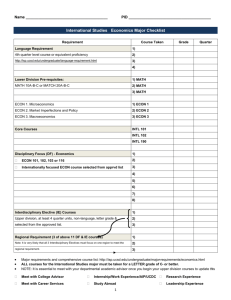

Econ Core

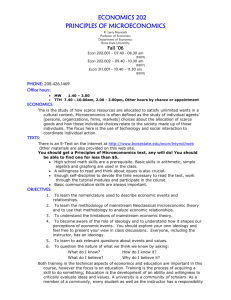

advertisement