Monetary Policy

Monetary Policy

Econ 102

2015

Money market equilibrium

Key player in the financial markets:

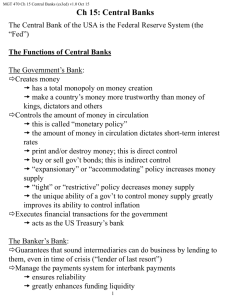

CENTRAL BANKS:

Every sovereign nation has a bank which is the ‘lender of the last resort’.

The Central Banks is a financial institution owned by the government, which is in charge of ‘managing the currency’

Turkey:

United Kingdom:

Central Banks

Türkiye Cumhuriyeti Merkez

Bankası (TCMB)

Bank of England (BoE)

United States:

(FED)

Federal Reserve System

Board of Governors

European Union:

European Central Bank (ECB)

Monetary Policy News

1) About Bit-coins

"This would create a new dynamic in the global monetary order, one in which central banks would struggle to implement monetary policy. And, central banks couldn’t act as lenders of last resort as they do for their own currencies. This means that households and businesses could suffer important losses if such an e-money were to crash.”

Senior deputy governor Carolyn Wilkins spoke about innovation and the changing face of central banking in a post-financial crisis world

.

2) Possible veto for rule based monetary policy rule in US

The White House on Tuesday issued a veto threat for a

Republican-backed bill to make the Federal Reserve set interest rate policy using a mathematical rule, a proposal

Fed Chair Janet Yellen said would "severely damage" the

U.S. economy.

The Obama administration opposes the proposal because it would hinder the Fed's ability to help the economy, the

White House said in a statement.

"If the president were presented with (the legislation), his

senior advisors would recommend that he veto the bill," the statement said

Functions of the Central Bank

1.

Issuance of currency: Prints or mints notes and coins for the gov’t (usually backed by the gov’t bonds).

2.

Reserve management: manages the foreign exchange reserves, buys and sells to influence the domestic currency value/

3.

Banker to the government:

4.

Banker to the commercial banks: provides payment system for the transactions between banks, provides liquidity to the banks.

Functions of the Central Bank

5.

Maintains financial stability: lender of the last resort, emergency liquidity to solvent financial institutions, otherwise they may collapse.

6.

Banking supervision: (BDDK)

7.

Monetary Policy Function: prevent inflation.

Monetary Policy Tools

1.

Open Market Operations: CB buys and sells gov’t bonds in private financial markets.

2.

Reserve Requirement Ratio:

Minimum reserves that the commercial banks have to hold as reserves for a given deposits

3.

Discount rate: Lending rate of the Central Bank to commercial banks

Balance Sheet of the Central Bank

Assets

Foreign government bonds (official international reserves)

Gold (official international reserves)

Domestic government bonds

Loans to domestic banks (called discount loans in US)

Liabilities

Deposits of domestic banks

Currency in circulation (previously central banks had to give up gold when citizens brought currency to exchange)

Money Market Operations and

Control of Money Supply and interest rates

1.

One tool is the open market operations:

CB can sell bonds and create shortages of liquid funds, this will decrease the price of bonds and increase the

interest rates because the funds are scarce.

2. CB can change in the interest rate (discount rate) that they charge to the commercial banks that borrow from the CB in case of liquidity shortages. If the discount rate changes the market determined interest rates also change in the same direction.

Money Market Operations and

Control of Money Supply and interest rates

3.

CB Bank can change the reserve requirement

ratios. This determines the amount of loans that commercial banks can give for a given amount of deposits, hence the money multiplier. This tool is seldom used.

i

Does the CB control MS or the

Interest rate? Or both???

Money market

Can they use both at the same time?

MS is the quantity and interest is “price” of money.

Either the MS or the interest rate

(Either the quantity or the price)

Does CB control MS or the interest rate?

Which one is easier to control?

- Your can control the narrow money supply (which is the liquidity – bank notes and coins)

- It is more difficult to control broad money supply

(liquidity plus demand deposits (M1))

Simple Monetary Policy

Transmission mechanism of the monetary policy.

Example: MS increase (interest rate declines),

Desired Investment expenditures increase,

Aggregate expenditures increase, (Aggregate Demand increase)

Hence, OUTPUT increases

.

