Types of Business

advertisement

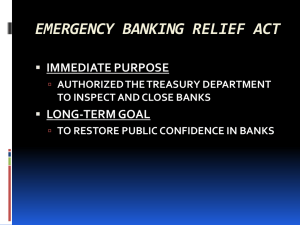

* Chapter 22.1 * 1. Sole proprietorship 2. Financial capital 3. Partnership 4. Articles of Partnership 5. Corporation 6. Charter 7. Stock 8. Stockholder 9. Board of Directors 10. Cooperative 11. Real GDP 12. Business Cycle 13. Civilian Labor Force 14. Unemployment Rate 15. Fiscal Policy 16. Inflation 17. Consumer Price Index (CPI) 18. Central Bank 19. Federal Open Market 20. Committee (FOMC) 21. Monetary Policy 22. Discount Rate Reserve 23. Open Market Operations 4 Elements of Business 1. Expenses • What you need to start & continue a business 2. Advertising • Introduction and reminder of your business 3. Receipts & Record Keeping • Needs to be accurate and dependable – for profits & losses 4. Risk (profit vs. loss) • Risk is a consequence to the advantage of being in business Considerations When Starting a Business *Establishment of inventory *Use of computers/Technology *Turbo Tax *Time – the opportunity cost. You could be working for someone else. * *There are three main types of businesses. They differ in size and in daily operations. *Sole-Proprietorship *Partnership *Corporation *3 Types of Businesses 1. Sole Proprietorship • Owned by 1 person • Easy & relatively inexpensive to start • Typically small businesses • Most common form of business • Owner receives all profits • Unlimited Liability * Advantages Disadvantages *Receive all profits *Quick decisions *Unlimited liability *Handle all decisions *Time consuming *Rely on own funds *Business depends on because no consultation *Relatively low taxes one person *3 Types of Businesses cont. 2. Partnership • • Owned by 2 or more individuals Articles of Partnership – Partners sign an agreement on what each is responsible for. • Limited Partnership o Partners are not equal o General Partner – has majority of control o Limited Partner – owns a small part of the business – does not voice opinions & is responsible only for what they put in to the partnership o LLPs (Limited Liability Partnerships) [mix of corporations and partnerships): Very popular with lawyers, accountants, and architects. • Joint Venture o temporary partnership to do a job * Advantages Disadvantages *Losses are shared *More efficient than *Profits are shared *Unlimited liability, *Pay taxes on share of *Must reach agreements *Committed partners proprietorships profit *Easier to borrow money most of the time *3 Types of Businesses cont. 3. Corporation a. Owned by many b. Started by a founder c. Owned by Stockholders d. Run by a Board of Directors e. State government issues a charter to run the business f. Complicated structure g. Business has the same rights as an individual h. Are Double Taxed – 1. Corp. pays a tax on its profits. 2. After profits are distributed to the stockholders – stockholders pay a tax on those earnings. *Founder’s responsibilities *Register with the state government for a charter *Sell Stock *Select the initial Board of Directors *Board of Director’s responsibility *Elected by Stockholders – act on behalf of the stockholders. *Supervise & control the corporation *Make all major decisions * Advantages Disadvantages *Owners do not have to *Decisions are slow. devote time to make money. *Stockholders have Interest of the board may differ from the stockholders. limited liability; they *Double taxation. Govt. only lose what they put taxes corporate profit then individual shares. in. *Individuals trained in *Stockholders have little or no say in how business is specific areas make run. decisions. *Stocks and Bonds *Stock: Individual ownership in a corporation. Shareholder receives voting rights and dividends. *Bond: Promise by a corporation to pay a stated amount of interest over a period of time. *Other Types of Businesses *Franchise – sell the name & structure of a business *Help train employees & set up the business *Franchisee – pays a start up fee & annual fee *Non – Profit – Making a profit is not the main purpose of the business *Cooperative – individual businesses that work together to benefit all members *Producer – Ex: Farmer’s Market *Consumer – Ex: PCC Natural Markets, REI *Service – Ex: Credit Unions, Utility companies *Stocks *Corporations sell stock to raise financial capital *People buy stock to make money *Dividends – a share of a corporation’s profits *Capital Gain – when stock is sold for more than it originally cost – Rule: Buy low, sell high * *Stock Indexes *Statistical measures that track stock prices over time *The ticker *Ex: Dow Jones Industrial Average (DJIA) or Standard & Poor’s (S&P) *Stock Exchanges *Stock market – where stock is bought & sold *Ex: NYSE – largest & most prestigious *Others: American Stock Exchange, Chicago Mercantile Exchange, Electronic – NASDAQ *Changes in stock prices are based on market forces of supply & demand * *Bull Market *Investors expect growth, profits high & unemployment low *Prices tend to rise *Bear Market *Investors are pessimistic, profits drop & unemployment rises *Prices fall *Changes to Stock Prices *Change in profits *Rumors (externalities) *News *Stockbroker – person who buys & sells stock * Chapter 22.3 * *1. Responsibilities to Consumers *2. Responsibilities to Owners *3. Responsibilities to Employees *4. Responsibilities to the Community Responsibilities to Consumers • • • • Sell products that are safe Products should work as promised Be truthful in advertising Treat all customers fairly * *To protect stockholders – to do this they *Reveal – making public important financial information *Transparency Responsibilities to Employees • Provide a safe workplace • Treat all workers fairly and without discrimination • * Basis of race, religion, color, gender, age, or disability * • Social responsibility – obligation to pursue goals that benefit society as well as themselves. • ex – charitable gifts, national volunteering, assisting disaster victims through relief agencies. Think about a personal experience in which a product you purchased was flawed? What did you do? Did the business try to fix the problem? * * The Business Cycle (AKA The Economic Rollercoaster) The ups and downs of the economy Alternating periods of growth & decline * Prosperity(Expansion) Boom Economy is improving Economic activity peaks Business activity is increasing Businesses work at full capacity Businesses hire more Stores sell at record workers amounts Consumers buy more *Peak: High point of boom Decline Economy slows down Production is cut down Workers are laid off Recession Lowest period for production High unemployment Low consumer spending *Trough: Low point of recession Depression: Severe recession * Peak Trough Boom Expansion/ Prosperity Decline/ Recession Recovery/ Prosperity Recession * * 1. 