Section 2 of the Sherman Act

advertisement

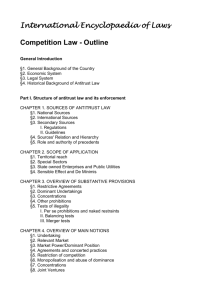

DELVACCA Presents: Antitrust "Change" Comes Through the Obama Administration Sponsored by: Katherine M. Katchen kkatchen@akingump.com David T. Blonder dblonder@akingump.com Charles J. Reitmeyer Reitmeyer-Charles@aramark.com February 17, 2010 Brief Antitrust Primer Who enforces the antitrust laws? ● Federal Trade Commission: ■ Mergers and joint ventures; ■ Consumer protection. ● Justice Department Antitrust Division: ■ All criminal price fixing; ■ Mergers and joint ventures. ● State Attorneys General: ■ Often join DOJ and FTC; ■ Enforce independently as well. ● Private Parties: ■ Can sue for injuries caused by anticompetitive effects of antitrust violations; ■ Class action lawsuits common. 2 Brief Antitrust Primer What Are The "Antitrust Laws"? ● Section 1 of the Sherman Act: ■ Prohibits price fixing and other cartel activities. Criminal prosecution for hardcore conduct (price fixing, dividing markets/customers “Per se” illegal: pernicious effect on competition and lack of any redeeming virtue.” ■ Applies to all agreements, such as joint ventures among competitors or distribution and marketing relationships. ● Section 2 of the Sherman Act: ■ Unilateral conduct, such as exclusive dealing, bundled pricing or tying. ■ Abuse or maintenance of monopoly; attempts to obtain a monopoly. ■ Rule of Reason: evaluates pro-competitive features of a restrictive business practice against its anticompetitive effects to decide whether or not the practice should be prohibited. 3 Brief Antitrust Primer What Are The "Antitrust Laws"? ● Section 7 of the Clayton Act ■ Governs lawfulness of mergers, whether horizontal (e.g., among competitors) or vertical (e.g., supplier-customer merger). ■ Forward Looking Test: Might the effect of the merger be to "substantially lessen competition?” ● Hart Scott Rodino (Clayton Act 7A) ■ Procedural statute only: imposes filing and waiting period obligations on transactions meeting certain size tests. ● Section 5 of the Federal Trade Commission Act ■ Catch-all statute for "unfair" methods of competition. 4 Why Increased Concern For Antitrust? The Agencies and Plaintiffs Haven't Changed. The Fundamental Statutory Texts Have Not Changed. No Major Court Decisions Heighten Concern. Just the opposite – recent years' decisions have largely restricted the scope of the antitrust laws. 5 But, Change Is In The Air President Obama promised during the campaign: "As president, I will direct my administration to reinvigorate antitrust enforcement." Change has come: ● Change in personnel; ● Change in policies; and ● Change in enforcement priorities. 6 The New Political Landscape DOJ: Christine Varney Former GC of Democratic Nat'l Committee. Represented Netscape in 1990's, urging DOJ to bring Microsoft monopoly case. Repudiated "laissez faire" approach of Bush Administration ─ more aggressive enforcement is promised, particularly against firms with market power. Focusing on Technology, Pharma, Agriculture, Dairy and Energy sectors. Intends “to explore vertical theories and other new areas of civil enforcement, such as those arising in high-tech and Internet-based markets.” 7 Christine A. Varney AAG Antitrust Division The New Political Landscape FTC: Jon Leibowitz Appointed FTC Commissioner in 2004. Designated Chairman in March, 2009. Very aggressive and policy-oriented. Very focused on IP, Healthcare, and Pharma and Technology issues. Jon Leibowitz FTC Chairman Opposes reverse payments to prevent brand-name drug companies from paying generics to keep products off the market. Strong interest in consumer protection. 