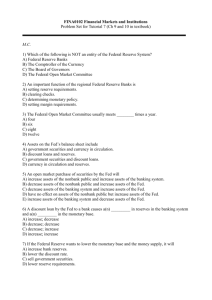

Ch 12

advertisement

Ch. 12: The Federal Reserve System James R. Russell, Ph.D., Professor of Economics & Management, Oral Roberts University ©2005 Thomson Business & Professional Publishing, A Division of Thomson Learning 1 The Federal Reserve System: Definitions Federal Reserve System: the central bank of the United States. Board of Governors: the governing body of the Fed. Federal Open Market Committee (FOMC): the 12 member policymaking group within the Fed. It has the authority to conduct open market operations. 2 The Federal Reserve System: Definitions Open Market Operations: the buying and selling of government securities by the Fed. Monetary Policy: changes in the money supply, or in the rate of change of the money supply, to achieve particular macroeconomic goals. 3 Exhibit 1: Federal Reserve Districts and Federal Reserve Bank Locations 4 The Board of Governors of The Federal Reserve Coordinates and controls the activities of the Federal Reserve System. 7 Members. 14 Year Terms. Appointed by the President with Senate approval. A governor is appointed every other year. President designates one member as President for a 4 year term. 5 The Federal Open Market Committee of the Federal Reserve The major policy making group within the Fed is the Federal Open Market Committee. Authority to Conduct Open Market Operations (Buying and Selling of Federal Securities). 12 Members – 7 Board of Governors – 5 District Bank Presidents (including New York) 6 Functions of the Federal Reserve System Control the Money Supply. Supply the economy with paper money. Provide check-clearing services. Hold depository institutions’ reserves. 7 Functions of The Federal Reserve System Supervise Member Banks. Serve as the government’s banker. Serve as the lender of last resort. Serve as a fiscal agent for the Treasury. 8 Exhibit 2: The CheckClearing Process 9 Self-Test The president of which Federal Reserve District Bank holds a permanent seat on the Federal Open Market Committee (FOMC)? What is the most important responsibility of the Fed? What does it mean to say the Fed acts as “lender of last resort”? 10 Fed Tools For Controlling the Money Supply: Open Market Operations Open Market Operations: Buying and Selling U.S. Government Securities in the Financial Markets U.S. Securities: bonds and bond-like securities issued by the U.S. Treasury. Open Market Purchase: The buying of government securities by the Fed Open Market Sale: The selling of government securities by the Fed. 11 Open Market Purchases Assume Fed purchases securities from a bank. The Fed receives the securities from a bank, and the bank’s reserves increase by the amount of the purchase (Reserves = Bank deposits at the Fed + Vault Cash). When the banks have a reserve increase and no other bank has a similar decline, the money supply expands through a process of increased loans and checkable deposits. 12 Open Market Sales Assume the Fed sells securities to a bank. To pay for the securities, the Fed takes reserves from the bank. Because of the decrease in the bank’s reserves, the bank reduces total loans outstanding, which reduces the total volume of checkable deposits and the money supply. 13 Exhibit 3: Open Market Operations 14 The Required-Reserve Ratio The Fed can also influence the money supply by changing the required-reserve ratio. An increase in the required-reserve ratio leads to a decrease in the money supply A decrease in the required-reserve ratio leads to an increase in the money supply. 15 The Discount Rate A bank can borrow from the federal funds market or from the Fed. Federal Funds Rate: The interest rate a bank pays for a loan in the federal funds market. Discount Rate: The interest rate a bank pays for a loan from the Fed. When a bank borrows money from the Fed, the money supply increases because its reserves increase while the reserves of no other bank decrease. 16 The Spread Between the Discount Rate and the Federal Funds Rate Banks may believe that the Fed is hesitant to extend loans to take advantage of profit-making opportunities. The bank may not want to deal with the Fed bureaucracy that regulates it. The bank realizes that acquiring a loan from the Fed is a privilege and not a right, and doesn’t want to abuse the privilege. 17 Discount Rate Vs. Federal Funds Rate If the discount rate is significantly lower than the federal funds rate, most banks will borrow from the Fed. An increase in the discount rate relative to the federal funds rate reduces bank borrowings from the Fed. 18 Which Tool Does the Fed Prefer to Use? Tools which can be used to influence the money supply: – open market operations – the required-reserve ratio – the discount rate The Fed prefers Open Market Operations – Open market operations are flexible – Open market operations can be reversed – Open market operations can be implemented quickly 19 Exhibit 4: Fed Monetary Tools & Their Effects on the Money Supply 20 Self-Test How does the money supply change as a result of (a) an increase in the discount rate, (b) an open market purchase, (c) an increase in the required reserve ratio? What is the difference between the federal funds rate and the discount rate? If bank A borrows $10 million from bank B, what happens to the reserves in bank A? In the banking system? If bank A borrows $10 million from the Fed, what happens to the reserves in bank A? In the banking 21 system? Coming Up (Ch. 13): Money and the Economy 22