unit 4 business environment

advertisement

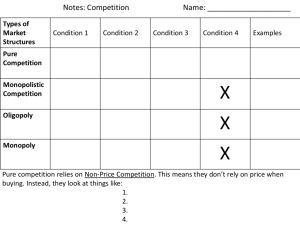

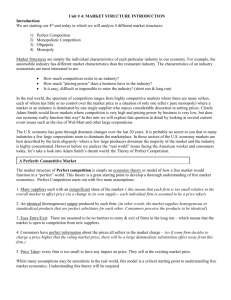

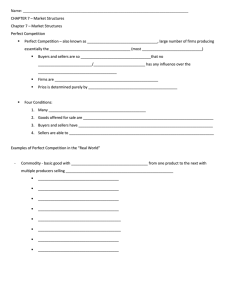

REVISION NOTES UNIT 4 BUSINESS ENVIRONMENT PREPARED BY: Ms SHABNAM SEP, 2010 OXFORD COLLEGE LONDON Unit 4 Business Environment Revision Notes, Prepared by: Ms Shabnam, Sep, 2010, OCL Page 0 TOPIC 1: MARKET STRUCTURES DEFINITION: Market structure is best defined as “the organisational and other characteristics of a market which affect the nature of competition and pricing”. In other words, the type of market structure influences how a firm behaves. The following are the determinants of market structures: – Control over pricing – Control over supply/output – Barriers to entry or freedom of entry and exit – Nature of the product-homogenous (identical) or differentiated – Degree of competition in the industry DIFFERENT TYPES OF MARKET STRUCTURES Characteristic Number of firms Type of product Barriers to entry Pricing Perfect Competition Many Homogenous None Price taker Perfect Competition: Monopolistic Oligopoly Monopoly Many Differentiated Relatively Free Some control One Limited High Price maker Few Differentiated High Price maker An economic model (market structure), where it is assumed that there is a large number of buyers and sellers for any commodity and each agent is a price taker. Basic assumptions required for conditions of pure competition to exist Many small firms, each of whom produces an insignificant percentage of total market output and thus exercises no control over the ruling market price. Many individual buyers, none of whom has any control over the market price. Perfect freedom of entry and exit from the industry. Firms face no sunk costs entry and exit from the market is feasible in the long run. This assumption ensures all firms make normal profits in the long run Unit 4 Business Environment Revision Notes, Prepared by: Ms Shabnam, Sep, 2010, OCL Page 1 Homogeneous products are supplied to the markets that are perfect substitutes. This leads to each firms being passive “price takers”. Perfect knowledge – consumers have readily available information about prices and products from competing suppliers and can access this at zero cost – in other words, there are few transactions costs involved in searching for the required information about prices. To summarise the above points, the following can be stated: – Free entry and exit to industry – Homogenous product – identical so no consumer preference – Large number of buyers and sellers – no individual seller can influence price – Sellers are price takers – have to accept the market price – Perfect information available to buyers and sellers Examples of Perfect Competition: financial markets – stock exchange, currency markets. This is because of the following: Homogenous output: The "goods" traded in the foreign exchange markets are homogenous - a US dollar is a dollar whether someone is trading it in London, New York or Tokyo. Many buyers and sellers meet openly to determine prices: There are large numbers of buyers and sellers - each of the major banks has a foreign exchange trading floor which helps to "make the market". Indeed there are so many sellers operating around the world that the global currency exchanges are open for business twenty-four hours a day. No one agent in the currency market can influence the price on a persistent basis - all are ‘price takers’. Currency values are determined solely by demand and supply factors. High quality information: Most participants in the market - be they be buyers or sellers - are well informed, in most cases with access to real time information and also plenty of background analysis on the factors driving the prices of each individual national currency. Technological progress has made much more information more immediately available as a result of which the market is rich with information. Unit 4 Business Environment Revision Notes, Prepared by: Ms Shabnam, Sep, 2010, OCL Page 2 Advantages of Perfect Competition: High degree of competition helps allocate resources to most efficient use as a result of which firms operate at maximum efficiency Price = marginal costs ( price sufficient for normal profits to be made in the long run and abnormal profits can only be made for a short term if any firm comes up with a new idea) Consumers benefit as they have choice and get to buy products at normal prices Perfect competition – a pure market/perfect market and the real world of imperfect competition! Perfect competition describes a market structure whose assumptions are extremely strong and highly unlikely to exist in most real-time and real-world markets. The reality is that most markets are imperfectly competitive. Hence, the assumptions of pure competition do not hold in the vast majority of markets. Some suppliers may exert some control over market supply and seek to exploit their monopoly power. On the demand-side, some consumers may have more bargaining power against suppliers because they purchase a high percentage of total demand. The markets are far from being homogeneous; most markets are full of heterogeneous products due to product differentiation. Consumers nearly always have