8 Policy Changes by the New Enforcers: Monopolization 9 Policy Changes by the New Enforcers: Monopolization – Immediate Change In Tone "Single-firm conduct offers some of the greatest challenges in antitrust enforcement today," said Thomas O. Barnett, Assistant Attorney General in charge of the Department's Antitrust Division. "While we need to identify and prohibit conduct that harms the competitive process, we also need to avoid interfering in the rough and tumble of beneficial competition that drives innovation and economic growth." ● Section 2 Report announced on September 8, 2008. ● The Report survived 8 months, perhaps the shortest-lived antitrust enforcement policy in the 100+ year history of the Sherman Act. 10 Policy Changes by the New Enforcers: Monopolization – Immediate Change In Tone Three weeks after assuming her new duties, AAG Varney dramatically repudiated the Section 2 Report on May 11, 2009: ● "The report, 'Competition and Monopoly: Single-Firm conduct Under Section 2 of the Sherman Act,' raised too many hurdles to government antitrust enforcement and favored extreme caution and the development of safe harbors for certain conduct within reach of Section 2. . . ." ● "Withdrawing the Section 2 Report is a shift in philosophy and the clearest way to let everyone know that the Antitrust Division will be aggressively pursuing cases where monopolists try to use their dominance in the marketplace to stifle competition and harm consumers. . . ." ● Implicit in the repudiated Report's "overly cautious approach is the notion that most unilateral conduct is driven by efficiency and that monopoly markets are generally self-correcting. . . . [R]ecent developments in the marketplace should make it clear that we can no longer rely upon the marketplace alone to ensure that competition and consumers will be protected. . . ." 11 Policy Changes by the New Enforcers: Monopolization – Immediate Change In Tone Expect the FTC to Pile On ● Chairman Liebowitz, on September 24, 2009: "Christine [Varney] withdrew th[e Section 2] report for some very good reasons. As I see it, . . . notions [in the Report] are inconsistent with the fundamental policy of the antitrust laws that competition leads to efficiency and to consumer gains." ● "Efficient monopoly may be better than inefficient monopoly, but it is still a monopoly, and we are a competition agency, not an efficient-monopoly agency. So when a practice simultaneously hinders competition and facilitates the efficient operations of a monopoly, I know where I start out. You can look for more vigorous assertion from me, at least, that competition is the better answer." 12 Policy Changes by the New Enforcers: Monopolization No new guidance in its place. Aggressive theories emerging: FTC's Cephalon complaint – product innovation as an antitrust violation. Numerous investigations opened: The agencies are open for business under Section 2. High profile investigations: ● Google Books (orphaned works); ● Monsanto (limiting of access to corn and soya bean traits); ● Intel (microprocessors); ● IBM (back to the future—monopolization of mainframes) Many smaller investigations in the pipeline. 13 Policy Enforcement: Mergers Joint FTC / DOJ workshops on the Horizontal Merger Guidelines. ● Five workshops: December 2009 – January 2010. ● "The goal of the workshops will be to determine whether the Horizontal Merger Guidelines accurately reflect the current practice of merger review at the Department and the FTC, as well as to take into account legal and economic developments that have occurred since the last significant Guidelines revision in 1992." ● Varney concedes “gaps” between guidelines and actual agency practice that pose uncertainty for parties and courts, particularly in how agencies use economic tools and views of competitors, customers, and industry experts to assess unilateral effects of a merger. ● No “radical revisions”-- envisions small amendments to clarify treatment of coordinated effects, price discrimination, market share analysis, and need for more unified approach to concepts of expansion, entry, and repositioning. Comments of Christine A. Varney at Horizontal Merger Guideline Review Project’s Final Workshop, January 26, 2010, Washington, DC. 14 Policy Enforcement: Mergers Consummated & Non-Reportable Merger Challenges – Continued Emphasis? ● Dean Foods (DOJ) (sale of Milk to School Districts and Retailers in Illinois, Michigan and Wisconsin), Jan. 2010 ● Scott & White/Kings Daughters Hospital (FTC) (Temple, TX hospital merger), Dec. 2009 ● In re Lubrizol