively in the first quarter of 2012, according to Atlantic Information Services Inc., a health-care information company that tracks PBM market share (Wall Street Journal). Express Scripts Holding is the nation's third-biggest pharmacy operator, trailing only CVS Caremark and Walgreens. Above analysis clearly indicates the effect of PBM business on retail drug stores and resulting increase in share of prescription revenues from claims processed by PBM business. With increase in number of insured population once Affordable Care Act (ACA) becomes fully effective in 2014, PBMs will gain even more market share through their role in administrating the expanded prescription drug plans. Given the risk of partnering with standalone PBMs such as Express script, competitive threat due to consolidation of PBMs, future growth in PBM business due to ACA and success of CVS Caremark merger, we would recommend Walgreens building its own PBM business either ground up or through acquisition. Strategic Uncertainties and Risks P a g e | 14 Walgreens was built on a model of organic growth while maintaining solid financial stability. The company has paid a high dividend to investors for almost 80 straight years. But now the company is faced with an evolving pharmaceutical industry, intense competition, and few prospects for expansion in the saturated US market. To continue to satisfy investors, Walgreens needs to look elsewhere to find growth. In implementing their strategy for continued growth, Walgreens will venture deeper into healthcare provider space, partnering with Accountable Care Organizations and Pharmacy Benefit Managers to seek greater revenue and profitability as the sweeping reforms of the Affordable Care Act are made the law of the land. Why would Walgreens expose themselves to so much risk by moving further into the volatile healthcare provider business despite its ambiguous future? One reason is that they believe they can exploit these risks, take advantage of growth opportunities and generate value for their shareholders. Unfortunately, it’s just not that simple. Substantial political and economic uncertainty lie ahead for the healthcare industry as the new laws of the Affordable Care Act are implemented. To be successful in their strategy of expansion, Walgreens must develop an acute understanding of the major risks they face in this new territory and create real options to mitigate these risks. By moving upstream in the healthcare supply chain, partnering with ACOs and acquiring its own PBM, Walgreen is taking on much greater risk than it faced in its previous position in the marketplace. Taking on this risk can yield two results: positive consequences- higher excess returns and sustained growth, or negative consequences- volatile earnings, a higher cost of capital, and potential bankruptcy. Good risk-taking is like a call option. It allows you to expand your exposure to upside risk (potential benefits), while limiting your downside risk (potential losses). Of course, creating these ideal conditions is much easier said than done. It is inevitable P a g e | 15 that Walgreens will meet unexpected challenges as it further embeds itself in the healthcare business. By understanding the risks, preparing adequately and responding definitively when conditions change and challenges appear, Walgreens will not only “survive the storm” but be positioned to take advantage of future opportunities as they present themselves. As Walgreens moves deeper into healthcare provider space partnering with ACOs, acquiring a PBM, expanding the number of Take Care clinics, in-store and worksite wellness centers, and on-site pharmacies, the company will need to understand, anticipate and minimize the risks associated with: Politics and the Changes in Healthcare Law (Affordable Care Act) Increased Provision of Clinical and Pharmacy Services Financial Uncertainties Competition Other General Uncertainties Politics and the Changes in Healthcare Law Our recommendations for Walgreen’s strategy for growth are contingent on the continued implementation of Affordable Care Act. During the 2012 federal election cycle there were numerous claims by the Republican presidential candidate, Mitt Romney, that if elected, he would repeal the Affordable Care Act. Since Barack Obama was successfully re-elected on November 6, 2012, Walgreens can be reasonably certain that Affordable Healthcare Act will move forward without risk of being repealed. However, nothing is ever certain in politics and the ACA has proven to be a very controversial law. As the healthcare reforms are enacted, it is almost certain that an abundance of legal challenges be forthcoming from the law’s many opponents. P a g e | 16 Walgreen must keep a careful watch on any discussion of possible changes to the law and adjust their strategy to align with the changes. This is especially true when planning for the long-term. Although we are assuming that the ACA will move forward as scheduled on the timeline ending in 2014, the future over the long-term is uncertain. There is the possibility that the new system will fail or be wildly unpopular. There is also the possibility that the law will be so successful that the government will dramatically increase healthcare benefits for American citizens. What is certain is that the state of healthcare in the United States is changing rapidly and Walgreen’s strategy must provide the flexibility to adapt to any possible alterations, improvements or reductions in healthcare benefits. Future laws and regulations will affect ACOs and PMBs either positively or negatively. Since our strategy is to form partnerships with ACOs and acquire our own PBM, Walgreens must be highly aware of any alterations and how they will affect the ACOs, PMBs and healthcare in general. For instance, part of our strategy