Wolfe_CargoSecurity - New England Supply Chain Conference

advertisement

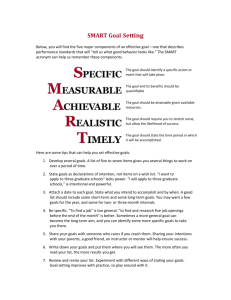

Northeast Supply Chain Conference The Dynamics of Supply Chain Security Is this the Calm Before the Storm? September 21, 2004 Michael Wolfe North River Consulting Group noriver@att.net Sources & References for Supply Chain Security, Productivity, & Technology* Security and productivity • • • • • • “Some Good News on Cargo Security” (2004) “The Dynamics of Supply Chain Security” (for the G-8, 2004) “Security must yield an economic benefit” (2003) “Supply Chain Security Without Tears” (2003, with Hau Lee) “Freight Transportation Security and Productivity” (2002) “Defense Logistics…” trends and implications (2001) Technology for security and productivity • • • • • • • • Smart Container Product and Market Reports (forthcoming, w/ HSRC) “APEC Secure Trade Project Preliminary Conceptual Plan,” (2004) “Technology Views and Issues” (2004) “Automating Security: Do E-Seals Make Sense?” (2003) “Target Capabilities for the ‘Future Smart Container’” (2003) “Technology to Enhance Freight Trans. Security & Productivity” (2002) “Electronic Cargo Seals: Context, Technologies, & Marketplace” (2002) “Trends in Freight Identification Technology” (1998) *Articles and papers by Mike Wolfe 2 Outline Cargo theft today The ‘rules of the game’ are fragile Smart containers Forecasting the market 3 Cargo Theft US cargo theft: $18 billion Global cargo theft: $50 billion Those statistics are inadequate • Law enforcement est.: ~60% is not reported • DOT report: claims, admin make total $20-$60 b. • Real cost of loss still not addressed – Sales lost to stolen goods – Disrupted customer service – Impact on brand reputation • Industry view: total cost = ~3-5x value of lost goods 4 A Better Estimate: Total Cost of Cargo Theft FBI/NCSC estimate: ~$18 billion Corrected for underreporting: ~$30 billion 3-5 X real cost adjustment: ~$90-$150 billion The total cost of US cargo theft rounds to: >$100,000,000,000 >1 % of the US GDP 5 Larger Significance of Theft and Contraband Issues Terrorism is the main threat • Potential direct losses from events • Potential indirect losses from countermeasures Cargo theft and contraband • Help educate terrorists • Help fund terrorists • Can divert security attention On the other hand…. • Reducing vulnerability to terrorism will cut into theft and contraband 6 Outline Cargo theft today The ‘rules of the game’ are fragile Smart containers Forecasting the market 7 Threats, Countermeasures, and Impacts Threats and Assessments Security Countermeasures Terrorist Events Impacts Indirect, Secondary Impacts Costs, delays, unpredictability Direct, Primary Impacts Damage & disruption Recovery Measures Emergency response Congestion & disruption 8 Potential for Self-Inflicted Wounds “How rational will ‘we’ remain after a second or third major terrorist attack?” 9 Regulatory Dynamics Threats and Assessments Security Countermeasures Terrorist Events Inherently Unstable Impacts “Next Event/ Overreaction?” Indirect, Secondary Impacts Costs, delays, unpredictability Direct, Primary Impacts What are the implications Congestion & disruption for your business? Damage & disruption Recovery Measures 10 Implications of Supply Chain Security Dynamics Micro: • You better ‘tune’ your supply chain to handle shocks from changing security mandates Macro: • Government should be acting to buffer the impact Techno: • Smart container technologies lie ahead Done right, new technology can enhance national security at the same time we enhance business performance 11 Outline Cargo theft today The ‘rules of the game’ are fragile Smart containers Forecasting the market 12 What is a Smart Container? Three main ingredients • An ISO standard “sturdy box” • Processing power • Communications There is no standard definition Goal is better visibility and control for: • Conveyances and equipment • Goods in transit Smart containers require smarter networks 13 Potential Processing Power Security sensors -- some are: • Intrusion detection • Chemical and radiological • Human presence Efficiency & quality sensors -- some are: • Temperature • Empty/partial/full load status Location determination Memory, both fixed and flexible