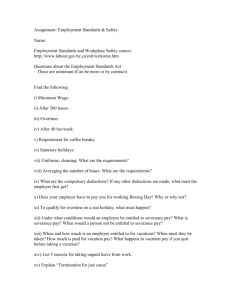

Wealth-income ratio before and after the severance

advertisement

The Consumption and Wealth Effects of an Unanticipated Change in Lifetime Resources Tullio Jappelli Università di Napoli Federico II Mario Padula Università della Svizzera Italiana The Bank of Italy’s Analysis of Household Finance, December 3-4, 2015 1 The old days Do people respond to unanticipated changes in resources? 1. Nature of change Fiscal vs. monetary shocks Temporary (tax rebate, bonus) vs. permanent tax reform Current vs. lifetime resources 2. Nature of response: Consumption, wealth, labor supply, portfolio choice 3. Heterogeneity of response Due to horizon, liquidity constraints, precuationary saving, behavioral theories 4 Outline - The reform of severance pay of Italian public employees - Simulated effect on wealth and consumption. - Difference-in-difference estimates using SHIW data. - €1 reduction in severance pay increases wealth-income ratio by 0.32 and reduces consumption-income ratio by 0.03. 5 Many MPCs… Consumption response Coupons Payroll Recession Age Check in Asset liquidity the mail Debt Context Anticipated income changes Unanticipated income changes Size Small Anticipated increase Anticipated decline Large Permanent shock Positive Transitory shock Negative 6 Measuring MPC from unanticipated income shocks To estimate response of consumption to income shocks 1. Write income process (say transitory/permanent decomposition). Then estimate MPCs using restrictions that theory imposes on the var-cov matrix of consumption and income growth residuals. 2. Hall and Mishkin (1982), Blundell, Pistaferri & Preston (2008) Subjective expectations: how will you spend hypothetical income increase / decrease? Saving, Consumption, Debt. - Don’t need data on consumption or worry about income process. - Can easily look at MPC heterogeneity Shapiro & Slemrod (various years), Jappelli & Pistaferri (2014) 3. Natural experiments Gruber (1997), Browning & Crossley (2001), Paxson (1993), Fuchs-Schundeln (2005), Di Maggio et al. (2014), Surico &Trezzi (2015). 7 A permanent income change: reform of severance pay of Italian public employees Intertemporal model: effect on wealth and consumption. Difference-in-difference using SHIW data from 1989-2010. €1 reduction in severance pay reduces consumption relative to income by 0.03. The wealth-income ratio increases by 0.32. The offset ratio is 0.4. Young vs old employees, more than 1 public employee Robustness Why is the reform interesting? Vast literature on the effect of transitory shocks on consumption, much less on the effect of permanent shocks. Some papers look at change in disability (Browning and Crossley, 2001). Others look at consumption and wealth effects of social security reforms (Attanasio and Brugiavini, 2003; Attanasio and Rohwedder 2003; Bottazzi, Jappelli and Padula, 2006). We study effect on both wealth and consumption looking at sizable and unanticipated changes in future income. The severance pay reform In 2000 Italy replaced its traditional system of severance pay for public employees with a new system. Old regime: severance pay was proportional to the final wage before retirement. New regime: proportional to lifetime earnings. The reform entails substantial losses for future generations of public employees, in the range of €20,000-30,000, depending on seniority. Contracts Severance payment Private employees All Years of contributions ×0.0691× yearly salary. Contributions are capitalized with accrual rate equal to 0.015+0.75 Public employees Pre-reform All Years of contributions × 0.80 × (final yearly salary / 12) Public employees Post-reform Before 2000 Pro-rata regime, with two components, until and after 2010, with weights given by years of service. After 2000 Same as private employees The size of the shock Before the reform (1) After the reform Contracts Contracts signed before signed after December 2000 December 2000 (2) (3) g=1.53%, y0=15,800 76,195 69,303 58,065 g=2.23%, y0=18,000 116,517 100,976 77,996 g=2.62%, y0=20,000 146,234 124,342 92,980 Assumptions: 40 years of work; in column (2) contract is signed in 1995; g