week_7_reading_material_gf

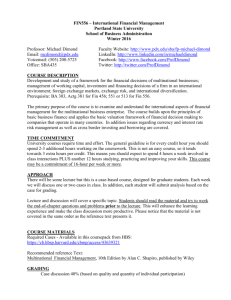

advertisement