Decision logic 14 Smart Container Communications Long range/regional/global • Satellite – global • Satellite - regional • Cellular – regional Short range/portal/choke point • Radio Frequency Identification (RFID) – Terminal gates – Container cranes – Dock doors 15 Some Attractions of Smart Container Technologies Improve chain-of-custody seal validation • Automation rather than human (non)inspection Reduce labor impacts • Cost and workload Provide container tracking information • Reduce time, cost, and service quality impact of misrouted containers 16 Supply Chains Can Make Money with Better Visibility and Control Better operating efficiency • Fleet, equipment, and labor utilization • Less wasted effort Mostly for Carrier Better operational effectiveness • More reliable customer service • Inventory savings • More flexible operations Shipment integrity • Less theft of goods and services Shipper & Carrier Shipper & Carrier 17 Examples of Potential Benefits Smart and Secure Tradelanes, Phase I • Economic assessment on one of 18 tradelanes – ~$400 benefit to shipper per container load US TDA/APEC “BEST” projects • Economic assessment of one tradelane – 80% probability of >$200 benefit to shipper per container load Cautionary note • These are small samples Hopeful note • Carriers and terminal operators should benefit as well 18 Outline Cargo theft today The ‘rules of the game’ Smart containers Forecasting the market 19 The Prospect for Smart Containers With or without security pressures … With or without DHS research … Smart containers will be deployed for commercial reasons, to make money • The question is when, not whether • Moore’s Law will bring them to the market In 1985, satellite monitoring of trucks seemed like a pipe dream. In 1990, Schneider National deployed Qualcomm’s OmniTRACS 20 Looking Ahead on Technology DHS Advanced Container Security Device • • • • HSARPA aims for the “Future Smart Container” “6 walls” intrusion detection Integrated WMD and stowaway sensors Highly reliable and inexpensive Potential commercial availability • Starting 2008 21 Forecasting Smart Container Growth SMART CONTAINER MARKET DYNAMICS: FRAMEWORK FOR MAJOR DRIVERS Regulatory Demands Two Major Drivers Strong Evidence of Smart Container Economic Value Economic Benefits Little Evidence of Smart Container Economic Value © North River Consulting Group Low Regulatory Pressure for Smart Containers High Regulatory Pressure for Smart Containers SMART CONTAINER MARKET DYNAMICS Regulatory Demands Low Regulatory Pressure for Smart Containers High Regulatory Pressure for Smart Containers Strong Evidence of Smart Container Economic Value III - Sweet Typical New Technology “Lazy S” or “Hockey Stick” Adoption Curve IV - Steroidal Accelerated Enhancement and Adoption Little Evidence of Smart Container Economic Value I - Slow Slow, Specialized and Limited Adoption Economic Benefits © North River Consulting Group II - Sour Reluctant Adoption Over High Resistance and Delaying Tactics Regulatory Demand for Smart Containers SMART CONTAINER MARKET DYNAMICS Regulatory Demands Low Regulatory Pressure for Smart Containers High Regulatory Pressure for Smart Containers Strong Evidence of Smart Container Economic Value III - Sweet Typical New Technology “Lazy S” or “Hockey Stick” Adoption Curve IV - Steroidal Accelerated Enhancement and Adoption Little Evidence of Smart Container Economic Value I - Slow Slow, Specialized and Limited Adoption Economic Benefits II - Sour Reluctant Adoption Over High Resistance and Delaying Tactics North River Assessment: • High regulatory pressure for smart container adoption can come only after a meaningful container-oriented terror event Scenario I, 2004-2012: • No container terror event Scenario II, 2004-2012: • Container terror event in 2005 © North River Consulting Group 24 Highlights of Scenario I, 2004-2012: No Meaningful Container Terror Attack Classic new technology introduction, with an R&D boost from war on terror (Cell I) Competitive pressures shift market decisively as successful early adopters reap benefits (Cell III) Smart containers will become accepted best practice for supply chain operations during forecast period Security benefits SMART CONTAINER MARKET DYNAMICS Regulatory Demands