2. 3. 4. Boom Trough Expansion Peak * *The way the government taxes and spends money. *In a recession: *The government spends more money on public works projects in order to provide jobs. This keeps companies running and workers employed. *Provides money to people and increases demand. Producers will then increase supply. *Tax cuts: Gives people more money to spend. *The government will control peaks by increasing taxes. * *The way the government regulates the amount of money in circulation. Accomplished through raising or decreasing interest rates. The Federal Reserve (FED) is in control of monetary policy. *There are 12 district banks in the Federal Reserve. * *A decline in the value on money. *Purchasing power: Amount a dollar can buy. *Inflation is measured by the Consumer Price Index and the Implicit GDP price deflator. * *Change in price over time of a specific group of goods and services the average household uses. *Each year is compared to the average of 1982-1984. This makes the base year. *This tells us the change in the standard of living. * *Takes inflation away for year. *The base year used for comparisons is 1987. * *The total dollar value of all final goods and services produced and sold in the nation during a single year. *Value is always expressed in terms of the dollar. *Final means only finished goods. *Only new items are counted. not counted. Anything bought used is * *Consumer Goods: Goods or services bought by consumers for direct use. *Business Goods: Business purchase of tools, machines, and buildings used to produce other goods. *Government Goods: Anything bought by federal, state, and local governments. *Export: Anything sold to other countries. *Import: Anything bought from other countries. *Net Exports: The difference in what the nation buys and sells with other countries. * * Loose Money 1. Easy to borrow 2. Consumers buy more 3. Business Expansion 4. Employment increases * Tight Money 1. Difficult to borrow 2. Consumers buy less 3. No business expansion 4. Unemployment increases 5. Spending increases 5. Production This can lead to inflation This can lead to a recession decreases * *The way banks create money. *Discount Rate: Prime rate that banks can borrow money from the FED. *Reserve Requirements: Percentage of deposits that banks must hold. *Banks are free to loan out money that is not on reserve leading to expansion. * http://www.learner.org/courses/amerhistory/un its/18/video/ * *The depression begins in 1929. Black Tuesday, October 29, 1929 *By 1933, salaries decreased by 40% and hourly wages by 60% compared to 1929 levels. *The average family income fell from $2,300 to $1,600. *1930: 4 million Americans were unemployed. By 1933 the number tripled. *Bank runs – People tried to get all their cash out of banks, banks ran out of money *Many Americans marked this as the end of capitalism. Communists and Socialists fought with each other leading to the decline of this movement. Soup Kitchen Hooverville – Names of shanties (homeless towns) during the Depression (President Hoover was president * *FDR’s plan to end the depression. First had to restore faith in banks. *Began “fireside chats” insuring Americans the situation would improve. *Hundred Days: March 9-June 16, 1933. Congress passed 15 bills. Most were written by FDR. * *Glass-Steagall Act (1933): Banks could not invest in the stock market. Created the FDIC to insure deposits. *Federal Securities Act (1933): fraud. No stock market * * First Fireside Chat * *Unemployment rate: Percentage of the labor force without jobs but actively looking for work. *Unemployment reduces living standards, disrupts families, and causes a loss of self-respect. *Reaches its height during recession. * *Cyclical: Associated with the ups and downs of the economy. *Structural: Changes in the economy based on technology. *Seasonal: Based on weather. *Frictional: Based on people being terminated or looking for new jobs. *Videos *Dealing with unemployment *The Pain of Unemployment *Slow Recovery * Hailey, a worker at Ford, loses her job because of a machine that can do her job more efficiently. * Structural * Matt works at the Sugar Mountain Ski Lodge. * Seasonal * Jarret, Hailey’s friend at Ford, loses his job because of low car sales. * Cyclical * Abby is tired of working at In-n-Out Burger quits her job. * Frictional * Maddy has just graduated from college and is unemployed. * Frictional * Travi slost his job at the neighborhood swimming pool after Labor Day. * Seasonal * Mrs. Kelley is laid off due to the tight budget of ISS for 2014-2015 school year. * Cyclical * Drake loses his job as a cleaning guy because he is replace by a RoboMaid. * Structural Write a short story, play, poem, or song about a family during the great depression. Make sure to include terms and concepts we have been talking about in class! * * Ch 24.3 * *What do Banks do? *Accept Deposits *Make Loans * *Checking Accounts – *Allow customers to write checks or use check/debit cards *Used to pay bills or transfer money from 1 person to another. *Pay little or no rate of interest. *People don’t keep money in checking accounts for very long. Why? *Used to meet regular expenses. * *Savings Accounts – *banks pay interest to customers based on how much is deposited. *Certificates of Deposits (CDs) – *Require the saver to deposit money for a certain period of time. *Offer higher interest rates. *The longer the time the higher the interest rate *Making loans - One of the main principals of banks is to lend money to businesses and consumers.