Practice test 1

advertisement

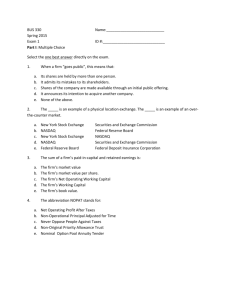

BUS 330 Corporate Finance Spring 2015 Practice Exam 1 Part I: Multiple Choice: Select the best answer for each of the questions below: 1. The form(s) of business organization that is regarded as a legal “person” distinct from the owner(s) of the business is: (i) (ii) (iii) sole proprietorship partnership corporation a. b. c. d. e. only (i) is true. only (ii) is true. only (iii) is true. both (i) and (ii) are true. both (ii) and (iii) are true. 2. The a stock’s intrinsic value is: a. b. c. d. e. the total assets divided by the number of shares outstanding. the total fixed assets minus liabilities, divided by the number of shares outstanding. total owners’ equity, divided by shares outstanding. the discounted sum of the firm’s free cash flow, divided by the number of shares outstanding. none of the above. 3. In which case are you buying a financial asset in the primary market? a. you buy shares of MCD on the stock exchange. b. you purchase US Treasury bonds from your broker. c. you purchase a mix of different shares through a mutual fund. d. you are already an owner of WEN, and choose to purchase additional shares from WEN when WEN issues new shares to finance overseas expansion. e. none of the above. 4. If frequent trading among well-informed buyers and sellers of an asset ensures that the market price of the asset is close to its intrinsic value, then we have: a. b. c. d. e. an efficient market. a primary market. a futures market a spot market none of the above. 5. The advantage to the owner of forming a corporation instead of a sole proprietorship is: a. b. c. d. e. the corporation has a limited lifespan. ownership shares of a corporation are more difficult to transfer. corporations find it more difficult than proprietorships to raise large amounts of capital. income to the owners of the corporation will be taxed twice. the corporation’s liabilities are not the liabilities of the owner of the corporation. 6. The senior executives of a corporation are hired (or fired) by the corporation’s: a. b. c. d. e. bondholders. employees. shareholders. customers. none of the above. 7. The obligation of a firm’s managers to respond to the interests of the firm’s creditors is based on _____. The obligation of the firm’s managers to respond to the interests of the shareholders is _____. a. professional ethics; the managers’ employment contracts b. industry standards; the company’s articles of incorporation c. the terms of the debt contract; the managers’ duty to advance the shareholders’ interests. d. the managers’ duty to honor the spirit of all contracts; the managers’ responsibility to assure reasonable profits. e. the managers’ legal duty to society’s well-being; the managers’ contract with shareholders 8. In a bankruptcy reorganization, there is not enough asset value (or discounted cash flow) to pay all claim holders everything they are owed. Not everyone gets the same percentage of what they hoped to get. The priority of claims is given by (from highest priority to lowest priority): a. b. c. d. e. stock holders, secured creditors, unsecured creditors secured creditors, unsecured creditors, stockholders unsecured creditors, secured creditors, stock holders secured creditors, stock holders, unsecured creditors unsecured creditors, secured creditors, stock holders 9. Lenders must carefully select borrowers, then design contracts that protect their rights against possible mishaps or abuses on the part of the borrower, and then ensure that the terms of the contract are being fulfilled. If there are many lenders, they must also ensure that the costs of the contract design and supervision are being shared by all lenders proportionately. When the lenders accomplish this by “hiring” a firm to do this on their behalf – they are using a: a. financial intermediary b. c. d. e. investment bank stock broker stock exchange derivative contract 10. Some financial ratios are especially useful to analysts or managers who wish to evaluate the operational performance of the company (compared to another company or the industry average), potential lenders, other financial ratios are more useful to a lender who wants to evaluate the ability of a company to meet its debts as they come due. The ____ ratio is an example of the first type of ratio, and