Due December 13, 2014

advertisement

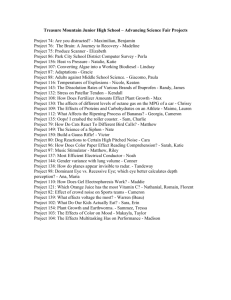

ACCT 5315 – Comprehensive Case #1 Due December 13, 2014 FACTS Nathanial and Ruth Fischer provide you with the following tax information for calendar year 2014. Nathanial and Ruth have four dependent children under the age of 12. They also provide all the support for Ruth’s sister Rosaria who is a resident of Mexico. Rosaria’s only income is from scholarships, the funds of which are used exclusively for tuition. Salary from Ruth’s Job as a professor $450,000 Salary from Nathanial’s Job as a Funeral Director $100,000 Interest Income $18,250 Dividend Income (non qualifying) $12,750 State of Oregon Municipal Bonds $15,250 Gambling Winnings (gambling costs = $18,785) $15,250 Prize (won cruise in a church raffle) $10,850 Annuity payments received (annuity cost $40,000, expected return $100,000) $10,000 Life insurance proceeds on the death of their grandmother $2,550,000 Gifts received from Ruth’s Brother $300,000 Alimony paid by Ruth to her ex-husband $60,000 Debt Forgiveness Income – Credit Card Debt Forgiveness $35,000 Note: Immediately prior to the forgiveness, the Fischer’s were insolvent to the tune of $20,000. Scholarship – Ruth (education expenses and tuition $8,750) $6,250 Damages from an age discrimination law suit Compensatory Damages $550,000 Punitive Damages $980,000 Damages to reimburse for psychiatric care $25,500 Sole Proprietorship Information (Tax Consulting) Revenue Office expense Supplies Meals and Entertainment Rent for Office Space Country club dues Business gifts to 20 people at $45 each Subcontract labor to helpers Self employed medical insurance Fines/penalties paid to local government Depreciation for assets placed in service prior to 2014 $927,000 $15,250 $40,500 $33,500 $75,000 $12,500 $900 $125,500 $16,000 $3,250 $32,250 New Asset Acquisitions Automobile – Passenger Auto less than 6000lbs – 11/15/14 Computer / networks /printers– 3/15/14 Office Equipment (business machine) – 10/15/14 Storage Facility for files (excluding land) – 9/1/14 Leasehold Improvements on office in service as office space since 2005 $46,500 $285,500 $295,000 $480,000 $162,000 Nathanial wants to maximize his depreciation using Sec. 179. 1 Nathanial and Ruth co-own and operate a management consulting practice out of the family home. This is also a sole proprietorship. They use one room in the home exclusively for business. His home has 2,400 square feet in total. The room he uses for business is 300 square feet. His tax net profit from the business before considering the office in home expenses is $37,500. The expenses related to the home are as follows: Mortgage Interest Property Taxes Utilities Homeowners Insurance $30,000 $10,500 $13,400 $5,200 The home was acquired on 3/15/12 for $375,000 (of which land is valued at $100,000). Figure the depreciation using this information. Residential Rental Property - 1 Nathanial and Ruth own jointly a home that they rent to a family. They actively participate in the business. They acquired the home in 2014. The information for the entity is as follows: Rent revenue Mortgage interest on the rental property Repair and maintenance Insurance Property taxes $55,600 $28,800 $18,000 $8,500 $12,500 They acquired the following assets related to the rental property in 2013. Rental Home: 2/3/14 Appliances – 10/4/14 $325,000 (land value is $45,000) $40,000 (do not use section 179 on these) Residential Rental Property - 2 Nathanial and Ruth also own a beach home that they use for both personal and business purposes. The rent the home for 120 days per year and use it personally 40 days per years. Information for the property is as follows: Rent Revenue Mortgage Interest Utilities Property taxes Management fees Insurance $34,000 $18,000 $6,400 $11,250 $7,275 $4,700 The home was acquired on 1/3/13 for $398,000 (of which $100,000 is the value of the land). Other Information Partnership K-1 – owned by Ruth Ordinary Income/Loss $225,000 (Active participation – This is self-employment income) S