and y are historical averages for all emplyees Simulations T 1 max E0 tU (Ct ) Income process T 1 Yt 1 Pt 1Vt 1 t 0 Ct N 1 Yt S Rt Rt RN t 0 Pt 1 GPZ t t 1 t 0 In the pre-reform regime, severance pay is: S 0.8 N YN 1 N 1 N t In the post-reform regime: S 0.0691 Yt (1 ) t 0 Results differ depending on when the reform occurs in the course of the life-cycle. Wealth-income ratio before and after the severance pay reform Change in the wealth-income ratio c/y before and after the severance pay reform Change in c/y An unanticipated negative income shock to lifetime resources reduces consumption and increases wealth relative to income. Both effects depend on the size of the shock, and are stronger for younger workers. Data Pooled 1989-2010 sample from SHIW Age 20-55, 39% public, 61% private Exclude self-employed and workers near to retirement. 2 3 4 5 6 Wealth-income ratio, by occupation 1990 1995 Public employees 2000 2005 Private employees 2010 .7 .75 .8 .85 .9 Consumption-income ratio, by occupation 1990 1995 Public employees 2000 2005 Private employees 2010 Difference-in-difference estimates yit Mi POSTt dMi POSTt xit it y = wealth or consumption-income ratio d>0 in the regression for the wealth-income ratio d<0 in the regression for the consumption-income ratio. Assumptions the reform is exogenous with respect to consumer decisions; the reform is exogenous with respect to changes in sample composition (no labor supply response). Baseline estimates Public employee Post-reform period Public employee post-reform Age Male Family size College degree High school diploma Resident in the Centre Resident in the South Wealth-income ratio Consumption-income ratio 0.015 (0.065) 0.772 (0.063)*** 0.321 (0.101)*** 0.088 (0.003)*** 0.093 (0.063) 0.051 (0.021)** 1.814 (0.079)*** 1.290 (0.052)*** 0.507 (0.063)*** -0.040 (0.057) 0.002 (0.010) 0.059 (0.009)*** -0.030 (0.015)** -0.004 (0.000)*** -0.009 (0.009) -0.009 (0.003)*** -0.137 (0.012)*** -0.082 (0.008)*** 0.037 (0.009)*** 0.092 (0.008)*** Regressions by number of public employees One public employee More than one public employee Post-reform period One public employee post-reform More than one public employee post-reform Wealth-income ratio -0.001 (0.068) -0.204 (0.101)** 0.745 (0.068)*** 0.281 (0.105)*** 0.363 (0.161)** Consumptionincome ratio -0.016 (0.010)* -0.090 (0.015)*** 0.058 (0.010)*** -0.026 (0.015)* -0.030 (0.024) Strongest impact for households with more than 1 public employee Young vs. old workers Wealth-income ratio Public employee Post-reform Public employee post-reform Consumption-income ratio 30 years of contributions >30 years of contributions 30 years of contributions >30 years of contributions -0.078 (0.063) 0.672 (0.071)*** 0.406 (0.119)*** 0.392 (0.150)*** 1.194 (0.152)*** -0.081 (0.253) 0.006 (0.007) 0.067 (0.016)*** -0.034 (0.014)** -0.022 (0.010)** 0.018 (0.010)* -0.011 (0.016) Strongest impact for young public employees. Robustness tests Group-specific pre-treatment trends. Restrict sample to years before the reform and redefine the post-reform dummy as 1 after 1995. Add to baseline specification post-1995 dummy and interaction with public employee dummy. Define treatment group as households whose all members are public employees and control group as households whose all members are private employees. Regional dummies, sector dummies. Stronger effects among household with higher education. Summary Consumption and wealth effects of 2000 severance pay reform: unanticipated negative shock to lifetime resources. Baseline: on average, reduction in severance pay equal to one year’s income increases wealth by 4 months income. The offset ratio is 0.4. The reform reduces consumption by 3pp relative to income. Heterogeneity: wealth and consumption response stronger among households with more than one public employee and young workers, who expect the strongest decline in severance pay. Summary There is no single MPC. Identify nature of income shock. Several strategies: structural models, natural experiments, direct survey questions. Effect of shocks depends on whether it is perceived as permanent or transitory Importance of heterogeneity of response.