the ____ ratio is an example of the second. a. b. c. d. e. current basic earning power total assets turnover operating margin inventory turnover price/earnings inventory turnover debt days sales outstanding quick (acid test) 11. The _____ describes how much (and why) a firm’s equity changed during a year. The _____ is the financial statement that describes the firm’s operating performance. The _____ is the financial statement that describes the company’s financial position at a particular date. a. b. c. d. e. income statement statement of stockholders’ equity statement of cash flows balance sheet income statement statement of stockholders’ equity statement of stockholders’ equity balance sheet income statement statement of stockholders’ equity income statement balance sheet none of the above. 12. If a corporation pays 40% of its income as tax (typical in the USA), the amount of pre-tax income needed to fund $6 of dividend payments to shareholders is: a. b. c. d. e. $6 $8 $1.60 $10 $40 Part II: Below are 2 sets of financial statements. One is Target (TGT) which is a US-based retail clothing chain. The other is Kohl’s (KSS), another clothing retailer operating in the same market segment. Answer the following questions, using ratio analysis when and where appropriate to support your analysis: Balance Sheet Target (TGT) Current Assets Cash And Cash Equivalents Short Term Investments Net Receivables Kohls (KSS) 695,000 971,000 - - - 142,000 Inventory 8,766,000 3,874,000 Other Current Assets 2,112,000 305,000 11,573,000 5,292,000 - 64,000 31,378,000 8,745,000 Goodwill - - Intangible Assets - - Accumulated Amortization - - Other Assets Deferred Long Term Asset Charges 1,602,000 277,000 - - 44,553,000 14,378,000 11,617,000 2,597,000 1,160,000 139,000 - - Total Current Liabilities 12,777,000 2,736,000 Long Term Debt 12,622,000 4,722,000 1,490,000 560,000 1,433,000 382,000 - - - - 28,322,000 8,400,000 - - Total Current Assets Long Term Investments Property Plant and Equipment Total Assets Liabilities Current Liabilities Accounts Payable Short/Current Long Term Debt Other Current Liabilities Other Liabilities Deferred Long Term Liability Charges Minority Interest Negative Goodwill Total Liabilities Stockholders' Equity Misc Stocks Options Warrants Redeemable Preferred Stock - - Preferred Stock - - Common Stock 53,000 4,000 12,599,000 11,462,000 Retained Earnings Treasury Stock - Capital Surplus 4,470,000 Other Stockholder Equity -891,000 -8,052,000 2,598,000 -34,000 Total Stockholder Equity 16,231,000 5,978,000 Net Tangible Assets 16,231,000 5,978,000 Income Statement Period Ending Total Revenue 72,596,000 19,031,000 Cost of Revenue 51,160,000 12,087,000 Gross Profit 21,436,000 6,944,000 - - 15,375,000 4,313,000 Operating Expenses Research Development Selling General and Administrative Non Recurring Others Total Operating Expenses Operating Income or Loss 1-Feb-14 -391,000 1-Feb-14 - 2,223,000 889,000 - - 4,229,000 1,742,000 Income from Continuing Operations Total Other Income/Expenses Net Earnings Before Interest 4,229,000 And Taxes Interest Expense 1,126,000 1,742,000 338,000 Income Before Tax 3,103,000 1,404,000 Income Tax Expense 1,132,000 515,000 - - 1,971,000 889,000 Minority Interest Net Income From Continuing Ops Non-recurring Events Discontinued Operations Extraordinary Items Effect Of Accounting Changes Other Items Net Income Preferred Stock And Other Adjustments Net Income Applicable To Common Shares - - - - - - 1,971,000 889,000 1,971,000 889,000 1. If you are commercial lending officer for Citicorp and both of these chains proposes to negotiate an additional $6 billion in borrowing from your bank in order to finance an expansion, which would you rather lend to (and why). 2. You are a management consultant for McKinsey specializing in retail businesses. The management of Kohl’s corporation hires you to recommend to them areas in which their performance can be improved that will generate greater shareholder value. What would you recommend? 3. The P/E (ttm) ratio for Target is 32.1, the forward P/E for Target is 16.8. If earnings per share is $2.38 and the number of shares outstanding is not expected to change, what earnings per share are projected for next year? 4. What would you examine to see if you think the earnings projection (above) for Target is achievable? Is it? (Explain).