Corp. & Lockhart Co. (FTC) (Chemical rust inhibitors), Feb. 2009 ● Ovation Pharmaceuticals (FTC) (drugs to treat congenital heart defects in premature infants), Dec. 2008 ● Microsemi (DOJ) (semiconductors for military applications), Dec. 2008 ● Inverness/Acon (FTC) (consumer pregnancy tests), Dec. 2008 Indicia and Potential Plus Factors ● Significant post-merger price increases in concentrated markets (e.g., Ovation – 1300% or select price discrimination) or other anticompetitive behavior. ● Vocal and important customers (DoD, NASA, federal and state agencies). ● Removal of significant competitor, high barriers to entry (IP). ● Raise unique substantive and procedural issues 15 Policy Enforcement: Mergers No recession exception. ● Shapiro speech on Competition Policy in Distressed Industries. “We at the Antitrust Division are dedicated to vigorous enforcement of the antitrust laws during these challenging economic times.” New emphasis on vertical mergers. ● Ticketmaster / Live Nation. ■ Ticketmaster required to license its ticketing software, divest ticketing assets and subject itself to anti-retaliation provisions in order to proceed with its proposed merger with Live Nation. News from the front: ● No easy passes; ● Readiness to issue second requests; but ● Not ready to abandon basic principles. 16 Policy Enforcement: Conduct Resale price maintenance: change from defending it to threatening it. Amicus Brief in the Supreme Court, January 2007: ● "The per se rule against vertical minimum resale price maintenance (RPM) established in Dr. Miles is irreconcilable with this Court's modern antitrust jurisprudence and cannot withstand analysis. That per se rule should be abandoned, and Dr. Miles should be overruled." ● "There is a widespread consensus of opinion that RPM, like non-price vertical restraints, can have a variety of procompetitive effects that enhance consumer welfare." 17 Policy Enforcement: Conduct Advice from AAG Varney to National Association of Attorneys General, on October 7, 2009, on "how to" challenge RPM. ● Under DOJ's new approach, the government would be required to make only a preliminary showing "of 'the existence of the agreement and scope of its operation' as well as the presence of structural conditions under which RPM is likely to be anticompetitive . . . to establish a prima facie case that RPM is unlawful." ● "[R]eports of potential cases that may be appropriate for federal enforcement" are welcome. 18 Policy Enforcement: Conduct Investigations Pursued That Would Not Have Seen the Light of Day before 2009: ● Google Books; ● Recruitment of Silicon Valley talent; ● Overlapping directors between Google and Apple; and ● Reversal of "Pay for Delay" position ─ supports the FTC in a position rejected by the Courts. 19 Policy Enforcement: "Unfair Competition" – Unbounded by the limits of the Antitrust Laws Speaking about losses the FTC suffered in the 1980s when it applied Section 5 beyond the Antitrust Laws, Commissioner Leibowitz in September made this statement: "People have asked us, given the thumping we took in those cases, why we would want to revisit Section 5? The answer is simple: antitrust law is far more restrictive than it was thirty years ago and if we want to accomplish our mission of protecting consumers in an age of judicial conservatism, we need to use every tool in our arsenal." 20 Policy Enforcement: "Unfair Competition" – Unbounded by the Limits of the Antitrust Laws Nonetheless, the FTC is intent on setting sail once again into those uncharted waters. "[Y]ou are likely to see us try to protect consumers by expanding the use of our authority to prohibit unfair methods of competition." And the Commissioner believes the business community will support this action: "So, ultimately, I am convinced that while the antitrust cognoscenti may be concerned, business executives will see some value in this approach.