Class 5: Prejudgment remedies

advertisement

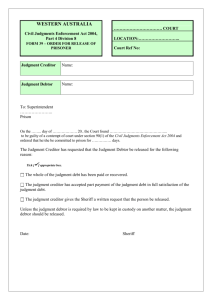

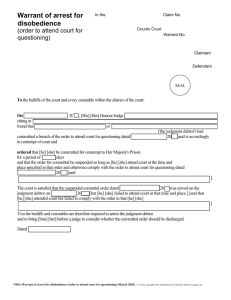

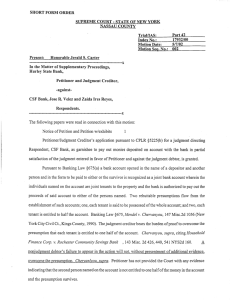

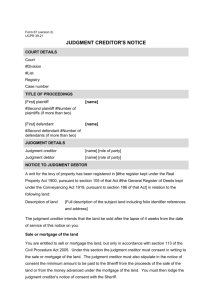

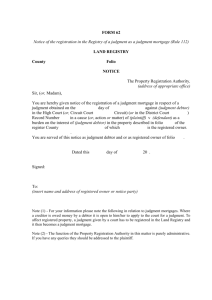

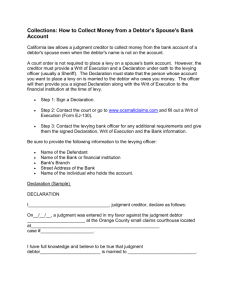

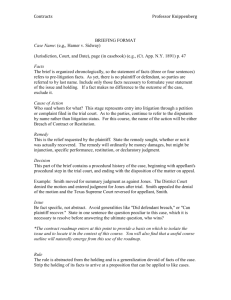

4: Prejudgment remedies © Charles Tabb 2010 Don’t Get Rid of my Money Timing • Postjudgment remedy: –Complaint –Judgment –Remedy (e.g., execution, garnishment) Timing • Prejudgment remedy –Complaint –Remedy (e.g., attachment, garnishment) –Judgment Essence of Prejudgment Remedy • Sheriff takes debtor’s property and holds it while the lawsuit is still pending – just in case the creditor gets a judgment! • And IF creditor does get judgment, then sheriff can just execute on the alreadyseized property Why creditor likes it • Obviously, the idea of a prejudgment remedy is a very sweet deal for the creditor – Secures any possible judgment they might later get – Claim spot in the priority line versus other creditors, purchasers vs. debtor Can they do that?? • But what about the poor debtor – loses dominion and control over his property before a court has held that he actually owes creditor anything • Enormous leverage for creditor for debtor to “voluntarily” pay debt – even if disputed Due Process concern • Prejudgment remedies raise serious due process issue, because debtor is deprived of property without having a chance to be heard • Supreme Court has issued series of opinions detailing required procedural safeguards So how justify? • Given extreme impact on debtor, and extraordinary benefit to creditor, how can we ever justify a prejudgment remedy? • i.e., what conditions must exist before it makes sense to take this extreme step? 1st (and primary) Justification • If don’t – judgment would be worthless • Prevailing creditor would not be able to collect because debtor would have transferred or hidden assets during the trial 2nd Justification • Even the threat of uncollectible judgment isn’t enough • ALSO have to have a high degree of confidence that the creditor will WIN the trial and get a judgment Grupo Mexicano example • Facts of Grupo Mexicano are paradigmatic example of when need a prejudgment remedy: –1st – absolute certainty that if wait till judgment, would be worthless Why Judgment Worthless in Grupo • 1st – Debtor insolvent • 2nd – Debtor transferring its sole substantial asset to other creditors (all of whom were in Mexico), to exclusion of π • 3rd –Debtor’s assets in Mexico – can’t reach by judicial process Grupo – 2nd aspect • So – 1st establish sufficient “threat” to security of judgment • AND • “almost certain” that π will succeed on merits of claim -- indeed, “no plausible defense” even presented What traditional prejmt remedy? • In Grupo, what would the traditional prejudgment remedy be? –Garnishment • Why? – Because the asset (Toll Road Notes) was a debt owing from “concessionaries” to debtor GMD Federalism • 1st – how was case in federal court? –Diversity • US creditor vs. Mexican debtor State remedies in Federal court • Are state remedies (such as prejudgment garnishment) available in federal court in diversity case? • Sure – see Fed R Civ P rules 64 (prejmt) and 69 (postjmt) State Garnishment in Grupo?? • So – why didn’t the creditor in Grupo just get a prejmt garnishment of the debtor’s asset – the debt on the Toll Road Notes (i.e, the one issued by the Mexican govt and owing to debtor GMD from the concessionaries)? Garnishment Unavailable • No garnishment because the prospective garnishees (either the concessionaries or Mexican govt) were located in Mexico – • And thus no personal jurisdiction in USA If not garnishment, then what? • Garnishment was not available • So π sought an injunction directly against Dr in NY federal court, prohibiting Dr from transferring its rights under the Toll Road notes Why was Dr subject to Personal Jurisdiction in New York? • Consent • In the notes issued to π “Mareva” injunction • An “asset-freeze” injunction such as this is now known as a “Mareva” injunction • That was name of 1975 English case that 1st granted such a remedy Mareva injunction - grounds Grounds: • Debt due and owing • Danger DR will dispose of assets to defeat jmt Why not use FRCP 64? • Recall that Rule 64 incorporates state prejudgment remedies in federal court • So – IF New York state law allowed Mareva