Low Regulatory Pressure for Smart Containers High Regulatory Pressure for Smart Containers Strong Evidence of Smart Container Economic Value III - Sweet Typical New Technology “Lazy S” or “Hockey Stick” Adoption Curve Little Evidence of Smart Container Economic Value I - Slow Slow, Specialized and Limited Adoption IV - Steroidal Accelerated Enhancement and Adoption Economic Benefits © North River Consulting Group II - Sour Reluctant Adoption Over High Resistance and Delaying Tactics • • Significant reduction in cargo theft and smuggling Enhanced protection against terrorist exploitation 25 Highlights of Scenario II, 2004-2012: Serious Container Terror Attack in 2005 SMART CONTAINER MARKET DYNAMICS Regulatory Demands Low Regulatory Pressure for Smart Containers High Regulatory Pressure for Smart Containers Strong Evidence of Smart Container Economic Value III - Sweet Typical New Technology “Lazy S” or “Hockey Stick” Adoption Curve IV - Steroidal Accelerated Enhancement and Adoption Economic Benefits Little Evidence of Smart Container Economic Value © North River Consulting Group I - Slow Slow, Specialized and Limited Adoption II - Sour Reluctant Adoption Over High Resistance and Delaying Tactics At time of attack, smart container benefits still unproven (Cell I) Political overreaction to attack produces premature mandates for smart container technologies (Cell II) Forced use accelerates learning curves for benefits (move towards Cell IV) Market for and use of smart containers builds faster and higher than Scenario I Security benefits • • Significant reduction in cargo theft and smuggling Enhanced protection against terrorist exploitation 26 Keep Technology in Perspective Technology is not magic • “Just because it’s electronic doesn’t mean it’s better” • Good processes and discipline are critical • Institutional challenges are toughest Technology is not irrelevant • “Just because it’s electronic doesn’t mean it’s a mistake” • Smart technology can – Enhance good processes – Simplify demands on the workforce 27 In Closing, Prepare for a Storm… In terms of supply chain strategy, your major concern in terms of cargo security should be ‘what happens after the next terror event?’ • The ‘rules of the game’ will shift • The shifts may not be rational or pretty 28 Thank you for your attention Mike Wolfe noriver@att.net 781-834-4169 Extra Material Follows: Sources and reference locations 29 Sources & References for Supply Chain Security, Productivity, & Technology* Security and productivity • “Some Good News on Cargo Security” (2004) • “The Dynamics of Supply Chain Security” (2004) • “Security Must Yield an Economic Benefit” (2003) – – – G-8 Summit edition of The Monitor, Univ. of GA, Center for International Trade and Security Journal of Commerce, December 1, 2003 • “Supply Chain Security Without Tears” (2003)** • “Freight Transportation Security and Productivity” (2002) • “Defense Logistics…” trends and implications (2001) – – – Journal of Commerce, July 26, 2004 www.manufacturing.net/scm/index.asp?layout=articleWebzine&articleid=CA278114 http://ops.fhwa.dot.gov/freight/publications/SecurExecSumm.doc http://www.ops.fhwa.dot.gov/freight/theme_papers/theme_paper_index.htm Technology for security and productivity • Smart Container Product and Market Reports (forthcoming, with HSRC) – • Email Mike Wolfe “APEC Secure Trade Project Preliminary Conceptual Plan,” (2004) – email from Mike Wolfe • “Technology Views and Issues” (2004) • “Automating Security: Do E-Seals Make Sense?” (2003) • “Target Capabilities for the ‘Future Smart Container’” (2003) • “Technology to Enhance Freight Trans. Security & Productivity” (2002) – – – – • www.eyefortransport.com/index.asp?news=33911&nli=freight&ch= email from Mike Wolfe http://ops.fhwa.dot.gov/freight/publications/Security Technology Appendix, 4-25-02.doc “Electronic Cargo Seals: Context, Technologies, and Marketplace” (2002) – • Cairo Transportation Security Forum Resource Guide, www.tda.gov Reachable from the Intermodal Freight page at http://www.its.dot.gov/ifreight/ifreight.htm “Trends in Freight Identification Technology” (1998) – Email from Mike Wolfe (noriver@att.net, 781-834-4169) *Articles and papers by Mike Wolfe **Co-authored with Hau Lee, Stanford