BUT, there will be an effect on PRICE and/or

EXCHANGE RATES

Central Bank

Central Bank

Central Bank (TCMB) Balance Sheet

TCMB Balance Sheet

A.ASSETS

A.1-FOREIGN ASSETS

A.2-DOMESTIC ASSETS

A.2A-Cash Operations

A.2Aa-Treasury Debt

A.2Aa1-Securities

A.2Aa1a-Government Domestic Debt Inst.Perior Nov.5

A.2Aa1b-Government Domestic Debt Inst.Purchased

A.2Aa2-Other

A.2Ab-Credits to Banking Sector

A.2Ac-Credits to SDIF

A.2Ad-Other Items

A.3-FX REVALUATION ACCOUNT

A.2B-IMF Emergency Assistance (Treasury)

18-11-2014

..

..

..

286458194 P.LIABILITIES

299491956 P.1-TOTAL FOREIGN LIABILITIES

6088357 P.1a-Liabilities to Non-Residents

P.1b-Liabilities to Residents

9077961 P.1ba-Public Sector and Other FX Deposits

9164751 P.1bb-FX Deposits of Banking Sector

P.2-CENTRAL BANK MONEY

P.2A-RESERVE MONEY

..

-86790 P.2Aa-Currency Issued

19275806 P.2Ab-Deposits of Banking Sector

0 P.2Aba-Required Reserves in Blocked Accounts

-22265410 P.2Abb-Free Deposits

-19122119 P.2Ac-Extra Budgetary Funds

P.2Ad-Deposits of Non-Bank Sector

P.2B-OTHER CENTRAL BANK MONEY

P.2Ba-Open Market Operations

P.2Bb-Deposits of Public Sector

286458194

208271525

10381568

197889957

3581636

194308321

78186669

100154933

84600695

14959610

0

14959610

245599

349029

-21968263

-35102300

13134037

Expectations

Consumer and Producers do not have static views, they look into the future and form ‘expectations’.

They form expectations about future prices, or the rate of change of prices.

In all their consumption, production and labor supply decisions they take the expected inflation rate into consideration.

What is your expected rate of inflation today for the next year in Turkey?

Central Bank Independence

Governments make a CB law which says that CB is independent and has the objective of controlling inflation and growth.

Central Bank

If credible everybody will adjust their expected inflation to the one announced by CB.

If they are not credible, because for example if they believe that with coming elections that will resort to expansionary policy, hence they will not be able to control the inflation rate...

Turkey’s disinflation policy

Inflation experience

Alternative Central Bank Policies

Inflation targeting

Monetary targeting

Exchange rate targeting

Discretionary monetary policy.

Inflation targeting

To achieve price stability they set an inflation target rate of x percent for the CPI increase in the following

12 months.

Then makes monthly forecasts of inflation looking two years ahead. Then decides whether the interest rates should be changed to avoid a deviation from the target.

Disinflation experience

Inflation realized and expected

CBRT “inflation is expected to be between

8.2 and 9.4 % (with a midpoint of 8.17 percent) at

the end of 2014.”

Inflation report 2013 .

Inflation report of 2014

Why the CB can not target one level of inflation rate?

What are the other factors that affect the rate of inflation rate other than money supply growth rate?

Fiscal policy,

Developments affecting business and trade in the country,

Developments affecting households

Developments affecting labor markets, unemployment

Wages and input prices

Foreign exchange and stock prices

Difficulties of monetary policy

Lags –delays between the start of the problem, and the effect of the policy.

Recognize the problem, decide on the action and implementing, then the effect will be observed.... Delays

Others...

TCMB Policies

Asymmetric Interest rate Corridor

Asymmetric Interest rate Corridor

Since 2010

Reserve Option Mechanism

Commercial banks voluntarily hold part of their reserve requirements in terms of foreign exchange and gold.

Weaken the effect of capital flows to exchange rates and bank lending

Why the CB can not target one level of inflation rate?

What are the other factors that affect the rate of inflation rate other than money supply growth rate?

Fiscal policy,

Developments affecting business and trade in the country,

Developments affecting households

Developments affecting labor markets, unemployment

Wages and input prices

Foreign exchange and stock prices

Other difficulties of monetary policy

Lags –delays between the start of the problem, and the effect of the policy.

Recognize the problem, decide on the action and implementing, then the effect will be observed.... Delays

Others...