imperfect information (for example information gaps) and their preferences and choices can be influenced by the effects of persuasive marketing and advertising. We can come only fairly close to a world of perfect competition or perfect market but in practice there are nearly always barriers to pure competition. Unit 4 Business Environment Revision Notes, Prepared by: Ms Shabnam, Sep, 2010, OCL Page 3 Monopolistic or Imperfect Competition: Monopolistic competition is a form of imperfect competition where many competing producers sell products that are differentiated from one another. The following are the characteristics of monopolistic markets: – Many buyers and sellers – Products differentiated – Relatively free entry and exit – Each firm may have a tiny ‘monopoly’ because of the differentiation of their product – Firm has some control over price – Examples: restaurants, solicitors, plumbers, etc. Oligopoly: It is a form of market structure where the industry is dominated by small number of large firms and competition is only amongst the few. The following are the characteristics of oligopolistic markets: – High barriers to entry – Products are differentiated – Price makers Examples of oligopolistic structures: – Medicinal drugs/chemicals (Glaxo Smith Kline, ICI, etc) – Oil (BP, Shell, Exxon etc) Duopoly is a special case of Oligopoly. Industry dominated by two large firms. Examples: Visa and MasterCard who between them control a large proportion of the electronic payment processing market. Another example of a duopoly is the global aircraft market, where the two dominant firms are Airbus and Boeing. Unit 4 Business Environment Revision Notes, Prepared by: Ms Shabnam, Sep, 2010, OCL Page 4 Pure Monopoly: It is a market structure where there is only one provider of a product or service. The industry is the firm. In a market where a monopoly exists, there is no competition, as the firm is the market. Pure monopoly exists when a single firm is the sole producer of a product for which there are no close substitutes. They are very desirable from the point of view of a company and, usually, not very desirable for consumers. Network Rail for example, is solely responsible for the maintenance and upgrading of the rail network of tracks, signals, bridges, stations and so on. Three characteristics define pure monopoly: There is a single seller There are no close substitutes for the firm’s product There are high barriers to entry Natural monopoly: The market is a natural monopoly, where there are significant savings to be had from having one company running the market. Thus natural monopoly is a monopoly in which economies of scale causes efficiency to increase continuously with the size of the firm. In other words, a firm is a natural monopoly if it is able to serve the entire market demand at a lower cost than any combination of two or more smaller, more specialised firms. Examples of natural monopoly could be Thames Water. Unit 4 Business Environment Revision Notes, Prepared by: Ms Shabnam, Sep, 2010, OCL Page 5 TOPIC 2: UK REGULATORY BODIES Office of Fair Trading (OFT): OFT is a non-ministerial government department of the United Kingdom, established by the Fair Trading Act 1973, which enforces both consumer protection and competition law, acting as the UK's economic regulator. The OFT's goal is to make markets work well for consumers, ensuring vigorous competition between fair-dealing businesses and prohibiting unfair practices such as rogue trading, scams and cartels. Its role was modified and its powers changed with the Enterprise Act 2002. Under the Enterprise Act 2002, the OFT can review mergers to investigate whether there is a realistic prospect that they will lead to a substantial lessening of competition. The majority of the OFT’s work now consists of analysing markets, enforcing consumer and competition law, merger control, delivering information, education programmes and campaigns to business and consumers and providing advice through Consumer Direct. Case Examples In 2006 the OFT investigated the charges being imposed on customers of credit card companies. In its report, the OFT confirmed these charges were unlawful as they amounted to a penalty, rather than the actual losses suffered by the companies. Skoosh.com, 17th Sep, 2010 - The Office of Fair Trading (OFT) is now investigating accusations of price fixing in the sale of hotel rooms online. The probe was triggered with a complaint from Skoosh.com, a discount website. The site had reported that they were being pressured to offer bookings at standard prices. If the OFT finds that the Competition Act has been breached then they can impose up to 10 percentage of the company’s turnover in penalties. Telegraph, 17th Sep, 2010- The managing director of Mercedes-Benz's commercial vehicle wing in Britain, Mr. Ian Jones, has been arrested as part of an Office of Fair Trading investigation into alleged price-fixing in the trucking industry. In a statement, the OFT confirmed it was "investigating suspected cartel activity involving commercial vehicle manufacturers in the UK”. Under OFT rules, companies involved in price-fixing can be fined up to 10 percentage of their annual global turnover, and executives face