“` 21 TRENDS IN PRIVATE ANTITRUST LITIGATION 22 TRENDS IN PRIVATE ANTITRUST LITIGATION Number of private antitrust cases filed is at highest level in 25 years ● 2007 – 1,018 cases filed in federal district courts ● 2008 – 1,287 cases filed (26% increase) Similar increase in U.S. Government cases filed in district courts ● 2006 – 37 cases filed ● 2007 – 36 cases filed ● 2008 – 52 cases filed (44% increase) *Source: Princeton Economics Group, Inc. 23 TRENDS IN PRIVATE ANTITRUST LITIGATION “Follow on” complaints after successful or highly publicized government action ● Timing of private complaints following announcements of government investigations/subpoenas ● Piggyback on agency discovery/investigation materials (including e-discovery) Potential for treble damages in private litigation 24 TRENDS IN PRIVATE ANTITRUST LITIGATION “Should I Stay Or Should I Go?” Decision whether to Opt-Out of private litigation can be critical one Consideration of risk/reward of opting out: ● Product/service at issue ● Business, political relationship(s) ● Cost vs potential recovery 25 TRENDS IN PRIVATE ANTITRUST LITIGATION Courts Have Not Yet Caught Up With Aggressive Enforcement and Increase in Private Filings Past Few Years Have Seen Series of “Watershed” Rulings Perceived to be Favorable to Defendants ● Look for potential increase in state court filings seeking to circumvent recent federal court rulings 26 CURRENT LANDSCAPE OF CASE LAW - PLEADINGS Bell Atlantic v. Twombly (2007) ● Redefined pleading standards in antitrust suits ● To survive motion to dismiss, plaintiffs must allege sufficient factual matter to show claim is plausible ■ “…an allegation of parallel conduct and a bare assertion of conspiracy will not suffice.” ■ “Without more, parallel conduct does not suggest conspiracy…” Ashcroft v. Iqbal (May 2009) ● Twombly standard applies to all civil actions Flood of opinions dealing with Twombly and Iqbal Impact still being sorted out 27 CURRENT LANDSCAPE OF CASE LAW - PLEADINGS In re: Travel Agent Commission Antitrust Litigation (6th Cir. Oct. 2, 2009) ● Sixth Circuit affirmed dismissal of amended complaint for failure to allege sufficient facts to plausibly suggest a prior illegal agreement. Bailey Lumber & Supply Co. v. Georgia-Pacific Corp. (S.D. Miss. 8/10/09) ● District Court granted manufacturer defendants’ motions to dismiss claims of conspiracy to fix plywood prices ● Pleadings insufficient to state a claim under Twombly ● Plaintiffs permitted to amend ■ Motions to dismiss filed (10/08/09) against amended complaint alleging pleading deficiencies not cured 28 CURRENT LANDSCAPE OF CASE LAW – CLASS CERTIFICATION In re: Hydrogen Peroxide Antitrust Litigation (2008) ● Third Circuit vacated grant of class certification ● District Court had not engaged in “rigorous analysis” of Rule 23 factors as required before a class can be certified ● Class certification should not be lightly granted and “the potential for unwarranted settlement pressure ‘is a factor [to] weigh in [the] calculus.’” Shift in case management after Hydrogen Peroxide ● More substance/discovery prior to certification proceedings ● Class v. merits discovery 29 CURRENT LANDSCAPE OF CASE LAW Leegin Creative Leather Products v. PSKS, Inc. (U.S. 2007) ● Formal departure from century old application of per se rule to resale price maintenance ● Vertical price restraints no longer considered “per se” illegal ● Should be evaluated under “Rule of Reason” McDonough v. Toys-R-Us (E.D. Pa. 7/15/09) ● Early case dealing with interplay between new Leegin and Hydrogen Peroxide standards ● Class certified under new standards 30 RECENT ATTEMPTS TO LEGISLATE AROUND CASE LAW Efforts to overturn Twombly/Iqbal and return to notice pleading standard for F.R.C.P. 12(b)(6) motions ● Notice Pleading Restoration Act (S. 1504) ■ Introduced June 2009 by Senator Specter ● Open Access to Courts Act (H.R. 4115) ■ Introduced November 2009 by Rep. Jerrold Nadler (D-NY) ● Senate & House Judiciary Committees have held hearings on bills Maryland Senate Bill 239 (signed into law 4/14/09) ■ Adds new provision to Maryland Antitrust Act that “a contract, combination, or conspiracy that establishes a minimum price below which a retailer, wholesaler, or distributor may not sell a commodity or service is an unreasonable restraint on trade or commerce.” ■ State attorneys general petitioning Congress to make resale price maintenance per se illegal ■ Congressional action (H.R. 3190, S. 148) 31 RECENT ATTEMPTS TO LEGISLATE AROUND CASE LAW Proposed Elimination of McCarron-Ferguson Antitrust “Exemption” ● Under McCarron-Ferguson - regulation of “business of insurance” left to states ● Would eliminate antitrust “exemption” under McCarron-Ferguson for certain conduct of health & medical malpractice insurers ■ Price fixing, bid rigging, market allocations ● President Obama (10/17/09) – Congress is “rightfully” reviewing the insurers’ “privileged exception from our anti-trust laws” FTC (with some Congressional support) calling for legislation prohibiting brand name drug manufacturers from compensating generic manufacturers to delay entry into market ● January 2010 FTC Staff Study 32 FTC “Red Flags Rule” – Applicable to Lawyers? FTC “Red Flags Rule” ● Requires certain businesses & organizations to implement written Identity Theft Prevention Program ■ Designed to detect warning signs of identity theft in day-to-day operations, take steps to prevent the crime, and mitigate damages. ● Applicable to “financial institutions” and “creditors” (banks, federally chartered credit unions, savings & loans, etc.) April 2009 – FTC announced for first time its belief that “lawyers” engaged in the practice of law were “creditors” under Red Flags Rule After several delays, enforcement was scheduled to begin November 1, 2009 33 ABA v. FTC – “Red Flags Rule” ABA Filed Lawsuit Against FTC (D.D.C.) (8/27/09) ● Challenging application of Red Flags Rule to Lawyers ● October 30, 2009 – Summary Judgment for ABA without opinion on Count I of Complaint ■ Alleged FTC’s application of Red Flags Rule to attorneys violates 5 U.S.C. § 706 (2)(C) because it is “in excess of statutory jurisdiction, authority, or limitations, or short of statutory right.” ● December 1, 2009 – District Court opinion in support of summary judgment Congress also working on legislation to limit application of Red Flags Rule 34 David T. Blonder represents clients before the Antitrust Division of the U.S. Department of Justice and the U.S. Federal Trade Commission in connection with government antitrust investigations of mergers and acquisitions as well as civil non-merger antitrust investigations involving allegations of potentially anticompetitive business practices. David has provided antitrust representation to clients involved in merger and acquisition matters in a diverse range of industries, including banking, consumer products, mining, health care and pharmaceuticals, telecommunications and communications equipment, and retailing and energy, among others. David T. Blonder Counsel Washington, DC Prior to joining Akin Gump Strauss Hauer & Feld LLP, Mr. Blonder was an associate at another international law firm from 2006 to 2008. Before that, he was a trial attorney in the Media and Telecommunications Enforcement Section of the U.S. Department of Justice: Antitrust Division, where he investigated numerous merger transactions and civil non-merger activity in the telecommunications, direct broadcast satellite and cable television industries. He has also authored and co-authored numerous articles in the area of antitrust law. dblonder@akingump.com 202.887.4023 35 EDUCATION J.D., Rutgers-Camden School of Law, 2001 B.S., University of Maryland, 1993 Katherine M. Katchen is a partner in Akin Gump’s Philadelphia office. She represents clients in a wide range of complex class actions and other commercial litigation in both state and federal courts nationwide involving antitrust, insurance, health care, RICO, business torts, trade secrets, and employment law. She recently represented a building materials manufacturer in nationwide direct and indirect purchaser antitrust class actions alleging conspiracy to restrict supply and fix prices. She also lectures regularly on antitrust and other complex litigation issues. Katherine M. Katchen Partner Philadelphia, PA kkatchen@akingump.com 215.965.1239 36 EDUCATION J.D., University of Pittsburgh, 1997 B.A.., Villanova University, 1994