1. Expectations for the Quarter

advertisement

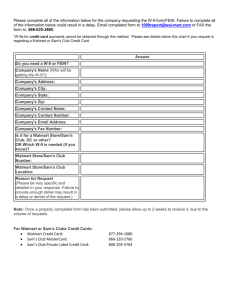

Strategic Preview: Q4 November 2013 - January 2014 17 February 2014 planetretail.net 1 STEPHEN SPRINGHAM Senior Retail Analyst 1. Expectations for the Quarter The unscheduled trading update in at the end of January confirmed that comp growth was negative in Q4 at both Walmart US and Sam’s Club. Walmart US: Like-for-Like Sales by Quarter, 2010-2013 (%) 3.5 3.0 Comparable Store Sales (%) 2.5 2.0 1.5 1.0 0.5 0.0 Q1 2010 Q2 2010 Q3 2010 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013f -0.5 -1.0 -1.5 Note: Includes Sam’s Club, excludes fuel; f – forecast. Source: Planet Retail. 2 Actual Like-for-Like Sales Projected Like-for-Like Sales 2. US: Q4 Strategic Changes All change at the top… Doug McMillon has stepped up to replace Mike Duke as Group President & CEO from 1 February 2014. A ‘Walmart lifer’, McMillon steps up from being CEO of Walmart International – possible recognition the business has been too US-centric in its outlook in the past. More significant is the fact he has senior management experience across all three of Walmart’s key operating units (he was previously CEO of Sam’s Club, before assuming the same role at International). Continuity, or just more of the same? McMillon's succession is logical, but there is also a school of thought that Walmart could also benefit from the ‘fresh blood’ and new ideas an external appointment could bring. © Walmart This is a natural succession, as opposed to a forced change. Duke’s departure was widely anticipated for some time and, at the age of 63 and having been in the role since 2009, his retirement had to come sooner rather than later. David Cheesewright has been promoted from President & CEO of EMEA to head up International. He has previously also headed the Canadian business and oversaw the integration of the Massmart acquisition in subSaharan Africa and the acquisition of the UK Netto stores. 3 Cheesewright comes with a very good reputation and significant and diverse experience across both geographies and retailing disciplines – key requisites for the International division. © Walmart A UK national, Cheesewright started his career with Asda. where he held leadership positions in operations, merchandising, logistics, strategy and format development. 3. Global: Q4 Strategic Changes Africa: Muted performance at Massmart. Acquired with a fanfare back in 2011, trading at Massmart continues to be subdued – and there is limited evidence to date of Walmart exercising its muscle in Africa. Massmart announced preliminary group turnover growth of 7.5% for the year to 29 December 2013. Like-for-like sales increased 3.8%, but taking into account internal inflation of 2.7%, volume growth was just above 1%. Massdiscounters, the general merchandise and food retail division, proved the group’s weakest performer - sales grew 1% on a like-for-like basis, with internal inflation of 0.5%. Masswarehouse, the group’s warehouse clubs division, increased sales 4% with inflation running at 2.1%. Walmart’s position in Africa is difficult to gauge. Massmart’s reported like-for-like figures seem weak against initial expectations of an emerging market like South Africa, but they are reflective of continued high unemployment and the low consumer confidence levels currently rife in wider the market. Expectations that Walmart would quickly impose its established business model in Africa and revolutionize the market look increasingly misguided. 4 Initially, the roll-out of FoodCo food departments within Game stores was expected to become the main expansion vehicle for food operations. However, the smaller, less established, Cambridge Food chain is increasingly proving a more suitable candidate for rapid expansion. Unlike Game, Cambridge Food has the benefit of being a predominantly food-focused format 4. Outlook Costco has outperformed Sam’s Club since Q3 2011. But the divergence has widened in the intervening period and has been massive over the last quarter. Sam’s Club vs. Costco; Quarterly Comp Sales Growth, 2011-2014 (%) 8 7.0 7 6.0 Year-on-Year Growth (%) 6 5.7 6.0 6.0 5.4 5.0 6.0 6.0 6.0 5.3 5.0 5.0 5 4.0 4.2 4.2 4.0 4.0 4 3.0 2.7 3 2.3 1.7 2 1.1 1 0.2 0 -0.5 -1 2011 Q1 2011 Q2 2011 Q3 2011 Q4 2012 Q1 2012 Q2 Costco 2012 Q3 2012 Q4 2013 Q1 2013 Q2 Sam's Club N.B. Costco’s financial year-end is September, Sam’s Club’s is January, so there is roughly one quarter’s time lag i.e. Costco’s Q1 figures correlate more to Sam’s Club’s Q4 figures. Source: Planet Retail 5 2013 Q3 2013 Q4 2014 Q1