a maximum jail term of five years. Unit 4 Business Environment Revision Notes, Prepared by: Ms Shabnam, Sep, 2010, OCL Page 6 Office of Telecommunications, (Oftel): This body previously regulated the whole of Britain's telecoms industry until the end of 2003. The new regulatory body is known as Ofcom, which manages the whole of the UK communications industry. Set up under the Telecommunications Act 1984, Oftel comprised of three directorates: The Regulatory Policy directorate develops new policies on telecoms. Compliance - the consumer end of Oftel, this directorate ensures that phone companies meet relevant obligations under the Telecoms and Competition laws and regulations. Business Support is the department that supports the entire industry. Oftel was responsible for promoting the interests of consumers, maintaining and promoting competition within the industry, and ensuring all reasonable consumer demands were met, including emergency numbers, public phones and services in rural areas. Ofcom has now taken over all of Oftel's former duties. Office of Communications, (Ofcom): Independent regulator and competition authority for the UK communications industries which includes Telecom, Broadcasting like TV, Radio etc. Case Example 15th Sep, 2010, BBC- The BBC has learned that Ofcom will be asked to review News Corporation's bid for BSkyB once a formal offer is made. An "intervention notice" to Ofcom would order the watchdog to look at the impact of the takeover. News Corporation has said it wants to take over the remaining 61% of BSkyB it does not own. The organisation, run by Rupert Murdoch, owns News International, which owns the Sun, the News of the World and the Times and Sunday Times newspapers in the UK. Together they account for more than a third of all national UK newspaper circulation. A referral to Ofcom would charge it with looking at whether News Corp's complete ownership of BSkyB would restrict the "plurality" and number of voices within the media. Unit 4 Business Environment Revision Notes, Prepared by: Ms Shabnam, Sep, 2010, OCL Page 7 Ofwat, the Water Services Regulation Authority: This body is the economic regulator of the water and sewerage sectors in England and Wales. It ensures that the companies provide household and business customers with a good quality service and value for money. Ofgem, the Office of the Gas and Electricity Markets: This was previously known as Ofgas. Its first priority is to protect consumers and it does that by promoting competition, wherever appropriate, and regulating the monopoly companies which run the gas and electricity networks. Other priorities and influences include: helping to secure Britain’s energy supplies by promoting competitive gas and electricity markets and regulating them so that there is adequate investment in the networks, contributing to the drive to curb climate change and other work aimed at sustainable development by, for example: helping the gas and electricity industries to achieve environmental improvements as efficiently as possible; and taking account of the needs of vulnerable customers, particularly older people, those with disabilities and those on low incomes. Unit 4 Business Environment Revision Notes, Prepared by: Ms Shabnam, Sep, 2010, OCL Page 8 ROLE OF COMPETITION COMMISSION (CC) The Competition Commission (CC) is an independent public body which conducts in-depth inquiries into mergers, markets and the regulation of the major regulated industries, ensuring healthy competition between companies in the UK for the benefit of companies, customers and the economy. The CC replaced the Monopolies and Mergers Commission in 1999, following the Competition Act 1998. The Enterprise Act 2002 introduced a new regime for the assessment of mergers and markets in the UK. The CC’s legal role is now clearly focused on competition issues. The Enterprise Act also gave the CC remedial powers to direct companies to take certain actions to improve competition; in the previous regime its role was simply to make recommendations to Government. All of the CC’s inquiries are undertaken following a reference made by another authority, most often the Office of Fair Trading (OFT) which refers merger and market inquiries. Where an inquiry is referred to the CC for in-depth investigation, the CC has wide-ranging powers to remedy any competition concerns, including preventing a merger from going ahead. It can also require a company to sell off part of its business or take other steps to improve competition. In market investigations, the CC has to decide whether any feature or combination of features in a market prevents, restricts or distorts competition, thus constituting an adverse effect on competition. If the CC concludes that this is the case, then it must seek to remedy the problems that it identifies. For example, on the 16th Sep, 2010, The Office of Fair Trading (OFT) and Competition Commission (CC) for the first time published joint Merger Assessment Guidelines. The guidelines are designed to assist companies and their advisers by providing greater clarity on how the competitive impact of mergers is assessed. Unit 4 Business Environment Revision Notes, Prepared by: Ms Shabnam, Sep, 2010, OCL Page 9