is to secure some of the funding allocated to the ACO’s with whom we plan to partner. Walgreens must not put itself in the position that they will take financial hit if funding is no longer available. Also, the PMB market has always been carefully watched and regulated by federal and state government agencies. If Walgreens successfully acquires a PBM of their own, they must make sure they follow all government laws and regulations. Failure to do so will result in potential fines and costly legal battles. As previously mentioned, depending on the success of the ACA, the government may significantly increase or decrease health care benefits it provides to the public. Walgreens must be prepared to compensate for any losses it may incur as a result of these changes. For example, if the federal government suddenly provides certain services or medications cost free to citizens, P a g e | 17 Walgreens stands to lose significant revenue if they currently profit from them. On the flip side, if funding is cut and certain benefits are dropped from the health care act, Walgreens must be ready to provide those dropped benefits affordably and conveniently. Increased Provision of Clinical Services Partnering with ACOs and pushing the expansion of Take Care clinics, in-store and worksite wellness centers, and on-site pharmacies could expose Walgreens to significant strategic risk and finance risk. If strong partnerships with ACOs fail to materialize or regulations are enacted that restrict the types of care that can be provided by the company’s nurse practitioners and pharmacists, Walgreens could be left with empty and overstaffed clinics and wellness centers. Essentially anytime an organization is subject to government regulations and procedures, risk exposure is increased, as environmental changes can call for significant adjustments to systems and operations. Furthermore, by increasing the number of clinics and wellness centers, Walgreens will be increasing its exposure and liability for medical malpractice cases. Through its partnerships with ACOs, acquisition of a PBM, along with deploying more clinics and wellness centers, Walgreens will be diagnosing and treating significantly more patients and dispensing more drugs than it did in the past. This larger volume of patients not only increases the potential for revenue, it increases Walgreen’s exposure to lawsuits resulting from misdiagnosis, mistreatment, or harmful drug interactions. Walgreens will need to be vigilant in managing malpractice liability risk through increased training and oversight and maintaining state-of-the-art patient and treatment record keeping systems using the latest technology. P a g e | 18 Financial Uncertainties Implementing Walgreens strategies for growth in time to take advantage of the 2014 market surge ignited by the Affordable Care Act of 2010 will require significant funding. Cash provided by operations is the principal source of funds for these capital expenditures (WAR). There are several uncertainties, both internal and external, that could decrease the amount of cash provided by operations. Any reduction in cash would make it very difficult for Walgreens to implement our growth strategies. Walgreens cash flows will be impacted most significantly by the performance of their acquisitions and utilization of generic drugs to fill prescriptions. Over the past three years, Walgreen's has spent $8.55 billion on four business acquisitions (WAR, W-news). The first two acquisitions, totaling $1.40 billion, reported a net loss for 2011 and had decreasing cash flows compared to 2010 figures (WAR). The third acquisition, a $6.7 billion investment ($4 billion in cash and $2.7 billion in stock) for 45% ownership of the Alliance Boots pharmacy chain, also reported decreasing cash flows for 2011 compared to 2010 (W-news). If these acquisitions consume more cash than they generate, Walgreens risks not having the cash and resources needed to implement our strategies to maximize the profitability of the enlarged healthcare and pharmacy markets come 2014. In addition, it is also possible that Walgreens could generate less cash from operations due to more conversions to generic prescription drugs (generic drugs introduced to the market for the first time) over the next three years. Generic prescription drugs “heavily impact sales and profit” and accounted for 74% of prescriptions filled by Walgreens in 2011 (WAR). If there are significantly more generic conversions over the next three years, sales will decrease (albeit profit margins will increase) as generic drugs are cheaper than their brand name counterparts. P a g e | 19 Competition The retail prescription drug market is extremely competitive. In order to extract maximum value from their growth strategies, Walgreens needs to anticipate the moves of their competition and stay a step ahead. Two competitors in particular, the retail drugstore CVS and the Express Scripts PBM, comprise the most risk to the success of Walgreen's strategy. As the market leader in the retail drugstore sector, CVS poses the largest threat to Walgreens growth as the company generates larger earnings and more cash flow from operations. Unlike Walgreens, CVS has not invested heavily in business acquisitions. This has resulted in more resources and free cash to invest elsewhere. CVS operates nearly 200 more in-store wellness clinics than Walgreens (AMA). This provides CVS with a significant advantage as they will be in position to capture a higher percentage of the new market expansion. Right from the start, CVS has the ability to serve more customers at in-store clinics and can focus more resources on expansion. Furthermore, as a result of the contract dispute between Walgreens and Express Scripts in 2011, a large percentage of Express Script clients stopped using