Chapter 2

Business

and the

Constitution

McGraw-Hill/Irwin

Copyright © 2011 by The McGraw-Hill Companies, Inc. All rights reserved.

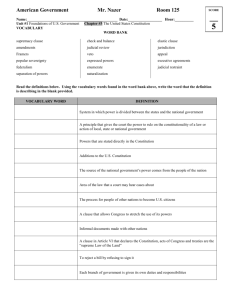

Chapter Overview

• The structure of the U.S. Constitution and

individual state constitutions, and their

respective roles in the American legal system.

• The specific powers granted to the government

in the Constitution.

• The protections afforded by the Constitution

in the Bill of Rights and the 14th Amendment.

2-2

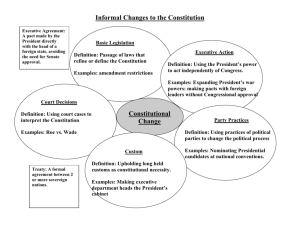

Functions of the Constitution

• (1) establishing a structure for the federal

government and rules for amending the

Constitution;

• (2) granting specific powers for the different

branches of government;

• (3) providing procedural protections for U.S.

citizens from wrongful government actions.

2-3

Structure of the Constitution

• Preamble

• Seven articles

• 27 amendments

2-4

Overview of Articles I, II

• Article I Establishes the legislative branch (A

Congress composed of the House of

Representatives and the Senate); sets

qualifications for members; grants congressional

powers (lawmaking).

• Article II Establishes the executive branch

(president); sets qualifications for the

presidency; grants executive powers

(enforcement of laws).

2-5

Overview of Articles III, IV, V

• Article III Establishes the judicial branch with a

federal system of courts, including a Supreme

Court; grants certain judicial powers.

• Article IV Establishes the relationship between

the states and the federal government;

describes how to admit new states to the Union.

• Article V Describes the process for amending

the Constitution.

2-6

Overview of Articles VI, VII

• Article VI Establishes the Constitution and

federal law as the supreme law of the United

States over any conflicting state law; authorizes

the national debt (Congress may borrow

money); public officials must take an oath to

support the Constitution.

• Article VII Lists the requirements for ratification

of the Constitution.

2-7

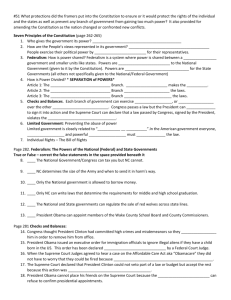

FEDERAL POWERS

The powers that generally impact business owners:

• (1) the power to regulate commerce

• (2) taxing the citizenry and commercial entities and

spending government funds (tax and spend provisions)

• (3) bankruptcy, patents, and copyrights

• (4) a more general implied authority to make all laws

necessary for carrying out its enumerated powers

2-8

Constitutional Checks and Balances

• This system of checks and balances is

called the separation of powers.

2-9

Judicial Review

• One of the central concepts in federal

Constitutional law is the notion that federal

courts have the right to invalidate state or

federal laws that are inconsistent with the

U.S. Constitution.

• The U.S. Supreme Court is the ultimate

judge

2-10

Standards of Review

• Court classifies the action into one of three

categories of scrutiny:

• (1) the rational basis category, or

• (2) intermediate-level scrutiny, or

• (3) strict scrutiny.

2-11

Supremacy Clause and Preemption

• U.S. Constitution provides that valid

federal laws (those made pursuant to

Congress’s constitutional authority and

that are constitutionally sound) are always

supreme to any conflicting state law

2-12

Cipollone v. Liggett Group, Inc., et al.,

505 U.S. 504 (1992)

• “Article VI of the Constitution provides that

the laws of the United States shall be the

supreme Law of the Land. Thus, [. . .] it

has been settled that state law that

conflicts with federal law is ‘without

effect.’

2-13

COMMERCE POWERS

• Congress’s broadest power is derived

from the Commerce Clause whereby

Congress is given the power to “regulate

Commerce among the several states.”

2-14

Application of Commerce Powers

• Congress has the express constitutional

authority to regulate:

– (1) channels of interstate commerce such as

railways and highways,

– (2) the instrumentalities of interstate

commerce such as vehicles used in shipping,

– (3) the articles moving in interstate commerce

2-15

Constitutional Restrictions on State

Regulation of Commerce

• The U.S. Supreme Court has ruled that

the mere existence of congressional

commerce powers restricts the states from

discriminating against or unduly burdening

interstate commerce.

2-16

Cavel International, Inc. v. Madigan,

500 F.3d 551 (7th Cir., 2007)

“The state statute regulates evenhandedly to effectuate a legitimate local

public interest, and its effects on interstate

commerce are only incidental, it should be

upheld unless the burden imposed on

such commerce is clearly excessive in

relation to the putative local benefits.”

