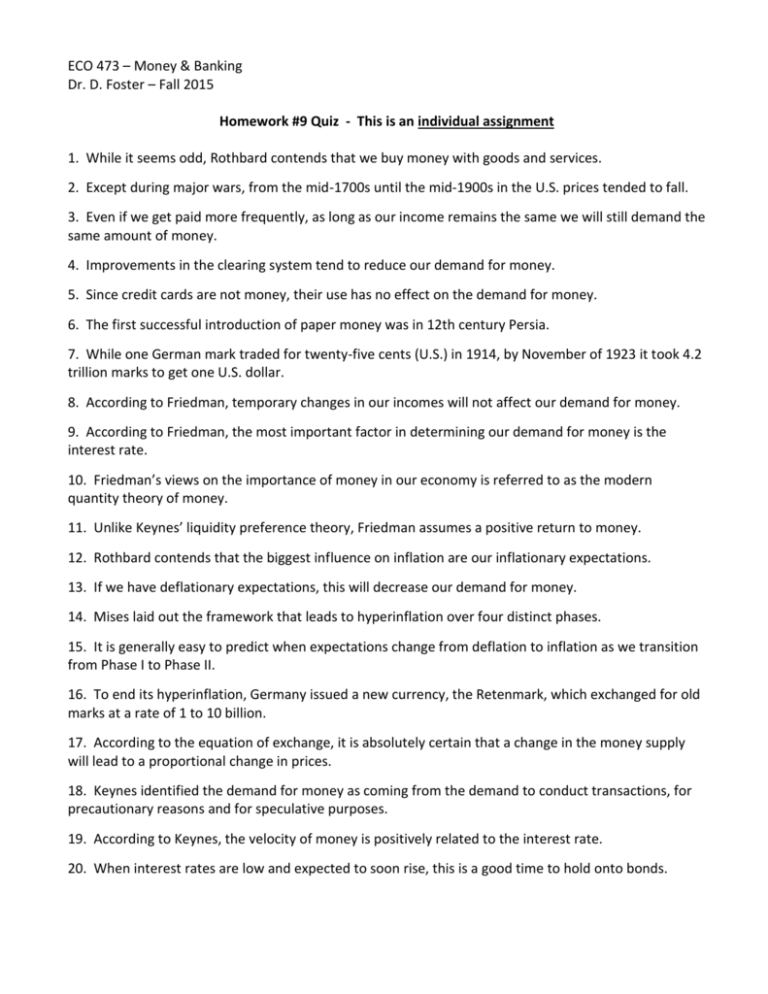

Money & Banking Homework Quiz - ECO 473

advertisement

ECO 473 – Money & Banking Dr. D. Foster – Fall 2015 Homework #9 Quiz - This is an individual assignment 1. While it seems odd, Rothbard contends that we buy money with goods and services. 2. Except during major wars, from the mid-1700s until the mid-1900s in the U.S. prices tended to fall. 3. Even if we get paid more frequently, as long as our income remains the same we will still demand the same amount of money. 4. Improvements in the clearing system tend to reduce our demand for money. 5. Since credit cards are not money, their use has no effect on the demand for money. 6. The first successful introduction of paper money was in 12th century Persia. 7. While one German mark traded for twenty-five cents (U.S.) in 1914, by November of 1923 it took 4.2 trillion marks to get one U.S. dollar. 8. According to Friedman, temporary changes in our incomes will not affect our demand for money. 9. According to Friedman, the most important factor in determining our demand for money is the interest rate. 10. Friedman’s views on the importance of money in our economy is referred to as the modern quantity theory of money. 11. Unlike Keynes’ liquidity preference theory, Friedman assumes a positive return to money. 12. Rothbard contends that the biggest influence on inflation are our inflationary expectations. 13. If we have deflationary expectations, this will decrease our demand for money. 14. Mises laid out the framework that leads to hyperinflation over four distinct phases. 15. It is generally easy to predict when expectations change from deflation to inflation as we transition from Phase I to Phase II. 16. To end its hyperinflation, Germany issued a new currency, the Retenmark, which exchanged for old marks at a rate of 1 to 10 billion. 17. According to the equation of exchange, it is absolutely certain that a change in the money supply will lead to a proportional change in prices. 18. Keynes identified the demand for money as coming from the demand to conduct transactions, for precautionary reasons and for speculative purposes. 19. According to Keynes, the velocity of money is positively related to the interest rate. 20. When interest rates are low and expected to soon rise, this is a good time to hold onto bonds. Name: ECO 473 – Money & Banking Dr. D. Foster – Fall 2015 Homework #9 Please use the following to record your answers and turn in with your homework: Quiz #9 1 6 11 16 2 7 12 17 3 8 13 18 4 9 14 19 5 10 15 20 Chapter summary (100 words) over Woods Chapter 6: Word count = Reaction essay (100-150 words) over Woods Chapter 6: Word count =