injunctions, then the π could have sought such an injunction under Rule 64 – rather than under Rule 65 Federalism problem • Apparently, then, NY state law did NOT allow a Mareva injunction • Since π could not get a Mareva injunction under state law and thus under Rule 64, have a federalism concern about allowing the π to get such an injunction in federal court Erie concern • Since is diversity case, under Erie doctrine apply state law in matters of substance (as opposed to procedure) • Only way to grant injunction sought, then, is to conclude that a Mareva injunction is a matter of procedure only, not substance Substance vs Procedure • Question then is – is granting a prejmt injunction freezing debtor’s assets a matter of procedure only or does it affect substance? Substance implicated • Majority in Grupo believes that the requested injunction affects the substance of the Dr-Cr relationship • Would in effect give CR a property right in Dr’s property, and alter Dr’s rights in own property Any Federal relief? • So– is there any instance where federal law DOES preempt state law and provide a federal law of debtor-creditor relations? • If so, then no Erie problem Federal relief -> BANKRUPTCY • Sure – the Bankruptcy Code (title 11, US Code) is a federal statutory law affecting dr-cr relations, and is not constrained by Erie Aspects of Bankruptcy Relief • Freeze DR’s assets pending resolution of claims • Prohibit preferential treatment of some crs to exclusion of others • Pro rata treatment of all unsecured crs So why not file a Bankruptcy case? • The core aspects of a bankruptcy proceeding arte exactly what π needs here – preserve dr’s assets and keep other crs from getting everything • Under US law Crs do have the power to file an involuntary bankruptcy case against a Dr who can’t pay its debts as they come due – Which certainly seems to be true here No US nexus • Can only file a bankruptcy case in US if have a nexus to the US – E.g., place of business, assets, residence, domicile • DR GMD did not have that nexus – Mexican corporation, all assets in Mexico Mexican bankruptcy? • Only bankruptcy option, then, for π would be to file IN MEXICO Nature of relief sought in Grupo? • The relief π sought in Grupo, then, is essentially what would be available in a bankruptcy case • Asking federal court to create as a matter of federal common law a quasi-bankruptcy right • Query whether appropriate under separation of powers? No jurisdiction in equity • Supreme Court held that federal courts lacked jurisdiction in equity to issue a Mareva injunction • i.e., had no POWER to issue the injunction at all Reasoning • Not within traditional equity jurisdiction at time of separation from England Problem 1.15 • Feb 1: CR sues Dr for $5K • March 1: Cr’s writ attachment issued & delivered • March 3: Sheriff levies on Dr’s pig Porky • April 10: DR sells Porky to Purchaser • June 1: Cr gets judgment Answer to 1.15 • Cr wins over Purchaser • Cr’s attachment lien arose upon levy on March 3 • Thus Purchaser acquired Porky subject to Cr’s attachment lien • Cr’s attachment lien became choate upon entry of final judgment on June 1 • CR can have Porky sold to satisfy judgment Fair to Purchaser? • Sure – sheriff LEVIED on Porky prior to Purchaser’s acquisition of Porky • So P should have had notice that DR did not have clear title to Porky 1.15 is why Cr needs attachment • Indeed, the facts of 1.15 are precisely why CR needs a prejmt remedy – > threat that DR will sell assets during pendency of lawsuit – > would now be a lot easier for DR to hide the $ that he got from P than a pig! Problem 1.16 • Same facts as 1.15, except CR dismissed her lawsuit vs DR when DR agreed to pay $200/month • Now who has priority to Porky? Answer to 1.16 • Purchaser has priority • Indeed, Purchaser has the ONLY claim against Porky • Once CR dismissed lawsuit, the inchoate attachment lien evaporated – > conditional on getting a judgment Problem 1.17 • Year before: CR Z perfects security interest in Dr art collection to secure debt of $18K • May 1: CR A sued DR for $5k • May 15: CR A writ attachment issued and delivered • May 17: sheriff levied on Debtor’s art collection, valued at $20,000. • August 1 Cr A final money judgment against Debtor for $5K Answer to 1.17 • Cr Z has priority • Its perfected security interest was 1st in time • Cr A as “lien Cr” under UCC 9-317(a)(2) only has priority as against an unperfected SI