Walgreens pharmacy services because they could not get their prescriptions filled. A significant number of those who left took their business to CVS. Even though the dispute between Walgreen's and Express Scripts has been resolved, CVS estimates that they will retain 60% of the customers that left Walgreens (CC). Although projections vary on the exact amount of customers who left Walgreens for CVS, this is worrisome for Walgreens because before the dispute Express Script customers represented $5.3 billion of Walgreen's $72.2 billion sales or 7.34% (WAR). Express Scripts also poses a threat to Walgreen's hopes for growth. Besides offering their customers the option of filling prescriptions through retailers like Walgreens, CVS, and others, Express Scripts encourages customers to fill their prescriptions directly through Express Scripts P a g e | 20 via mail order. Express Scripts recently merged with Medco to form the largest mail order prescription business in the US. If Express Scripts continues to not only grow their market share but grow the percentage of their customers that exclusively use the mail order service, they will steal significant business from Walgreens and leave them with less resources available to take advantage of the larger market in 2014. Also not helping this situation is Walgreen's strained relationship with Express Scripts in the wake of the aforementioned contract dispute. Other General Uncertainties In addition to the specific risks identified above, Walgreens also faces general business risks such as the overall economic environment and consumer sentiment. Changes in the global economic climate such as prolonged recessions in the US or Europe could adversely affect the healthcare industry’s financial strength, the government’s health care initiatives, and consumer buying habits. All of these would affect Walgreens potential for revenue and profitability. Because Walgreens has a large and diverse customer base (not a single customer accounts for more than 10% of revenue), the company’s general business risk is relatively spread out. Although competition in the retail drug industry is escalating from all angles (websites, mail orders, grocery and discount stores), Walgreen’s solid reputation, brand recognition, and multiple channels for reaching customers position the company to remain an industry leader. In recent years, Walgreens has begun taking a more proactive approach to risk management in preparation for their next phase of growth. The company recently installed their first Chief Risk Officer (CRO) and began tracking specific performance measures as leading indicators of increasing risk. The healthcare reforms brought on by the ACA will without a doubt significantly impact the environment in which Walgreens operates. As the company moves forward implementing their strategies, partnering with ACOs and acquiring a PBM to increase P a g e | 21 service and prescription sales, they must focus on creating the real options that allow them to limit exposure to downside risk and increase upside risk, generate greater revenues, profitability and growth. Conclusion Throughout this in-depth analysis of Walgreens’ strategy, one thing remains clear: they are on the right path. They are financially solid, have a strong brand with increasing reputational capital and their business is evolving with the help of technology. They are expanding internationally to keep up with the global market. Most importantly, they are in tune with their industry, their markets and their consumers. By continuing to forge strong partnerships, adapting to the changing environment, and managing risks and uncertainties, Walgreens is poised to continue their success for years to come. P a g e | 22 Works Cited Walgreens. (2011). Walgreens Annual Report. CVS. (2011). CVS Annual Report. Nussbaum, Alex. (2012, May 20). Health-Care Costs Rise Faster Than U.S. Inflation Rate. Retrieved from: http://www.bloomberg.com/news/2012-05-21/health-care-costs-rise-faster-thanu-s-inflation-rate.html CMS.gov. (2012, May 1). Retrieved from: https://www.cms.gov/Regulations-and Guidance/Legislation/EHRIncentivePrograms/index.html?redirect=/EHRIncentivePrograms/ HealthCare.gov. (2012, March 12). Accountable Care Organizations: Improving Care Coordination for People with Medicare. Retrieved from: http://www.healthcare.gov/news/factsheets/2011/03/accountablecare03312011a.html. Johnsen, M. (2012). Drug Store News. Retrieved Oct 4, 2012, from dsn.com: www.drugstorenews.com/print/466196 Useem, J. (2001, Feb 19). Most Admired: Conquering Vertical Limits. Fortune , pp. 84-96. PBM 101 by Mike Medel with Pharmaceutical Strategies Group Walgreens Newsroom Article 1: http://news.walgreens.com/article_display.cfm?article_id=1046 Walgreens Newsroom Article 2: http://news.walgreens.com/article_display.cfm?article_id=5537 Drug Store News Article: http://www.drugstorenews.com/article/walgreens-outlines-five-keystrategies-change-pharmacy-retail-industry Ernst & Young Article: http://www.ey.com/GL/en/Industries/Life-Sciences/Walgreens-strategictransformation Diagle, Lisa. “Pharmacists’ Role in Accountable Care Organizations.” Jan. 2011. Web. 20 Oct. 2012. <http://www.ashp.org/doclibrary/advocacy/policyalert/aco-policyanalysis.aspx.>. CNN Money- http://money.cnn.com/2012/07/19/investing/walgreens-express-scripts/index.htm P a g e | 23 Seeking Alpha – http://seekingalpha.com/article/979061-watch-for-walgreen-express-scripts-impact-in-cvscaremark-earnings Wall Street Journal http://online.wsj.com/article/SB10001424052702303816504577319372702722002.html AMA: “CVS retail chain clinics expand while Walgreens operation stalls” by Pamela Lewis Dolan, 1/23/2012, American Medical Association CC: “CVS bullish after snatching some of Walgreen’s customers” by Zoe Galland, 11/6/2012, Crain’s Chicago Business