Corporation K-1 (Passive) owned jointly Net income from operations $28,000 2 Other Information Moving expenses to relocate from Texas to Connecticut SEP Contribution for Nathanial’s business State and Local taxes Personal property taxes (on value of car) Charity (cash) Medical expenses paid to doctors & hospitals (not elective) Investment interest expenses Investment counsel fees Unreimbursed employee business expenses for Ruth $15,000 $49,500 $22,000 $1,250 $36,000 $105,000 $55,500 $16,600 $18,250 Other Transactions 1. Nathanial sold his investment in VB Co. for $75,000. He originally invested $240,000 in the company that qualified as a Sec. 1244 company. He purchased the stock in 1995 and sold it in 2014. On 2/1/14 Nathanial sold the old storage facility. Nathanial received $175,000 cash and the buyers assumed the remaining $75,000 loan on the building. He originally purchased the building for $40,000. As of the date of sale, he had taken $10,000 of tax depreciation. He also paid the real estate agent 3% of the sales price as a commission. On 1/15/14, Nathanial sold his old computer system. He was paid $18,000 for the computer. Nathanial originally purchased the equipment in 2010 for $42,000 and elected Sec. 179 expense for the asset. On 8/15/14 Nathanial and Ruth sold there home that they used their principal residence for 10 years without interruption. They sold the home for $575,000. He originally purchased the home for $150,000 in 2004. On 8/4/14 Ruth sold her complete ownership in TimeWarner Inc. She bought the stock for $15,350 on February 2, 2008 and sold it for $11,000. For purposes of the Sec. 1231 lookback rules, Nathanial has not had any Sec. 1231 transactions in the last 5 years. Required – Analysis must be completed using EXCEL Create a schedule of all sales and exchanges of property transactions and label them accordingly (e.g., Sec. 1231 gains/losses, Long-term capital, Sec. 1245 recapture, etc.) Group 1 will present Part 1 2. 3. 4. Prepare a depreciation schedule for all assets (Schedules C and E). Be sure to deduct the depreciation on the proper schedules. Calculate the Schedule C net income for the Fischer’s What is the Fischer’s total Self Employment tax liability for 2014? Group 3 will present Parts 2-4 5. 6. 7. 8. 9. Calculate the Total Schedule E net income for the Fischer’s (the rental property) What is the total passive activity income/loss and how much is includible in gross income for 2014. Provide a detailed schedule of the Fischer’s AGI (include Gross Income and Deductions for AGI) Provide a detailed schedule of the Fischers’s Itemized deductions – show support for all limitations. – Do not elect to use any long-term capital gains for the Investment Interest Expense limitation. Provide a detailed schedule of the calculation of the Fischer’s total 2014 tax liability (be sure to show your work here) Group 5 will presented parts 5-9 3 10. PREPARE THE FISCHERS complete 2014TAX RETURN USING EITHER THE FILL IN FORMS AVAILABLE ON THE WWW.IRS.GOV WEB CITE OR OTHER TAX SOFTWARE. BE SURE TO INCLUDE ALL NECESSARY FORMS THAT WOULD ACCOMPANY A PROPERLY FILED RETURN- Present the cross referenced return copy (PDF format) and explain on how the cross-referencing was completed. If 2014 forms are not available yet, please use the 2013 forms with proper 2014 numbers. 11. The above requirements should be remitted in a cross-referenced workpaper file that includes summary schedules on top referencing the location of the source information behind each section 12. Prepare a research memorandum discussing the following income tax doctrines: 1) step transaction doctrine and 2) assignment of income doctrine 13. Prepare a research memo that discusses the Passive Activity loss rules and the proper method for allocation of suspended losses to multiple passive activities. In your answer also discuss the IRS forms used to report passive activity losses. 14. Prepare a memorandum explaining the new surtax on Net Investment Income that was enacted starting 2013. Group 7 will present parts 12-14 4