2-17

TAX AND SPEND POWER

• Congress has a far-reaching power to tax

the citizenry and to spend the federal

government’s money in any way that

promotes the common defense and

general welfare.

2-18

Necessary and Proper Clause

• Congress may also place conditions on

the use of federal money in order to

achieve some public policy objective.

• Congress generally cites the Necessary

and Proper Clause as authorization to set

conditions on the spending.

2-19

CONSTITUTIONAL PROTECTIONS

• The Constitution provides protection for

the citizenry from unlawful or repressive

acts by the government.

• The Bill of Rights (the first ten

amendments) and other amendments that

guarantee the right of due process.

2-20

First Amendment

• “Congress shall make no law”:

• That allows government encroachment in

the areas of religion, press, speech,

assembly, and petition of grievances.

2-21

Speech by Corporations

• Commercial Speech

• Political Speech

• Which can be regulated?

2-22

Pagan v. Fruchey and Village of

Glendale, 492 F.3d 766 (6th Cir., 2007)

“Glendale’s attempt to justify its

ordinance amounts to nothing more than a

conclusory articulation of governmental

interests.”

2-23

Political Spending and Corporations

• Traditional distinctions between free

speech vs. spending limits on political

advertising.

• General rule prior to 2010 was that

spending limits were legal.

• See recent case on following slide.

2-24

Citizens United v. Federal Election

Commission

• In a 2010 case that attracted significant

media attention, the U.S. Supreme Court

ruled that the government may not ban all

political spending by corporations in

candidate elections.

2-25

Fourth Amendment

• The U.S. Supreme Court has

systematically applied a reasonableness

test to define the limits of when the

government may search without a warrant

based on probable cause that criminal

activity is possible.

2-26

Fifth Amendment

• This amendment does not apply to

corporate entities when the government is

seeking certain business records,

individual corporate officers and

employees are entitled to Fifth

Amendment protection when facing a

criminal investigation.

2-27

DUE PROCESS PROTECTIONS

• Fifth and Fourteenth Amendments

• These clauses protect individuals from

being deprived of “life, liberty, or property”

without due process of law

2-28

Fourteenth Amendment

• Perhaps the most important role of the

Fourteenth Amendment is that it makes

the Bill of Rights applicable to the states.

2-29

Equal Protection under the 14th

Amendment

• Fundamentally, the clause guarantees that

the government will treat people who are

similarly situated equally.

2-30

State Farm Mutual v. Campbell

538 U.S. 408 (2003)

“States possess discretion over the

imposition of punitive damages, but it is

well established that there are

constitutional limitations-the Due Process

Clause of the Fourteenth Amendment

prohibits the imposition of grossly

excessive or arbitrary punishments.”

2-31

PRIVACY

• Although not explicitly mentioned in the

Constitution, privacy rights play a central

role in our legal system.

• Common law origins

• Statutory law examples

2-32

Federal Statutes

• Health Insurance Portability and

Accountability Act (HIPPA)

• Uniting and Strengthening America by

Providing Appropriate Tools Required to

Intercept and Obstruct Terrorism Act

(called the USA Patriot Act)

2-33

Workplace Privacy

• Most privacy rights afforded by the U.S.

Constitution do not extend to the

workplace.

• Nonetheless, privacy rights have become

increasingly important to business owners

and managers as Congress and state

legislatures seek to clarify workplace

privacy rights by statute.

2-34

learning outcome checklist

• 2 - 1 Explain the federal system in the context of the U.S.

Constitution.

• 2 - 2 Describe the purpose and structure of the

Constitution.

• 2 - 3 List the major provisions of the first three articles of

the Constitution and explain the underlying assumptions

of coequal branches of government.

• 2 - 4 Identify the powers of Congress that impact

individuals and businesses.

2-35

learning outcome checklist

• 2 - 5 Recognize the role of judicial review in interpreting

the Constitution.

• 2 - 6 Understand the various applications and limits of

congressional power under the Commerce Clause.

• 2 - 7 Apply Constitutional restrictions on state regulation

of commerce in the business environment.

• 2 - 8 Explain how the tax and spend powers impact

business.

2-36

learning outcome checklist

• 2 - 9 List the major protections in the

Constitution’s Bill of Rights and explain how

they apply in the business environment.

• 2-10 Understand limits imposed on government

overreaching by virtue of the Due Process

Clause and Equal Protection Clause.

• 2 - 11 Explain the right of privacy that has been

recognized by the U.S. Supreme Court and

Congress.

2-37